Very few industries combine fashion and function as well as eyewear. And state-by-state regulations that mandate optometrists performing exams in “two-door” states operate separately from opticians filling prescriptions provide a clear separation between medical necessity and personal indulgence. This combination has led to peak conditions for the nascent online eyewear subindustry. In today’s Insight Flash, we compare online versus offline growth rates, see which top online eyewear brands are outperforming in terms of spend growth and transaction frequency, and dig into customer demographics.

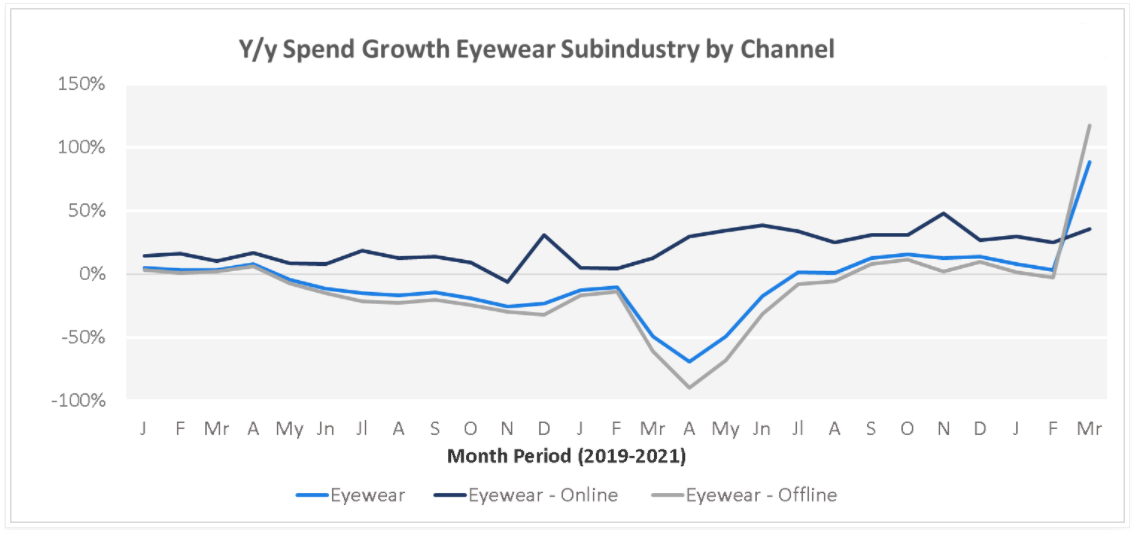

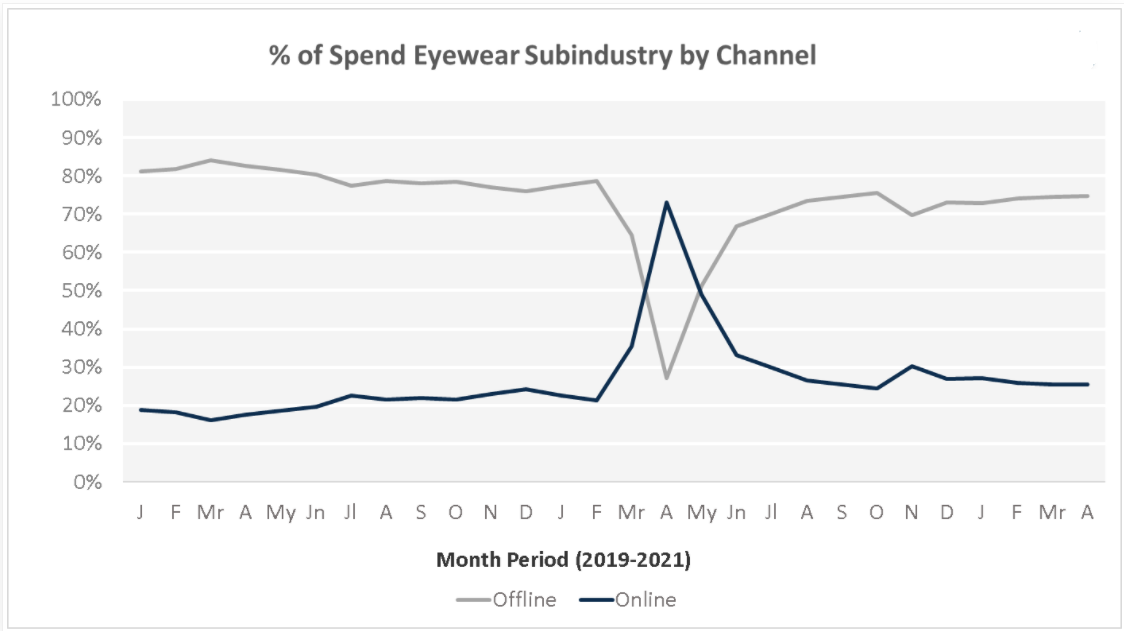

At the beginning of 2019, less than 20% of eyewear spend was online, with channel spend growing double-digits as offline spend growth stayed in the low single digits. In the second half of the year, offline spend began declining y/y, allowing the online share of total spend to reach as high as 24%. While the COVID pandemic put a damper on offline sales, the online channel has retained momentum in reopening, peaking at 30% share of spend in November 2020.

