In this Placer Bytes, we dive into the recent recovery data from pharmacy leaders CVS and Walgreens and analyze their potential in the coming months.

Tough Start to 2021

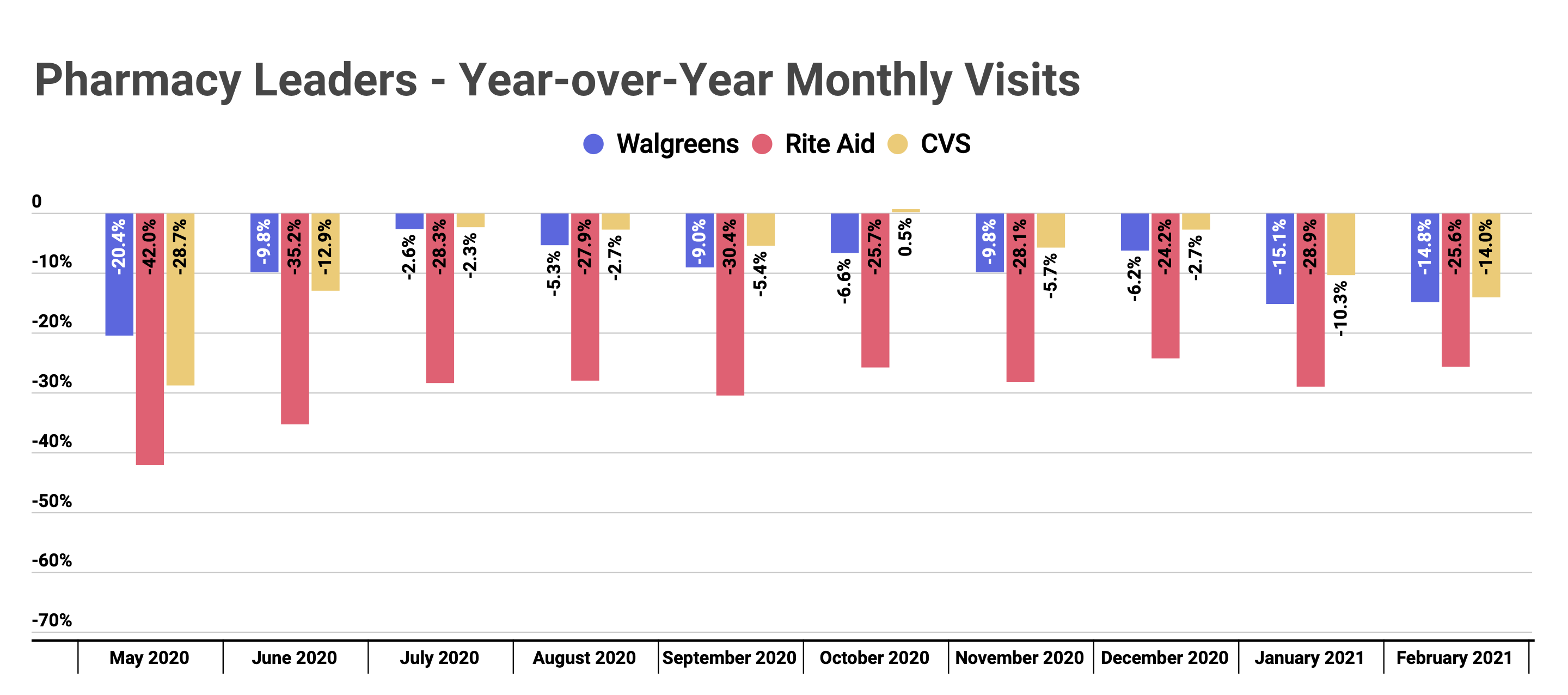

Visits to Walgreens, Rite Aid and CVS locations were trending in a very positive direction in late 2020. While the sector saw the same dip that other retailers did because of a resurgence of COVID cases, by December visits were again moving in a positive direction. CVS saw monthly visits down just 2.7% year over year, while Walgreens and Rite Aid were down 6.2% and 24.2% respectively – marking the lowest visit gap for Rite aid since the start of the pandemic.

But this positive momentum was short lived and a combination of inclement weather, continued COVID concerns and one fewer day in February saw visit gaps increase significantly in early 2021. For both CVS and Walgreens, visit gaps were the largest they had been since June 2020.

