Source: https://www.placer.ai/blog/placer-bytes-michaels-rising-five-below-and-belks-potential-recovery/

In this Placer Bytes, we look at two of retail’s strongest in Five Below and Michaels and break down the potential for a Belk recovery.

Five Below’s Growing Strength

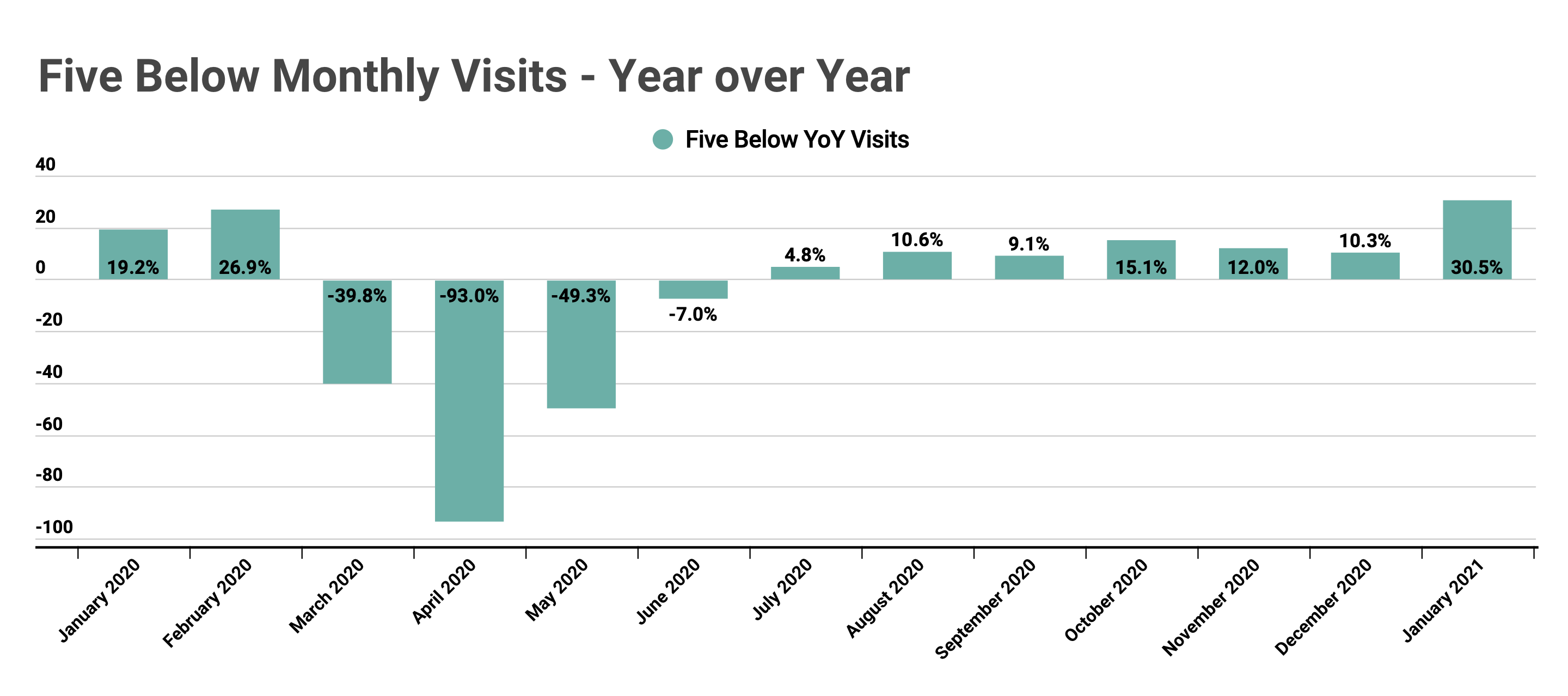

Five Below is among the most interesting brands to watch as it is seeing exceptional offline strength heading into a period where its value offering could be even more attractive. Following a dip in year-over-year visits driven by the pandemic, the brand quickly saw visits return to year-over-year growth by July 2020. And the year ended with exceptional strength with visits in November and December up 12.0% and 10.3% year over year, respectively. And, this strength carried into 2021 with visits up 30.5% year over year in January.

