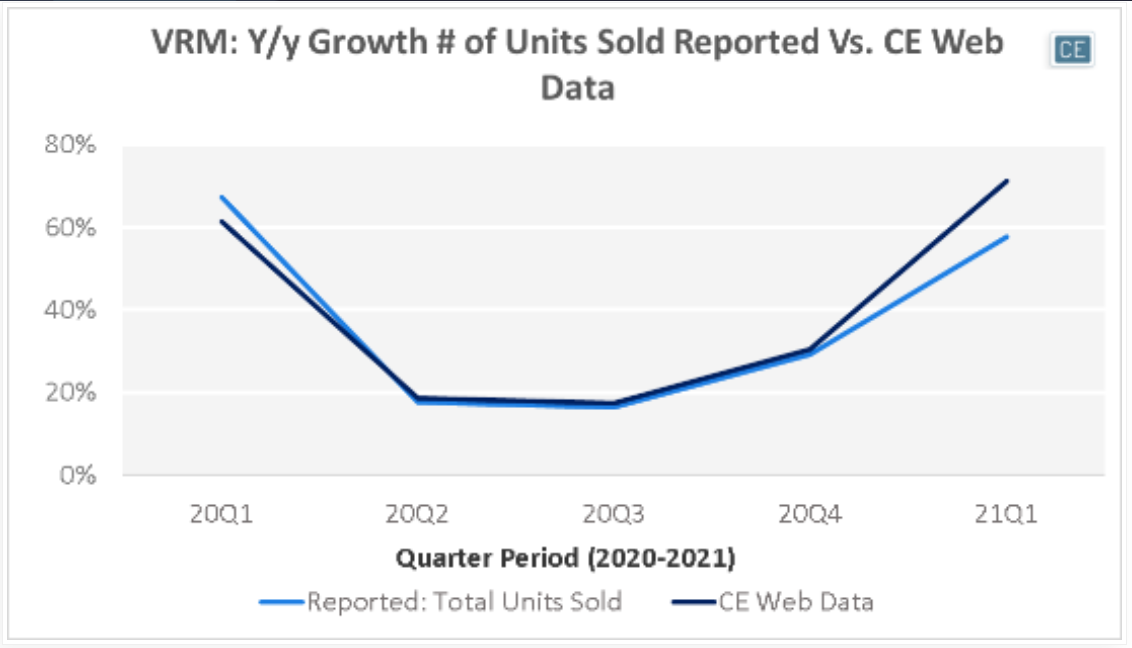

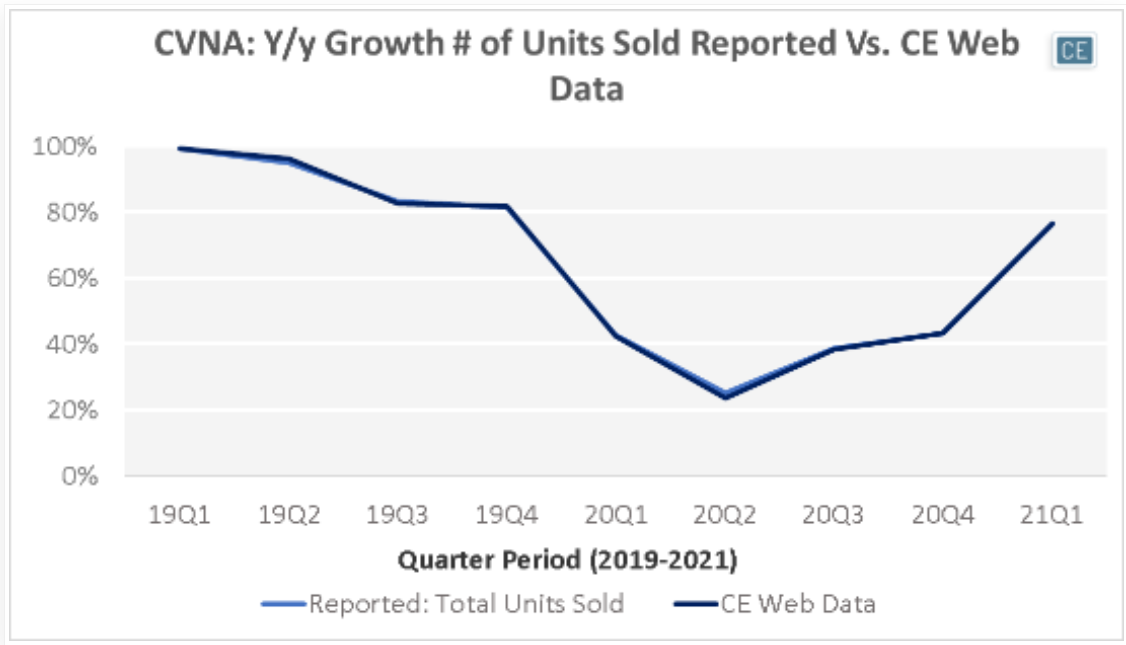

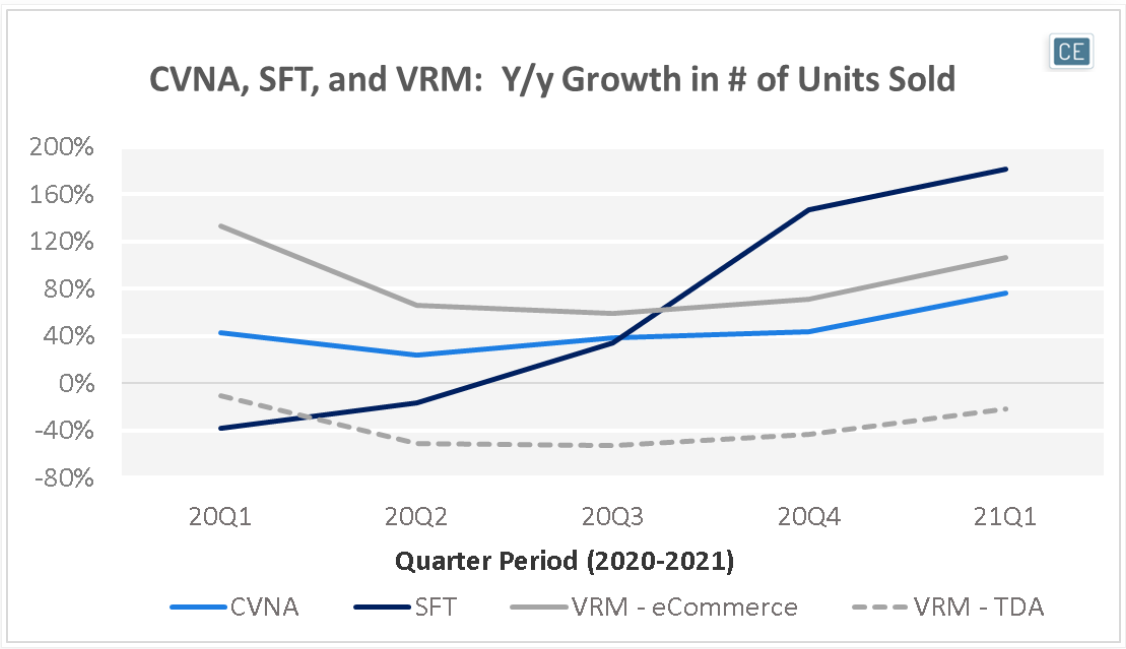

The flight to the suburbs coupled with a fear of human contact has been a boom for online auto sales. Although some may have anticipated a post-pandemic slowdown, VRM’s recent strong performance indicates otherwise. In today’s CE Web Insight Flash, we compare VRM performance (including our unique ability to split out eCommerce vs. TDA) to that of CVNA and SFT in terms of unit growth, ASP, and vehicle model year trends.