**

Subindustry Channel Trends**

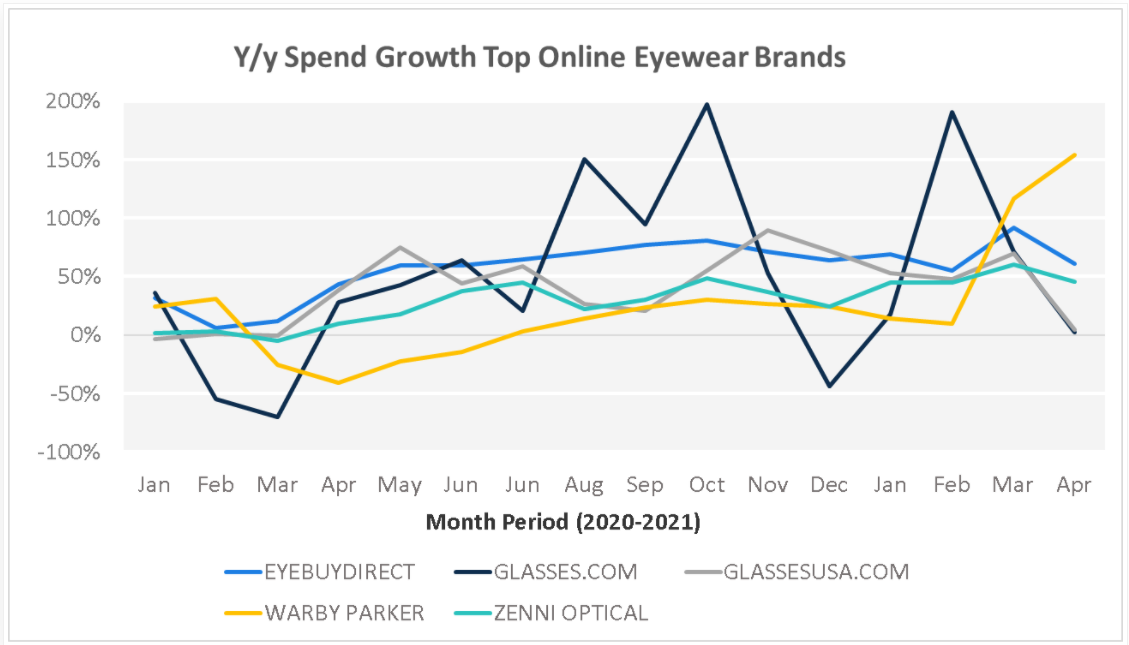

Although Warby Parker has greatly enhanced the visibility of online eyewear (even as the company expands its brick-and-mortar retail presence), spend growth for the company trailed competitors for much of 2020 and only retook the lead in March and April of 2021. Glasses.com and EyeBuyDirect were the growth leaders in 2020, with GlassesUSA.com showing strength in May and November.