While these are impressive numbers in their own right, the rise is especially interesting because of the timing and sustainability. While many retailers saw significantly reduced offline strength in November because of rising COVID cases, Five Below actually saw an especially strong month. This was further supported by a January that witnessed massive visit growth when compared to a January in 2020 that was exceptionally strong in its own right. When combining this data with the near-perfect alignment with the mission-driven shopping trend, the outcome is a prognosis that may position the brand even more effectively in the coming years.

DIY to the Rescue

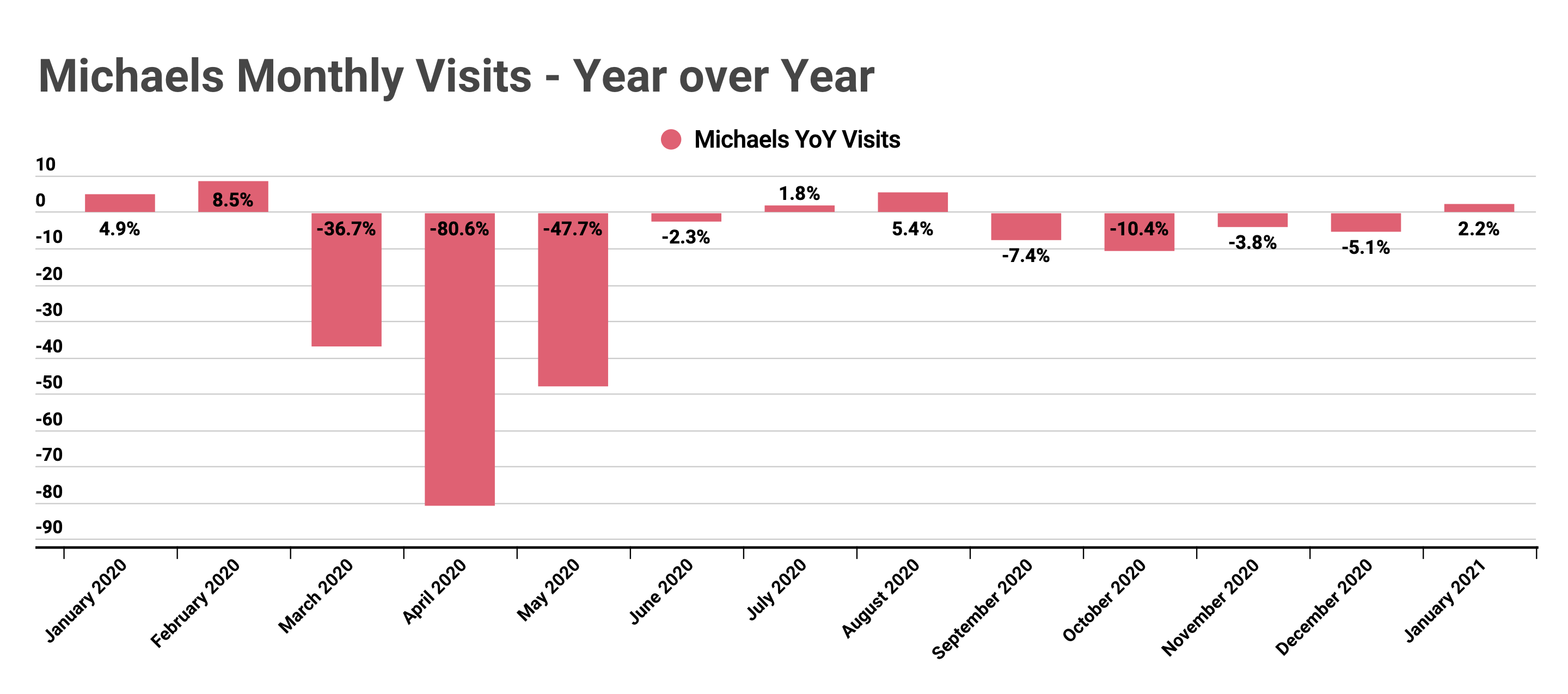

Why was Michaels such an attractive acquisition? Following a severe drop in visits in the Spring, Michaels offline locations returned to form by summer when the brand enjoyed year-over-year visit growth in July and August. Yet, this quickly tapered off with visits down 3.8% and 5.1% year over year in November and December respectively. However, just before that trend stuck, visits in January rose 2.2% year over year refueling the idea that the brand’s DIY focus could fuel strength deep into the new year.

