Introduction

Welcome to the July Apartment List National Rent Report. Our national index increased by 2.3 percent in June, continuing the trend of rapid price growth since the start of the year. So far in 2021, rental prices have grown a staggering 9.2 percent. To put that in context, in previous years growth from January to June is usually just 2 to 3 percent. After this month’s spike, rents have been pushed well above our expectations of where they would have been had the pandemic not disrupted the market.

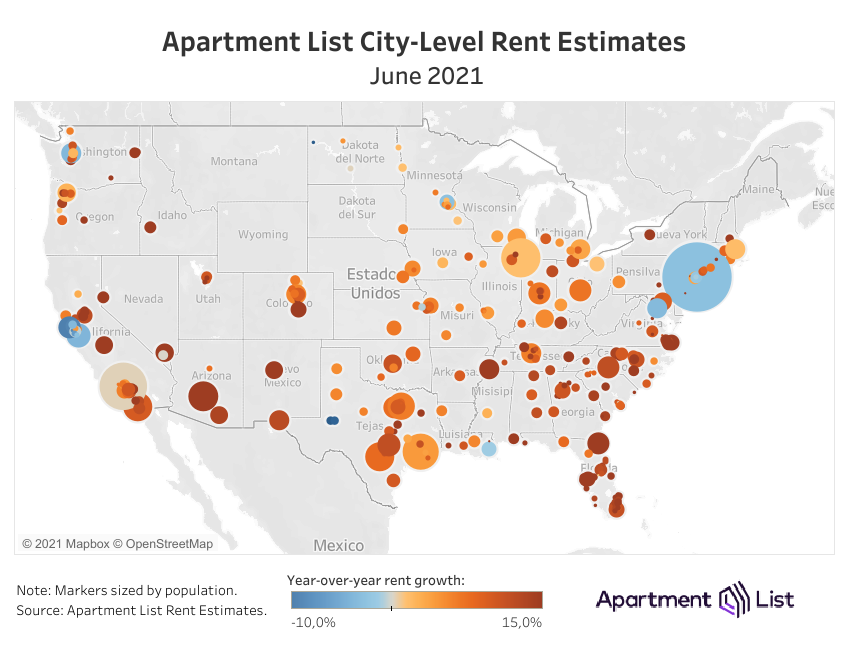

That said, the data continue to exhibit significant regional variation, and there are still a number of markets where rents remain well below pre-pandemic levels. But even in these markets, the trend has turned a corner. Rents in San Francisco, for example, are still 14 percent lower than they were in March 2020, but the city has seen prices increase by 17 percent since January of this year. At the other end of the spectrum, many of the mid-sized markets that have seen rents grow rapidly through the pandemic are showing that there’s still steam left in the current boom – Spokane, WA saw the nation’s fastest monthly rent growth in June (8.1 percent), and now prices there are up 31 percent since the start of the pandemic.

