As travel-related sectors are bouncing back from the COVID-19 pandemic, rental cars have been in short supply. Consumer transaction data reveals that June 2021 sales for top rental car parent companies like Avis Budget Group and The Hertz Corporation exceeded sales from the same month in 2019 and 2020. At the same time, peer-to-peer car rental companies like Turo continue to capture market share from competitors.

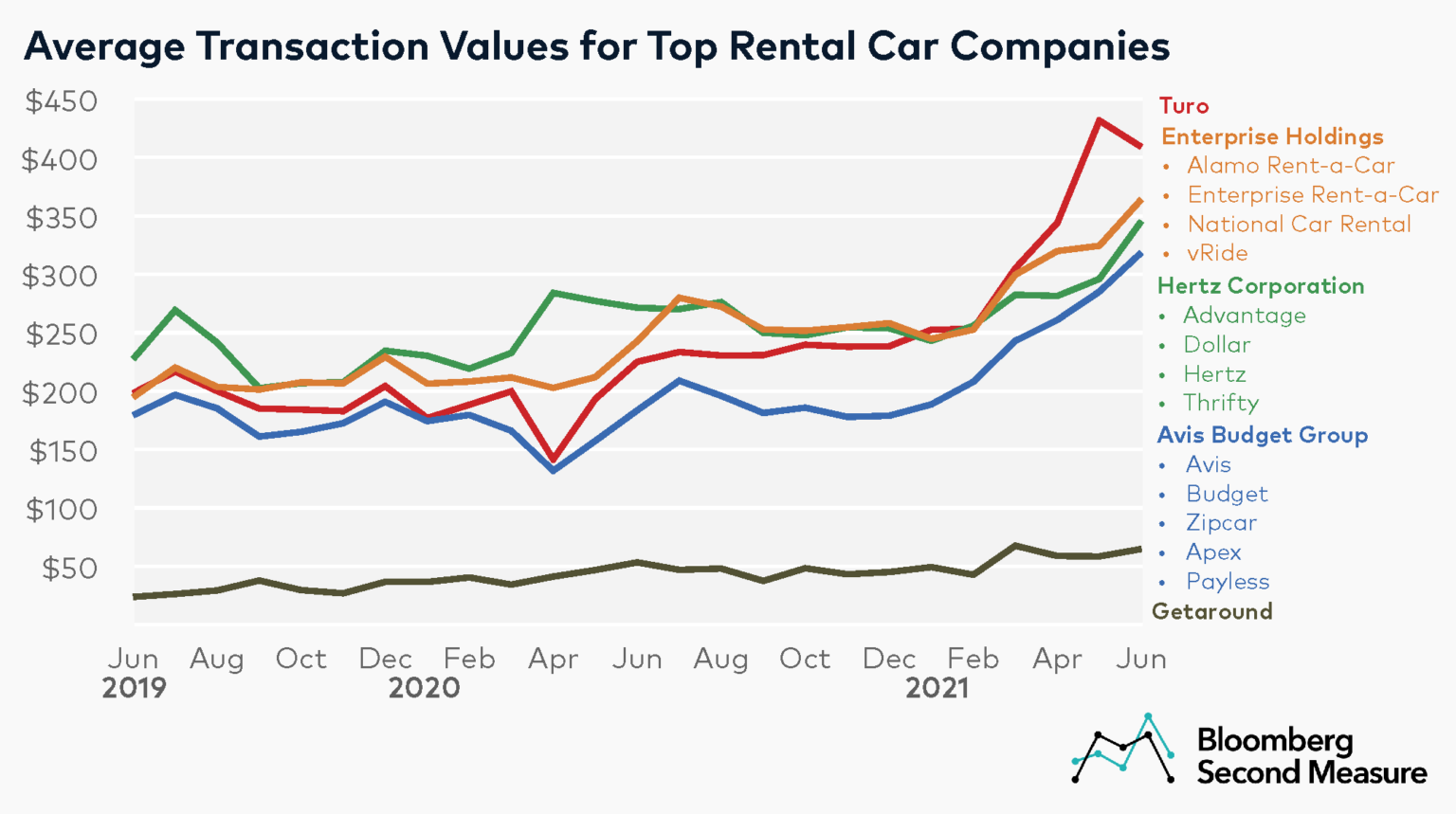

Average transaction value has been on the rise for rental cars in 2021

Similar to a recent trend in the rideshare industry, average transaction values for rental car companies rose throughout the spring and early summer of 2021. Among a select set of competitors, Turo has the highest average transaction value, reaching $410 in June 2021. Turo also experienced the most growth year-over-year, with its average transaction value in June 2021 increasing 82 percent compared to June 2020. The average transaction value at Turo has also more than doubled since June 2019.

