Monday.com has officially filed for its initial public offering (IPO) on the NASDAQ stock exchange, under the ticker MNDY. The project management tech company is yet to report a profit, but did report impressive total revenue for 2020, of $161 million.

The company has not yet disclosed its target valuation. In the meantime, let’s see what the alternative data has to say, ahead of the monday.com IPO.

Key Takeaways:

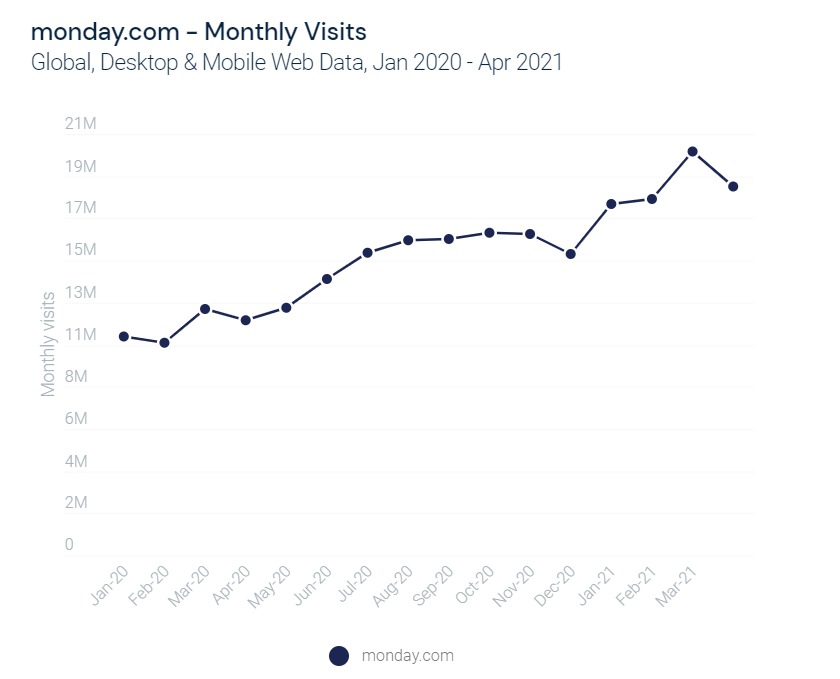

Monthly visits trend higher

Monthly visits to monday.com are experiencing an upward trend, showing the platform’s increased popularity. February saw the highest number of monthly visits to the site to date, at 20.1 million, and YoY growth in 1Q21 was 63.7%.

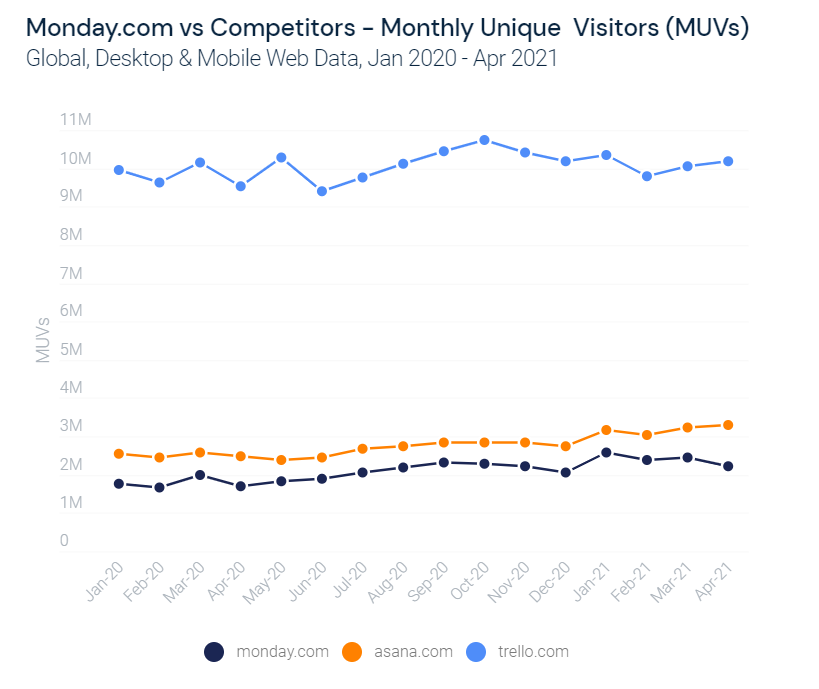

The competitive landscape

The positive trajectory for site visits is encouraging, but how does monday.com fair against its competition?

This time, we looked at monthly unique visitors (MUVs), rather than site visits, for an indication of the number of actual visitors to project management sites. Compared to the two other big players in the space, Asana and Trello, monday.com is lagging behind. In 1Q21 monday.com saw 7.39 million MUVs, while asana.com and trello.com brought in 9.44 million and 30.19 million respectively.

The total addressable market (TAM) for these companies is huge, and constantly growing with the birth of new businesses all the time.

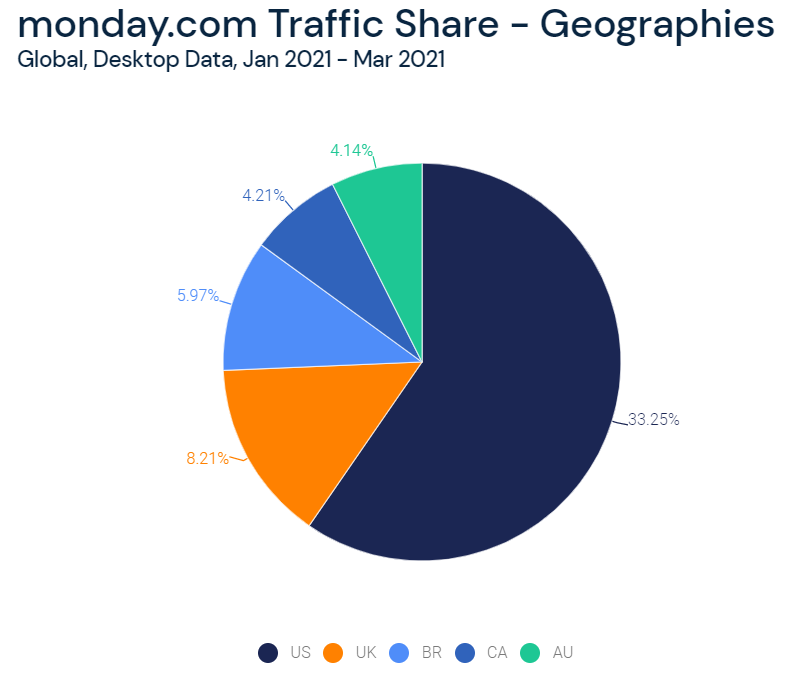

Global footprint

Monday.com’s business primarily comes from the U.S., which accounted for 33.25% of website visits in 1Q21. This represents a 1.69 percentage point (ppt) drop from the previous year. Other countries driving significant traffic to the site include the U.K. (8.21%), Brazil (5.97%), Canada (4.21%), and Australia (4.14%).

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.