In many cities, “Pandemic Pricing” is over

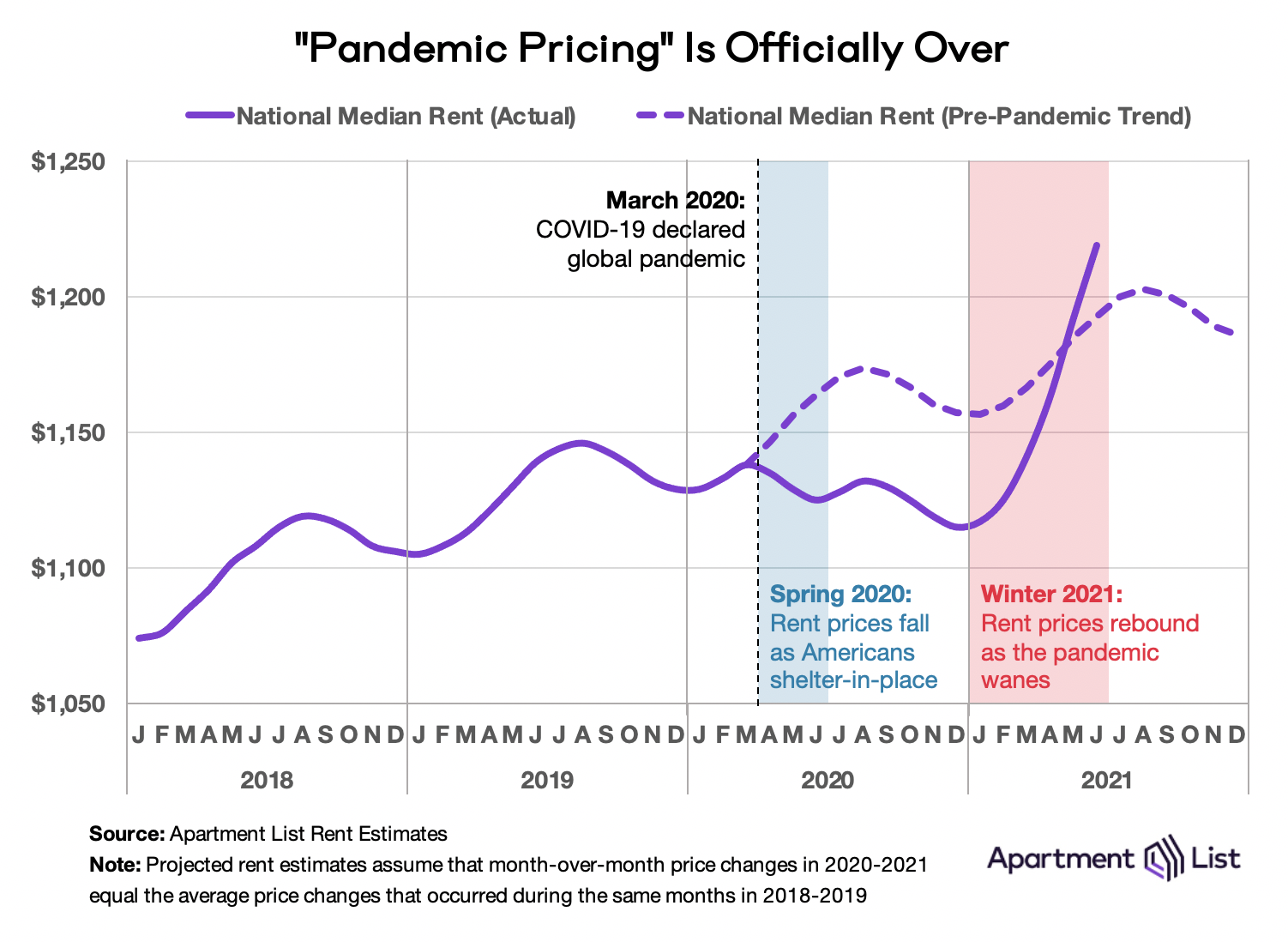

In Spring 2020, the pandemic drove rent prices down during what is usually the busiest season for the rental market. For the remainder of the year, our national index hovered around 4 percent below its projected level. But a rapid rebound in the first half of 2021 wiped out that price gap last month; today, the national median rent is 2 percent higher than where we expect it would have been had 2020 looked like a typical year.