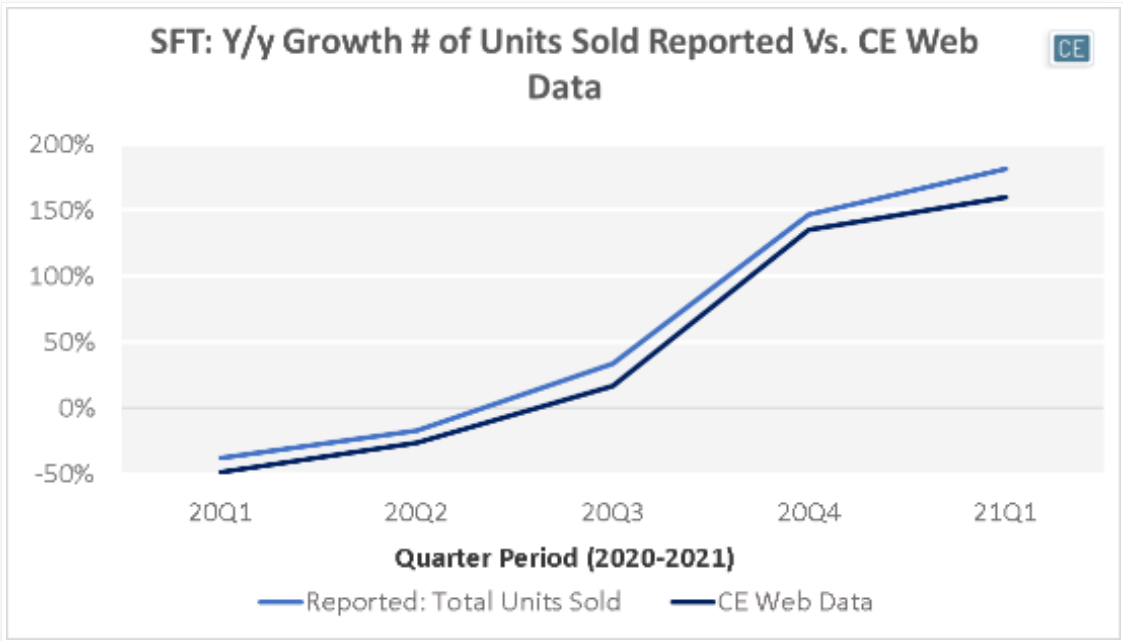

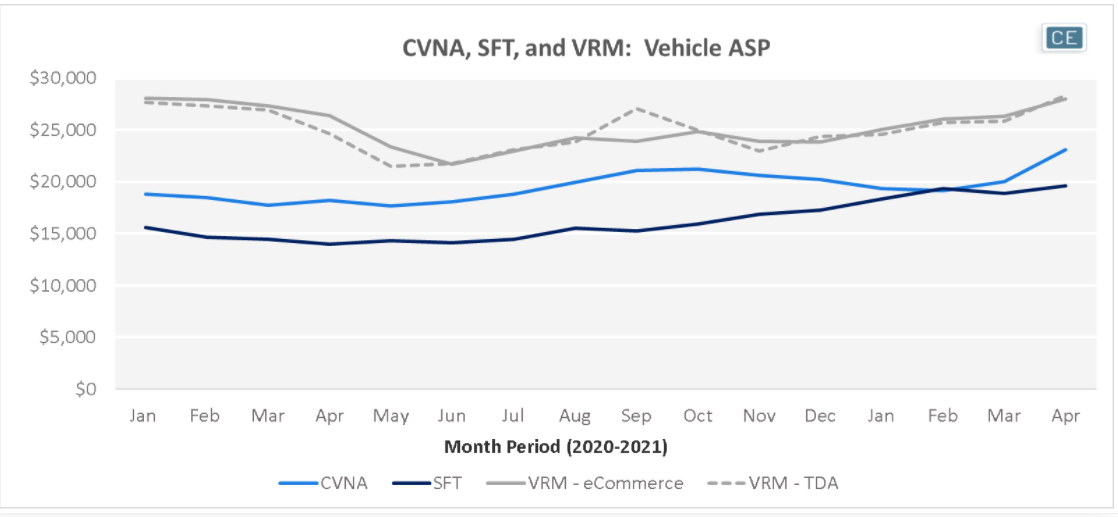

SFT may be a company worth watching in the future. It went from the lowest unit sales growth in Q1-Q3 of 2020 to the highest growth among CVNA, SFT, and VRM eCommerce the last two quarters. Additionally, although it has the lowest ASP among that set, ASP has been growing and saw over 30% y/y growth in February through April of 2021. VRM has seen consistently strong unit growth in its eCommerce business over the last five quarters, and leads the tracked set in ASP, which topped $25,000 in each month of 2021. CVNA sits in the middle of the pack when it comes to both unit growth and ASP.

