Unsurprisingly, malls were hit especially hard by COVID with visits declining dramatically in the spring before beginning a slow comeback to normalcy in May and June. Yet, there are real reasons to believe that the sector could see a strong revival in 2021.

And that starts with better understanding the sector’s current status.

Mall Index – March Update

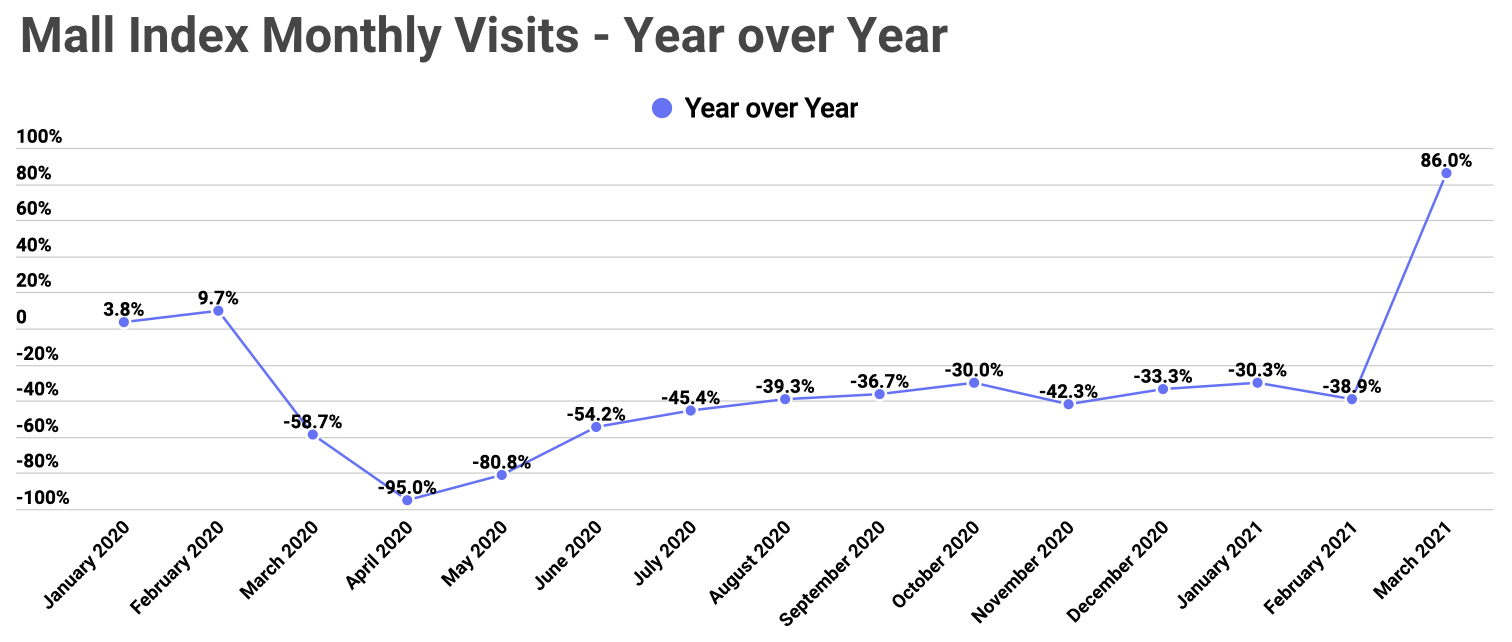

Looking at an index of over 50 top tier malls throughout the country shows the steady pace of return that the sector saw throughout the summer. Following a dip in November as COVID cases surged a week before Black Friday’s shopping peak, the sector recovered with year-over-year gaps shrinking each month from November through January.

Yet, February again presented challenges with the year-over-year visit gap expanding as inclement weather throughout key regions of the country limited the continued recovery. Nonetheless, March presented a breakthrough with visits surging 86.0% year over year. But while this number is indeed impressive, it is also a very limited indicator as much of these same malls were already closed by mid-month in 2020, thus challenging the effectiveness of the metric to show what is really happening in context.

