This blog post discusses changes in federal district court litigation due to the COVID-19 pandemic in 2020. Lex Machina monitors and reports on how courts are affected by the social changes due to the pandemic with our COVID-19 blog posts, the COVID-19 Impact Analyzer tool that is publicly accessible, and in-product case tagging for litigation caused by COVID-19.

Our analysis of federal district court activity revealed the following:

This blog post specifically focuses on litigation activity in civil trial courts of the United States federal district court system. We compared the calendar years of 2018, 2019, and 2020.

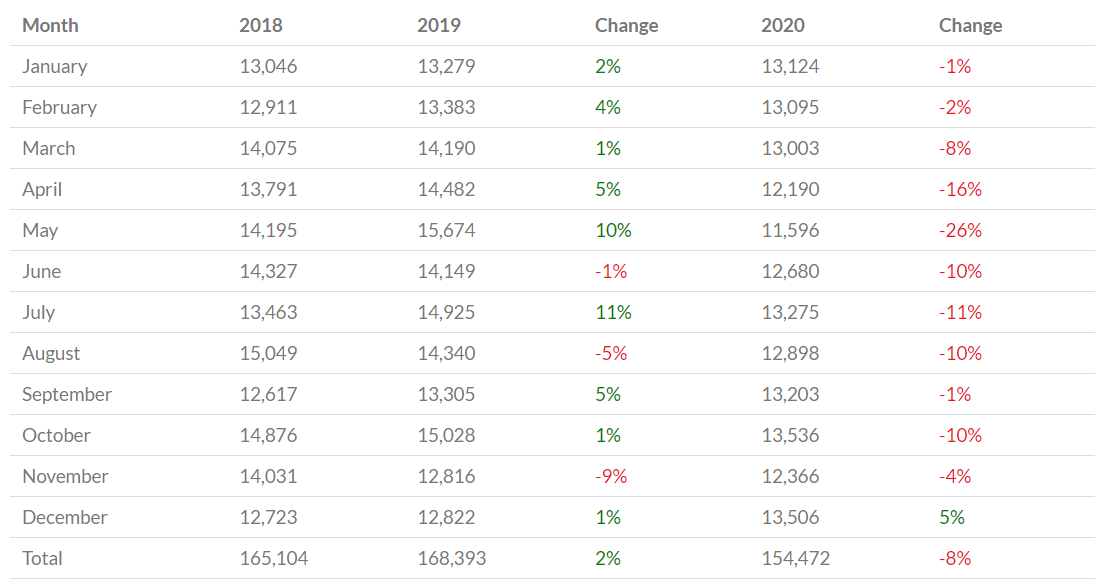

Case Filings by Month

The first figure below shows monthly case filings in federal district court for the last three years, excluding Product Liability filings. Product Liability filings are not included because multidistrict litigation (MDL) in that area would skew the data. (Product Liability information is included in the next section.) The second figure shows the number of cases filed each month and the percent change from the previous year.

There are natural fluctuations in court activity every year. In “normal” years, this includes events such as slowdowns around holidays and summer vacations. In March of 2020, cases didn’t so much drop off as held steady when case filings would normally jump, as seen in the two previous years. The largest drop-off last year was in May when there were 26% fewer cases filed compared to May 2019. May 2019 also happened to be the most active month for case filings for all three years surveyed, with 15,674 cases filed.

In previous years, we saw large numbers of cases filed in October which dropped off in November and December as things naturally slowed down during the holidays. In 2020, however, case filings were similar in October and December but lower in November. December was the only month in 2020 with an increase in case filings over the two previous years. Possible reasons for this include litigants taking fewer days off in December as people remained home during the pandemic and increased workloads to make up for shortfalls in previous months.

Overall, case filings (excluding Product Liability cases) fell 8% between 2019 and 2020. While this is significant, it is not the drop-off many feared at the beginning of the pandemic.

Total Federal District Court Case Filings (Excluding Product Liability) By Month*