Rising Visits into the Spring

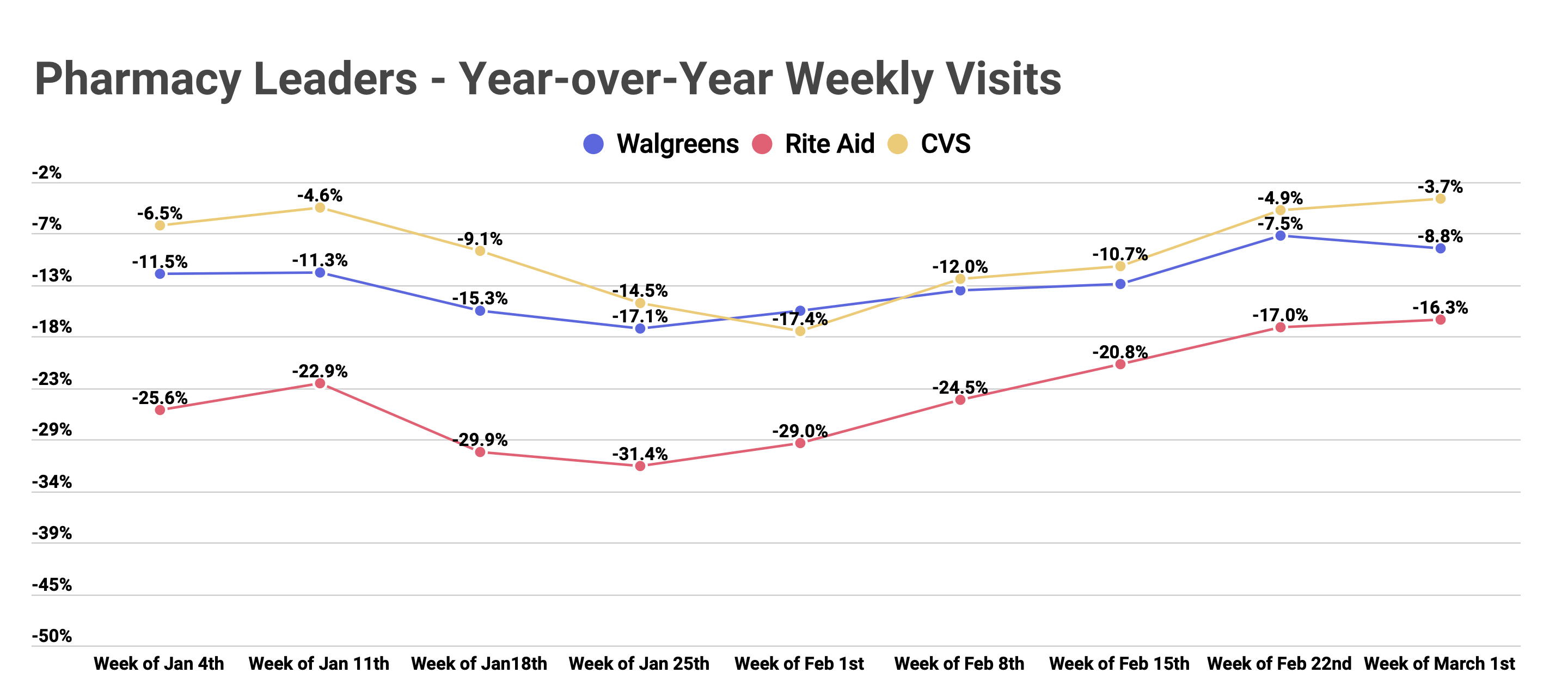

However, weekly data put the dips into a very different context. Year-over-year visits were down at their greatest point in late January and early February as severe weather was hitting across the country. And by late February and early March, visits had returned to late 2020 levels and were trending positively in the right direction. Looking at weekly visits the week of March 1st saw CVS traffic down just 3.7% year over year, while Walgreens and Rite Aid were down 8.8% and 16.3% respectively. Essentially, CVS and Walgreens were back on their recovery path, while Rite Aid was showing more positive visit rates than it had seen throughout the pandemic.

