The coronavirus forced people to reconsider and even scrap their vacation plans altogether. While reservations through short-term rental sites like Airbnb and VRBO plummeted 47% from January to April, bookings slowly recovered in the following months. Experts theorize short-term rentals in remote markets offer a social distance-friendly experience, with multiple bedroom-units and whole homes furnished with full-service amenities, including kitchens, making longer-term stays more convenient.

Additionally, when you book an entire home, it’s sheltered from interaction with staff and strangers, making for a safer experience than hotels in many cases. A recent survey conducted by OmniTrak analyzed travel-related perceptions of risk related to the coronavirus pandemic and found that travelers viewed hotels (46%) as a greater risk than an Airbnb or VRBO vacation rental (39%). Ouch. That’s gotta hurt.

Let’s take a look at how short-term vacation rental giants Airbnb and VRBO fared during the pandemic and adapted their ad strategy under the travel industry’s new normal.

Airbnb slashes ad budget in half, pushes longer-term rentals to accommodate “flexcationers”

Since its inception, Airbnb has been a disrupter in the travel and hospitality market. But even this market disrupter couldn’t shake the pandemic’s death grip. Airbnb decided to lay off a quarter of its workforce and saw a 30% dip in profits YOY. Still, the company quickly adapted its business model to the unprecedented landscape, launching a new Online Experience feature where users could participate in various virtual activities from the comfort of their home. The company also started to push longer-term rentals to accommodate travelers and remote workers eager to put distance between themselves and their crowded, urban homes – many of which were host to the most devastating outbreaks in the early days of the pandemic.

In terms of ad strategy, the company invested $7.6 million in ads from February 1st, 2020 to February 1st, 2021, less than half of their total ad budget from 2019. One of the brand’s top creative from the year featured a picture slideshow backed by Dolly Parton’s I Will Always Love You. The YouTube ad spot centered on a couple’s adorable labrador retriever finding home and happiness in their kitschy rental, as highlighted through snapshots of the dog lounging on the couch, playing in the backyard, or with a toy in his mouth ready for a game of tug of war. The video spot was Airbnb’s biggest campaign of the year, pushed out in late February of 2021, presumably to stoke public interest in the idea of traveling in a post-pandemic world.

