As retailers see increased traffic from shoppers returning to brick-and-mortar stores, department stores such as Macy’s are experiencing significant sales growth. In fact, Macy’s Inc.’s (NYSE: M) most recent earnings report outperformed investors’ expectations. Consumer transaction data identified growth in retail channel sales and spend migration from competitors as factors potentially driving Macy’s earnings surprise.

Transaction data predicted Macy’s strong sales performance before earnings call

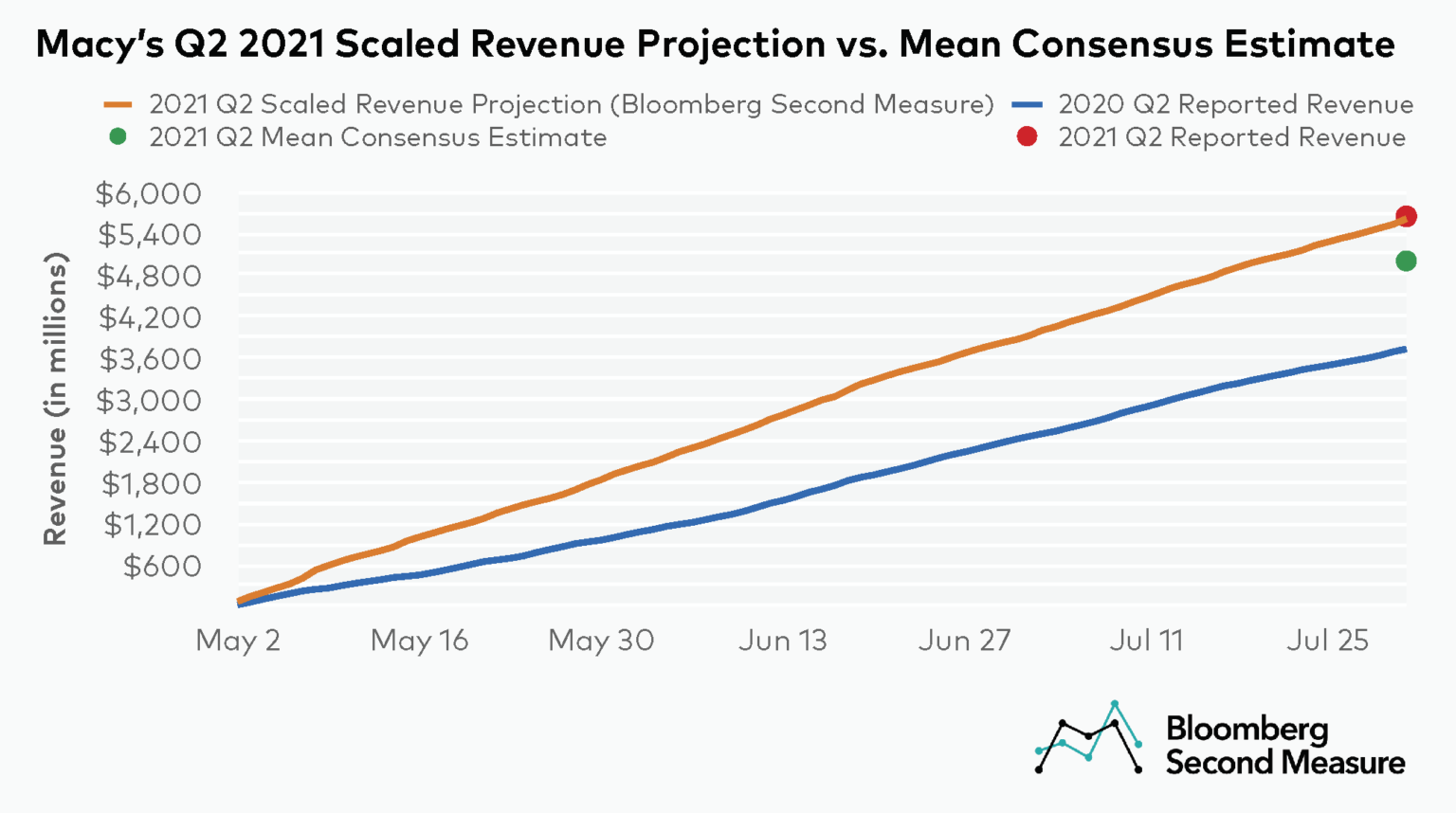

On August 19, Macy’s Inc. announced that its second quarter earnings reached $5.65 billion. The mean consensus underestimated Macy’s earnings by 13 percent. Meanwhile, Bloomberg Second Measure’s scaled revenue projections from July 31 forecasted revenue of $5.61 billion for Macy’s, coming within 1 percent of reported revenue. Macy’s Q2 2021 revenue also far exceeded its Q2 2020 revenue.

