The demand for athleisure apparel has been soaring as Americans continue to work from home and swap their gym routines for at-home workouts. As a result, activewear companies have experienced strong sales growth over the past year, while several retailers and clothing subscription box companies have incorporated more athleisure into their offerings. Additionally, our analysis of athleisure brands reveals that UK-based Gymshark is gaining market share from its more established competitors, and continues to gain traction in the U.S.

The athleisure market has grown during the pandemic

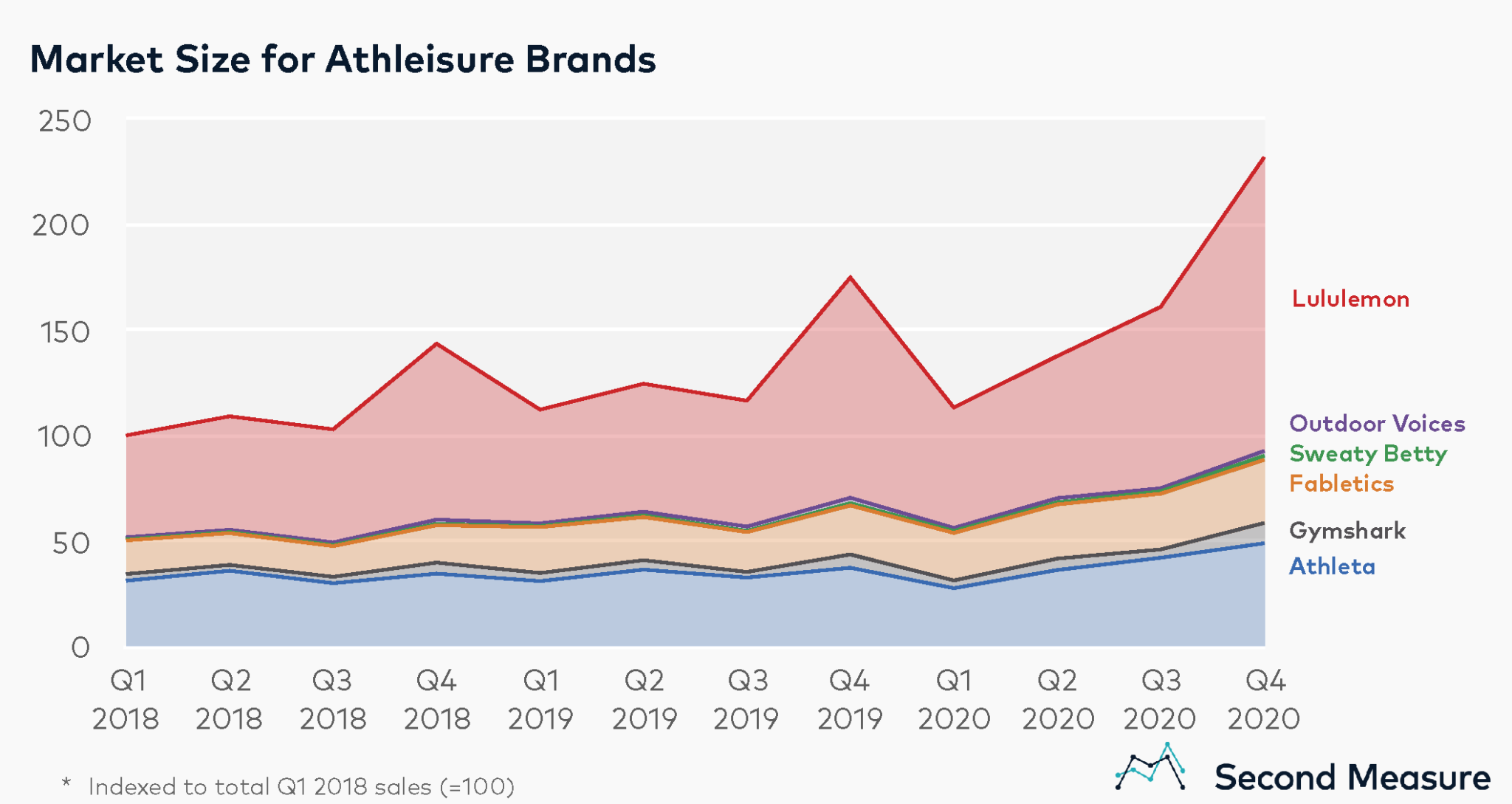

The athleisure category has been growing over the past three years, with accelerating growth during the COVID-19 pandemic in 2020. Although many gyms and fitness centers were closed throughout spring and early summer, the athleisure market grew 22 percent between the first and second quarters of 2020. Sales for this category have also consistently spiked in the fourth quarter, corresponding with the holiday season. Combining these two trends, the athleisure market, comprising six competitors, grew 44 percent between Q3 and Q4 of 2020.