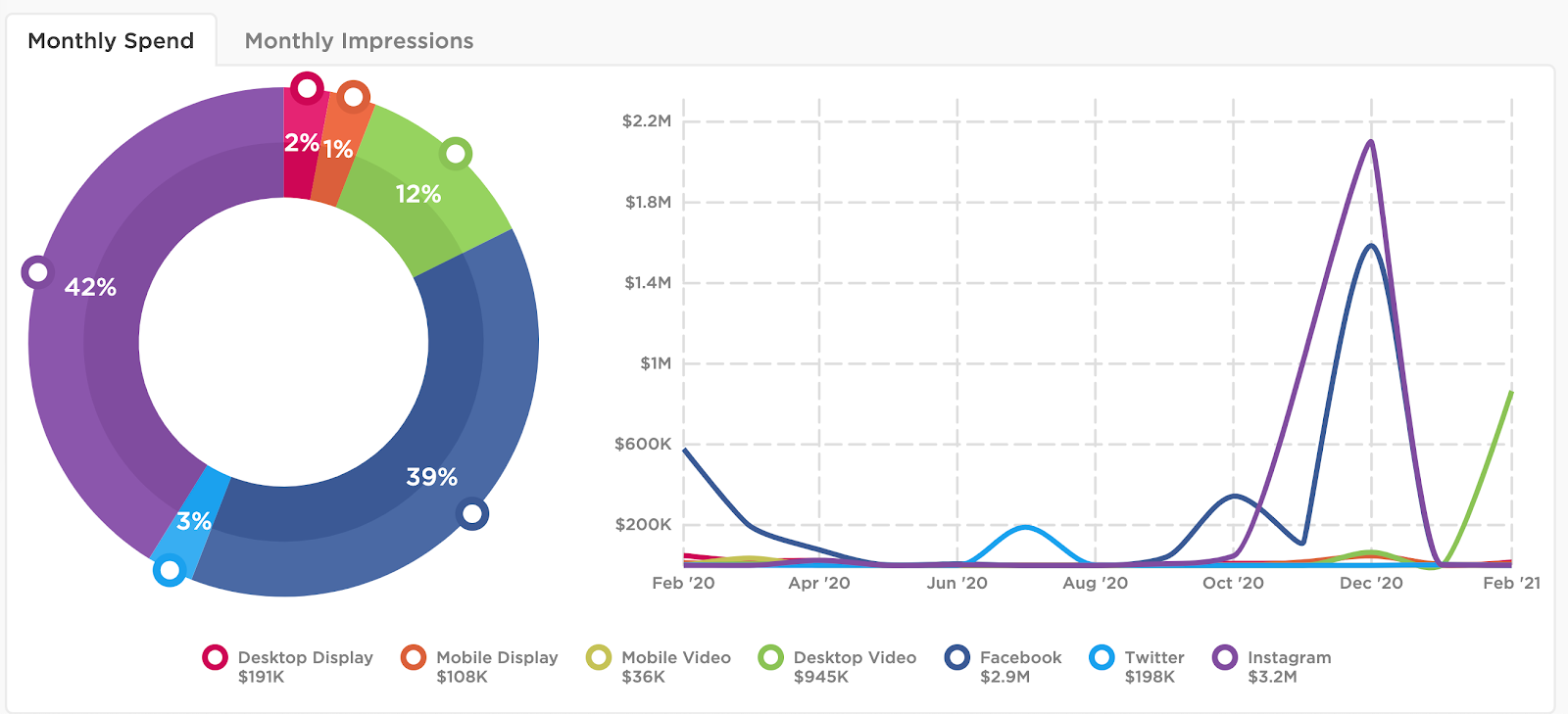

Ad spend remained virtually nonexistent across all channels until early fall when Airbnb started pushing out campaigns inviting hosts to rent out their homes to holiday travelers. Ad spend reached its peak in December with almost $2.1 million funneled into

Instagram ads and over $1.5 million going to Facebook. 42% of total ad spend for the year went to Instagram, with Facebook trailing close behind at 39% and YouTube coming in third with 12% total spend. In terms of impression share for the year, the ratios paralleled spend share for each platform. Instagram earned 43% of impression share, followed by Facebook at 38% and YouTube with 6% of total impression share.

VRBO bets big on cabin fever

Expedia-owned VRBO is off to its best start to a year in almost a quarter-century. While the company saw an 85% dip in bookings in March and April as COVID-19 began spreading across the globe, VRBO reported gross bookings “increased significantly” in May and June of 2020. The company said “drive-to destinations” were among the first travel segments to bounce back from the pandemic. As opposed to Airbnb, the brand increased its ad spend year over year from $72 million in 2019 to $103 million in 2020. The short-term rental brand racked up a cumulative 8.5 billion ad impressions in 2020, an impressive jump from the 5.2 billion impressions they gained in 2019.

VRBO’s top creative centered around whimsical and humorous video spots advertising the platform as a place where anyone could find a vacation rental matching their unique needs. VRBO’s ads follow a definitive theme. Backed by bubbly pop music, their ads explode with vitality and color, inviting travelers to create a paradise of their own making within this new normal.