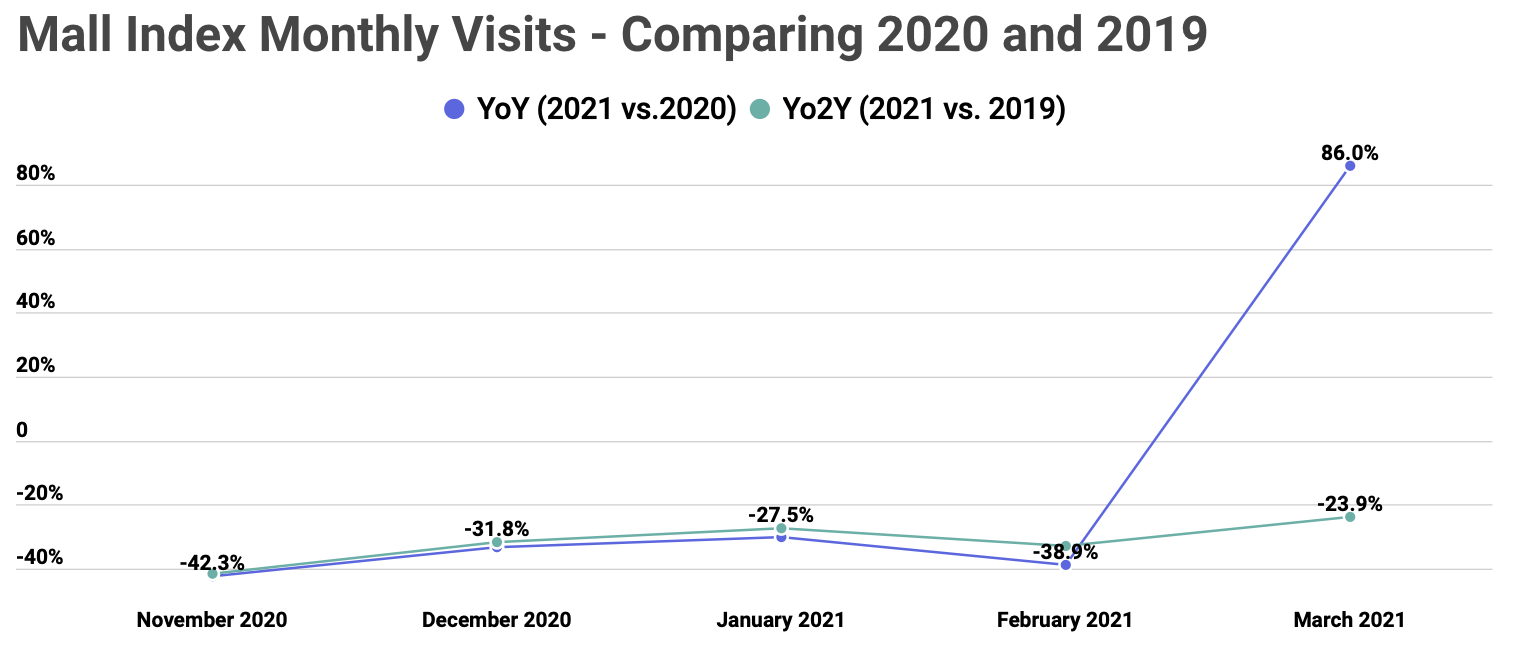

However, 2021 numbers can also be compared to ‘normal’ 2019 levels, and from this perspective too there was a clear and marked step forward. Comparing March 2021 visits to the same malls in March 2019 shows the visit gap down to just 23.9%, the lowest since the pandemic began. This was buoyed heavily by a 43.6% jump in visits between February and March further indicating that the ‘return’ to malls is in fact in full swing. And even accounting for the weather challenges in February and the fewer overall days, there was still a 25.7% jump in visits in March when compared to January, which had been a high point for the sector until then.

