Everyone seems to love the U.S. industrial sector these days, but when did so many investors come to that conclusion and how long can it continue? The rise of e-commerce has been a driving force behind changing investor perceptions on the sector, but there are two misleading signals in the trends for e-commerce.

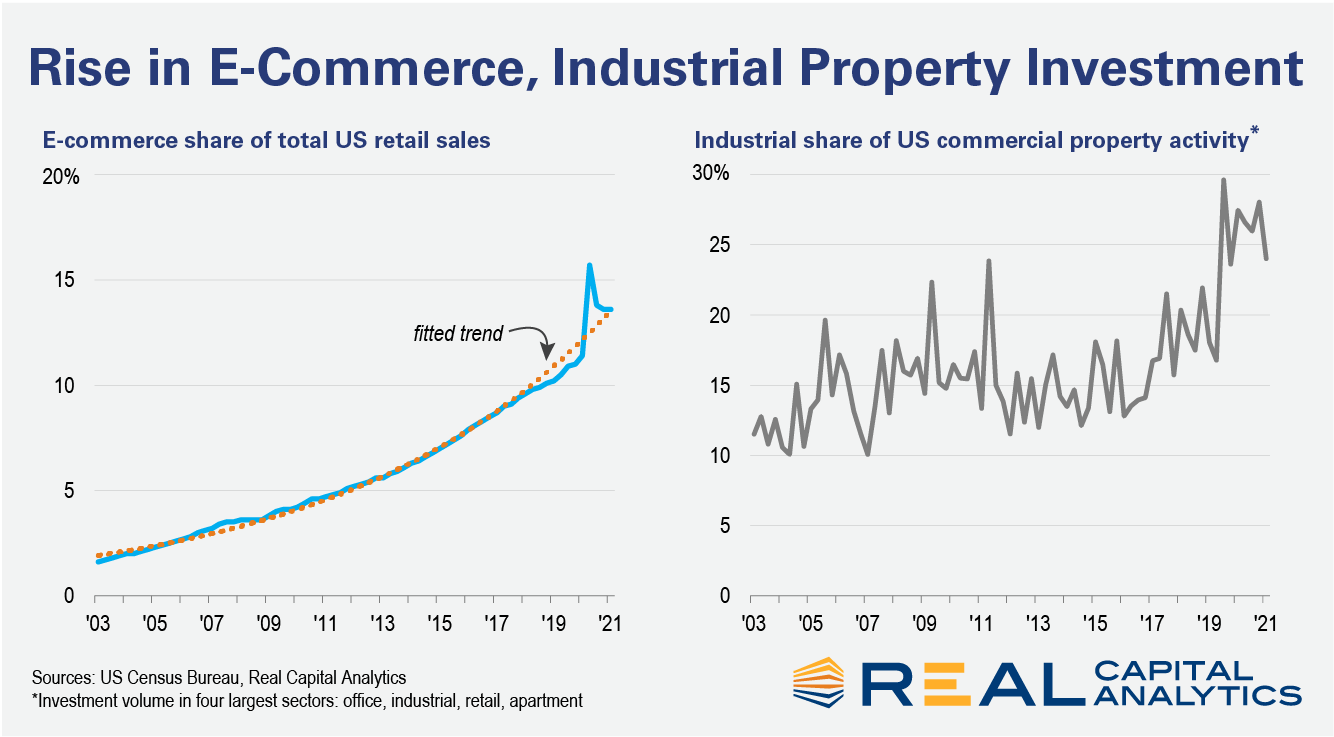

The industrial sector was long viewed as sleepy and slow-moving, and few investors saw exciting opportunities within such a low volatility sector. Industrial deal volume represented only 15% of investment in the big four sectors — office, retail, apartment and industrial — on average from 2003 through to the end of 2016. There was a change that year, however, with people coming to a realization that e-commerce was a thing.

All industrial is not tied to online retailing and not every building is a logistics asset. The life sciences industry is very popular these days, for instance, and has driven much activity for R&D assets within industrial. Nonetheless, the investment theme on chasing the back end of the internet where goods are stored became very popular by 2016, and industrial investment began to climb as a share of total activity. By Q1 2021 industrial investment represented 26% of all U.S. commercial real estate investment activity, based on a 4-quarter trailing average.

This growth in investor interest in the industrial sector caught up late to the changes in e-commerce adoption. In 2003, less than 2% of all consumer activity was satisfied through the internet, government data shows. This figure grew at roughly 50 basis points per year until 2014 when the pace of growth began to accelerate, and hit the 10% level by 2018. Fitting a trend to e-commerce sales from the pace of growth from 2003 to 2019 would suggest such sales reach up to a 20% market share by the end of 2024.

That exponential growth in online shopping activity is the first misleading signal for the industrial market. The thing about exponential trends is that they only match into the future for some time, then everything starts to fall apart. Before the pandemic, that sort of breakdown in the pattern of growth for e-commerce activity was already underway.

From 2017 to Q1 2020 before the worst of the pandemic hit, the online retailing share of total had started to slip relative to that exponential trend. Fundamentally, e-commerce growth should slow at some point to a pace more like that set by disposable personal income as it starts to capture a greater share of total consumer spending. The uncertainty here is exactly when the slowing begins.

The second misleading signal is the wrench that the Covid-19 pandemic threw into the works in early 2020. These online channels represented 15.7% of all sales in Q2 2020 during the worst part of the pandemic. That fitted trend would have put e-commerce sales at 16% of total by the end of 2022. So, there was two years’ worth of growth in e-commerce market share within a single quarter if one still holds to that exponential trend.

Any investor who set their expectations for the industrial sector moving forward based on that one spike is likely to be disappointed. It was a temporary shock and while the e-commerce share of total is still high, and investors continue to hunt for industrial assets across the U.S., that spike was not indicative of the future trend. E-commerce activity has already retreated to a 13.6% share by Q1 2021 as brick-and-mortar distribution channels rebuild.

Make no mistake, there is a lot to like about the industrial sector. All of the performance characteristics that made the sector boring in the past are now en vogue. Stable yield with low capex relative to the NOI … what’s not to like? Still, if one is undertaking an investment strategy that will only work if there is continual exponential growth in e-commerce activity, one might be disappointed as that industry matures.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.