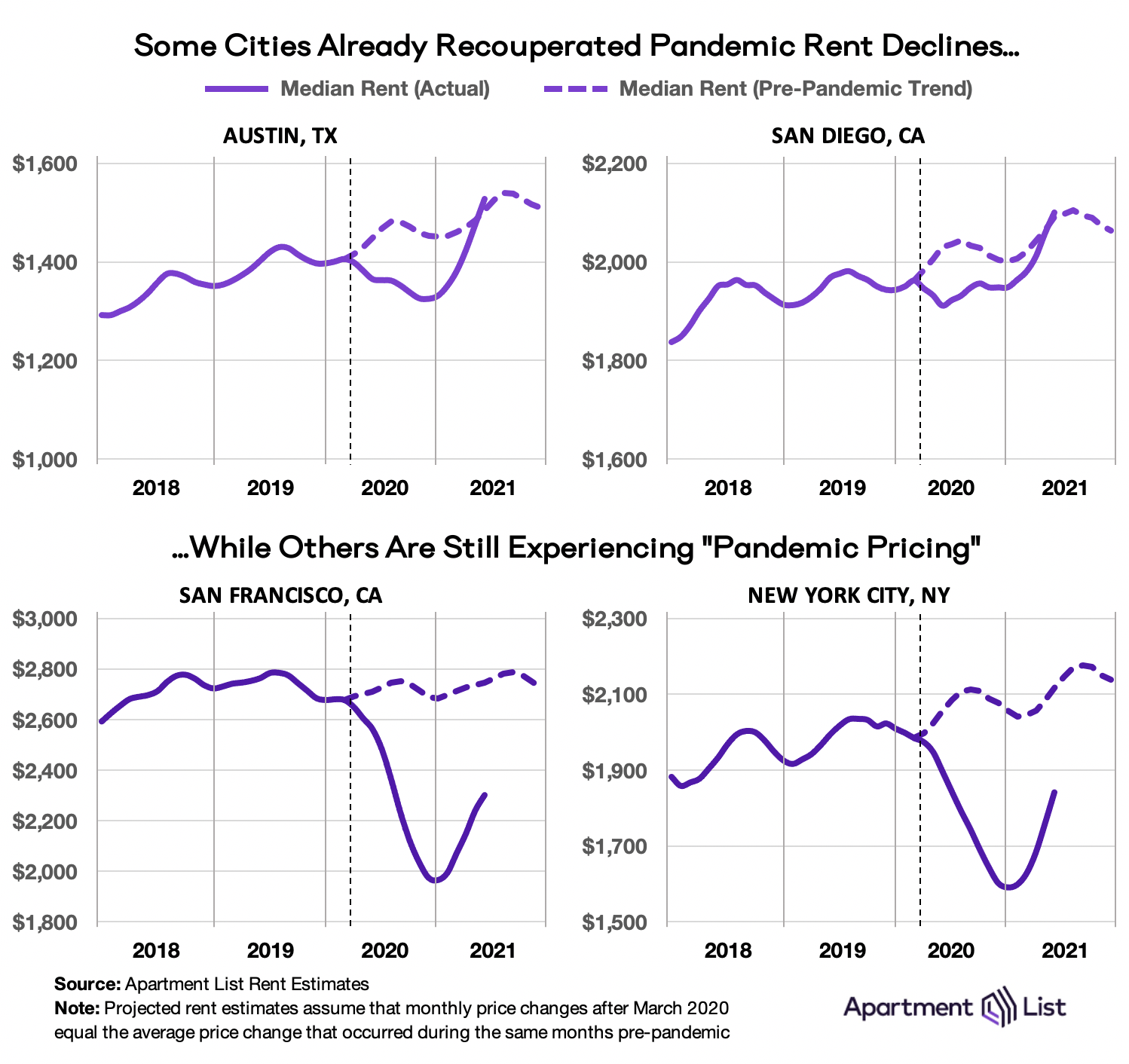

Many individual cities have also seen “pandemic pricing” come and go. This month, rents caught up with pre-pandemic expectations in a handful of major markets including Austin and San Diego. Meanwhile, prices remain below the pre-pandemic trend in some of the hardest-hit markets, like New York and San Francisco. Here, the lasting effects of the pandemic mean renters can still find apartments at discounted prices.

For more on this comparison of actual versus projected rents, as well as details about how we calculate our rent projections, please see our recent report: In Many Cities, “Pandemic Pricing” Is Over.

