An increase in nonbuilding construction starts not enough to offset a decline in buildings

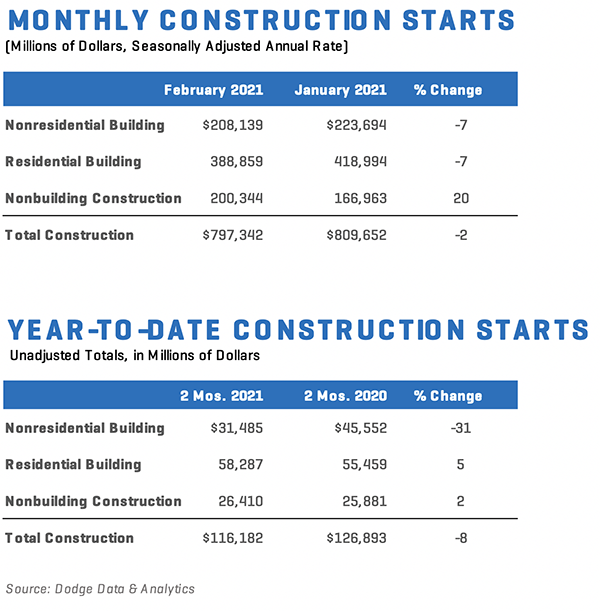

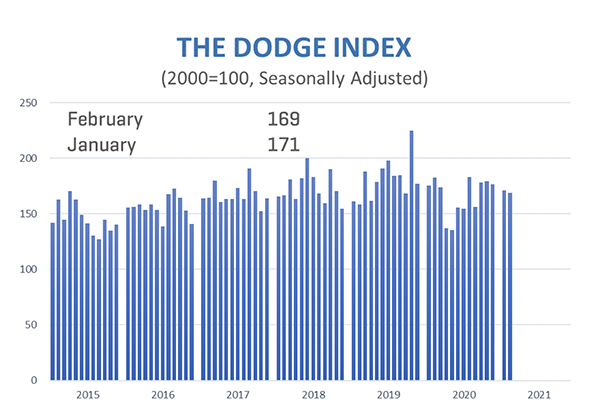

Total construction starts fell 2% in February to a seasonally adjusted annual rate of $797.3 billion. Nonbuilding construction starts posted a solid gain after rebounding from a weak January, however, residential and nonresidential building starts declined, leading to a pullback in overall activity. The Dodge Index fell 2% in February, to 169 (2000=100) from January’s 171.

“With spring just around the corner, hope is building for a strong economic recovery fueled by the growing number of vaccinated Americans,“ said Richard Branch, Chief Economist for Dodge Data & Analytics. “But the construction sector will be hard-pressed to take advantage of this resurgence as rapidly escalating materials prices and a supply overhang across many building sectors weighs on starts through the first half of the year.”

Below is the full breakdown across nonbuilding, nonresidential, and residential construction:

For the 12 months ending February 2021, total nonbuilding starts were 13% lower than the 12 months ending February 2020. Highway and bridge starts were 4% higher on a 12-month rolling sum basis, while environmental public works were up 1%. Miscellaneous nonbuilding fell 26% and utility/gas plant starts were down 37% for the 12 months ending February 2021.

The largest nonbuilding projects to break ground in February were the $2.1 billion Line 3 Replacement Program (a 337-mile pipeline in Minnesota), the $1.2 billion Red River Water Supply Project in North Dakota, and the $950 million New England Clean Energy Connect Power Line in Maine.

Nonresidential building starts fell 7% in February to a seasonally adjusted annual rate of $208.1 billion. Institutional starts dropped 8% during the month despite a strong pickup in healthcare. Warehouse starts fell back during the month following a robust January, offsetting gains in office and hotel starts, and dragging down the overall commercial sector by 8%.

For the 12 months ending February 2021, nonresidential building starts dropped 28% compared to the 12 months ending February 2020. Commercial starts declined 30%, institutional starts were down 19%, and manufacturing starts slid 58% in the 12 months ending February 2021.

The largest nonresidential building projects to break ground in February were Ohio State University’s $1.2 billion Wexner Inpatient Hospital Tower in Columbus OH, ApiJect Systems’ $785 million Gigafactory in Durham NC, and Sterling EdgeCore’s $450 million data center in Sterling VA.

Residential building starts slipped 7% in February to a seasonally adjusted annual rate of $388.9 billion. Both single family and multifamily starts fell during the month, with each losing 7%.

For the 12 months ending February 2021, total residential starts were 4% higher than the 12 months ending February 2020. Single family starts gained 12%, while multifamily starts were down 15% on a 12-month sum basis.

The largest multifamily structures to break ground in February were Bronx Point’s $349 million mixed-use development in The Bronx NY, the $215 million Broadway Block mixed-use building in Long Beach CA, and the $200 million GoBroome mixed-use building in New York NY.

Regionally, February’s starts fell lower in the South Central and West regions but moved higher in the Midwest, Northeast, and South Atlantic Regions.

FEBRUARY 2021 CONSTRUCTION STARTS

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.