Source: https://secondmeasure.com/datapoints/fashion-resale-platforms-outperform-retailers-during-pandemic/

As environmentally-conscious consumers turn away from fast fashion and seek more sustainable alternatives, resale marketplaces have been on the rise. Furthermore, traditional retailers have started implementing new resale initiatives; Lululemon recently announced a resale program for pre-owned activewear, and Neiman Marcus launched a platform for its stylists to sell clients’ unwanted handbags and accessories. Transaction data reveals how fashion resale companies’ growth has contrasted with fashion retailers’ declining sales during the COVID-19 era, as well as which resale platforms are capturing market share from competitors.

Resale marketplaces were booming, as fashion retailers faced challenges

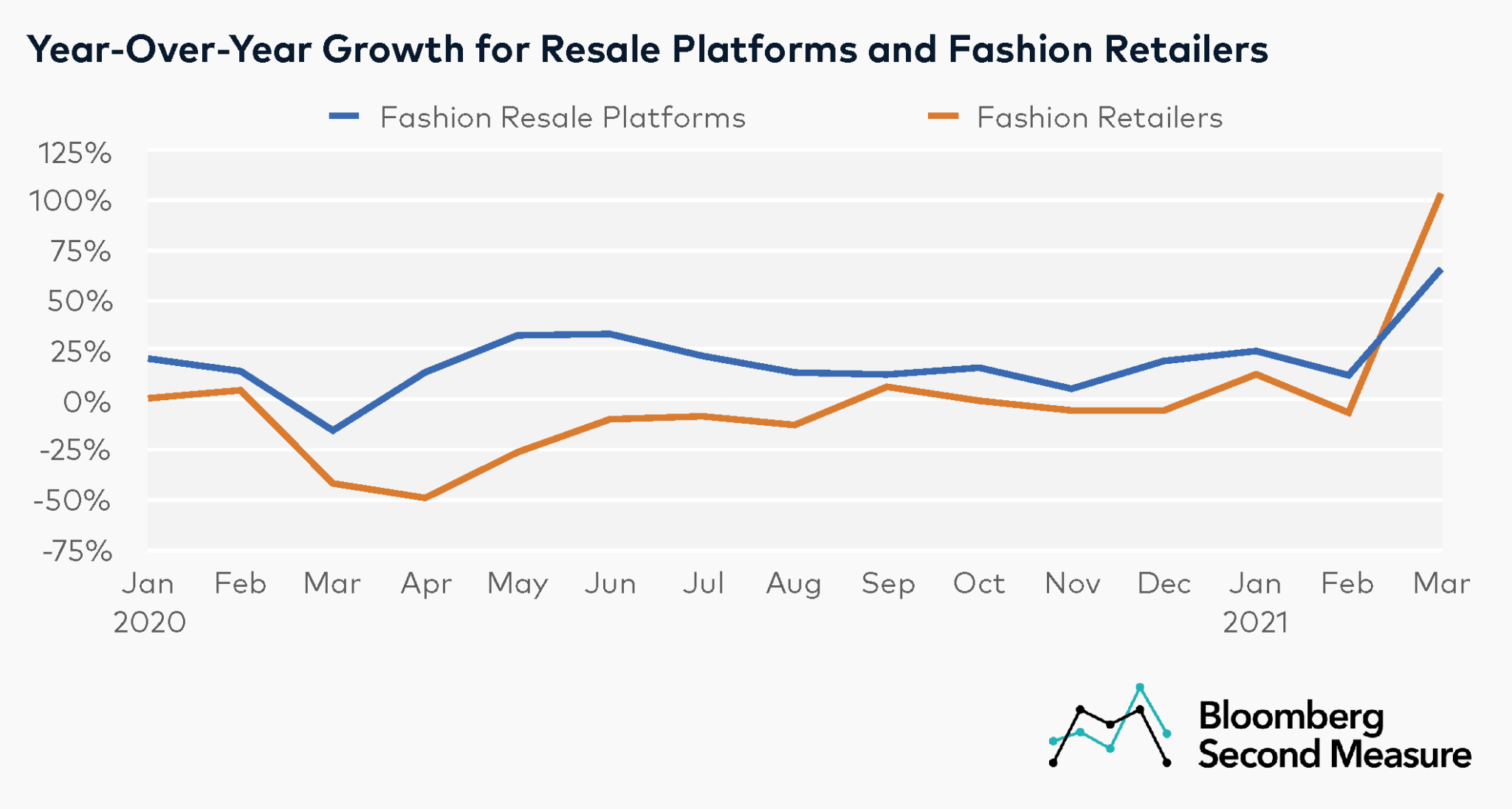

Throughout most of the pandemic, fashion resale platforms outperformed fashion retailers in terms of year-over-year sales growth. The average monthly year-over-year growth for a select group of fashion resellers in 2020 was 16 percent. These companies performed the strongest in June, peaking at 33 percent year-over-year sales growth. Meanwhile, overall sales among some of the largest fashion retailers experienced an average monthly decline of -12 percent year-over-year in 2020.