Rents in coastal superstar cities continuing a strong rebound

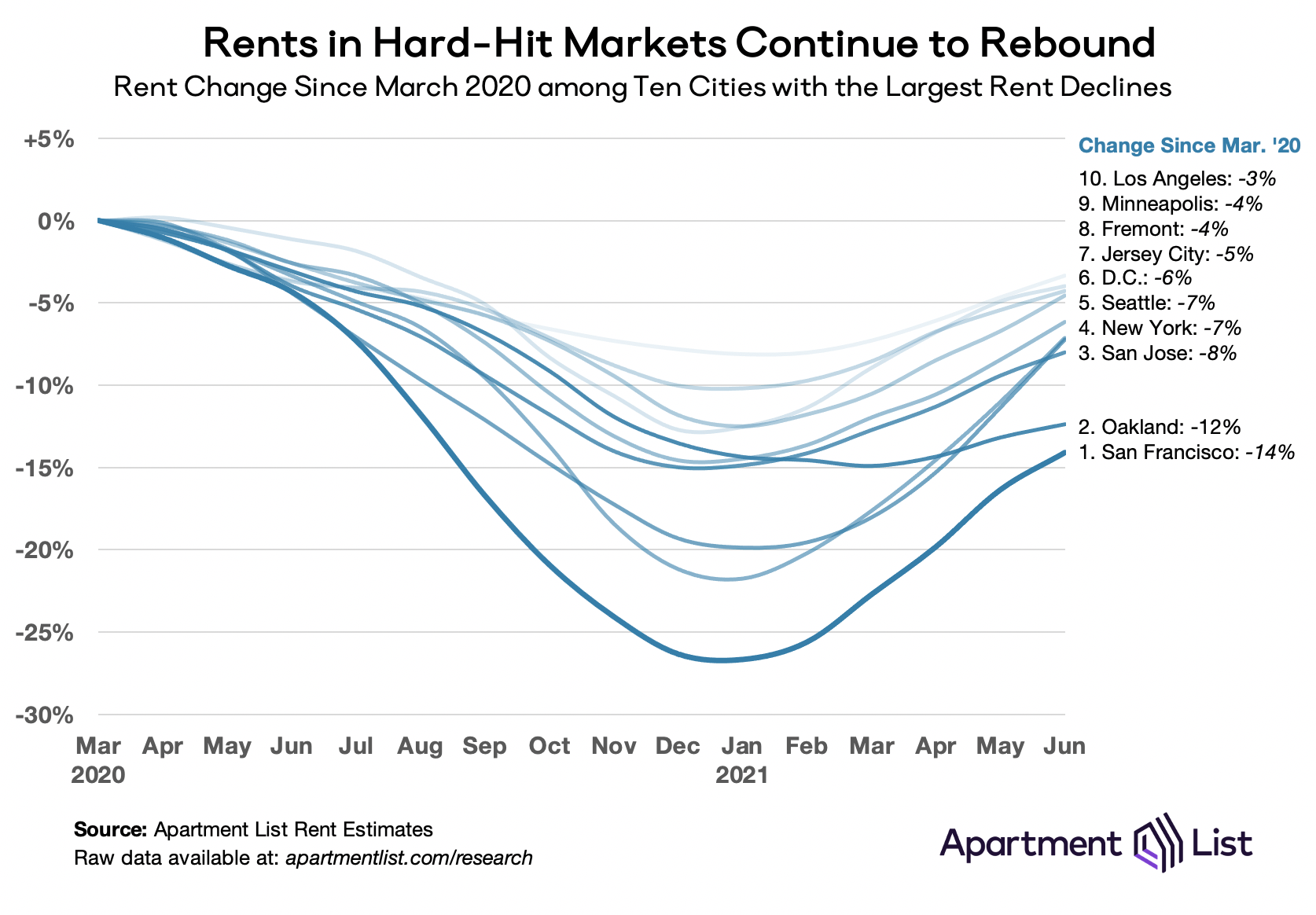

In the markets where rents remain below pre-pandemic levels, prices are rebounding quickly. San Francisco consistently made headlines throughout the pandemic for the staggering 26.6 percent drop in rents from March 2020 through January 2021, but since January, San Francisco rents have increased by over 17 percent. Similarly, sharp rebounds have been observed in Seattle (+19 percent since January) and New York (+16 percent). The chart below shows these rent drops and rent rebounds, in the 10 cities with the largest gap between March 2020 and June 2021 prices.

