If there’s one sector that saw a pandemic driven boost, it was the home improvement space. Home Depot saw a year-over-year visit increase of 13.1% between 2019 and 2020, while Lowe’s and Tractor Supply saw respective jumps of 21.3% and 18.5%. The success carried into 2021, with visit surges driving huge year-over-year growth in the first quarter. The rise of work from home, the added time at home during closures, and shifting migration patterns all contributed to the sector’s unique success.

Yet, there were clear signs that the extended surge the sector experienced was likely coming to an end in April. So how did May visit data compare, and what does it mean for the sector moving forward?

May Declines – The End of the Run?

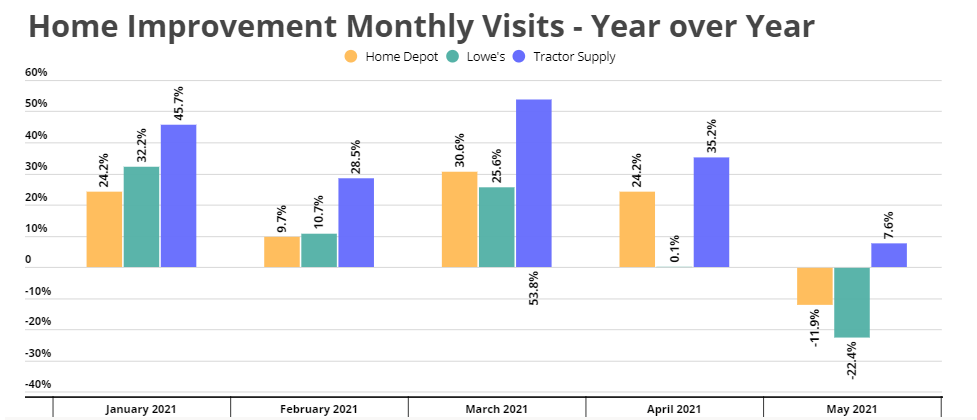

Home Depot kicked off 2021 with average year-over-year monthly visit growth of 22.2%, with Lowe’s coming in just behind with a 17.1% average increase. The run capped off a period of almost an entire year during which visits surged each month – even during off-peak seasons.

However, this extended period of year-over-year growth came to an end in May with Home Depot visits down 11.9% and Lowe’s visits down 22.4% compared to May 2020. And while the month marked a huge change for Home Depot, the writing was on the wall for Lowe’s already in April when visits were up just 0.1%. Even Tractor Supply, a brand still seeing growth, saw visit increases drop from a 35.2% year-over-year jump in April to just a 7.6% increase in May.

So is this the end of the run for home improvement’s supercharged numbers? Maybe. Does it mean the sector is taking a step back? Absolutely not.

Home Improvement Still Thriving – In Context

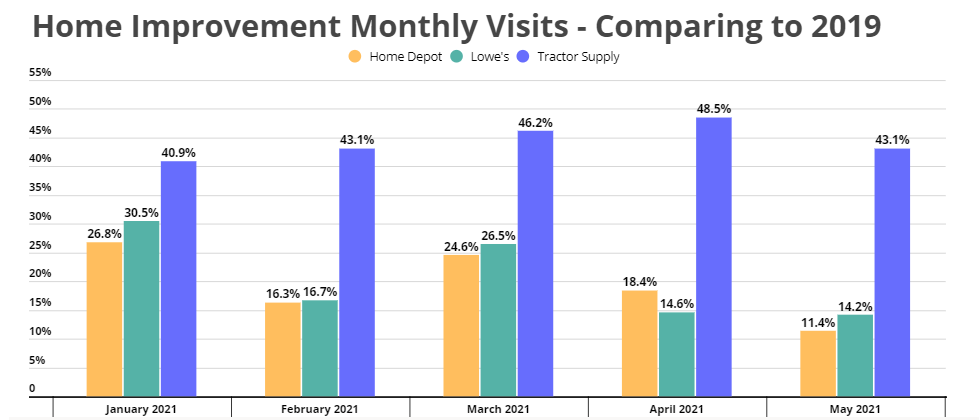

While the visit declines seem significant, they require context for a proper perspective. Comparing visits in May 2021 to May 2019 shows that Home Depot and Lowe’s were still seeing massive increases of 11.4% and 14.2% respectively.

The clear takeaway is that while the huge growth levels experienced during the pandemic will likely fade, the sector’s leaders have been pushed into a stronger long-term position as a result of that extended ‘lightning in a bottle’ moment. Brands in most sectors are being compared to 2019 to put dramatic year-over-year changes into context, and the best performing brands from the pandemic period demand a similar approach. While the unique nature of the pandemic provided a huge short-term boost to the home improvement sector, even those that don’t reach the levels set in 2020 may still be performing exceptionally, even historically, well.

There are also other reasons to believe that this level of extended strength could continue. Major disruptions to migration patterns have more people moving to further distances, giving an added value to brands oriented around home improvements and upgrades. And even those not moving could drive value for the sector: High residential real estate prices could push more people to invest in in-home upgrades instead of moving.

Balance of Power Shift – The Rise of Tractor Supply

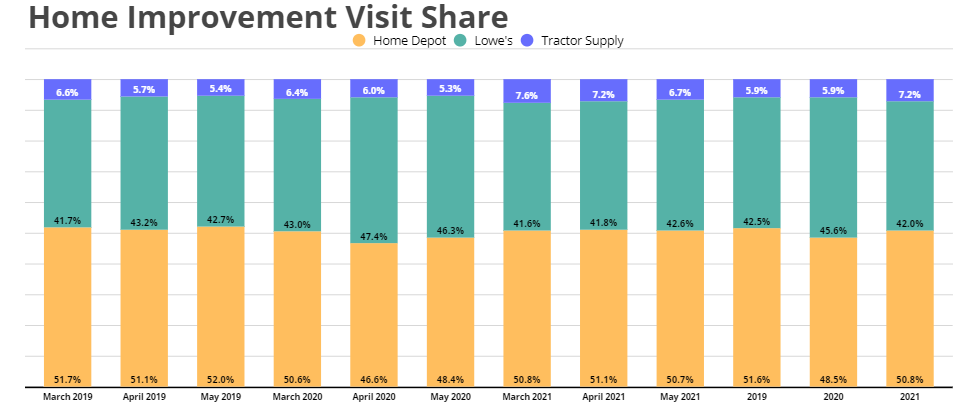

Even amid the murkiness driven by the huge success of the sector since the onset of the pandemic, the rise of Tractor Supply still jumps out. Looking at monthly visits for the first five months of 2021 shows average year-over-year monthly growth of 34.2%, something only surpassed by an average monthly increase of 44.4% when compared to 2019.

It appears that the jumps have pushed Tractor Supply into a stronger position within the sector. Looking at visit share between the three analyzed brands during the peak March through May period shows a significant shift in Tractor Supply’s favor. In 2019 and 2020, the brand averaged 5.9% visit share during the period, a number that jumped to 7.2% in 2021. While this should certainly not shake anyone’s confidence in Home Depot or Lowe’s, it does point to a rising power in the home improvement space.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.