The COVID-19 pandemic has affected every facet of day-to-day life. Rising unemployment rates, decreased recreational spending, and lockdown measures have taken a toll on our collective psyche and spending habits. The beauty and fashion industry did not go unspared from the pandemic’s death grip; big-name brands were forced to shutter their storefronts and furlough thousands of corporate and retail-level employees. At the same time, a dramatic increase in online sales put pressure on key industry players to re-examine and invest in their respective e-commerce strategies.

Today, we’ll take a closer look at how the top three advertisers in the beauty and fashion category shifted their digital ad strategies and spend in the first half of 2021 in response to these shifting consumer trends and behaviors.

H&M highlights their sustainability initiatives

H&M reported a 21% YOY drop in sales in their first quarter of 2021. While the Swedish-based fashion brand explained this decrease was due to COVID- related restrictions, the company did note that reduced in-store sales were partly compensated for by growth in online sales, which increased by 57% in the first quarter.

H&M highlighted customer loyalty, sustainability and e-commerce as the brand’s primary areas of growth. Further, the latest iteration of the company’s loyalty program will reward customers for turning in old clothes to H&M’s garment collecting, choosing climate-smart delivery options at checkout, shopping with their own reusable bag, and choosing products made from more sustainable materials. In the brand’s 2021 Sustainability Report, H&M outlined its goal of achieving 30% recycled materials by 2025 and reducing packaging across the value chain by 25% by 2025.

From January through June of 2021, H&M invested over $25 million into its digital campaigns. The brand’s creative strategy promoted its sustainability initiatives and giving a subtle nod to the current health climate. Their top creative from this period is a Facebook link post with ad copy reading, “Bright, comfy and sustainable pieces to get you through winter.” The company is undoubtedly feeling the heat from young consumers eager to put their allowance behind a brand that puts their money where their mouth is. The steep rise in remote work and virtual schooling also put pressure on the brand to develop new and creative ways to keep consumers spending – even if they have no one to look cute for but themselves. Loungewear and work from chic home styles are all the rage, and H&M is responding in kind.

To match their sustainability initiatives, H&M also launched its Role Models campaign in the early spring. According to the campaigns landing page, “They can’t drive, vote or tweet, but they will change the planet. We’re shining a spotlight on the people making the world a better place: kids. These are the Role Models.” The campaign aims to shine a spotlight on the younger generation making an impact in their community and the world. In another show of putting their money where their mouth is, H&M pledged to make a $100,000 donation to support UNICEF’s work to ensure Every Child’s voice is heard.

