Key takeaways

Network congestion constrains India’s 4G speeds

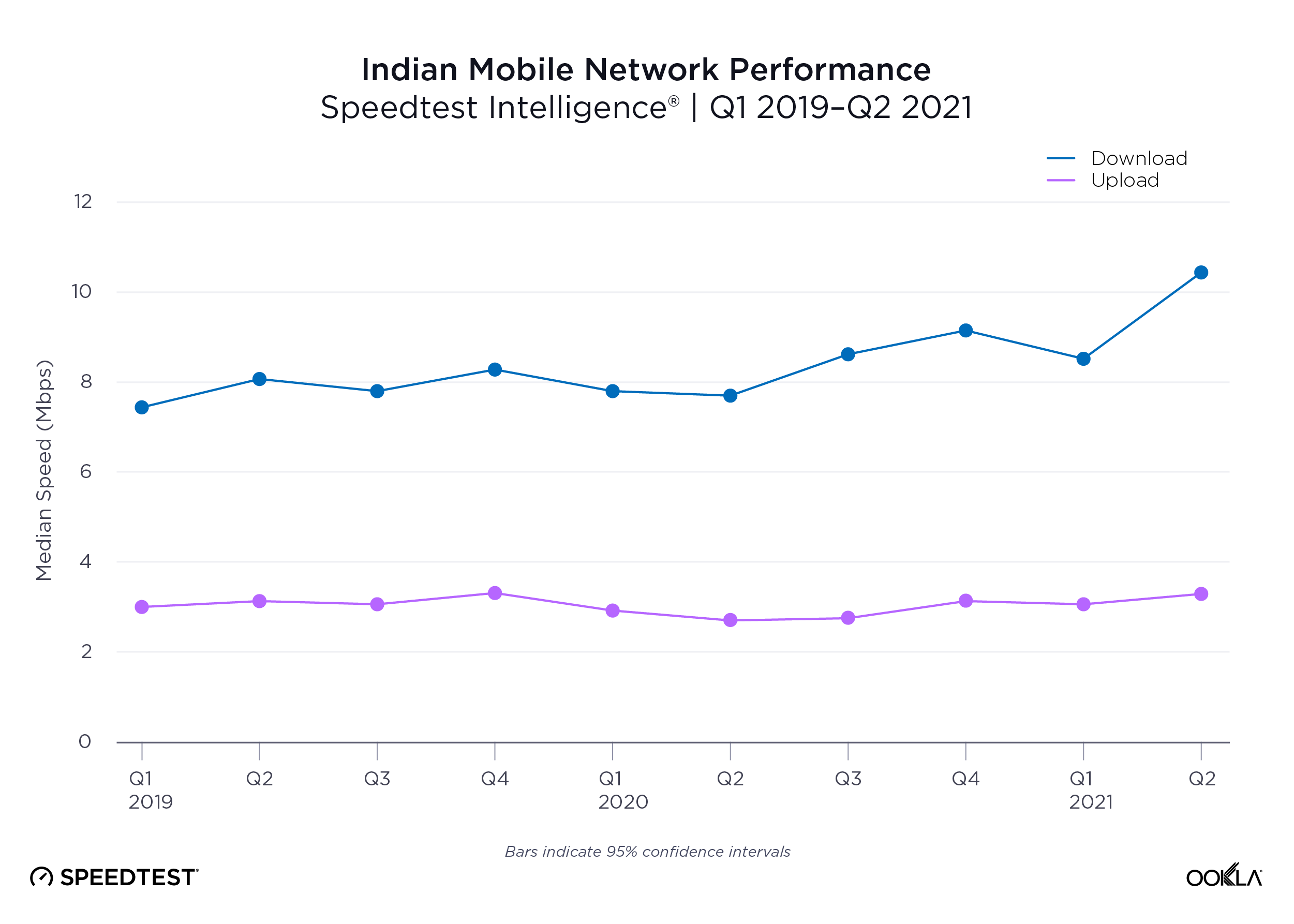

India has witnessed a rapid migration to mobile broadband services over the past five years, growing from 22.4%, of the more than 1 billion mobile connections in the country, on either 3G or 4G networks at the end of 2016, to over 70% by Q2 2021 according to GSMA Intelligence. Rapidly falling data prices, spurred by the arrival of Jio in the market, have contributed to strong increases in mobile data consumption. This trend has only accelerated as more video streaming services have targeted the market and as a result of recent COVID-19-related lockdowns. In its June 2021 Mobility Report, Ericsson called the market out as one of the regions with the highest mobile data use per smartphone globally, at 14.6 GB per month, well above the global average of 9 GB and second only to the GCC states. While 4G still has a way to go to support this growth, it’s clear that this combination of connections and data growth has put a strain on India’s 4G networks. Speeds have stagnated as a result, with median download speeds struggling to breach 10 Mbps during 2019 and 2020 according to Speedtest Intelligence data.