Case Filings With Percent Changes (Excluding Product Liability) by Month*

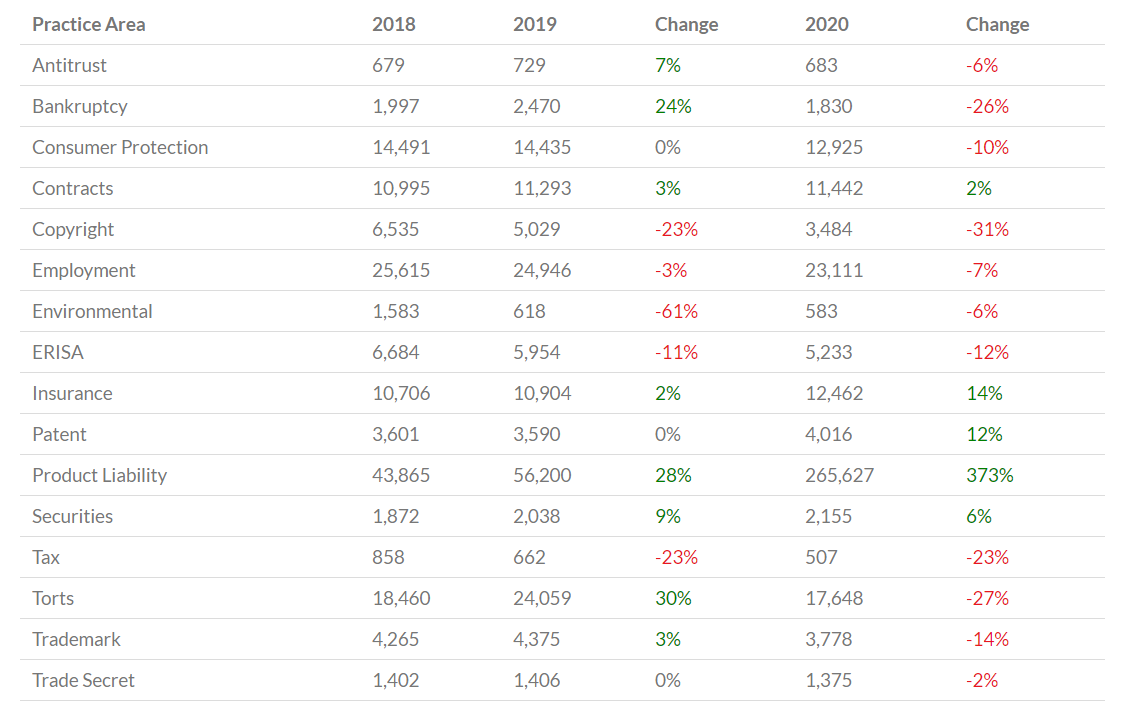

Case Filings by Practice Area

While case filings (excluding Product Liability) were down 8% overall, different practice areas fared differently in 2020. In the Product Liability practice area, a large MDL case set involving ear plugs resulted in a 373% increase in case filings between 2019 and 2020. While no other practice area had a major increase, a few practice areas did have increases over 2019.

Insurance had a 14% increase in case filings due to business interruption cases as a result of pandemic-related shutdowns. Business interruption claim filings did decline later in 2020, as 822 business interruption cases were filed in federal court from March to July versus 643 cases filed between August and December. Several courts have ruled in favor of insurers, and three multidistrict litigation suits have been created to handle claims under these types of policies issued by specific carriers.

Other practice areas with increases included Patent cases (12%), Securities cases (6%), and Contracts cases (2%). While Securities and Contracts had a significant number of cases attributable to COVID-19, Patent cases may have increased for a few practice-area specific reasons. (More information about this is available in our Patent Litigation Report 2021.)

Copyright had the biggest drop-off in case filings with a 31% decrease compared to 2019. Torts was next with a 27% decrease. Surprisingly, bankruptcy cases in federal district courts decreased 26% and tax cases decreased 23%. We expect to see more of this type litigation make its way to federal court as a result of the pandemic in the coming years.