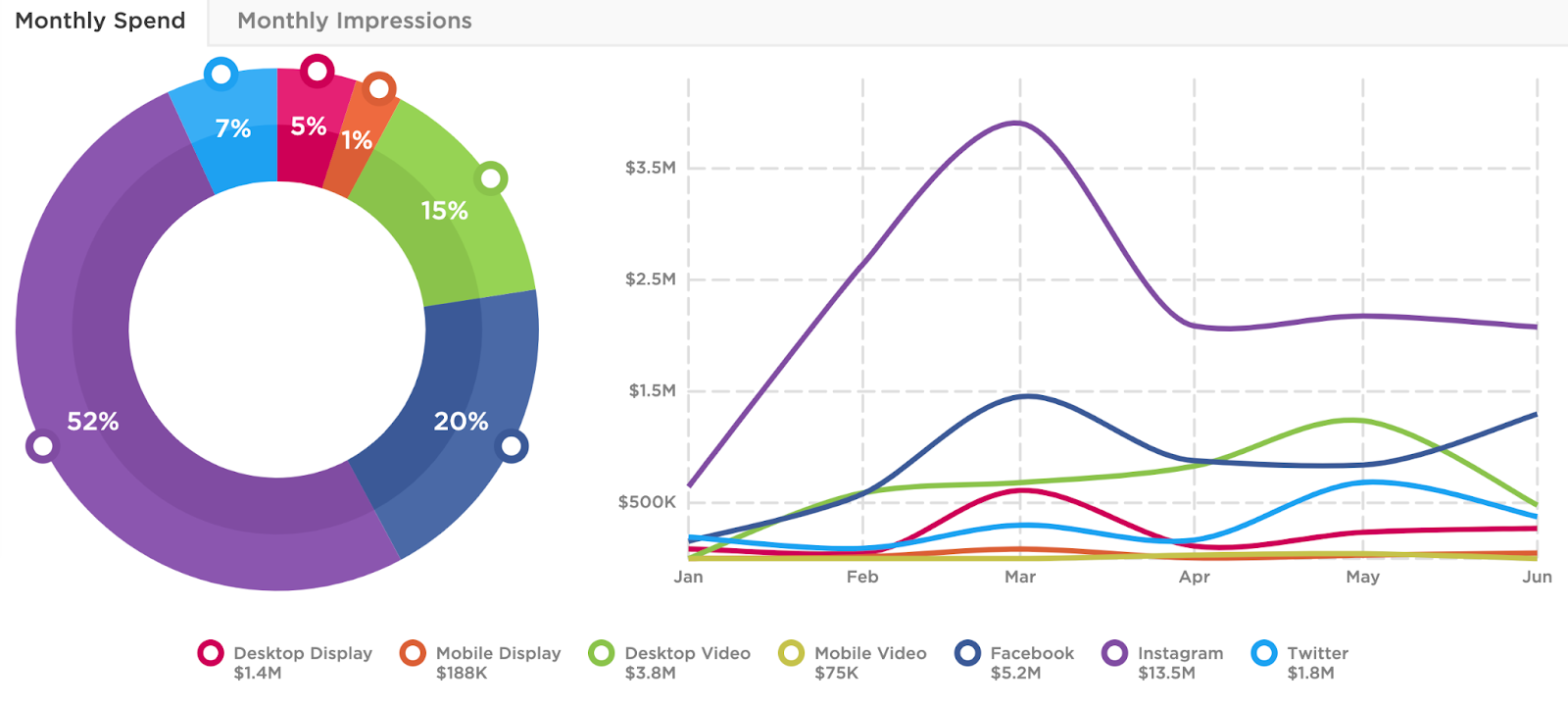

H&M’s total ad spend for H1 was split between Instagram (52%), Facebook (20%), and desktop video (15%), a strategy that tracks with the brand’s effort to connect with Gen Z and younger millennial consumers.

Ulta gradually resumes in-store operations and forecasts a more profitable 2021

In 2020, Ulta Beauty’s net sales decreased by 16.8% due to the impact of COVID-19. However, thanks to rising consumer confidence, stimulus checks and the easing of COVID-19 restrictions, the beauty company started the year better than it ended, with net sales soaring 65% by the end of the first fiscal quarter. In addition, Ulta’s ongoing efforts to cultivate an exceptional and seamless online and in-store consumer experience has set the stage for the company’s recovery and growth.

All told, Ulta funneled $32 million into their ad campaigns in the first half of 2021. Their strategy during this period incorporated video creative promoting Ulta’s online ordering and curbside pickup options. This long-running campaign launched in August 2020 and concluded in mid-May 2021, coinciding with the loosening of COVID-related restrictions nationwide. Beyond COVID-specific creative, Ulta continued to promote ad partner product lines, including Nair, Kristin Ess, and Jimmy Choo. In response to improving buyer confidence and an optimistic market outlook, Ulta also bumped up their ad spend by 16% in H1 2021 compared to H2 2020.