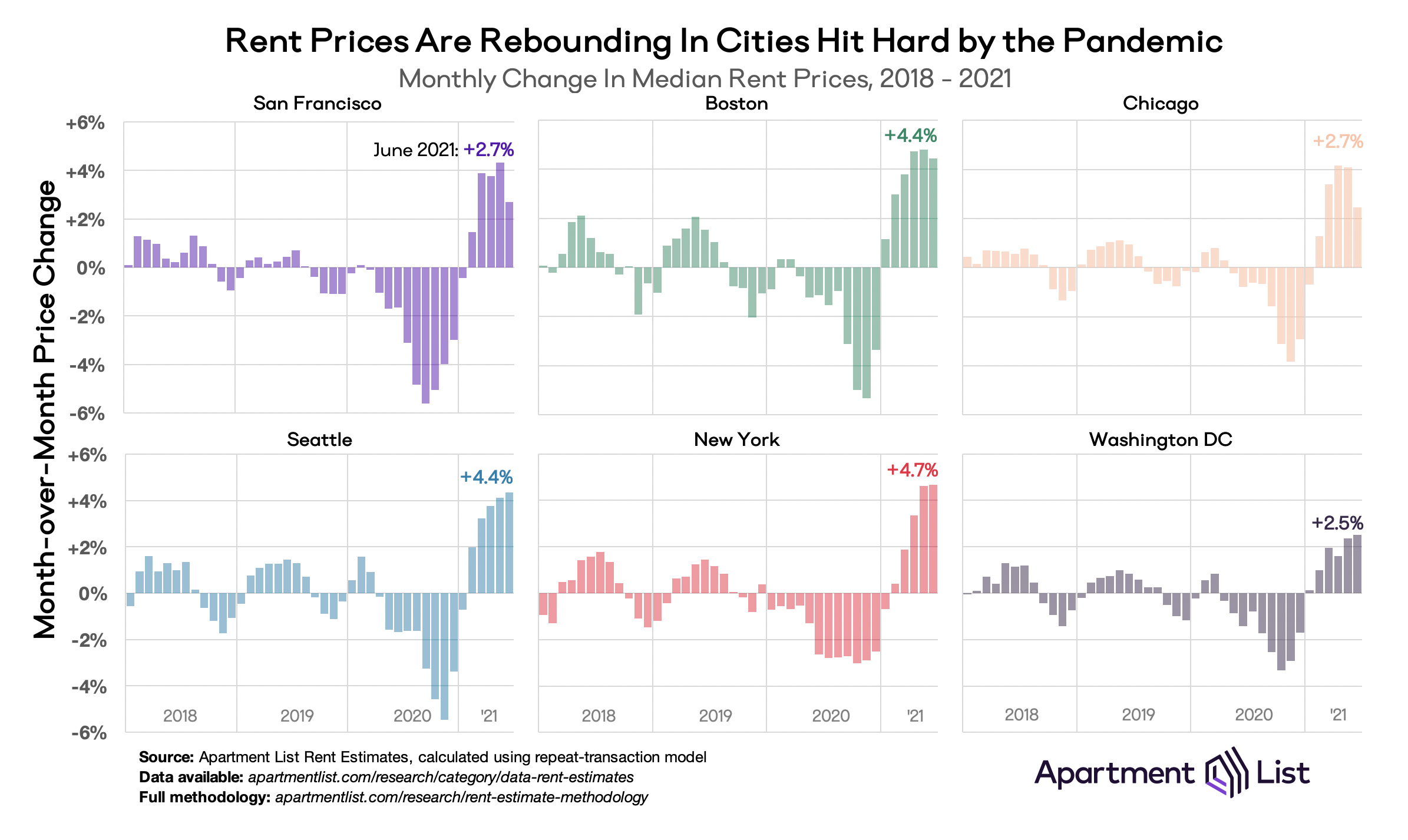

These COVID-era price fluctuations – down quickly at the start of the pandemic, up quickly since the start of 2021 – are significantly more volatile than the seasonal price fluctuations we are used to seeing in pricey rental markets. The chart below shows month-over-month price changes from 2018 to the current month. Monthly changes of +/- 2 percent are relatively rare under normal circumstances, but in 2020 and 2021 we have extended stretches where prices rise and fall at more than twice that rate. In Boston, monthly rent growth swung from -5 percent in November 2020 to +5 percent just six months later in May 2021.