Case Filings With Percent Changes by Practice Area

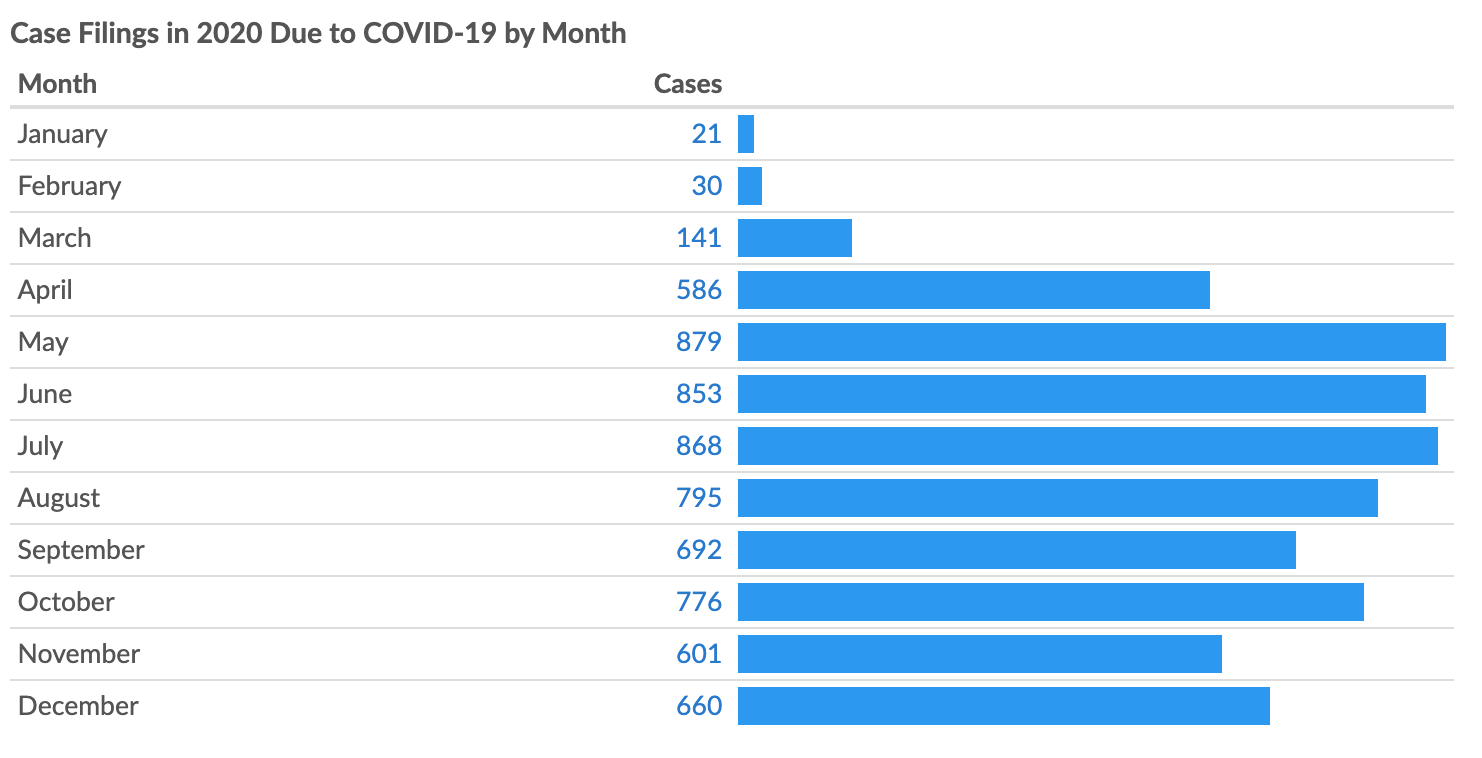

Cases Caused By COVID-19

Lex Machina created a case tag that allows users to view and analyze cases with claims that were directly caused by, or were significantly impacted by, the coronavirus health crisis or related societal changes. The Lex Machina team of legal experts reviews cases with pandemic-related keywords to verify whether the case was filed as a result of the COVID-19 crisis.

A case will receive the COVID-19 case tag if it was filed January 1, 2020 or later and satisfies either one of the following two criterion in the complaint text:

