In the last year, the dollar store sector has clearly been among the better positioned segments within all of retail. And there is real reason to believe that this is just the beginning. Brands like Dollar General and Big Lots are poised for big things in the next year, and new concepts like Dollar General’s Popshelf could make the coming years even more exciting for an increasingly sophisticated sector.

But how are the top performing brands looking today, and what might this tell us about their short term future? We dove into the data to find out.

Dollars All Around

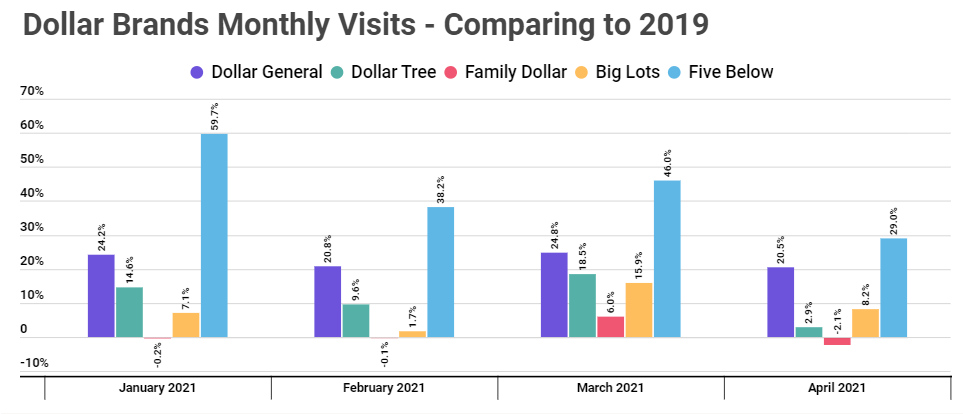

Year-over-year metrics are helpful for analyzing brands that have received ‘essential retail’ status like Dollar General, but for the wider space the comparison to 2019 has proven to be a far more useful standard. And looking at visits from the first four months of 2021, compared to 2019 show just how strong the sector truly is. Of the five brands analyzed, only Family Dollar saw declines in any month when compared to 2019 – and these drops were so limited that they’d be industry leading in many other retail sectors.

Dollar General and Five Below led the way with massive growth when looking at 2019 comparisons, largely as a result of the combination of brand strength and aggressive expansions. Dollar Tree and Big Lots also saw impressive growth numbers with March 2021 driving increases of 18.5% and 15.9% for the two brands respectively compared to the same month in 2019.

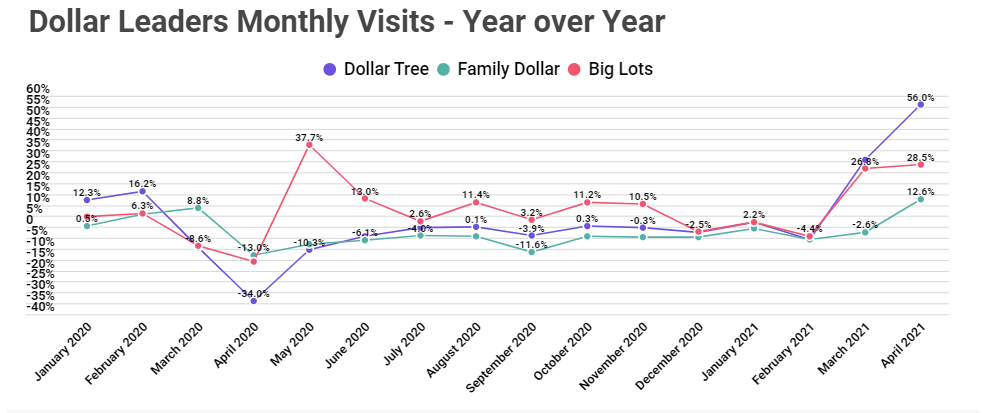

And analyzing year-over-year numbers for three of the brands that had been open only deepens the feeling that the momentum is firmly behind this sector. Year-over-year increases are growing – partially as a result of the downs felt in March and April – but also because of this sector’s unique alignment with key consumer trends. While much has been made of the power of stimulus checks to spark pent up demand, there is still likely to be an extended period of economic uncertainty. An environment like this, driven by an extended period of rapid change, will only add more success to brands that can provide a wide range of goods at very competitive prices.