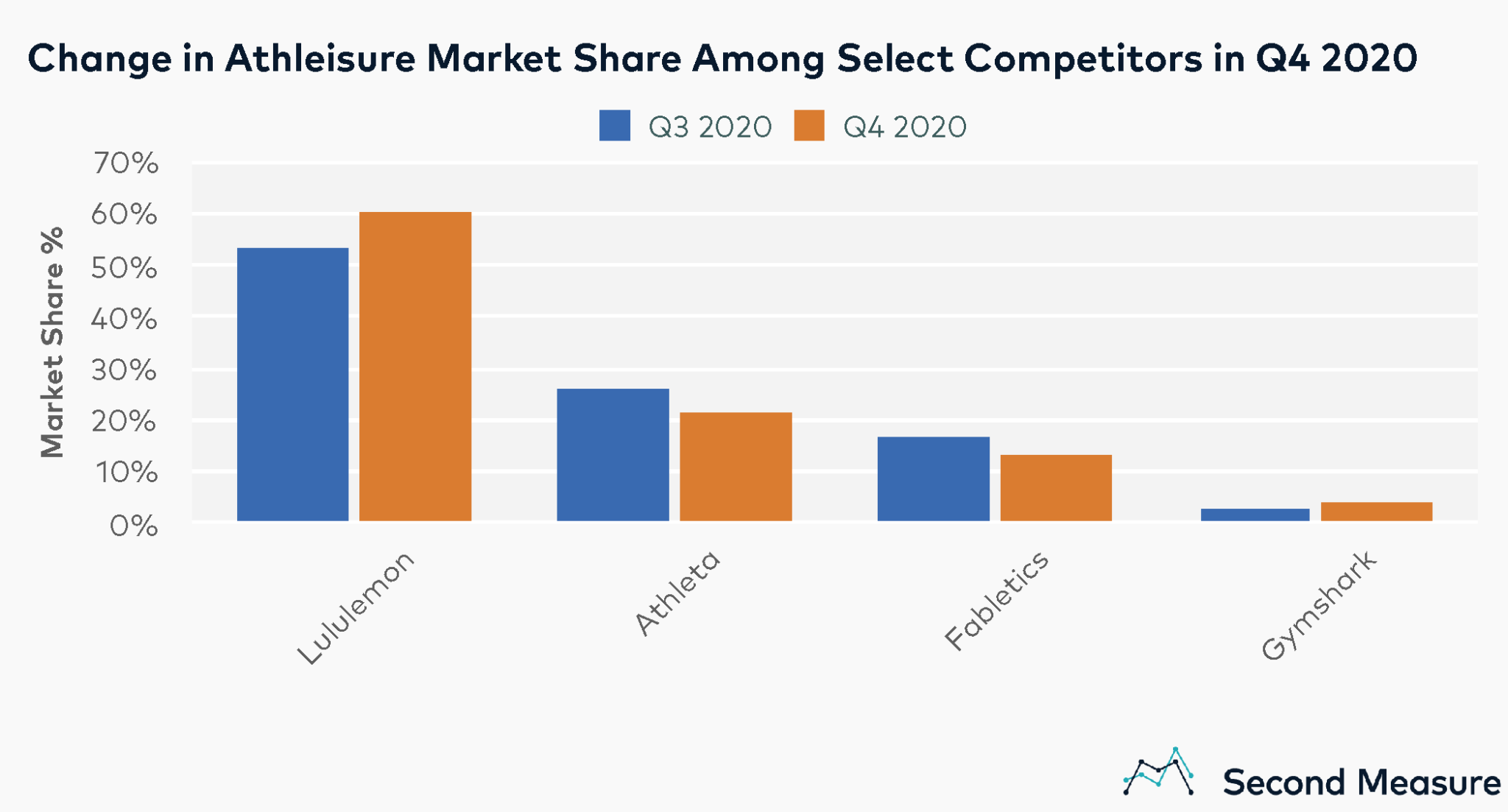

Among the select set of athleisure companies, Lululemon leads the pack in terms of sales volume. In Q4 2020, Lululemon’s market share among these six companies was 60 percent, followed by Athleta with 21 percent and Fabletics with 13 percent. Interestingly, Gymshark is the only company in the competitive set that sells exclusively online, while the others sell their products through a combination of retail and online channels. Fabletics is also the only company within the competitive set that uses a subscription-based business model.