In each of the panels in the chart above, we see three distinct phases:

In each of the six cities shown, the fastest single-month rent increase has taken place in 2021. Rents are still below pre-COVID levels in each of these cities, but they’re quickly catching up.

Affordable mid-size markets continue to boom

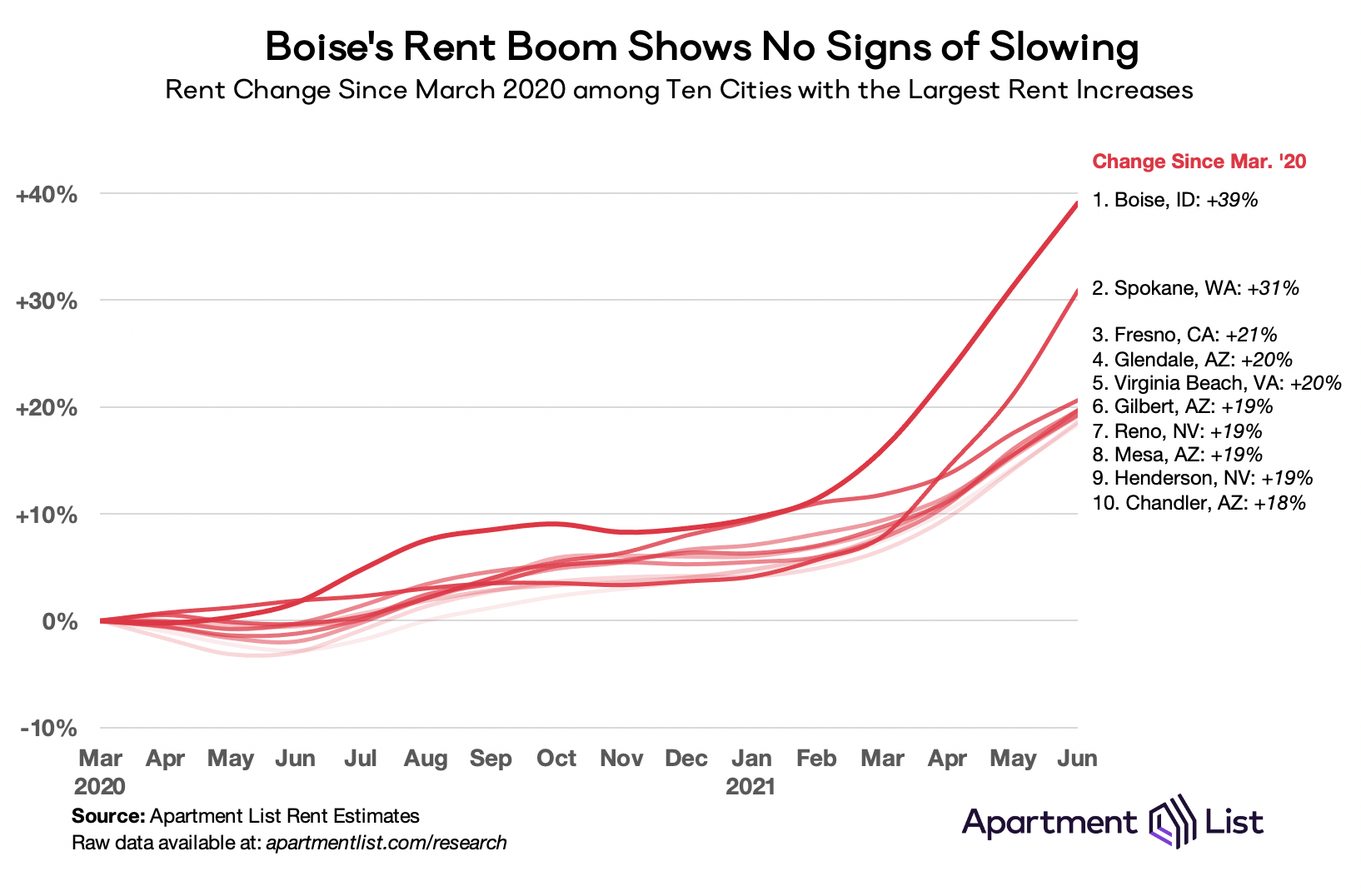

As expensive coastal cities watched rents plummet throughout 2020, another group of mid-sized markets were heating up. The pandemic and remote work spurred demand for the space and affordability that these cities offered, and in response, rent prices grew even as the surrounding economy struggled. Even while rent declines in expensive markets have reversed course, the cities where rents have been growing fastest are continuing to boom.

Leading the trend is Boise, ID, where rents grew another 6 percent in June and are now up 39 percent since the start of the pandemic. But the fastest single-month rent growth took place in Spokane, WA, where prices shot up 8.1 percent in June and sit 31 percent above pre-pandemic levels. After that, a handful of fast-growing cities have experienced roughly 20 percent price appreciation over the last year and a half. With the exception of Virginia Beach, VA, all of them are located in the Western United States, absorbing the rental demand overflowing from nearby, pricey metros like the San Francisco Bay Area and Greater Los Angeles.

The pandemic did not start a new trend in these markets, so much as accelerate an existing one. For example, from 2017 through 2019, rents in Mesa, AZ increased 25.5 percent, the fastest growth in the nation over that period. Similarly, Fresno, CA ranked third for fastest rent growth, while Chandler, AZ ranked sixth. This stands in contrast to what has happened in the expensive markets discussed above, for which the rent declines of the past year were a complete aberration. Given this longer-term context, as well as the continued upward trajectory in rent trends, it seems that Boise and cities like it have yet to hit their peaks.