King of the Space?

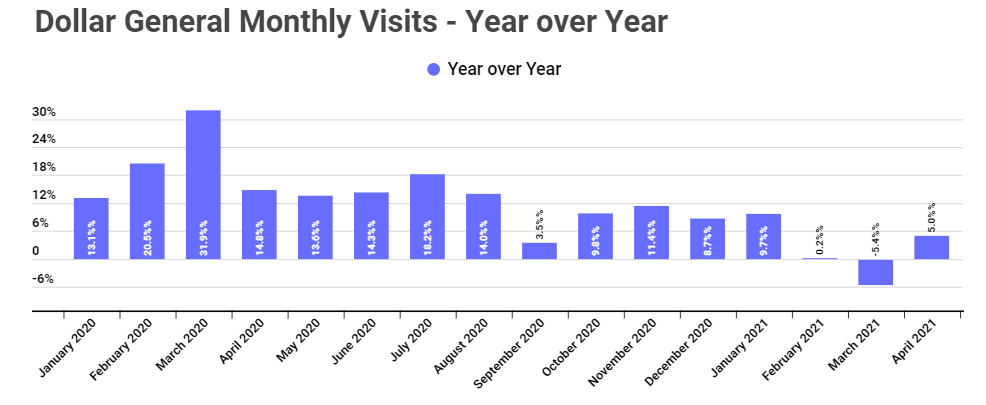

But for all of the success of other players in the space, the combination of high absolute visit numbers and impressive year-over-year growth rates point to a king rising in the sector. Dollar General hasn’t just seen strong numbers compared to 2019, but impressive numbers compared to a very strong start to 2020. Visits in January, February and April have been up 9.7%, 0.2% and 5.0% year over year, with March seeing a decline largely due to the heights hit in the pre-pandemic stock up fervor.

And 2020 wasn’t just a good year for Dollar General within the COVID context, but a good year, period. Visits were up 14.2% year over year for Dollar General in 2020. And the pace doesn’t appear to be slowing. Looking at the first four months of 2021 compared to the same period in 2020, there has been a 1.9% overall visit increase – and this includes a February that had a day fewer and was hit by terrible weather across key regions.

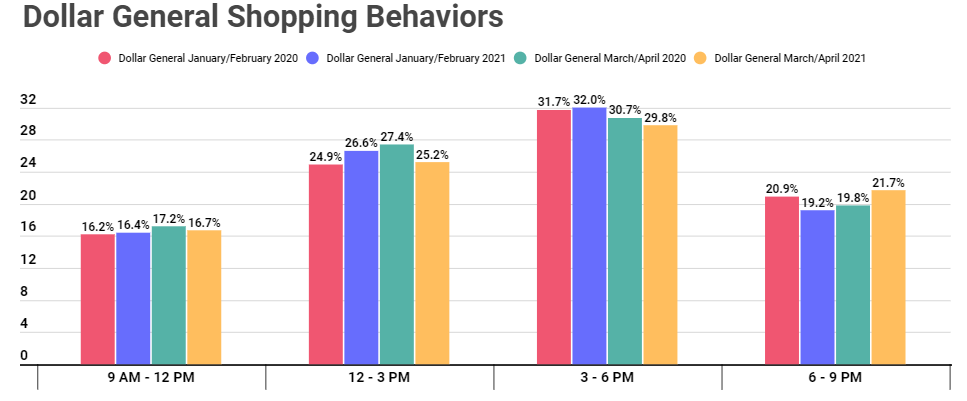

The hard visit numbers are also supported by another factor that further indicates Dollar General’s growing strength. The brand succeeded across significant shopping behavior shifts. Whether consumers prefer morning or evening visits, weekends or weekdays, they want to make the trip to Dollar General. And with the brand showing a willingness to test upmarket concepts, they may have the potential to rival some of retail’s most significant names.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.