AMC’s stock began surging unexpectedly in mid May, as meme-driven retail investors bolstered a trading frenzy. But as AMC themselves admitted in their recent SEC filings: “We believe that recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business.”

So how is AMC really doing? We dove into the data to find out.

AMC’s Slow Recovery

Memorial Day 2021 was celebrated as the movie industry’s post-Covid comeback, with ticket sales reaching $100 million. But although Memorial Day weekend brought in the highest weekend earnings since the start of the pandemic, the movie industry is far from recovered – revenue from ticket sales this year was less than half the $213 million in sales that came in over Memorial Day Weekend 2019.

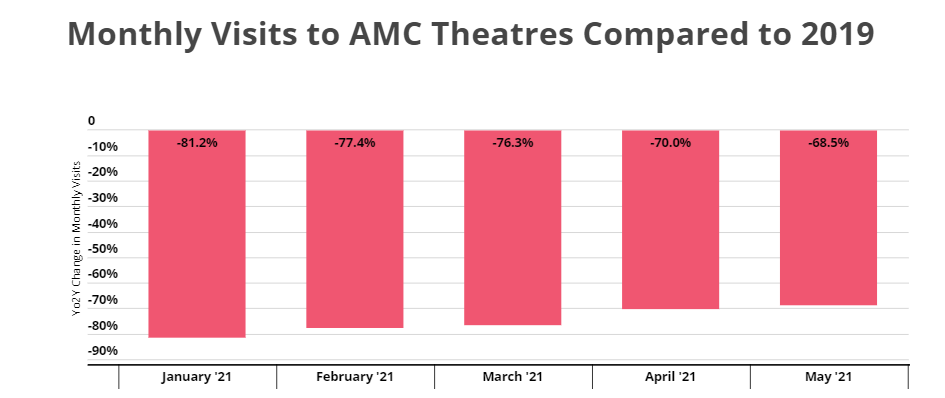

AMC is certainly in the midst of a recovery with monthly visits consistently, albeit slowly, improving. Visits in May 2021 were down 68.5% when compared to May 2019 – a step forward from April, when the visit gap stood at 70.0%. And while May marked the strongest showing for AMC since the start of the pandemic in 2020, it also showed just how significant the recovery will need to be to reach previous levels.

Change in Moviegoing Pattern

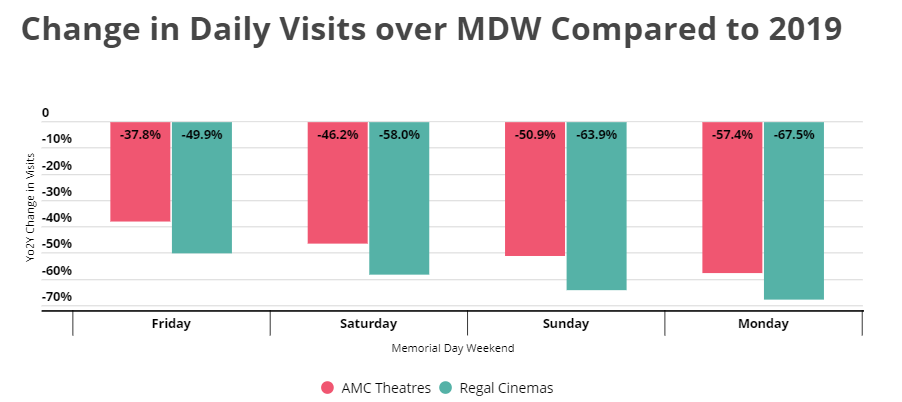

Overall, visits to AMC locations nationwide over Memorial Day 2021 were down approximately 49% and 46% compared to Memorial Day Weekend 2019 and 2018, respectively. And not only were there fewer visits – those who did hit the movies did not follow the typical Memorial Day movie going pattern. The Friday and Saturday of the weekend saw visits down 37.8% and 46.2%, respectively, but by Sunday and Monday, those visit gaps had ballooned to 50.9% and 57.5%, respectively. This further cements the challenges the sector needs to rise above – a fundamental disruption to movie going patterns in addition to the standard hurdles to recovery.