Gymshark’s market share growth outpaced that of competitors in Q4 2020

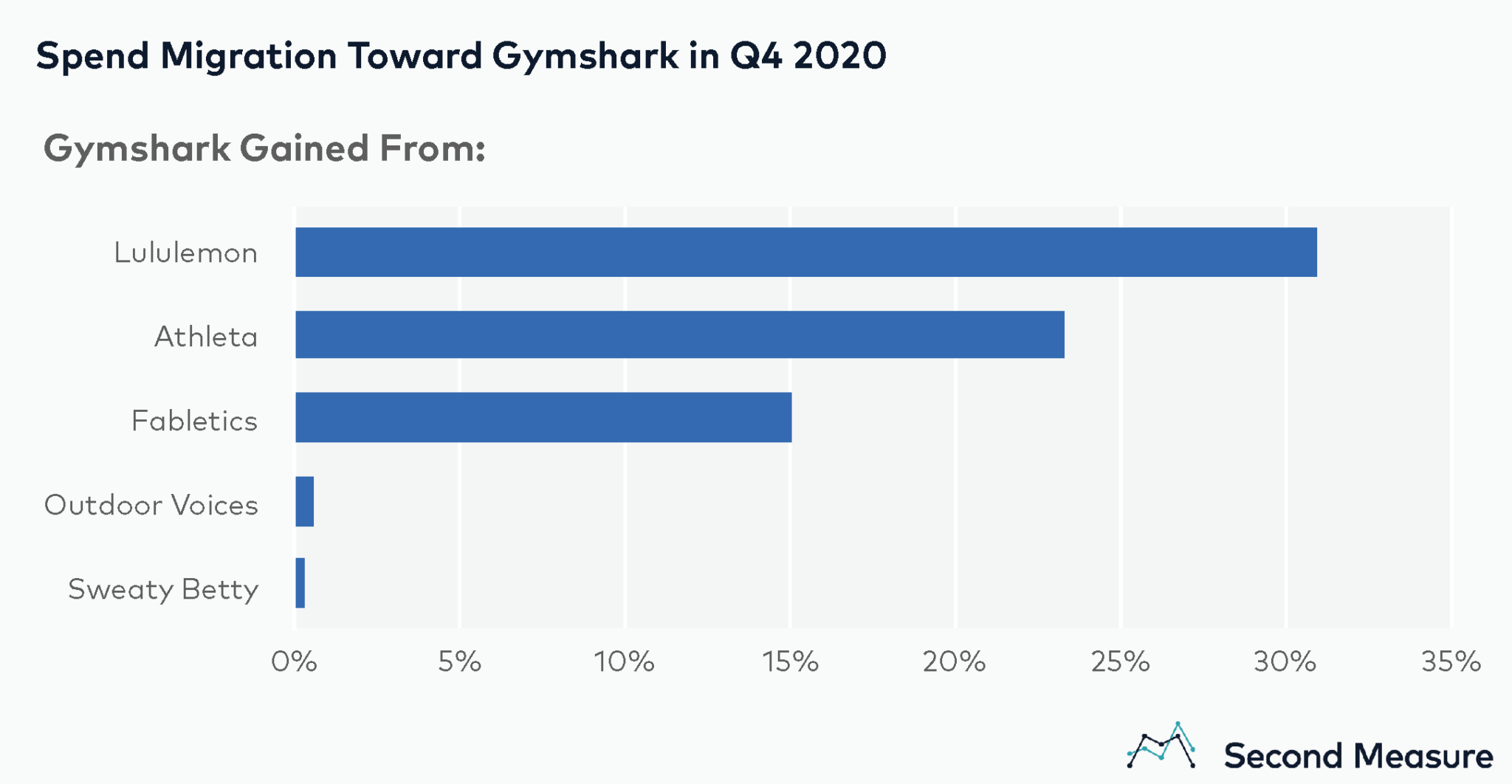

While the athleisure category as a whole increased in 2020, the growth was not evenly distributed among the companies. In Q4 2020, Gymshark grew its U.S. sales 145 percent quarter-over-quarter, outperforming the category’s growth of 44 percent. Consequently, Gymshark’s relative share growth — or its growth rate of market share — was 70 percent, the highest among the competitive set. The company ended Q4 2020 with 4 percent market share. By contrast, Athleta and Fabletics lost market share in Q4, with relative share declines of 19 percent and 22 percent, respectively.

Of Gymshark’s 70 percent relative share growth in Q4 2020, 31 percentage points came from Lululemon and 23 percentage points came from Athleta. Gymshark captured less than 1 percentage point, combined, of spend from Outdoor Voices and Sweaty Betty.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.