COVID and the implementation of lockdowns in the market have only served to complicate matters, leading to a delay in India’s much anticipated 5G auction and also to changes in consumer and enterprise demand. During the first wave of the pandemic, operators had to respond to a massive shift in traffic – from urban commercial centres to outskirts and residential areas in cities, and from urban to rural areas – and also growth in traffic due to lockdowns. They also had to contend with disrupted supply chains and an inability at times to physically deploy network components.

New spectrum boosts Jio’s performance and customer sentiment

Operators were better prepared during the second wave of COVID (Q1-Q2 2021) – being able to manage more of their network estates remotely but also having increased their spectrum holdings across a variety of bands. Median download speeds increased from 8.52 Mbps in calendar Q1 2021, to 10.44 Mbps in Q2 2021, while 4G Service (the percentage of operator known locations where a device has access to 4G LTE service) hit 96.0% in Q2 2021, up from 93.5% in Q4 2020.

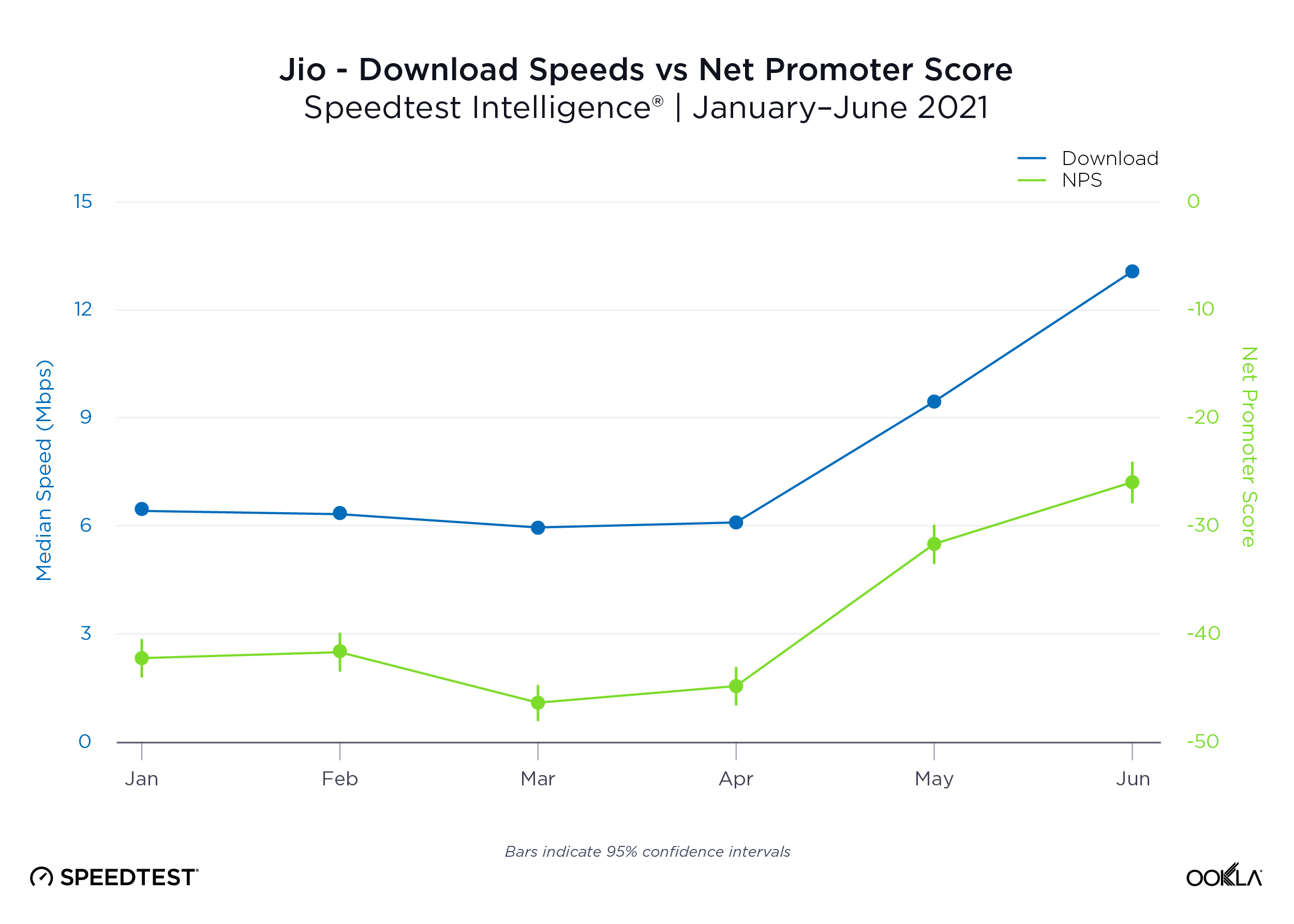

Spectrum is the lifeblood of the industry. It’s an oft-used phrase, but our Indian data demonstrates its importance in helping Indian operators build more positive customer experiences. The starkest improvement in network performance over the past year has come from Jio. In March 2021 the operator acquired spectrum in the 800, 1800 and 2300 MHz bands, across 22 circles — a good mix of coverage and capacity spectrum to support its 4G LTE service. Importantly for Jio, this increased its overall spectrum footprint by 55% and included a number of contiguous blocks of spectrum.