While the company’s DIY approach seems well suited to the current environment and trends, the up and down performance makes it a difficult brand to fully nail down. But there is clearly room for optimism here as the alignment with key trends and strong relative performance point to a brand that could significantly outperform in the coming year.

Belk Recovery?

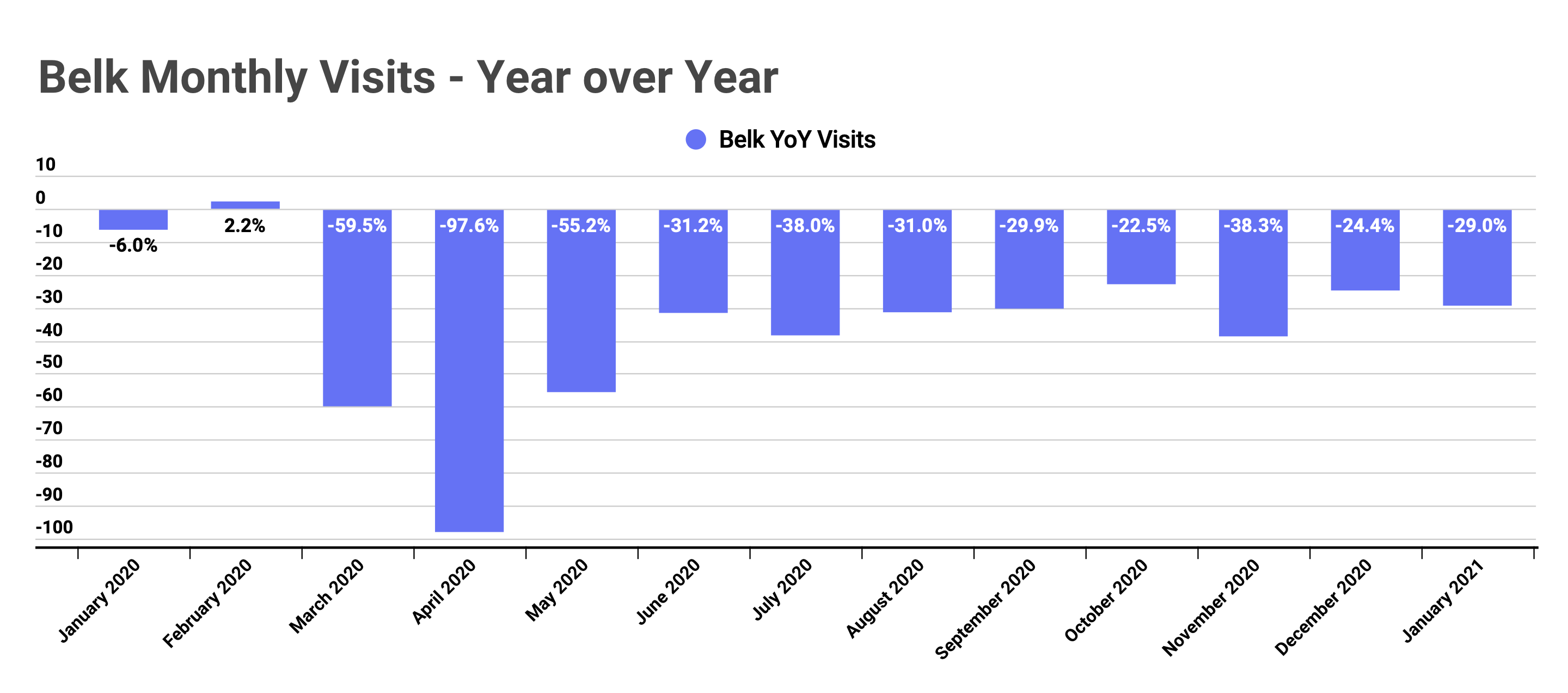

While it isn’t necessarily the greatest time to be a department store, Belk recently exited bankruptcy with a new lease on its retail life. And there’s reason to believe that Belk could be capable of surprising in the year to come. The brand’s visits are in-line with, if not better than, other department store players, and the new financial breathing room could allow Belk to reclaim its past glory.

Yet, as with many of the sector’s leaders, the key will be identifying the right retail mix while upgrading a format to meet newer and more complex customer needs.

Will Five Below continue its rise? Can Michaels find consistent growth? Will Belk drive a remarkable turnaround?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.