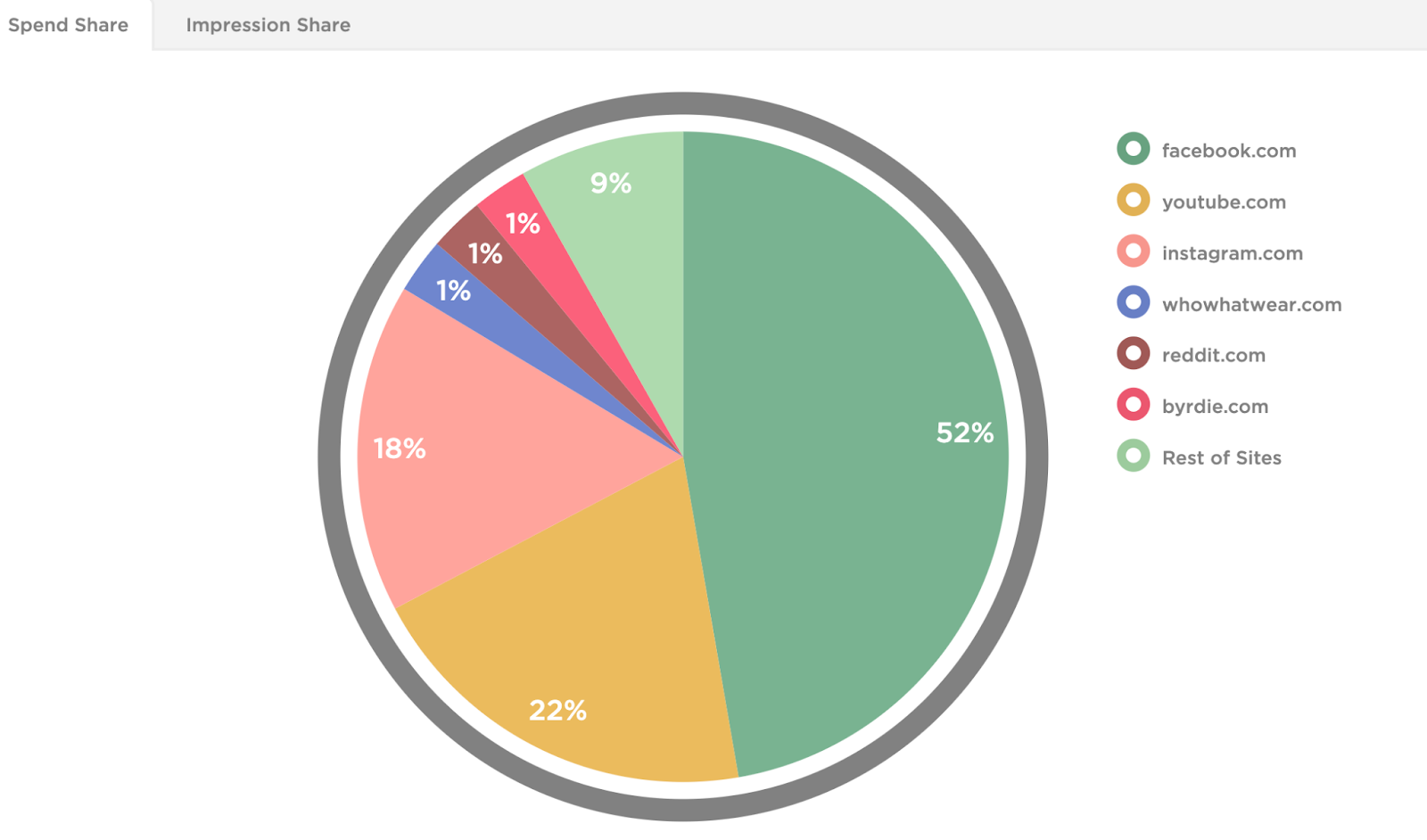

Ulta allocated its ad budget for the first half of 2020 primarily to Facebook (52%) followed by desktop video (22%), with Instagram coming in at a close third (18%).

Shein knocks out Amazon as most downloaded shopping app

On May 17th, e-commerce fast fashion brand Shein did the impossible and ended Amazon’s 152-day streak as the most downloaded shopping app in the U.S. We have Gen Z and young millennial shoppers to thank for Shein’s rise to fast fashion stardom. The company’s never-ending, always-changing catalog at astronomically low prices offers a euphoric rush for cash-strapped teens. The app’s annual sales more than tripled last year during the pandemic, making Shein the biggest e-commerce only fashion brand in the world. And that’s not all. There are rumors abound the company is prepping to go public. At $47 billion, Shein’s listing would be the largest IPO in history.

But enough investor talk. Just how much did Shein spend on ads during the first half of 2021, and where? Surpassing Ulta and H&M, Shein earmarked $34 million for digital ads in H1 2021, amassing over 7.7 billion in total paid impressions.

The brand’s creative strategy leaned heavily on desktop display ads, promoting the app’s latest seasonal styles and 1000+ new item launches in addition to free returns. Even when looking at their H2 2020 strategy, the company didn’t diverge from its redundant and formulaic ad strategy. However, they did invest $10 million more in digital ads in H1 2021, a potential indicator their ad budget is scaling with their outstanding growth.

