Now it’s the turn of SaaS companies to take center stage this earnings season. For the first quarter, SaaS expectations called for sustained enterprise momentum. However, for certain B2B platforms, there are concerns that these expectations could prove aggressive. That’s the case even for those who have experienced account growth acceleration in 2021, such as cloud-based software provider Salesforce (CRM) and Workday (WDAY).

Here we examine the alternative data for two key SaaS stocks, Workday and Salesforce. How are these B2B companies faring in this era of the ‘new normal?’ We use our near-real-time digital data to find out.

Workday earnings: Moving on up?

Workday specializes in human resources and cloud software. Shares surged 40% in 2020, but have yet to make any gains in 2021. Heading into the print on May 26, the projected EPS stands at 73 cents with revenue of $1.16 billion.

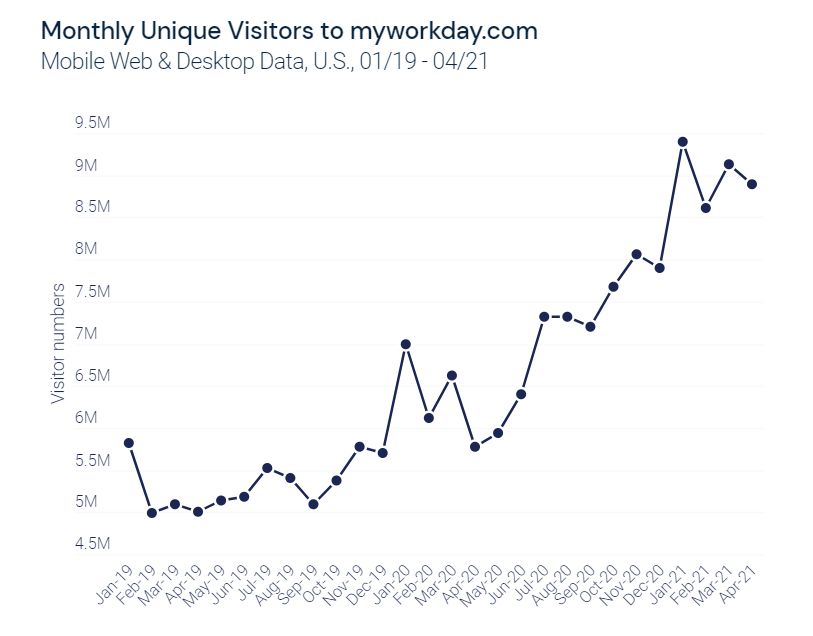

If we look at monthly unique visitors to myworkday.com (the company’s customer portal) then the market trends appear encouraging. Note that monthly unique visitors (MUVS) is the sum of devices visiting the analyzed domain, so it does not include repeat visits. This makes MUVs a powerful tool to analyze a website or a platform’s digital growth.

We can also see that total Q1 visits to myworkday.com, which includes repeat visits, have surged 50% year-over-year (YoY) from 85.7 million to 128.3 million, and are also up 18% from the previous quarter.