Company Trends

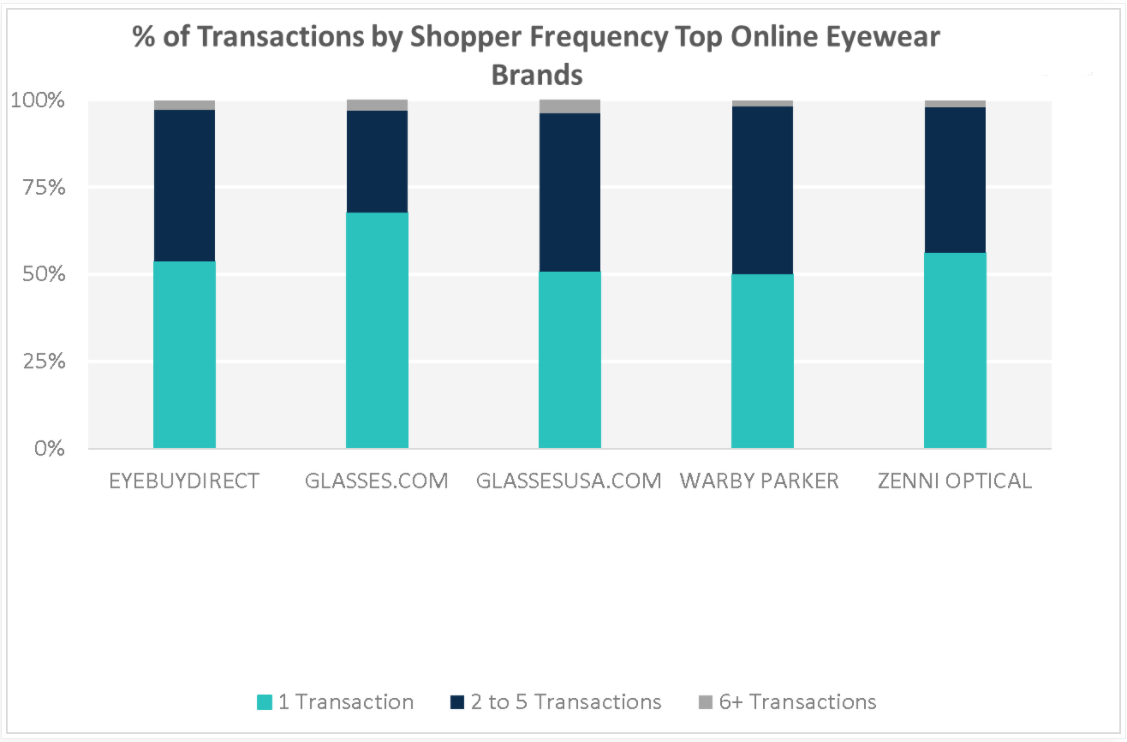

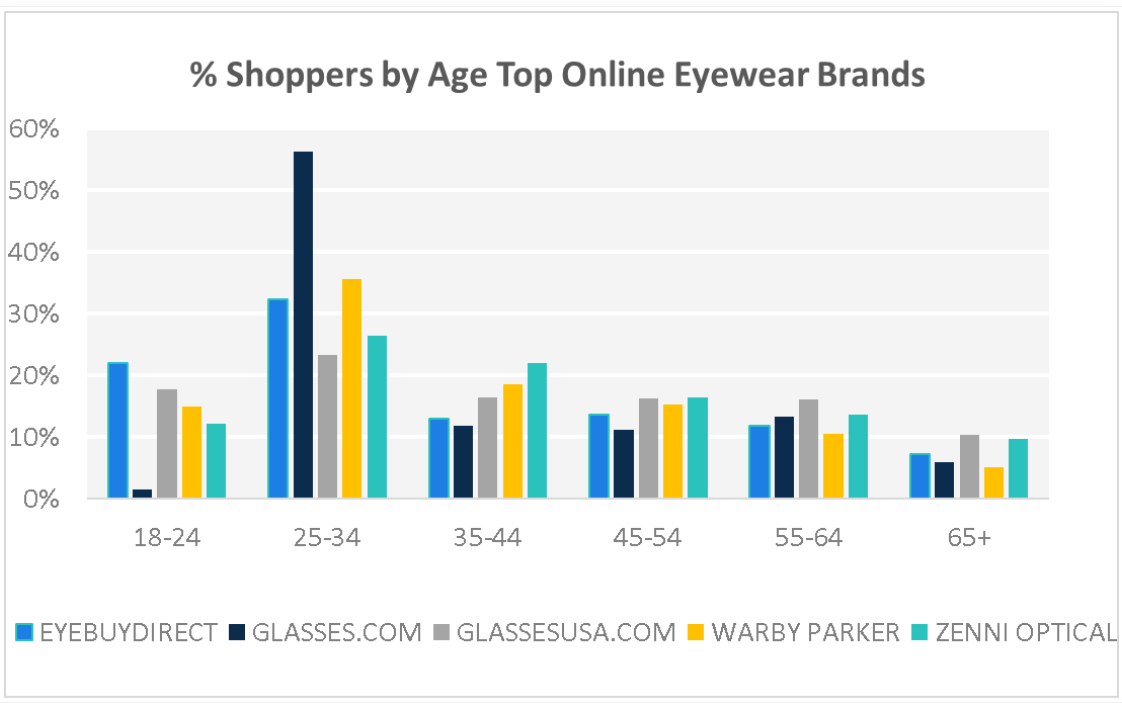

As glasses have become more of a fashion item, transaction frequencies have increased as shoppers swap out old frames for newer looks or buy several pairs to match outfits. Warby Parker’s on-trend positioning has led to half of shoppers making more than one purchase in the last year, the most among the top tracked online eyewear brands. Interestingly, GlassesUSA.com is right behind with 49% of shoppers buying more than once, and 4% of shoppers making at least six transactions. Some of the high purchase rate could be contact lens sales, which have higher replenishment frequency. Notably, GlassesUSA has the oldest customer base among our top tracked brands, while EyeBuyDirect skews youngest, Glasses.com is heavily indexed to 25-34 year olds, and Warby Parker skews in the 25-44 age range.

Shopping Frequency

Demographics

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.