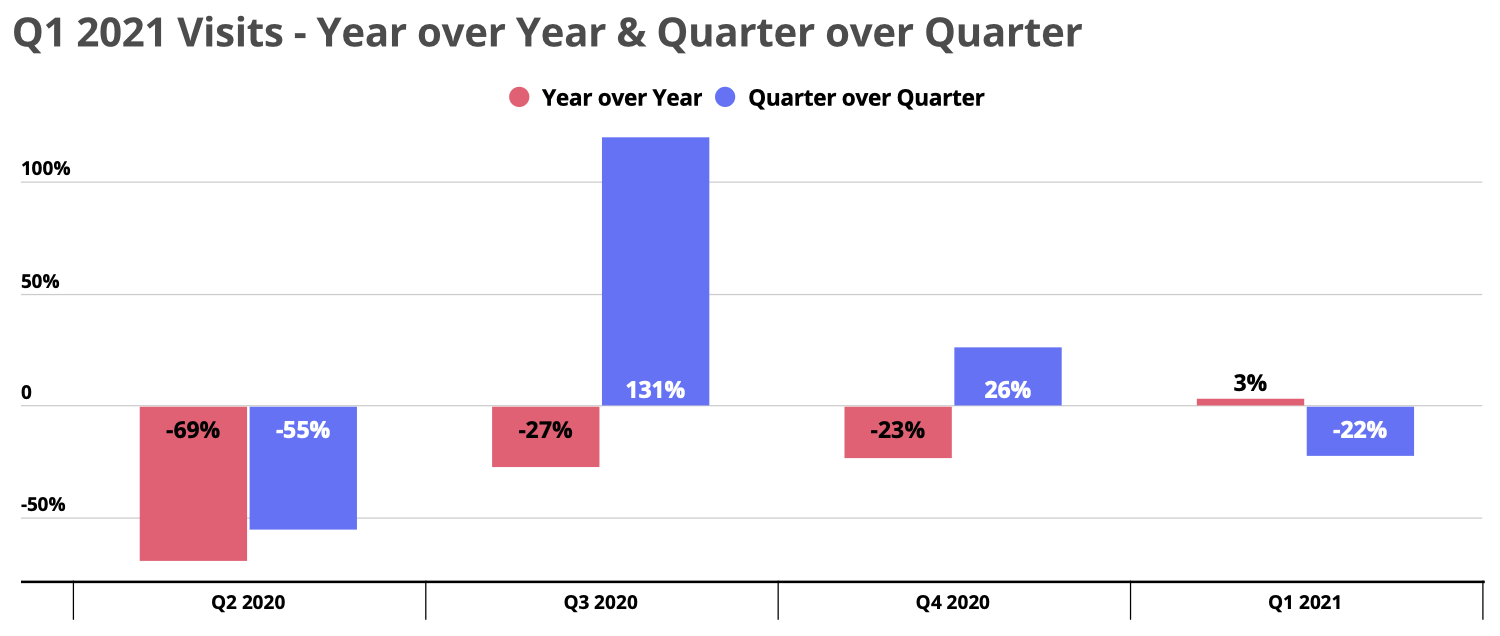

From serving as the one-year mark since the onset of the pandemic in the U.S. to potentially highlighting the beginning of retail’s return to normalcy, Q1 was very important.

We dove into some of the biggest trends.