The Hertz Corporation generally had the highest transaction value between June 2019 and August 2020, before it was overtaken by Enterprise Holdings and eventually Turo. Getaround, another peer-to-peer car rental platform and Turo competitor, has the lowest average transaction value within this competitive set—$65 in June 2021.

Car sharing service Turo increasingly becoming an alternative to traditional car rentals

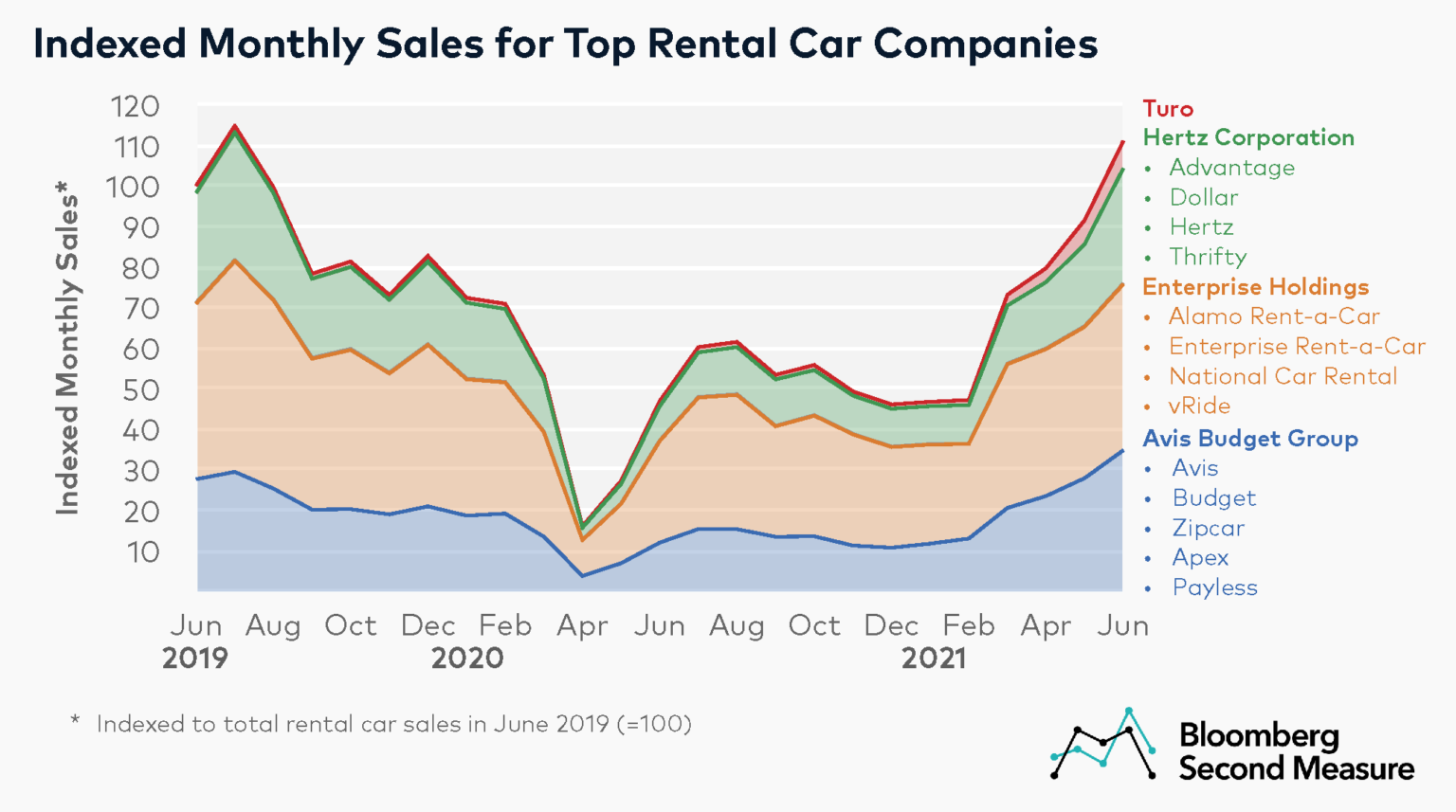

For the top car rental companies and peer-to-peer platforms in this analysis, total sales in June 2021 grew 137 percent year-over-year. Compared to June 2019, rental car sales were 11 percent higher.

Car sharing services such as Turo are becoming a more popular option among consumers. Turo’s sales have experienced the most growth among the competitive set. In June 2021, Turo’s sales were 442 percent higher than June 2020 and 290 percent higher than June 2019. On the other hand, growth has been slower for Enterprise Holdings. In June 2021, Enterprise Holdings’ sales were 64 percent higher than sales from the previous year, but 6 percent lower than in June 2019.