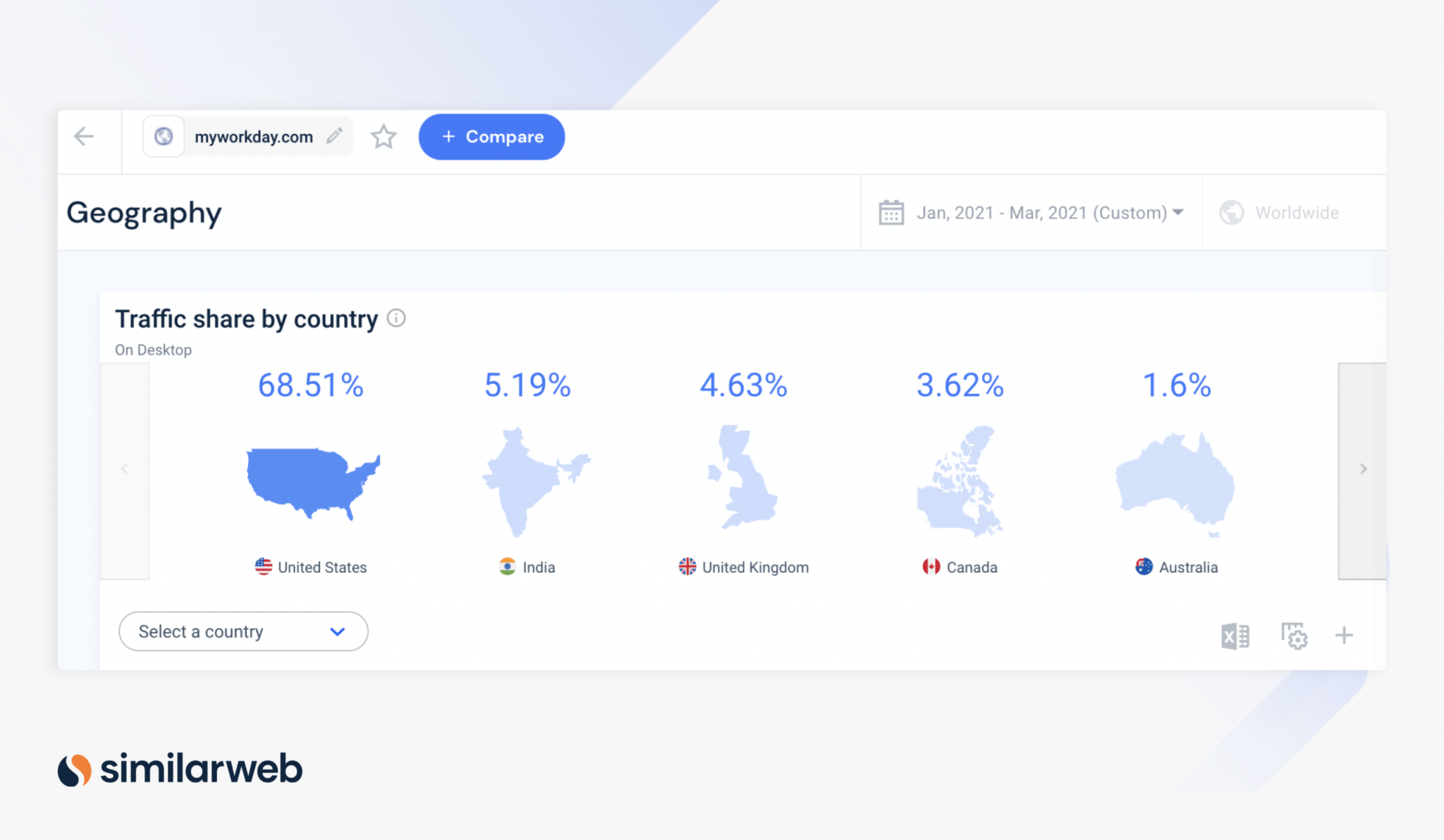

Interestingly, the geographical breakdown of these visits reveals that India now boasts the second-highest number of visits with a 5.2% audience share. This is a significant shift from Q4 where the U.K. came second after the U.S., with Canada in third place and India in fourth.

Salesforce earnings: Ready for a rebound?

According to Morgan Stanley’s Keith Weiss, Salesforce is “well positioned to benefit from an accelerating pace of investment in strategic digital transformation initiatives.” He upgraded the software giant before its earnings date on May 27, arguing that the recent pullback “creates a good entry point.” Consensus estimates call for EPS of 88 cents and revenue of $5.89 billion.

Indeed, shares have faltered following CRM’s pricey $27.6 billion Slack acquisition in December, with some critics arguing that the deal for the workplace chat app was too expensive. Others believe that Slack will bolster CRM’s position against rivals like Microsoft, especially as hybrid working models increase demand for non-email forms of communication.

So what does the digital data show?