COVID shakeups have led to some convergence of expensive and affordable markets

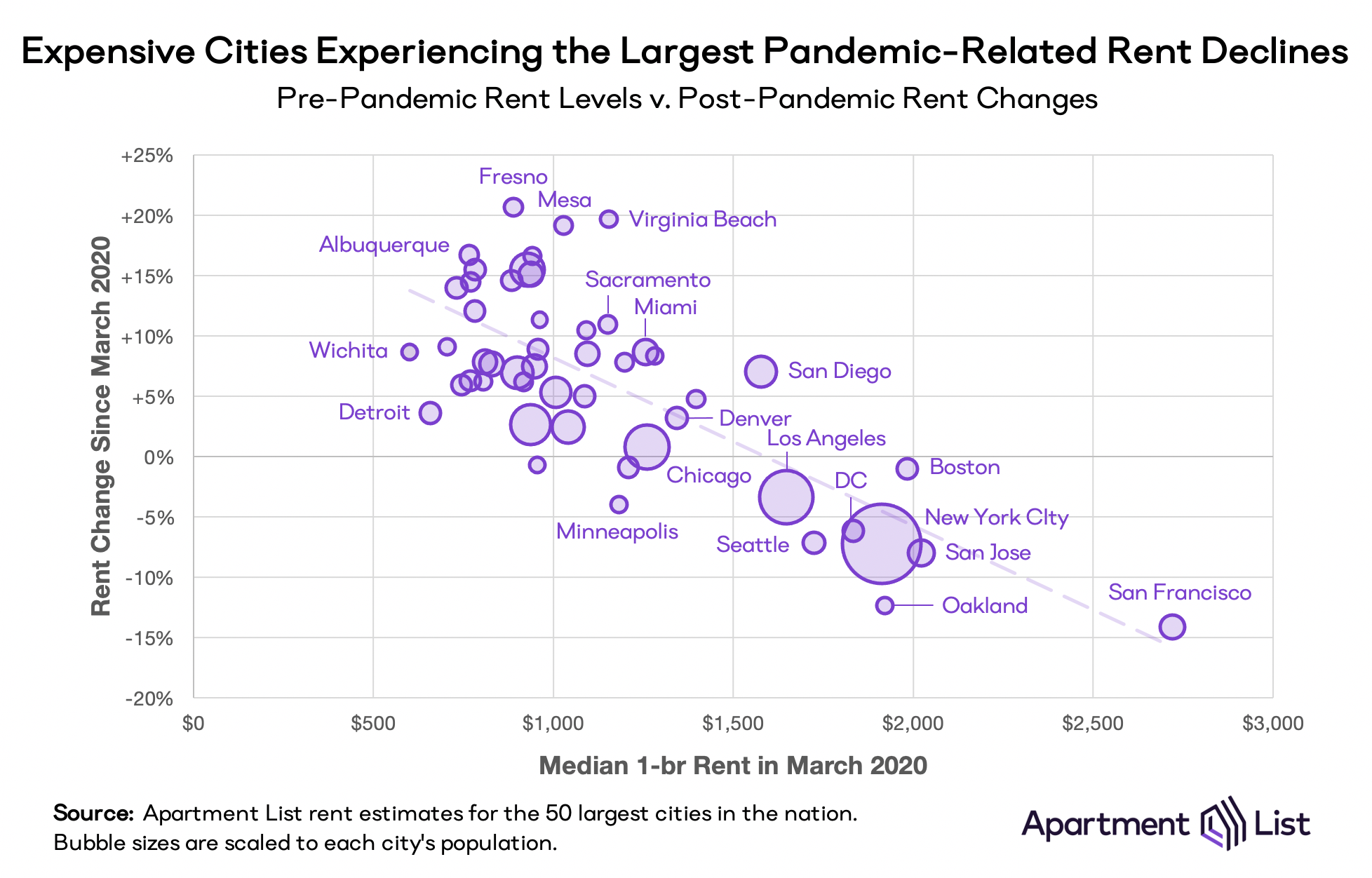

As described above, affordability has been a key determinant of whether cities are experiencing falling or rising rents during the pandemic. The relationship is made more explicit in the chart below, which plots rent levels against rent changes for the 50 largest cities in our data. There is a clear correlation between the two; the cities that had the highest pre-pandemic rents in March 2020 (moving right along the x-axis) have seen the steepest rent drops since then (moving down along the y-axis).

Meanwhile, more affordable cities have tended to see prices climb. This has led to a certain degree of convergence in rent prices across the country – the most expensive markets have gotten somewhat more affordable, while the most affordable markets have grown pricier. For example, last March, the median 2-bedroom rent in San Francisco was $3,146, which was 3.4x the $929 median for a 2-bedroom in Boise. As of this month, the 2-bedroom median in San Francisco has dropped to $2,695, while in Boise it has grown to $1,303, meaning that rents in San Francisco are now just 2.1x those in Boise. While still a significant price difference, the affordability gap has narrowed substantially, and even as rents in San Francisco have rebounded in recent months, Boise has continued to grow even faster.

Conclusion

Although the pandemic created some softness in the rental market last year, 2021 brought the fastest rent growth we have on record in our data. Nationally, and in many individual cities across the country, rents have now surpassed the level where they would have been if rent growth had not been disrupted by the pandemic. And in markets like San Francisco and New York where “pandemic pricing” is still in effect, prices have turned a corner and are now rebounding. At the same time, booming markets like Boise continue to see prices climb. More broadly, rental inventory across the nation remains tight, and as vaccine distribution continues to gain momentum, we may be seeing the release of pent up demand from renters who had been delaying moves due to the pandemic. Whereas last year’s peak moving season was halted by the pandemic, this year’s seasonal spike appears to be making up for lost time.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.