Over the past two summers, Turo has also seen an increase in market share. Turo’s share of sales tripled from 2 percent to 6 percent between June 2019 and June 2021. Enterprise Holdings—which comprises Alamo Rent-a-Car, Enterprise Rent-a-Car, National Car Rental, and vRide—accounted for 37 percent of sales among top rental car companies in June 2021, down from 48 percent in June 2019. Avis Budget Group, which includes Avis, Budget, Zipcar, Apex, and Payless, came in second with 31 percent. The Hertz Corporation, which includes Dollar, Advantage, Hertz, and Thrifty, earned 26 percent of sales. Getaround accounted for less than half of a percent of sales in June 2021.

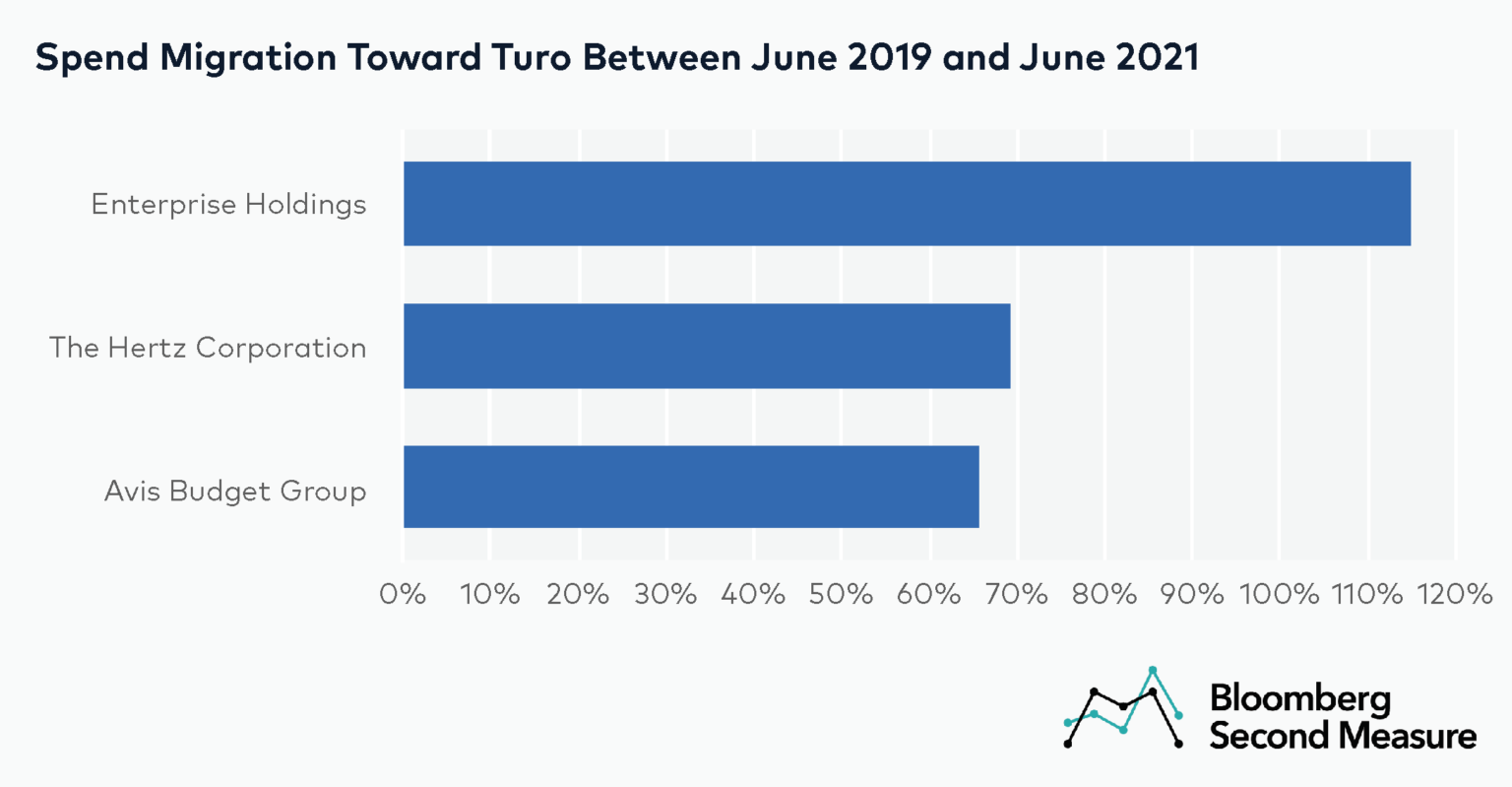

Turo has captured market share from its established rental car competitors

Spend migration analysis reveals that between June 2019 and June 2021, the rental car market grew 11 percent. However, Turo’s sales growth outperformed the market during this time, resulting in a relative share growth—or growth rate of market share—of 251 percent. Enterprise Holdings accounted for 115 percentage points of Turo’s 251 percent market share growth. The Hertz Corporation and Avis Budget Group accounted for 70 percentage points and 66 percentage points, respectively.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.