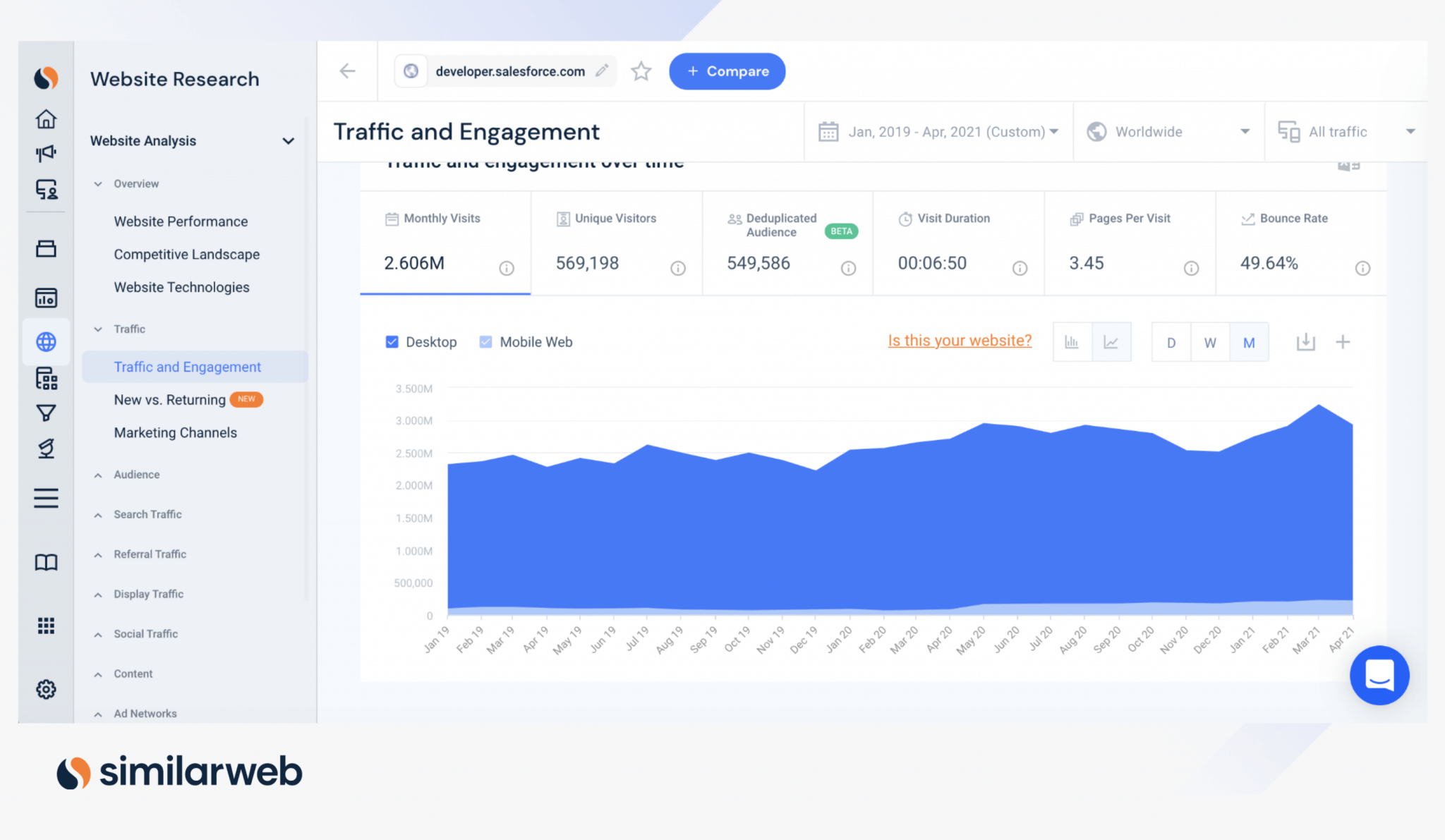

Worldwide MUVs to my.salesforce.com, which hosts the Salesforce platform enterprises use in their day-to-day activities, were up 28% YoY in 1Q21, indicating that the number of Salesforce paying users continues to grow.

Meanwhile, worldwide visits to developer.salesforce.com were up 14.6% YoY in 1Q (and 13.5% from Q4), suggesting that Salesforce is successfully building a community of developers to iterate and work off their sales-tracking platform.

Spotlight on Slack

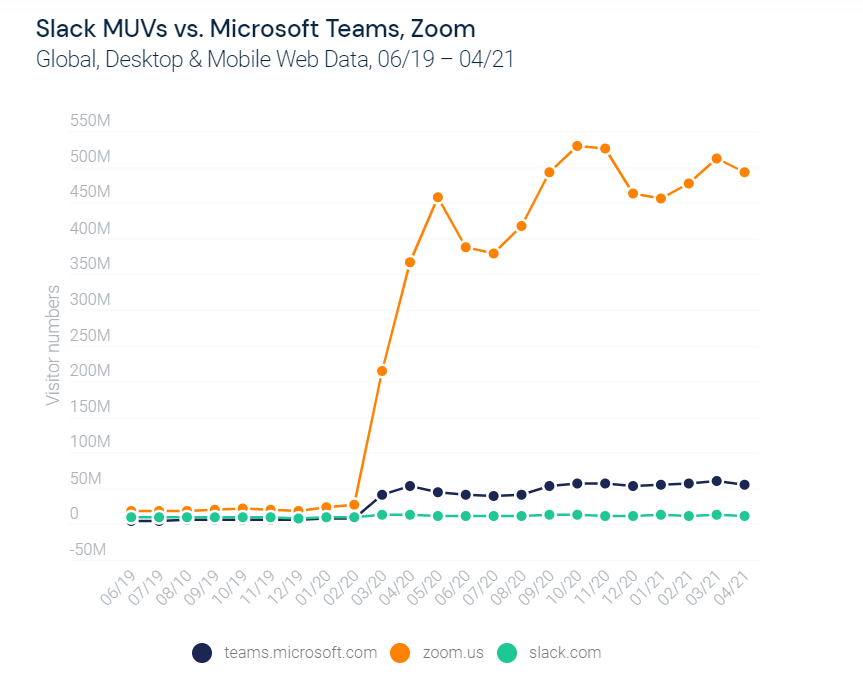

Slack’s growth has been impeded by Microsoft Teams, but under the Salesforce umbrella it could be given a new lease of life. The integration with the rest of the Microsoft (MSFT) enterprise suite gave Teams a unique advantage compared to standalone services like Slack (WORK).

“We have been surprised by the limited success Slack has seen from the pandemic and the rise of remote work,” wrote D.A. Davidson analyst Rishi Jaluria recently.

“Microsoft Teams has been able to capitalize on the opportunity presented by the pandemic better than Slack, in our view, and this rapid growth in adoption has hurt Slack.”

Here we can see Slack MUVs vs. its two main rivals, Microsoft Teams and Zoom (ZM):

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.