Company Comparison

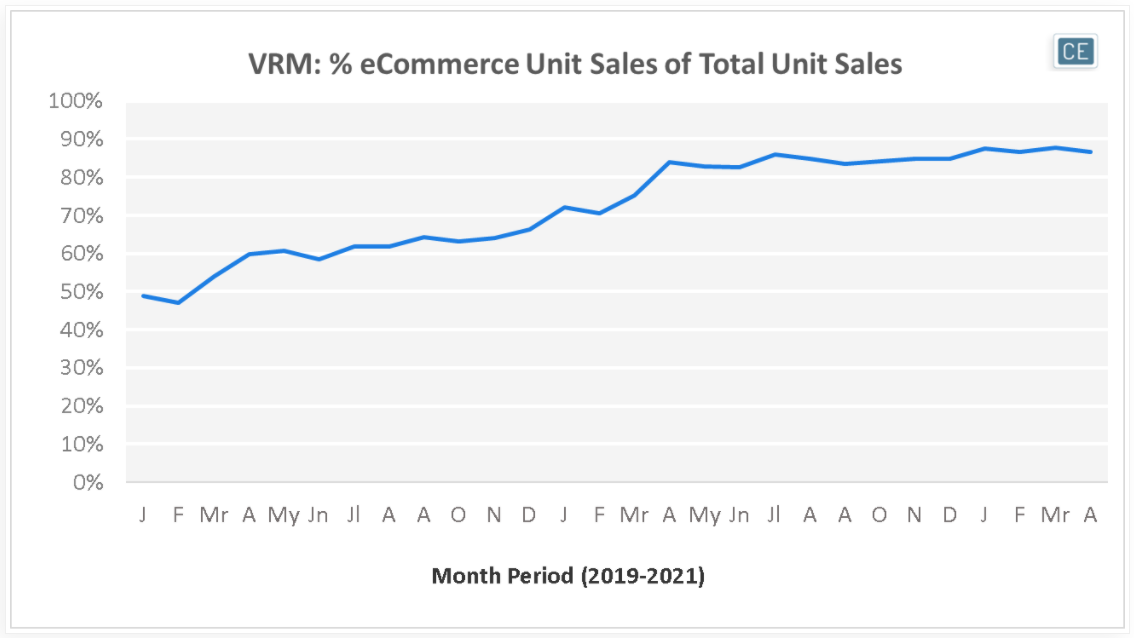

Within VRM, eCommerce sales have been trending up. eCommerce started 2019 at under half of total units sold, but that percentage increased to over 70% in the first three months of 2020 and has since increased even further to 87-88% in the first four months of 2021.