Our data maps the increase in Jio’s performance since March, showing median download speeds increased from 5.96 Mbps in March 2021 to 13.08 Mbps in June. Its upload speeds and Consistency Score™ (% of samples which exceed 5 Mbps download and 1 Mbps upload) also saw considerable improvements. Most tellingly, at the same time its NPS score (the relative weight of a brand’s promoters and detractors) rose from -46.37 in March, to -25.93 in June.

What India can expect from 5G

While the additional spectrum Jio acquired in March helped ease congestion on its 4G-LTE network, new spectrum, particularly for 5G use, is critical to the continued growth of the sector and to further improve the consumer experience across all operators. India clearly lags behind markets that have already begun 5G deployment, such as the U.K. and U.S. However, that doesn’t mean Indian operators are just playing a waiting game — it’s clear there’s a lot of work going on behind the scenes to help drive 5G commercialization once the spectrum becomes available. All three major network operators are busy conducting 5G trials and have achieved very impressive 5G speeds. On top of that, Airtel has already started to roll out 5G-ready network equipment and Jio is testing its own 5G open RAN solutions in several cities.

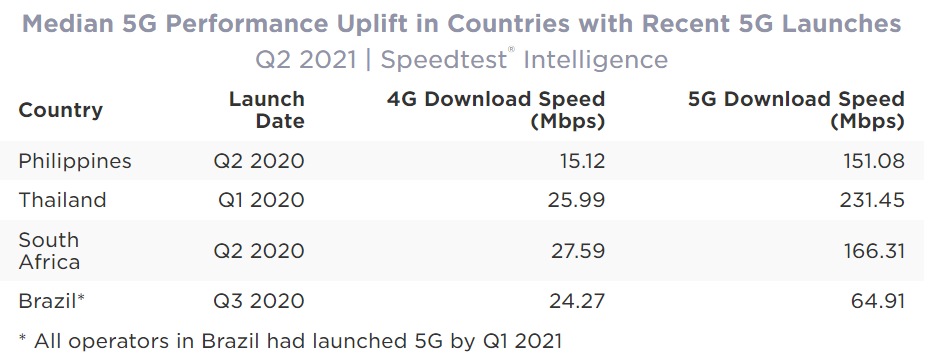

One of the key benefits of 5G is that it can operate over a wider range of spectrum frequencies than LTE. The Telecom Regulatory Authority of India (TRAI) plans to allocate a wide band of 275 MHz of spectrum in the 3.3-3.6 GHz range (C-Band), which will offer much greater capacity than existing spectrum used for LTE services. Speedtest® data from other markets in Asia that have recently launched 5G (Thailand and the Philippines both launched 5G in Q1 2020) shows that the differential between 4G-LTE and 5G speeds was on average approximately 9-10x in Q2 2021.

India’s 4G Consistency score has been improving. As of June 2021, 64.5% of 4G users in India could expect to achieve download speeds in excess of 5 Mbps, the speed required to stream HD video content, up from 52.9% in March. It’s impossible to say exactly how fast 5G will be for the average Indian user, given uncertainty over exact spectrum allocations and rollout plans (including the radio access network and improvements to backhaul and transport networks), but it’s safe to say 5G will bring a considerable bump to overall speeds in the country.

Market outlook: Turning a negative into a positive

It’s a big year ahead for TRAI and the new Communications Minister Ashwini Vaishnaw in overseeing a 5G auction to deliver an optimal outcome for the State while ensuring operators are able to invest adequately in 5G networks. However, it’s worth noting that there are two key benefits to the delay in India’s 5G launch, as the country witnessed from launching 4G-LTE relatively late in the tech cycle:

5G should represent a step up in experience over current 4G LTE networks for Indian consumers, providing the bandwidth and latency to enjoy uninterrupted access to services such as high-definition video streaming, mobile gaming and video calling on the go. The advent of 5G should propel the market up the ranks on the Speedtest Global Index™, where it sat in 122nd place for median download speed as of June 2021. For Indian mobile operators and the regulator, the 5G era should be one of growing stability. With three large-scale operators, we’re unlikely to return to the price wars that occurred during the early 4G tech cycle, which is important in ensuring adequate re-investment in networks. Beyond that, I see a clear desire to be at the forefront of next generation network technologies. This is shown by the moves to embrace Open RAN and network virtualisation by all three mobile operators, the government’s Make in India initiative and the Indian Telecom Standard Body’s recent submission of its 6G vision to the ITU.

To learn more about the data behind this article and what Ookla has to offer, visit https://www.ookla.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.