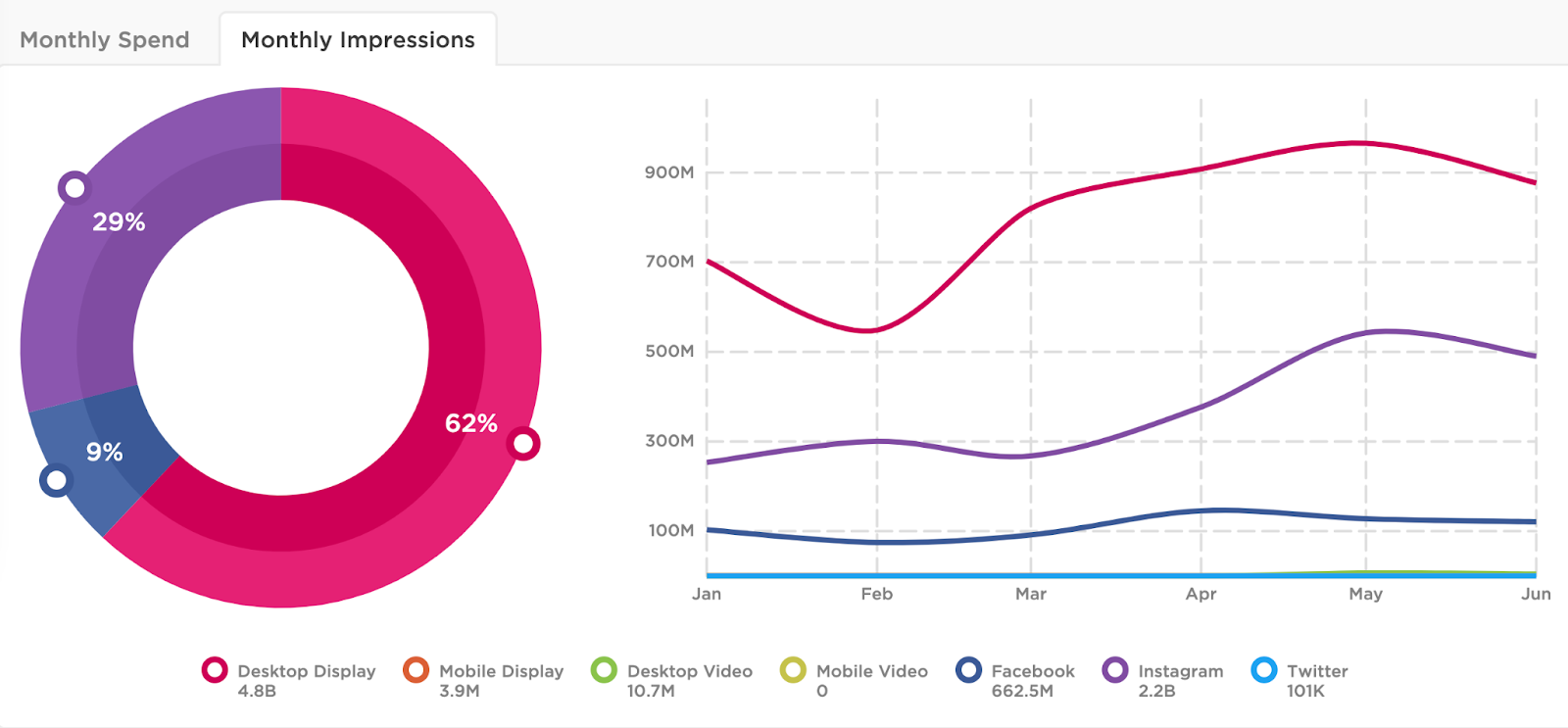

Shein’s total ad spend for H1 was split between Instagram (48%), desktop display (36%), and Facebook (15%), although, interestingly, the lion’s share of the company’s ad impressions during this period came from desktop display ads (62%).

After a long year of donning masks and back-to-back Zoom calls, newly inoculated Americans are ready to reemerge from the confines of their homes and reconnect with society. That means investing in their appearance. We predict demand for new clothing styles, accessories and beauty products will continue to grow as the pandemic recedes and life returns to normal. Regardless, the proof is in the pudding. In order to stay competitive and profitable, fashion and beauty brands will need to adapt quickly and continue investing in e‐commerce technology, digital customer acquisition, online ordering, and delivery/logistics infrastructure.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.