Heading into the print on May 6, we used Similarweb’s alternative data to analyze Peloton’s (PTON) unique users and payment referral traffic as a window into F3Q21 earnings.

Peloton is in a tricky spot right now. Shares are down 35% year-to-date, as investors question the sustainability of elevated pandemic growth levels. Negative headlines around the safety of its new high-end treadmill Tread+ have also weighed on the stock, and could potentially pressure new unit deliveries (more on this below).

What you need to know

Peloton has reported very strong earnings numbers for the last three consecutive quarters. Last quarter, for instance, the home gym-maker reported revenue above the Street’s forecasts, boosted by pandemic tailwinds, strong continued demand for Bike, Bike+, and Tread+, and lower-than-expected churn.

For the fiscal third quarter, which ended March, expectations remain relatively elevated at 325,000 consensus net member additions vs. guidance at 313,000. It’s also important to note that the comparison to last year’s performance is becoming increasingly tough, due to the beginning of lockdowns in March 2020 and the subsequent surge in sales.

Key takeaways

Unique visitors to Peloton’s member site decelerated from F2Q21 to F3Q21.

Outgoing payment referrals are also down on a year-over-year (YoY) basis.

Support visits increased during March, which could reflect Tread+ safety concerns.

Subscriber growth reaching the hill

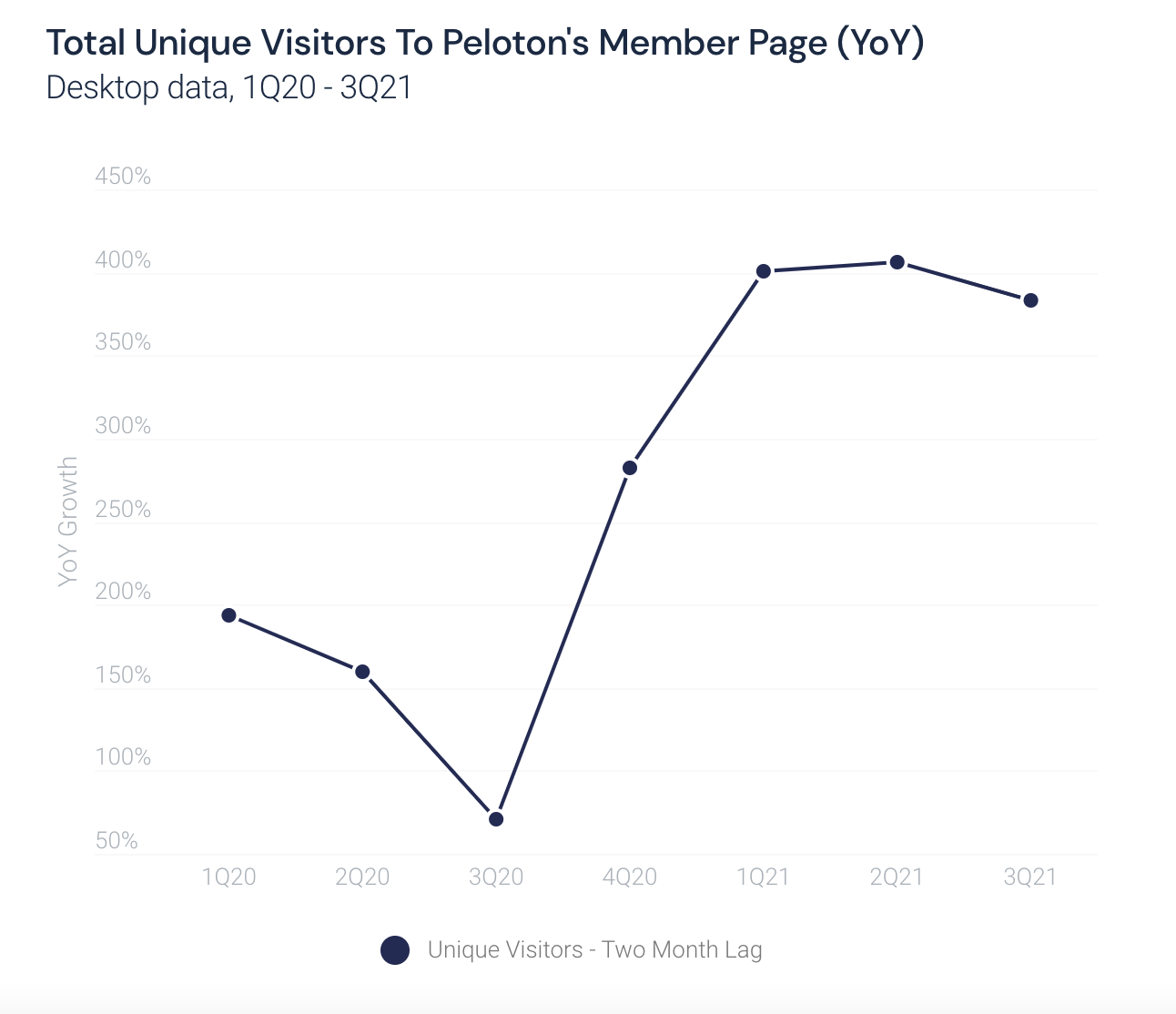

Unique visitors to members.onepeloton.com (from the U.S., Canada, U.K. and Germany) is a historically strong indicator of overall growth in Connected Fitness Subscribers on a two-month time lag.

According to our data, unique visitors experienced a modest sequential deceleration in F3Q21, generally in line with the modest pullback implied by company guidance. Last quarter, management guided for F3Q YoY subscriber growth of +123%, a 10 percentage point deceleration from F2Q (December) at 134%. Meanwhile, the Street is slightly above guidance.

Management also warned that similar to recent quarters, the company has “carried a substantial number of backlog deliveries into the quarter.” However, Peloton offered free digital app trials to bridge the gap between order and delivery. This could push more users to the member page before they become paid subscribers.

Modeling considerations

Users visit Peloton’s member page to initialize or update their profile as well as to take classes disconnected from equipment, like yoga, however it is not reflective of the entire subscriber base.

Plus visits to the member page may also be influenced by shipment delays. As a ratio to the reported member base, visitors to the member page have increased substantially during the pandemic as users track shipment status and take online classes.