Long Term Benefits

And there is still another gear for this sector to hit. In the short term, CVS and Walgreens are likely to benefit from the combination of a continued recovery and the roll out of COVID vaccinations in locations across the country. Considering the fact that pharmacy locations are especially well oriented to driving unexpected purchases, the process could provide a strong bump for business.

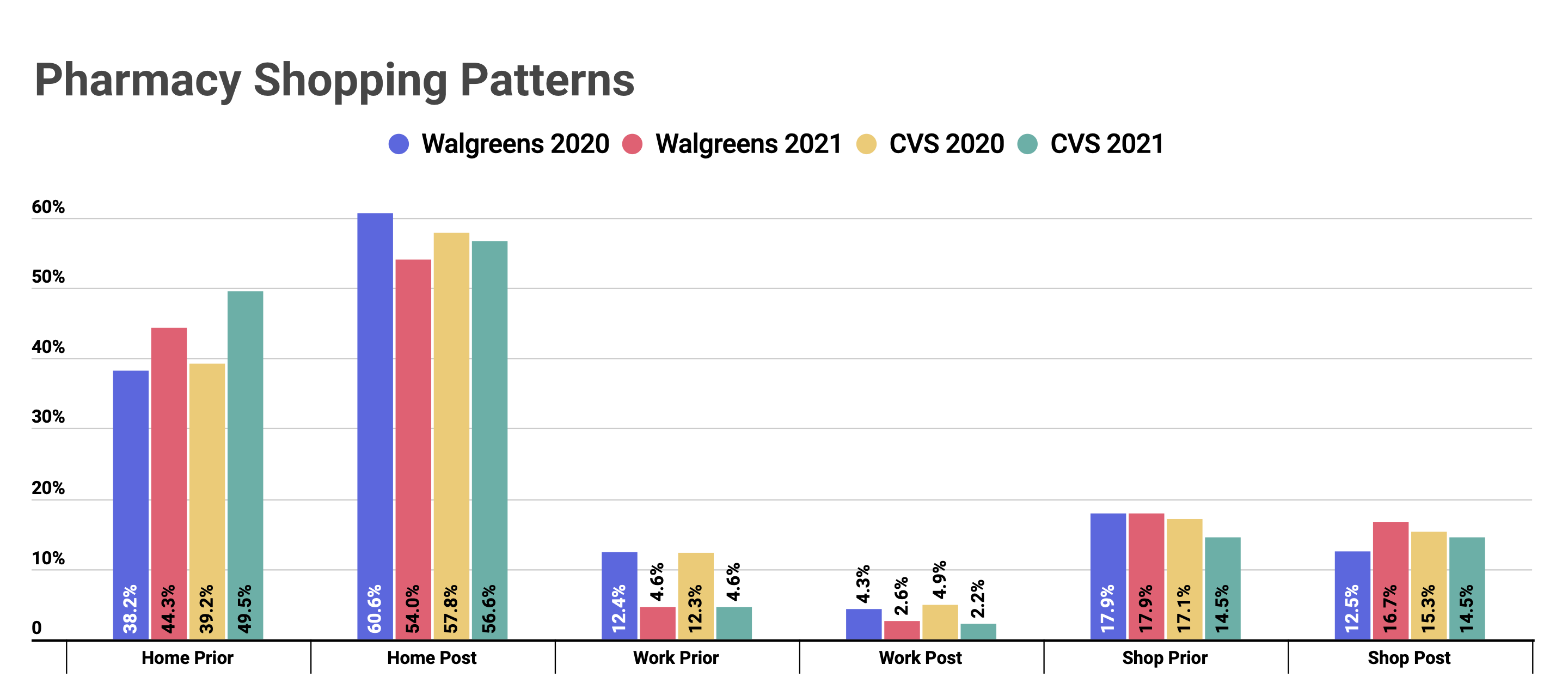

But in the longer term, these brands are among those that should benefit most from the return of normal routines. Looking at the first week of March year over year, Walgreens and CVS were still seeing major increases in those coming to locations from home and major declines in those coming before or after work. Pharmacies benefit from the need ‘to grab a few things’ and their ability to satisfy that trip very effectively. They are less oriented to the full shopping experience, which is what a traditional grocery store would provide. So, the return of professional routines could mean more visits, very quickly.

Will the recovery continue on pace for these brands? Can a return of routine drive a major impact for pharmacies?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.