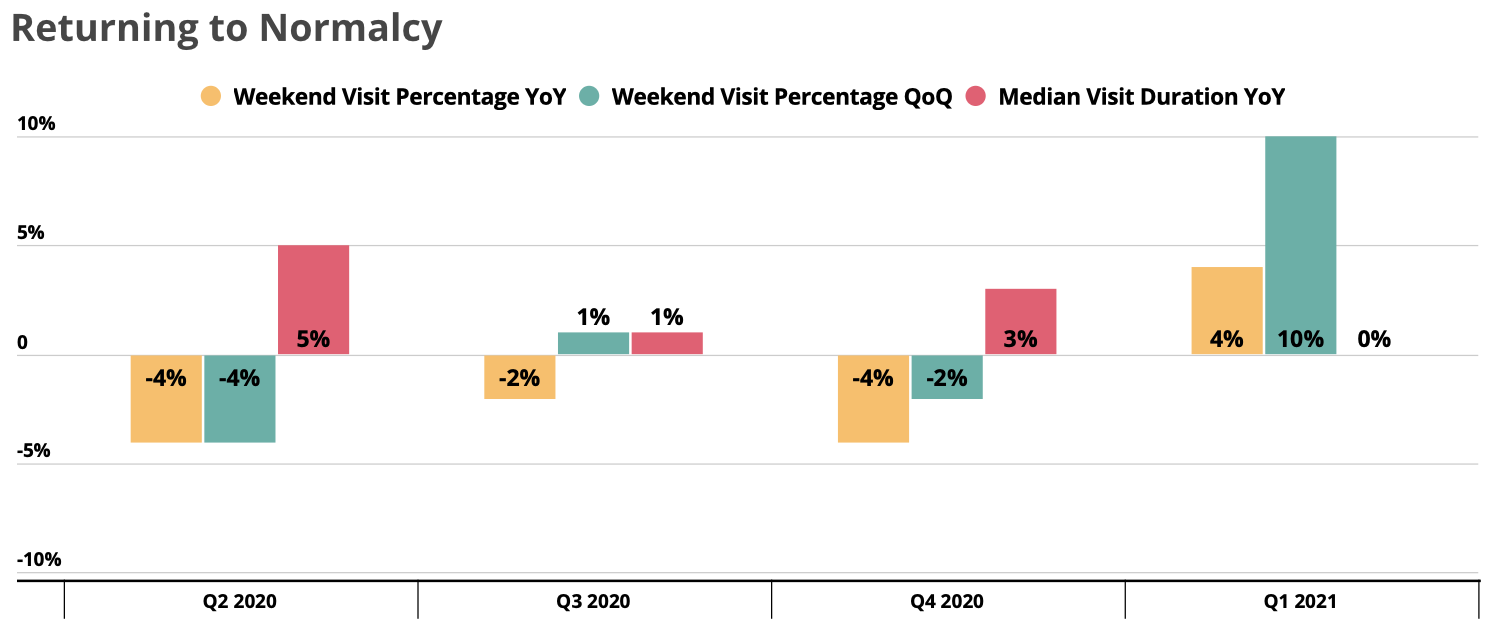

Return to Normalcy

One of the most significant trends in Q1 retail was signs that normal shopping patterns were returning. In the apparel space, our Q1 Quarterly Index showed that weekend visit percentage rose for the third quarter in a row with a quarter-over-quarter jump of 10%. This is critical as many apparel players rely on shoppers being willing to spend more time getting to a regional mall in order to drive sales.

The grocery sector also saw a similar return with weekend visit percentage rising and median visit duration flat quarter over quarter for the first time since the onset of the pandemic. While this may be less positive for supermarkets, it does indicate a return of routine, pushing brands across different retail segments to prepare accordingly.

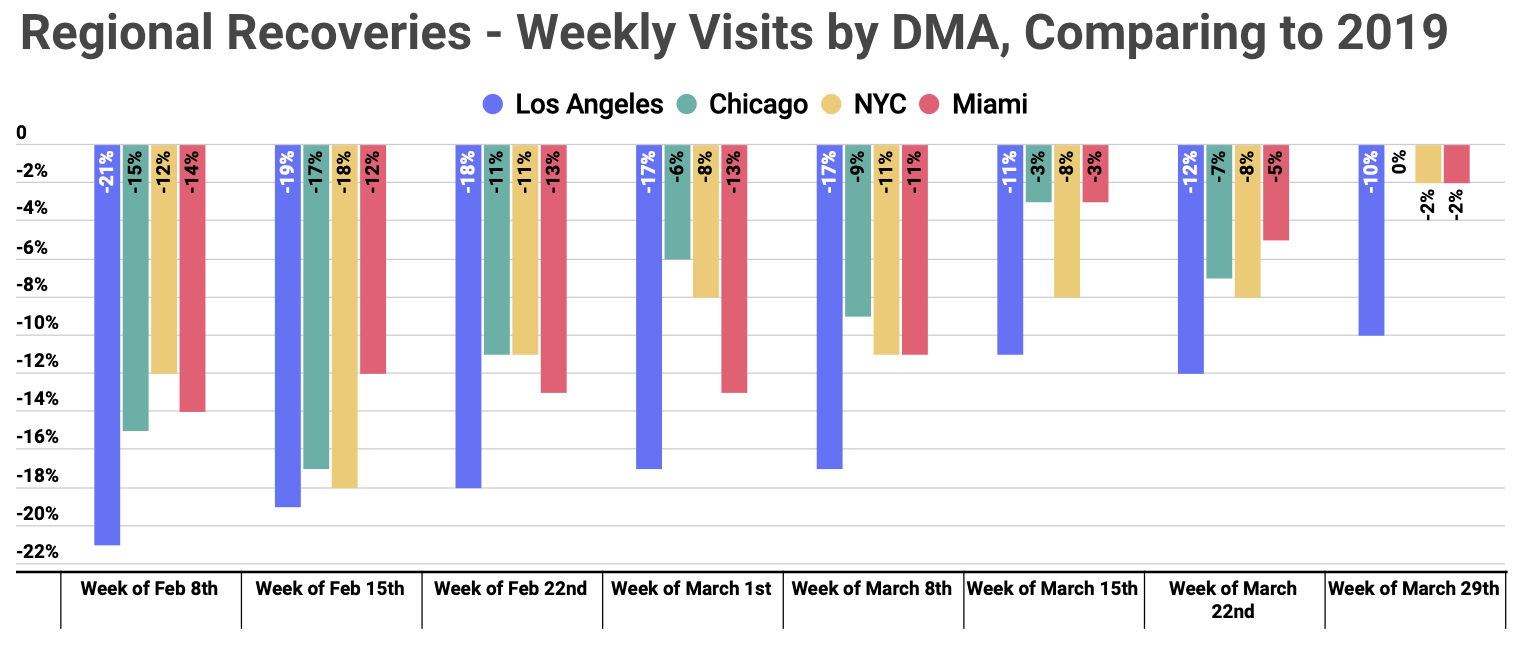

Regional Recoveries

While there are clearly still differences – mainly between California and everywhere else – all regions are seeing growing retail strength. Looking at the overall retail category across four major DMAs shows that several are returning rapidly. And this is not based on a comparison with the equivalent weeks in 2020 where the onset of closures and the pre-closure rush throws off comparisons. Instead, it compares visits to the relative normalcy of the equivalent weeks in 2019. By the week beginning March 29th, retail traffic in LA was still down 10%, but in Chicago it was flat, while in NY and Miami it was down just 2%.

Will retail’s march towards recovery continue?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.