Payment data suggests slowing purchases

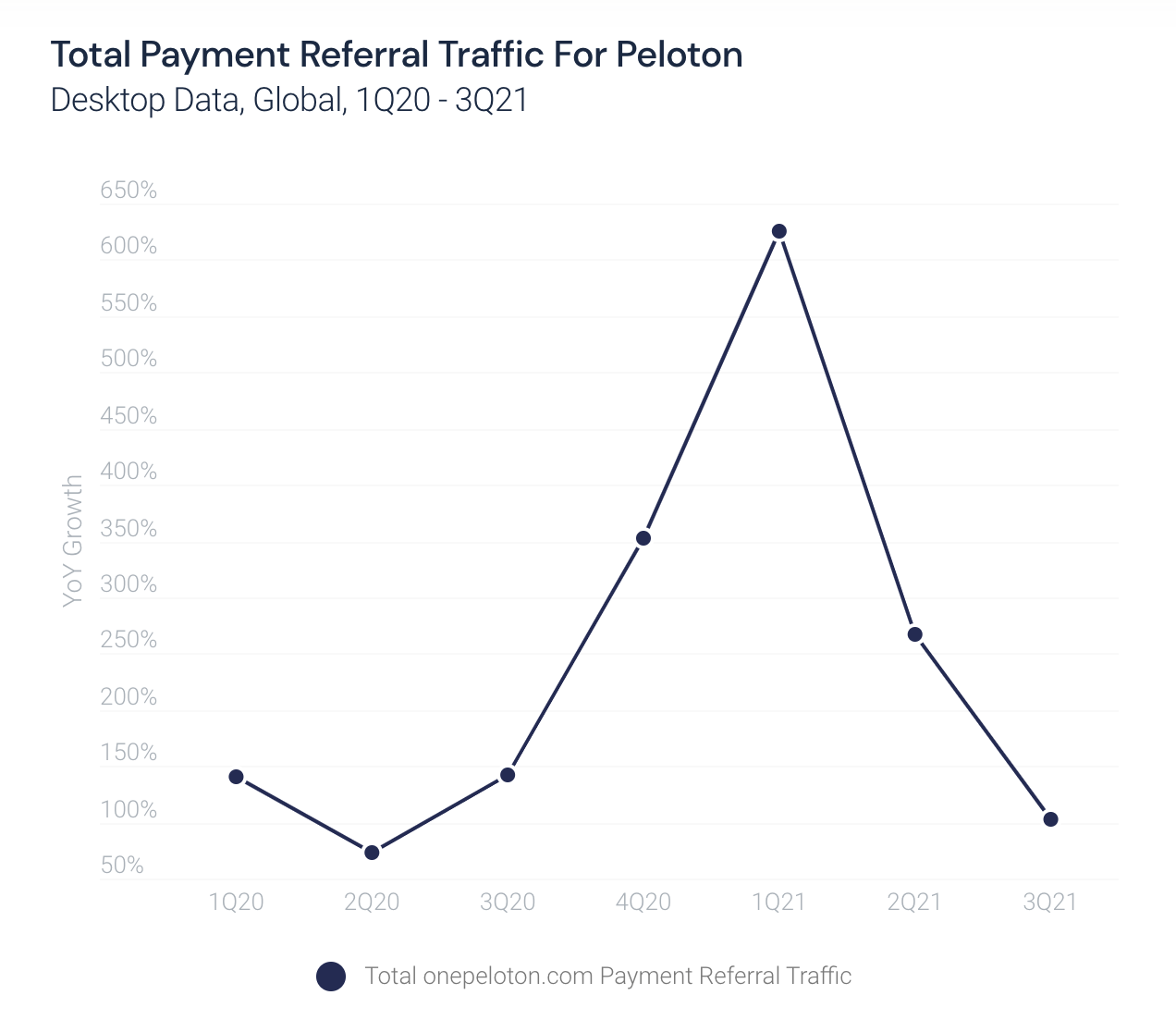

We can assess aggregate outgoing traffic from global onepeloton sites to online payment solutions, such as Affirm, Shopify, and PayPal. This is a key directional indicator of new unit sales and, as a result, Connected Products Revenue.

According to our data, outgoing payment referrals from onepeloton.com also decelerated sequentially vs. F2Q21. In the fiscal third quarter, we found that outgoing payment traffic grew at less than half the rate of F2Q, signaling a softer period ahead.

While payment traffic can be a more volatile indicator and can be influenced by marketing and new partnerships, it does provide a useful signal for new member transactions, particularly in the mass market (via Affirm).

Modeling considerations

Connected Product Revenue is only recognized when the product is actually delivered to the customer. This means there is a lag between payment and the recognized revenue.

In addition, outgoing payment traffic is heavily weighted to Affirm, which offers consumers to pay for equipment in zero-interest installments over time.