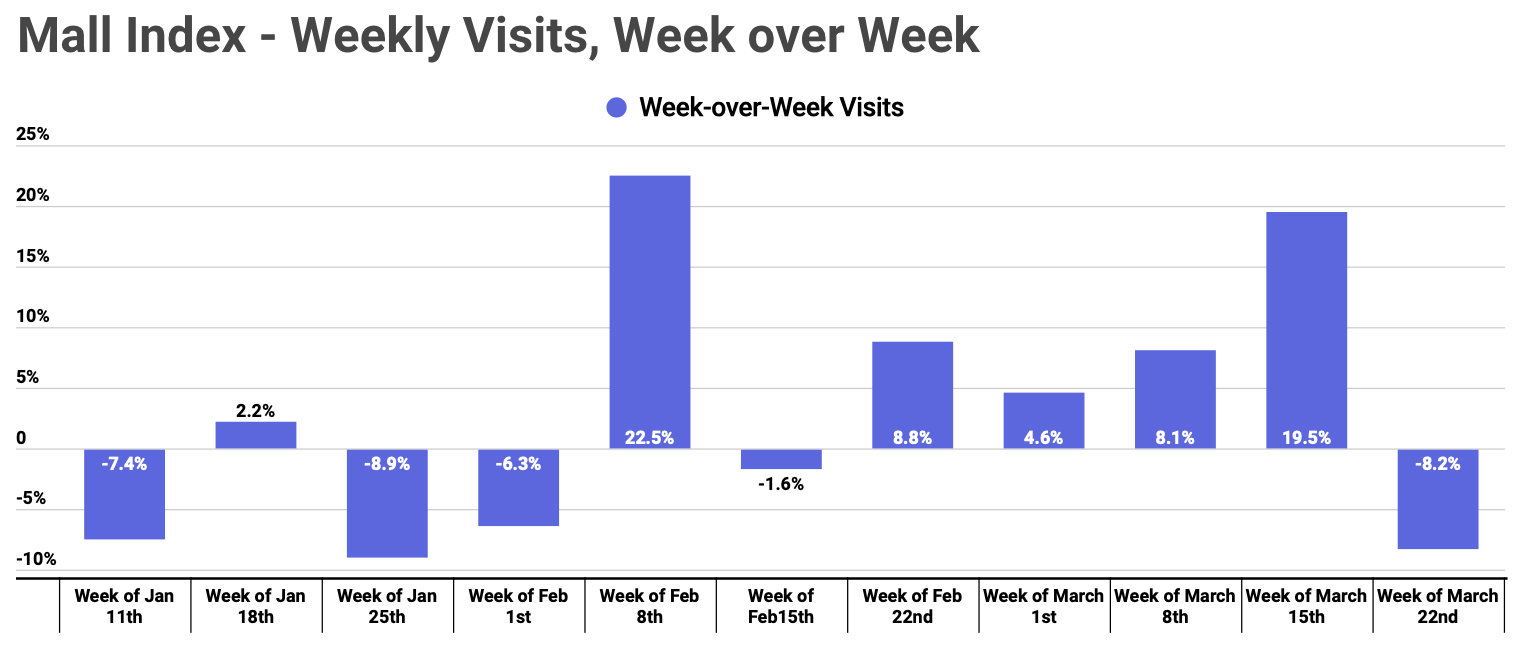

Weekly data further deepens this concept as weekly visits consistently rose throughout late February and early March compared to the week prior. And even the week of March 22nd, which saw an 8.2% dip compared to the preceding week, still marked a relative high point. Visits the weeks of March 15th and 22nd were 19.1% higher than the two weeks prior, and both weeks marked clear high points since the start of 2021.

Does this mean the mall sector has completed its recovery? Certainly not. But it does mean that top tier malls throughout the country still have exceptional strength. Their continued capacity to rebound quickly when given the opportunity speaks to the continued strength in the sector, and explains why the format still deserves its lofty position within the retail landscape.

Will malls continue to show recovery strength?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.