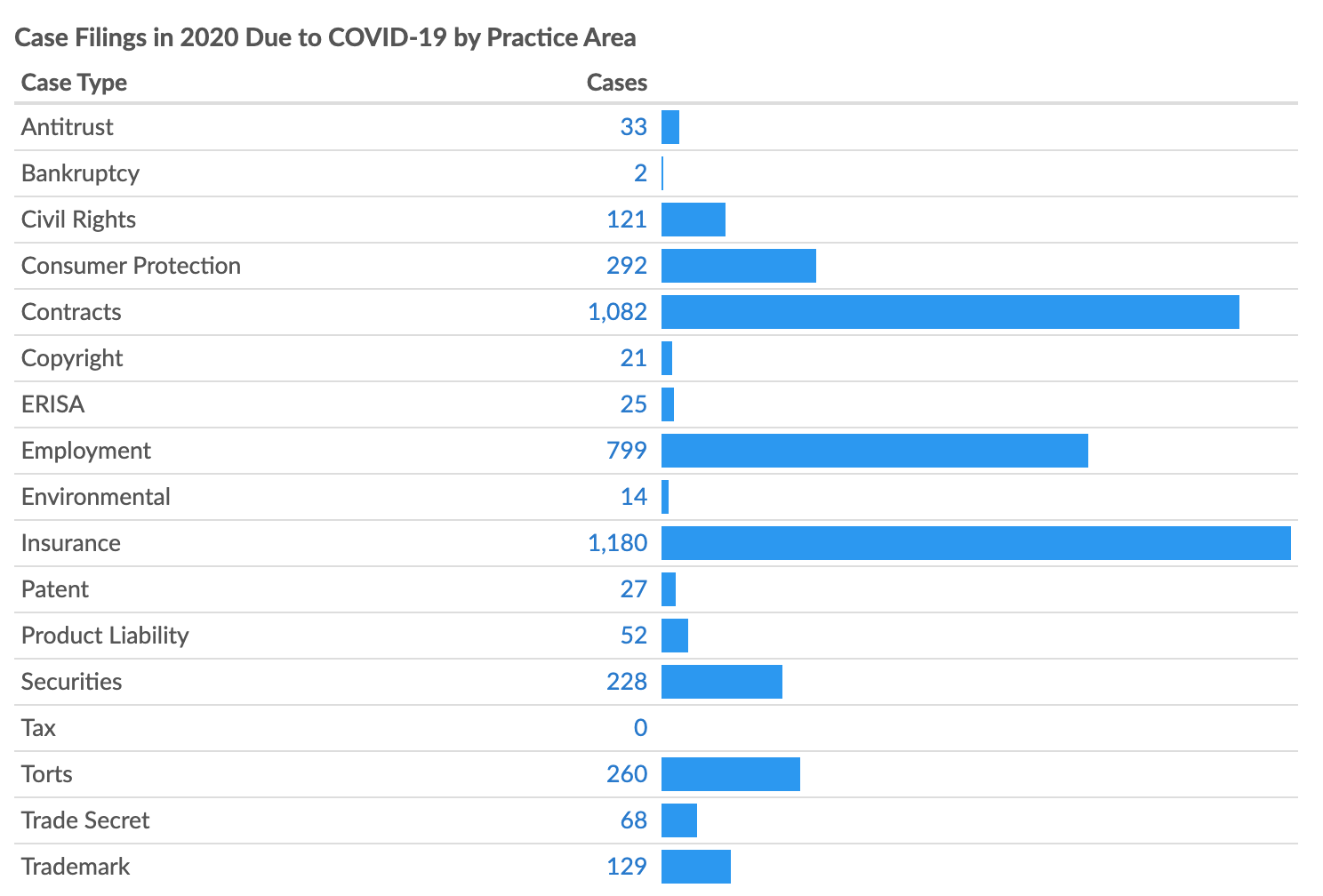

Plaintiffs filed over 6,900 cases due to COVID-19 in 2020. Those cases peaked in the summer months with May seeing 879 cases, the highest of any month in 2020. Looking at the cases by practice area, Insurance saw the most cases caused by COVID-19 in 2020 (1,180 cases) due to the business interruption cases discussed above. Contracts was second with 1,082 cases, many of which concerned cancelled events. Employment was third with 799 cases caused by COVID-19 in 2020. While employment cases caused by COVID-19 peaked in Q4 of 2020, this practice area is still seeing a growing number of cases, as COVID-related issues are still occurring in workplaces.

Note that cases may be filed in more than one practice area and over 2,700 cases were filed in Lex Machina’s “Remaining Federal” category, which includes cases outside of the listed practice areas. Many cases in this category were civil rights cases including constitutional challenges, voting rights lawsuits, and Americans with Disabilities Act (ADA) cases.

Court Findings in 2020

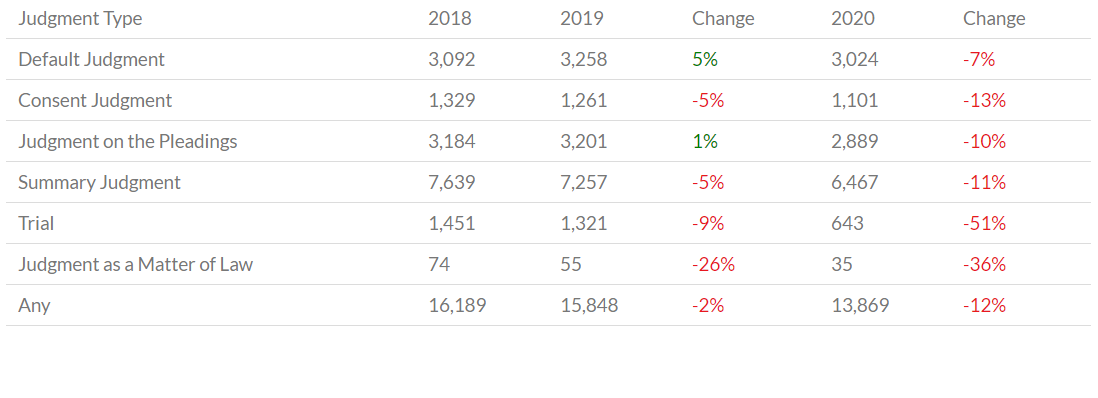

This section shows the number of cases with a Lex Machina “finding” in the listed judgment event occurring in 2018, 2019, and 2020. Findings are court-enforceable determinations such as “Infringement” or “No Breach of Contract.” Lex Machina tracks findings for our 16 practice areas.

It is no surprise that the number of cases with findings decreased in every judgment event in 2020, and cases with findings at trial saw the largest drop-off (a 51% decrease). While there were a substantial number of default judgments, cases with findings on default fell the least since 2019 (7%.) These numbers vary in different practice areas, but it is clear that court activity was down due to the pandemic.

Cases With Findings With Percent Changes By Event

To learn more about the data behind this article and what Lex Machina has to offer, visit https://lexmachina.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.