Peloton Tread+ headline fallout

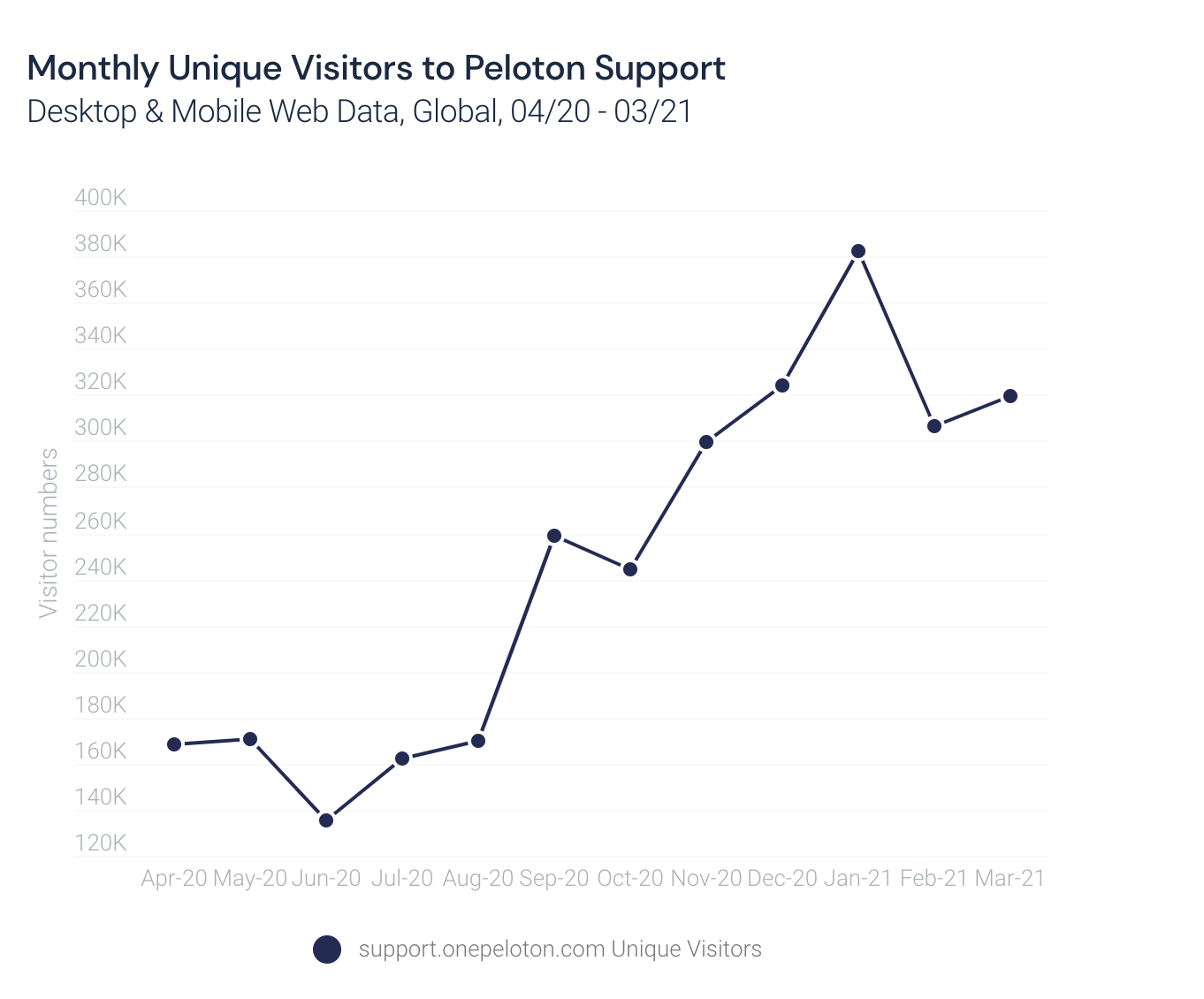

In March, a child died following an incident with Peloton’s $4,295 high-end treadmill. A U.S. government agency subsequently issued an “urgent warning” for the Tread+, noting 39 accidents involving the treadmill, and advising owners to stop using the machine if small children or pets are at home.

While acknowledging the dreadful tragedy, Peloton has dismissed the Consumer Product Safety Commission’s advice, calling it “inaccurate and misleading.” “There is no reason to stop using the Tread+, as long as all warnings and safety instructions are followed,” the company stated.

Our data shows that unique visitors to Peloton’s support page (support.onepeloton.com) accelerated in March 2021 compared to February. This could indicate that the accident and probe are possibly negatively impacting Peloton and potentially even driving equipment cancellations, particularly if users anticipate a recall and/or safety enhancements.

Step up your game

Peloton’s digital data provides critical pre-earning and intra-quarter insights. Similarweb gathers, analyzes and synchronizes the vast world of digital data to deliver distilled signals for single stocks. See how the data can strengthen your market analysis and investing strategy.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.