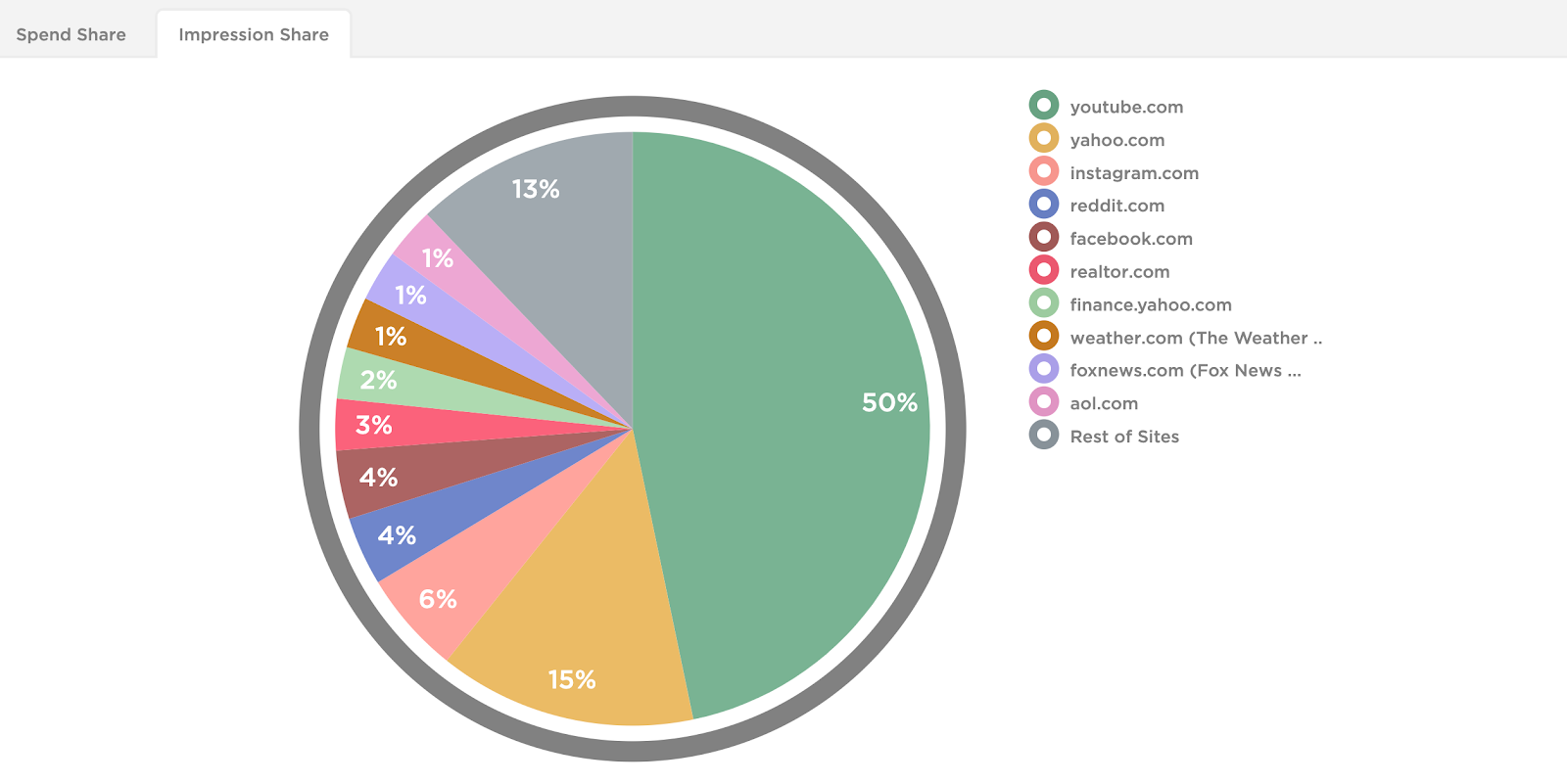

The brand’s ad spend was riding a high in February 2020. However, with the pandemic’s onset, we see that VRBO pumped the brakes on spending starting in April to reconfigure their strategy and incrementally increased monthly ad spend until reaching a peak in January 2021. VRBO’s ad strategy wasn’t as diversified as Airbnb’s, with 85% of total ad spend for the year funneled into YouTube. VRBO also targeted sites like Yahoo, Fox and AOL, and while spending for these platforms was marginal at best (around 3%), it does speak to the type of audience the company targets and attracts. Regarding impressions, YouTube returned over 50% impression share, with Yahoo coming in at a distant second pulling in 15% impression share.

As people hit the road for Spring Break and begin making plans for the summer season, it’s clear travelers are longing for ways to reunite and connect with loved ones. The short-term rental industry is undergoing a massive transformation from extended stays to new cleanliness guidelines, and demand isn’t slowing down.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.