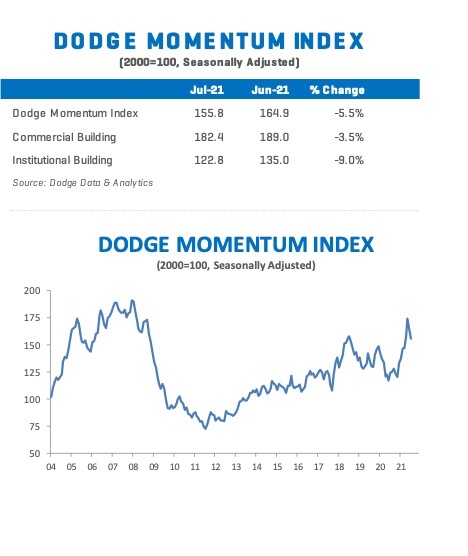

The Dodge Momentum Index fell to 155.8 (2000=100) in July, a 6% decline from the revised June reading of 164.9. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

Both components of the Momentum Index fell in July. Commercial planning fell 3%, while institutional planning dropped 9%.

The Momentum Index posted strong gains through much of the winter and spring as the economy and building markets began to stabilize following the recession. While the economy has continued its forward progress through the summer, the Index has regressed somewhat as higher material prices and shortages of skilled labor continue to exert a strong influence over the construction sector. Despite the declines in June and July, the Momentum Index remains near levels last seen in 2018. Compared to a year earlier, the Momentum Index was 25% higher than in July 2020 — institutional planning was up 27% and commercial planning was 25% higher than last year.

A total of 11 projects with a value of $100 million or more entered planning during July. The leading commercial projects were a $240 million Microsoft Data Center in San Antonio, TX and a $200 million Amazon, Inc. fulfillment center (Project Basie) in Woodburn, OR. The leading institutional projects were the $225 million Baptist Health Hardin Medical Pavilion in Elizabethtown, KY and the $200 million AdventHealth Narcoossee campus in Orlando, FL.

The pressures caused by higher material prices and labor are unlikely to ease anytime soon and, when added to the rising number of COVID-19 cases caused by the Delta variant, raises concerns that the nascent recovery in construction may stall in the months ahead.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.