AMC did, however, perform slightly better than its main rival. Overall, visits to Regal Cinemas dropped by 60.3% compared to Memorial Day 2019. And like with AMC moviegoers, visitors to Regal Cinemas caused less of a surge on Saturday and dropped off more dramatically throughout the weekend. Attendance grew by a mere 12.2% from Friday to Saturday only to drop by 10.0% from Saturday to Sunday and by a whopping 25.9% from Sunday to Monday.

Is This the Turning Point for Movie Theatres?

Traditionally, May in general and Memorial Day in particular produce an especially strong period for movie theaters, marking the kick off of the summer blockbuster season. But this year’s May was relatively anemic. Despite the gains of Memorial Day weekend, May visits did not come close to 2018 or 2019 numbers. There could be several explanations for this. First, many movie theaters have yet to reopen, and many that have opened still limit capacity. It’s also worth noting that the Covid-related production delays might still be impacting release dates: According to the website Movie Insider, 11 new movies were released to theaters for Memorial Day weekend 2019, compared with only 6 new movies released on Memorial Day this year.

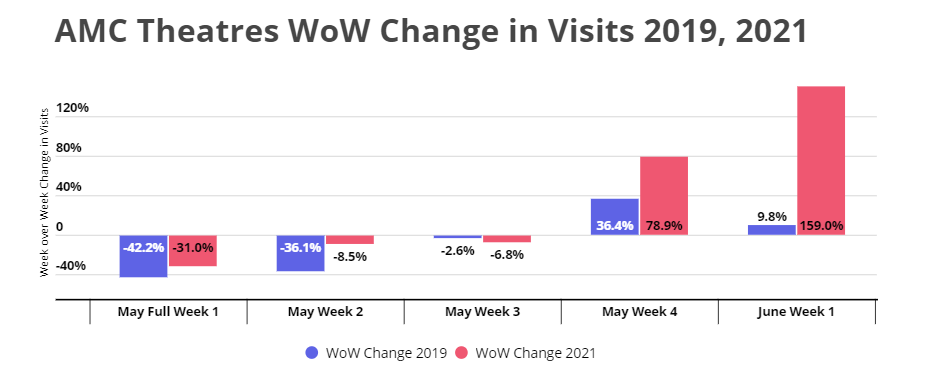

But just because movie theatres are not at the top of the recovery list doesn’t mean they won’t make a comeback. Zooming into the data from May through the beginning of June, an interesting pattern emerges: In 2019, movie attendance peaked over Memorial Day week only to return to pre-Memorial Day levels following the long weekend. This year, on the other hand, Memorial Day seems to mark the beginning of a real recovery.

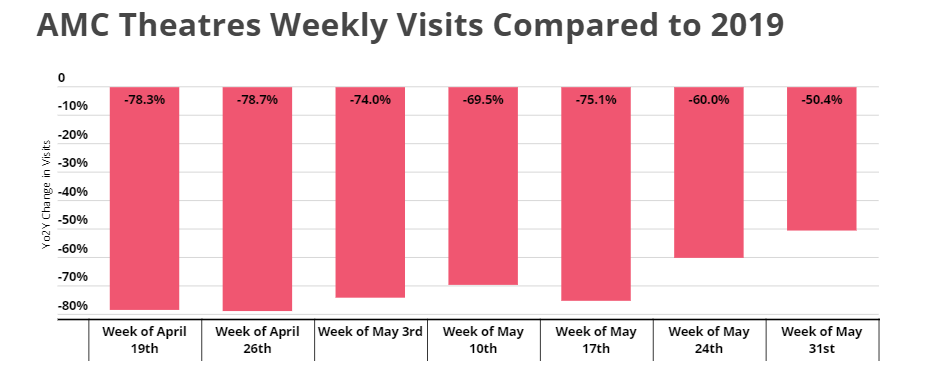

And this showed in comparative metrics as well. Visits the week of May 31st were down just 50.4% when compared to the equivalent week in 2019 – by far the strongest turnout the brand has seen since the pandemic made its retail effects felt.

The movie theatre segment faces unique challenges, even among those heavily impacted by the pandemic. Yet, there are signs that the sector could recover with key milestones coming up such as the summer movie season and further reopenings across the country.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.