In this Placer Bytes, we break down the effectiveness of Kohl’s June ‘Wow deals’ push, the continued rise of AMC and Massage Envy’s surprising recovery.

Kohl’s Wows in June

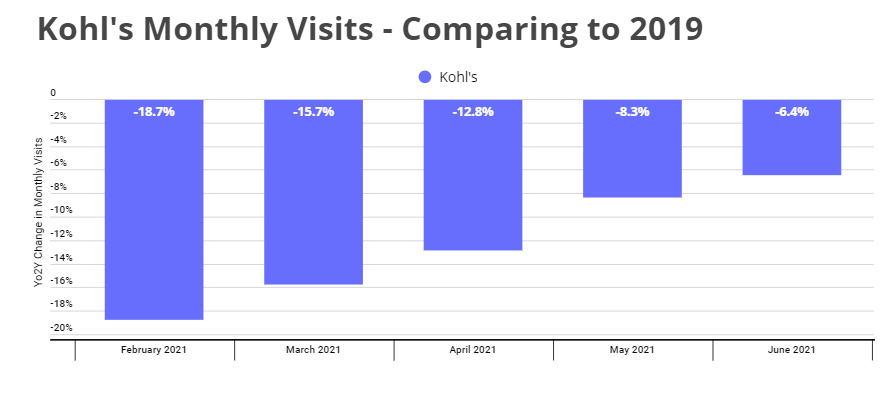

For Kohl’s, June marked another significant step in the recovery of offline locations with visits down just 6.4% compared to June 2019. This was the best mark in 2021 and showed a near 2% decline in the visit gap when comparing to 2019.

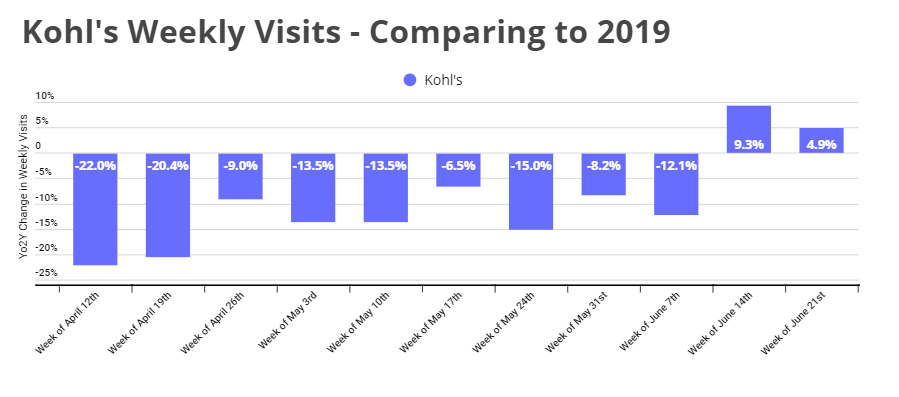

But success of the department leader’s June push becomes all the more significant when analyzing visits at the weekly level. Visits the weeks beginning May 31st and June 7th were down 8.2% and 12.1% respectively when compared to the equivalent weeks in 2019. Yet, the weeks beginning June 14th and 21st saw major visit increases of 9.3% and 4.9% when compared to their 2019 equivalents.

The weekly visit trend shows that the Kohl’s recovery is actually gaining momentum ahead of a critical back to school season. The result is a further testament to the brand’s unique positioning and capability to drive success in the department store sector.

AMC Continues to Rise

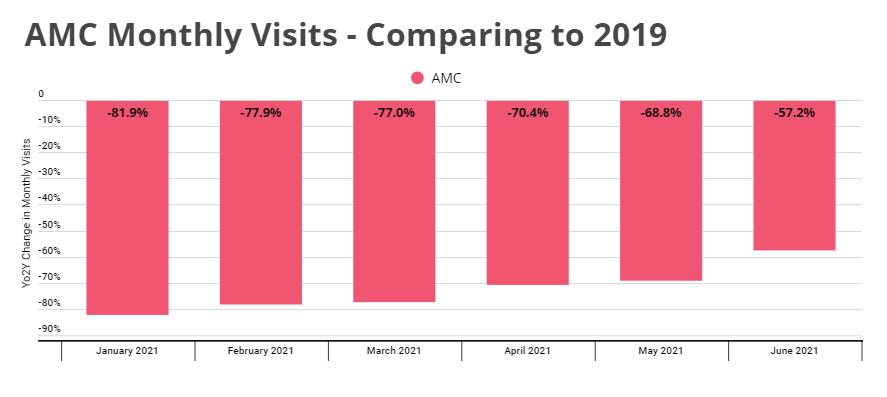

The theatre recovery has been fascinating to watch, and June marked another significant step forward for AMC and the wider sector. Visits were down just 57.2% when compared to June 2019, the best mark since the onset of the pandemic’s retail impact by far.

The surge – likely driven by the release of major summer blockbusters and a continued return to ‘normalcy’ – could indicate that even a sector like movie theatres could recover. While there are longer term questions about how the sector may need to evolve to stay relevant, the continued return of visits is an incredibly positive sign for the long term viability of the segment.

Massaging the Numbers

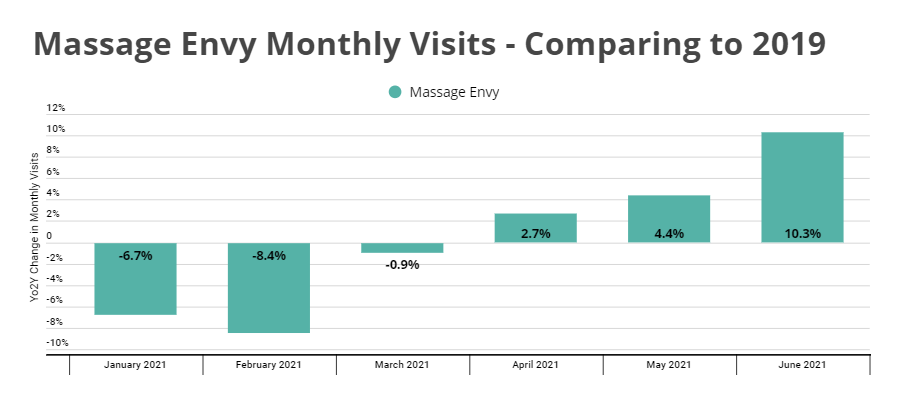

There are few sectors less COVID-proof than massage parlors, with the close contact creating tremendous friction in the pandemic environment. However, Massage Envy’s impressive recovery shows that customers were waiting for their opportunity to return. Visits in June were up 10.3% compared to June 2019, continuing a steady positive trend of visit recovery seen since the start of the year.

And beyond the strong visit results, the brand may also benefit from a powerful alignment with several key trends. Health and wellness were put on a pedestal throughout the pandemic, and as concerns over COVID ease there is real reason to believe that massage parlors could be a prime beneficiary. In addition, the continued limitation on international travel amid a wider period of increased savings may push more customers to splurge on a needed release.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.