Fast fashion has become an enduring trend in both North America and Europe. But early innovators like Zara and Forever21 can’t rest on there laurels, as there are even faster e-commerce brands looking to take the crown. In today’s Insight Flash, we look at the performance on Romwe, Shein, and Wish in the US and UK to see which of these brands are most disruptive.

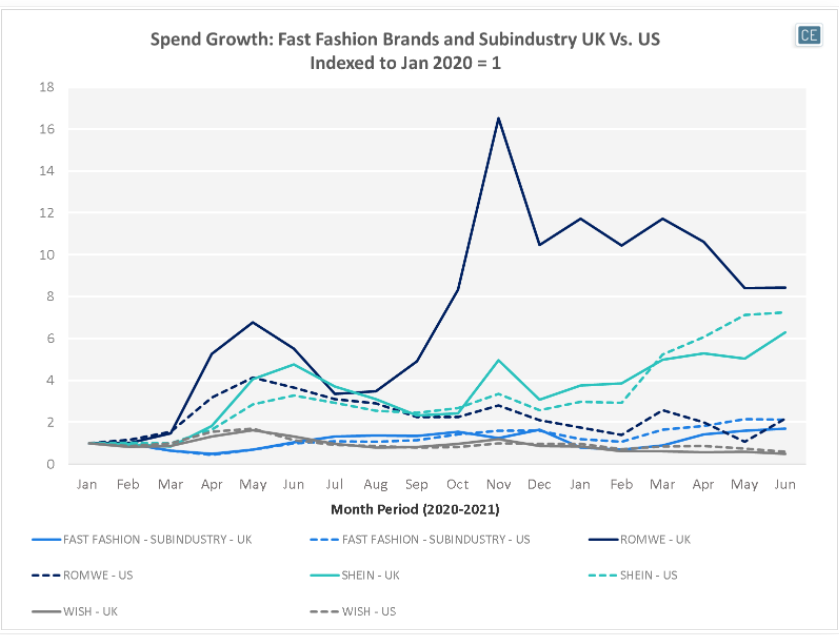

Of these brands, Romwe’s UK business has seen the biggest explosion in the last 18 months off a very small base. Its US spend has been more muted but still strong with sales more than doubling in the same period, in line with overall Fast Fashion trends. Shein has had more consistent growth in the two markets, with June UK spend over 6x January 2020 levels and June US spend over 7x. Wish appears to have already passed its moment in the sun, with June sales in both the US and UK about half of what they were in January 2020. One interesting note across the brands is the spike in November spend as shoppers anticipate delivery lags ahead of Christmas.

US and UK Spend

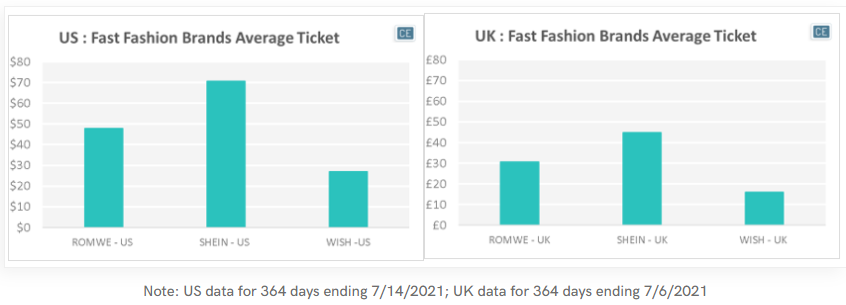

The average transaction size for these brands is similar across geographies. In both the US and UK, Shein commands the highest average ticket at about 50% higher than Romwe and over 150% higher than Wish.

US and IK Average Ticket

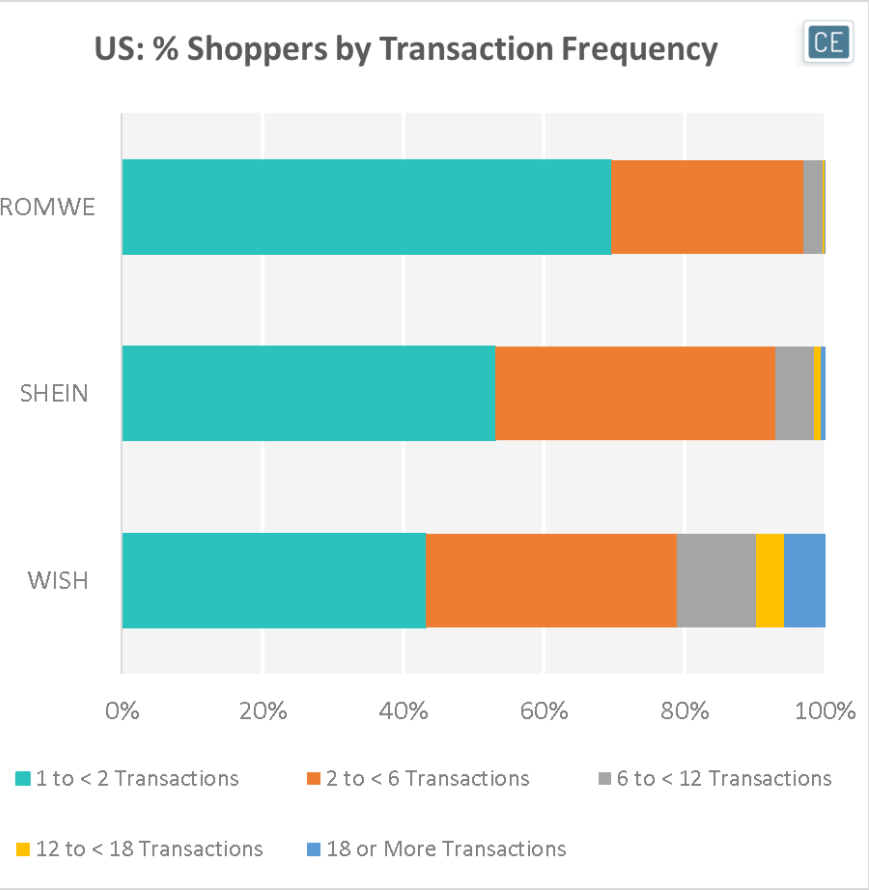

Though Wish is seeing a smaller ticket per transaction, it does stand out versus its competitors in transaction frequency. 57% of Wish shoppers made more than one purchase in the last year, with 10% buying from Wish at least monthly. Meanwhile, over half of Shein shoppers made only one transaction, and only 7% shopped every other month or more. Romwe saw the lowest frequency with two-thirds of shoppers making only one purchase in the last year, and only 3% buying every other month or more.

US Transaction Frequency

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.