VRM Mix

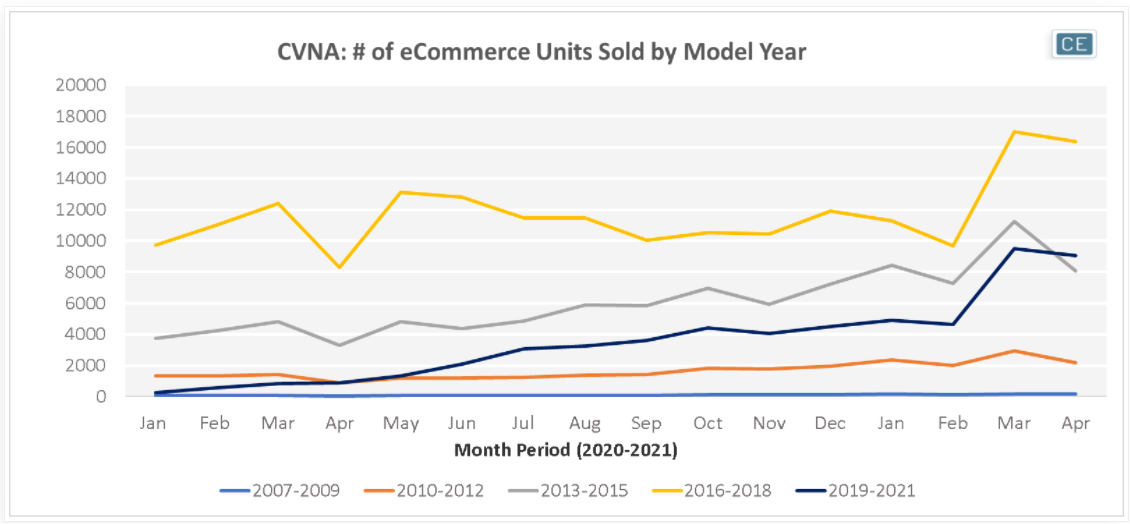

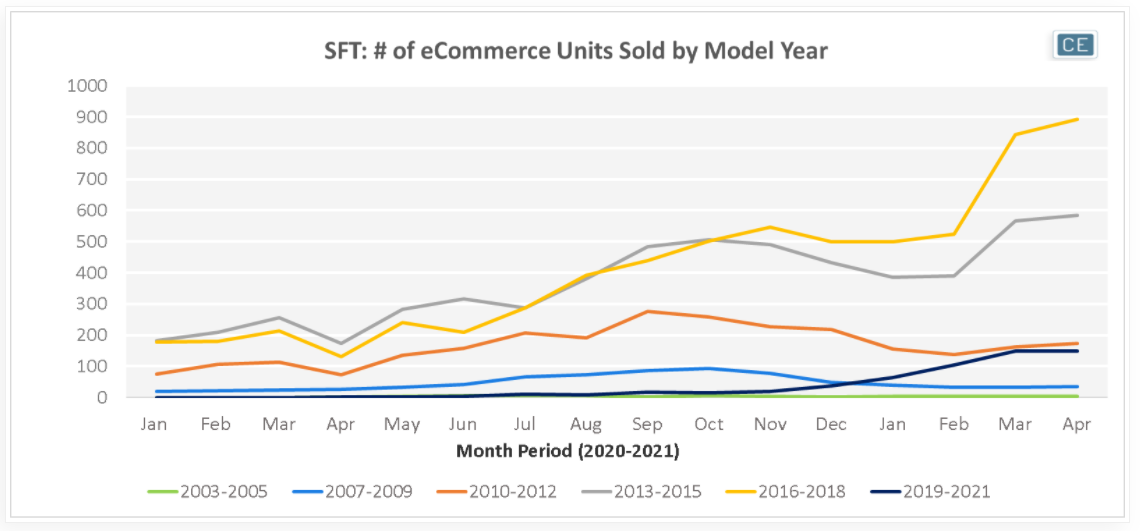

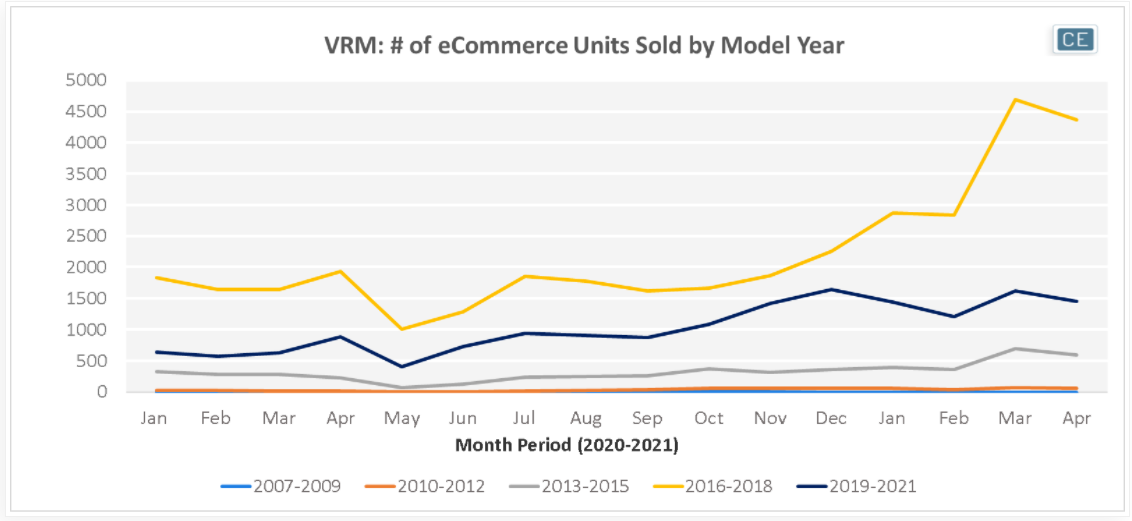

In general, three to five year old models make up the bulk of sales for these players – 45% for CVNA, 49% for SFT, and 67% for VRM in April 2021. Unsurprisingly given its higher ASP, VRM has by far the youngest base of the set with 90% of cars sold in April 2021 from model years 2016 or later. This is versus 71% for CVNA and 57% for SFT.

Model Year Trends

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.