Fashion resale vs fashion retailers

The year-over-year growth rate increased significantly for fashion retailers in March 2021, reaching 103 percent year-over-year. Potential factors contributing to retailers’ strong growth in March include increased consumer confidence resulting from vaccination rates and demand for professional apparel as offices reopen. Another likely factor is that March 2021 marks the one-year anniversary since the initial shelter-in-place orders that shuttered most brick-and-mortar retail locations.

The same month, fashion resale platforms grew 65 percent year-over-year. Possible reasons for fashion resale platforms’ strong growth may involve their diversified offerings and channels. Poshmark recently entered into the pet category, following its launch of a home decor category in mid-2019. The RealReal is also investing more in its brick and mortar strategy as demand for luxury consignment continues to grow.

The RealReal and Tradesy have the highest average transaction values among resellers

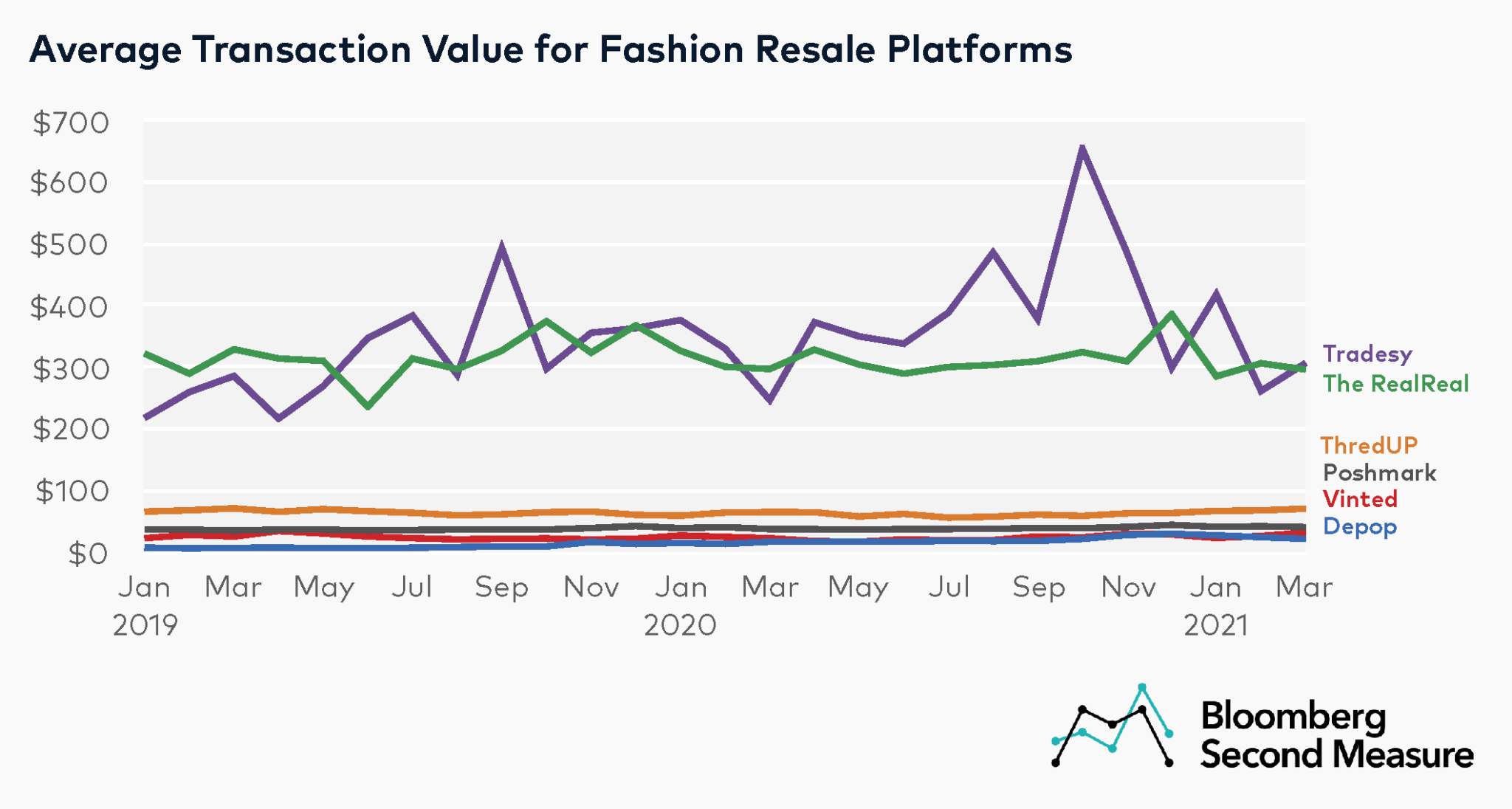

The RealReal and Tradesy are geared toward luxury items, while their resale competitors have a broader range of brands and price points. As a result, these two companies have a much higher average transaction value. In March 2021, the average transaction value was $296 at The RealReal and $306 at Tradesy. ThredUP was a distant third with an average transaction value of $70. Depop has the lowest average transaction value in the competitive set, with $21 in March 2021.

