Note: This mall index includes an expansion of the number of locations analyzed, bringing the number of malls in the index from just over 50 to 100 nationwide. We have also added an outdoor mall category which includes 100 major outdoor outlet and lifestyle centers.

Q2 brought indoor malls within striking distance of pre-pandemic levels, serving as a massive testament to the continued power and draw of this critical retail format. Outdoor malls also received a boost in May when the visit gap shrunk to just 0.7%.

How did the two formats recover in Q2? We dove into the data to find out.

The Recovery Continues

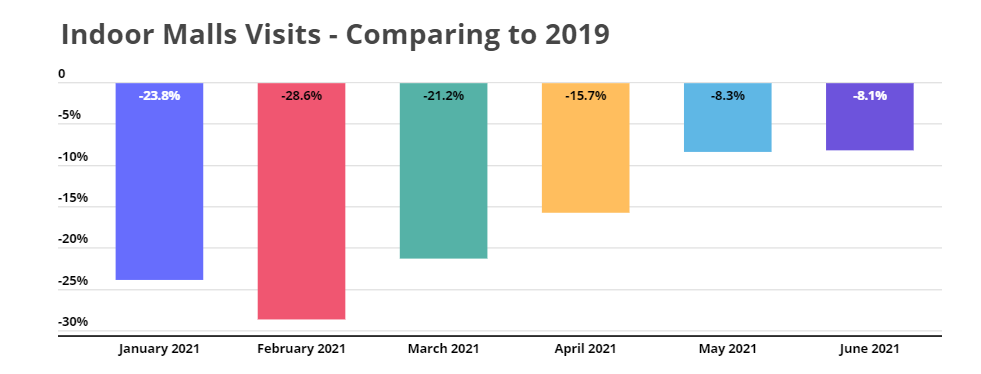

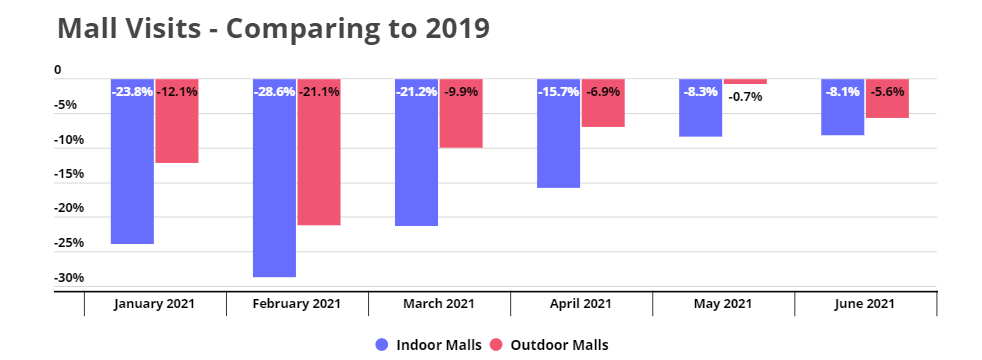

The mall recovery continues with visits to indoor malls down just 8.1% in June – a slight improvement on May, when visits were down 8.3% compared to the equivalent month in 2019. Q2 as a whole marked a massive step forward for the segment with visits down 15.7% in April, 8.3% in May and just 8.1% in June compared to the same months in 2019.

Malls have made an impressive leap forward in the past three months compared to Q1, when year over two year visits were down an average of 24.5%. This consistent progress – even without a major shopping holiday – shows the true strength of the rebound for this critical retail format. And shoppers continue to show their desire to visit these retail destinations, another sign of the powerful resiliency of consumer demand for the mall format.

Looking at outdoor oriented centers– including major outlet and outdoor lifestyle centers – shows that the visits gap in June was smaller than for indoor malls, standing at just 5.6% when compared to June 2019. However, the gap did increase when compared with May, when visits were down just 0.7%.

June still marked the second strongest month of 2021 for outdoor centers, and the drop relative to May could be due to May’s Memorial Day sales drawing a surge of shoppers to outdoor shopping centers as many indoor malls were still fully or partially closed. Even with the relative drop in June, outdoor centers saw a very strong quarter with visits down an average of 4.4% compared to the equivalent months in 2019 – a major improvement on Q1 when the average decline stood at 14.4%.

Increasing Momentum Heading Into Back to School

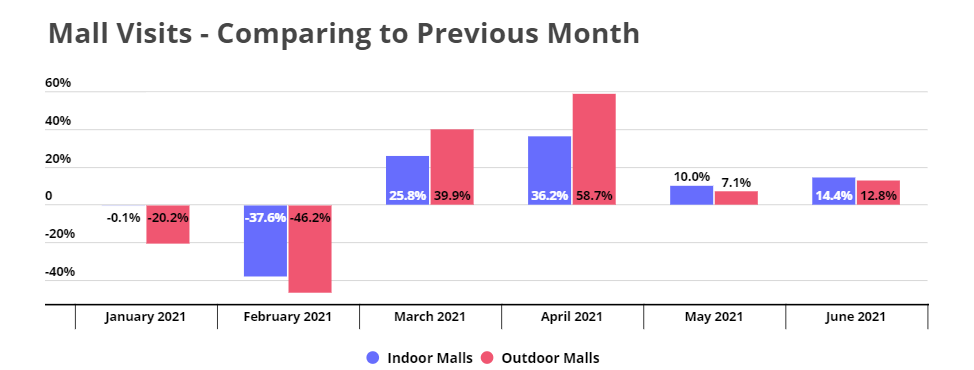

While seeing the visit gap with 2019 continue to shrink is a very positive sign, the most promising metric may actually come from looking at visits rates month over month. Indoor malls have seen a significant improvement in visits each month since February, with June enjoying a marked increase over May. Visits to indoor malls rose 14.4% month over month, while outdoor mall visits rose an equally impressive 12.8%. This shows the strong momentum working in the favor of both retail formats, and the powerful draw they continue to possess.

And both the 2019 comparison and month over month visit data will be critical when analyzing the Back to School season in 2021. The 2019 iteration of Back to School shopping was especially successful, setting a very difficult bar to reach for the 2021 season. If the visit gap continues to shrink, it will be an exceptionally strong sign for the retail sector. However, even if the gap increases, it may have more to do with the heights hit in 2019 than the pace of recovery in 2021.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.