Average Transaction Value for Fashion Resale Platforms

Each of these platforms has its own business model. Poshmark, Tradesy, Vinted, and Depop are peer-to-peer marketplaces where sellers post their own items for purchase. ThredUP and The RealReal require sellers to mail in their items, which are then posted on each respective website for sale. It is worth noting that Bloomberg Second Measure only tracks transaction data for U.S. consumers, so international transactions are excluded from this analysis.

In Q1 2021, ThredUP captured spend from its resale competitors

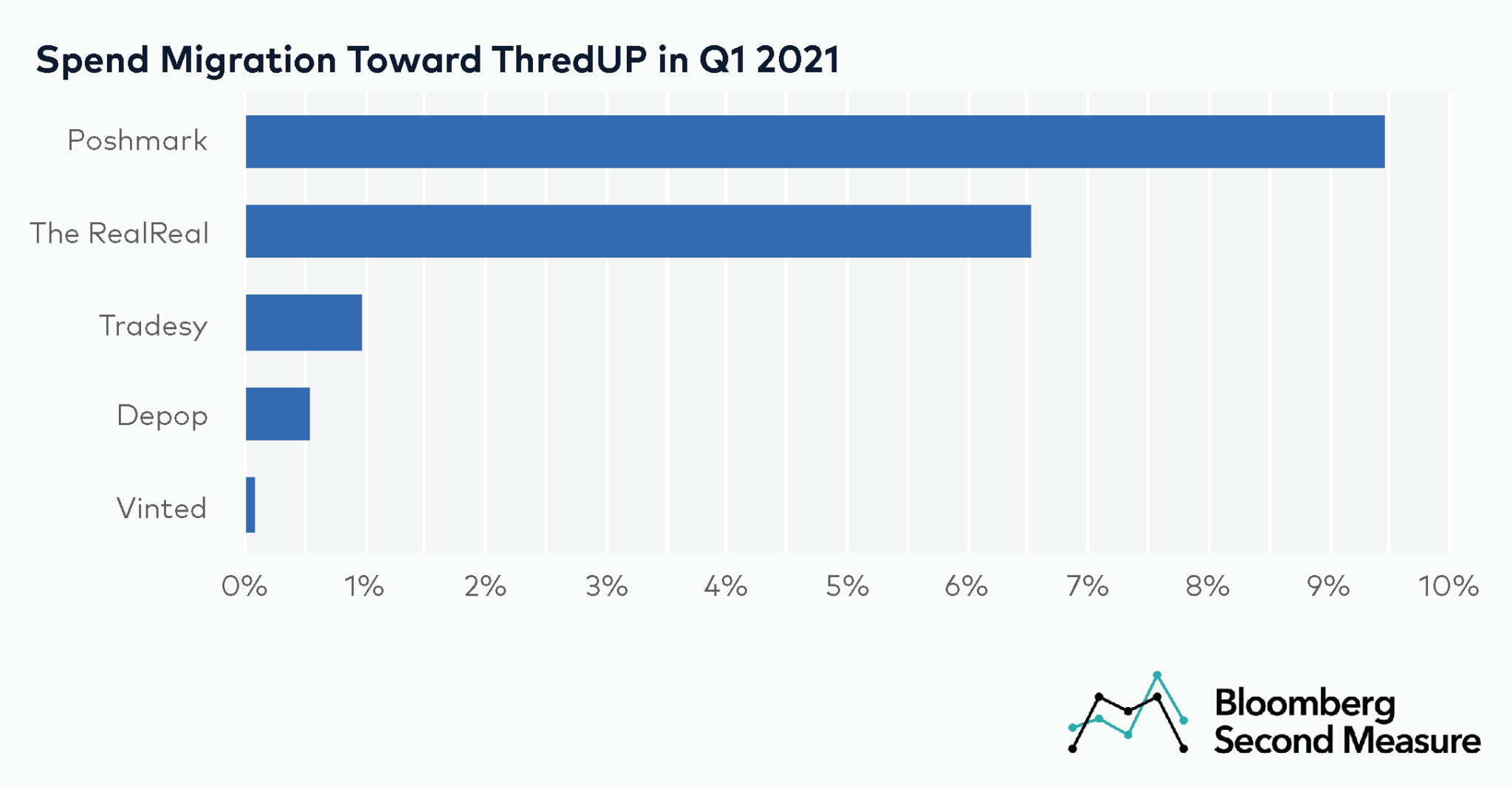

Between Q4 2020 and Q1 2021, overall sales in the fashion resale market grew 13 percent. ThredUP’s sales growth outperformed the market, resulting in a relative share growth—or growth rate of market share—of 18 percent. Of ThredUP’s 18 percent relative share growth, 9 percentage points came from Poshmark and 6 percent came from The RealReal. One percentage point of spend came from Tradesy, and less than 1 percentage point came from Depop and Vinted each.

Spend Migration Toward ThredUP

In recent years, ThredUP has expanded its reach by partnering with retailers and big box stores, including Walmart, Macy’s, and Gap. ThredUP went public in March 2021, following in the footsteps of Poshmark and The RealReal.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.