Macy’s online sales are still higher than pre-pandemic levels as customers return to brick-and-mortar locations

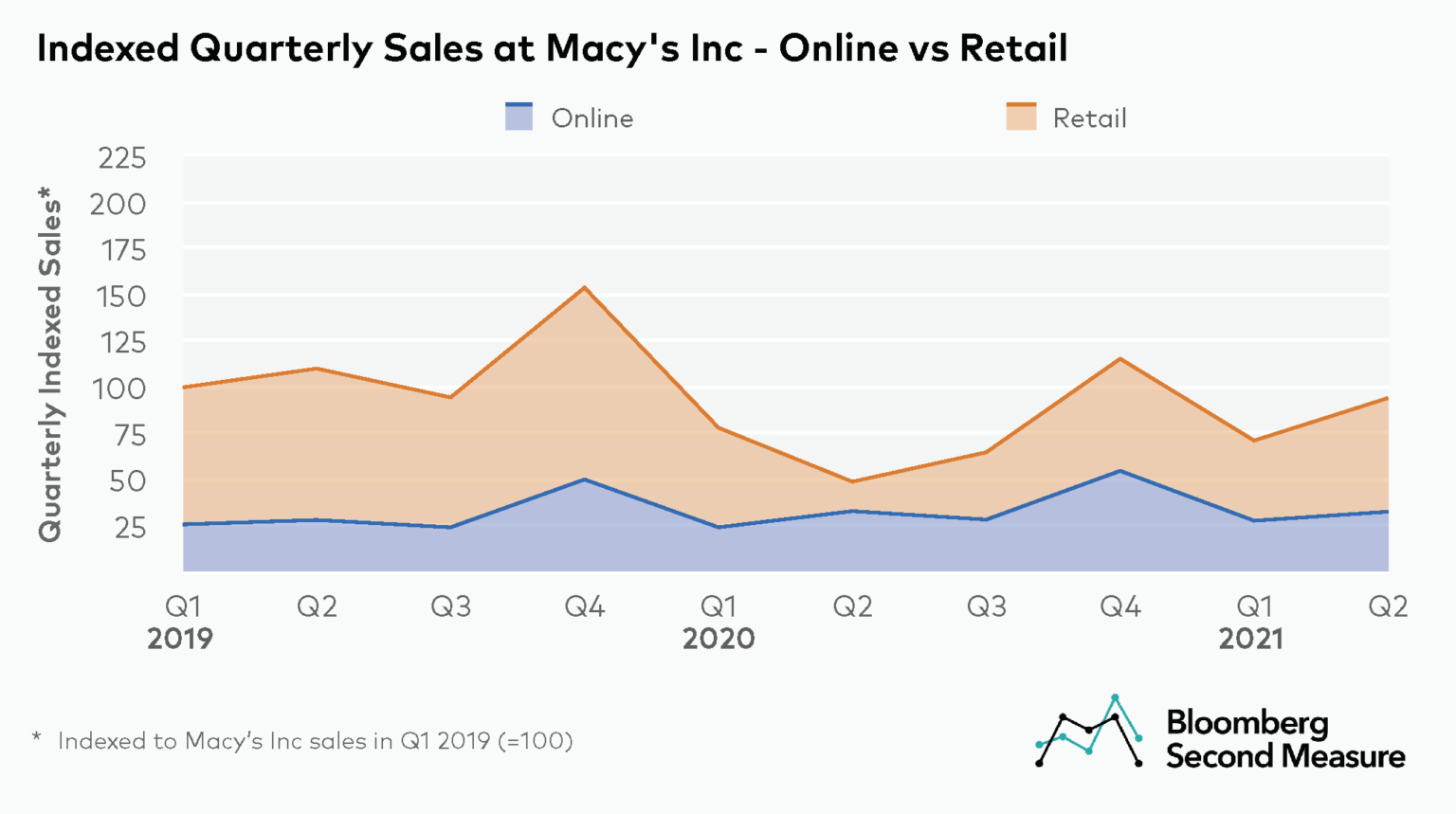

Although Macy’s experienced a sales boost in the second quarter, sales have not fully recovered to pre-pandemic levels, especially for retail. Compared to Q2 2019, Macy’s sales in Q2 2021 were 14 percent lower. A breakdown by sales channel shows that online sales in Q2 2021 were 16 percent higher than in Q2 2019, while retail sales were 25 percent lower.

The share of online sales as a percentage of total sales has also been decreasing over the past year. This could be partially attributed to the fact that shelter-in-place orders were still in effect for much of Q2 2020, so sales at that time primarily took place online. In fact, two-thirds of Macy’s sales in Q2 2020 were online. The share of online sales dipped to 35 percent in Q2 2021—which, while lower than early in the pandemic, is still 9 percentage points higher than in Q2 2019.

Macy’s captured spend from Nordstrom and Kohl’s between Q2 2020 and Q2 2021

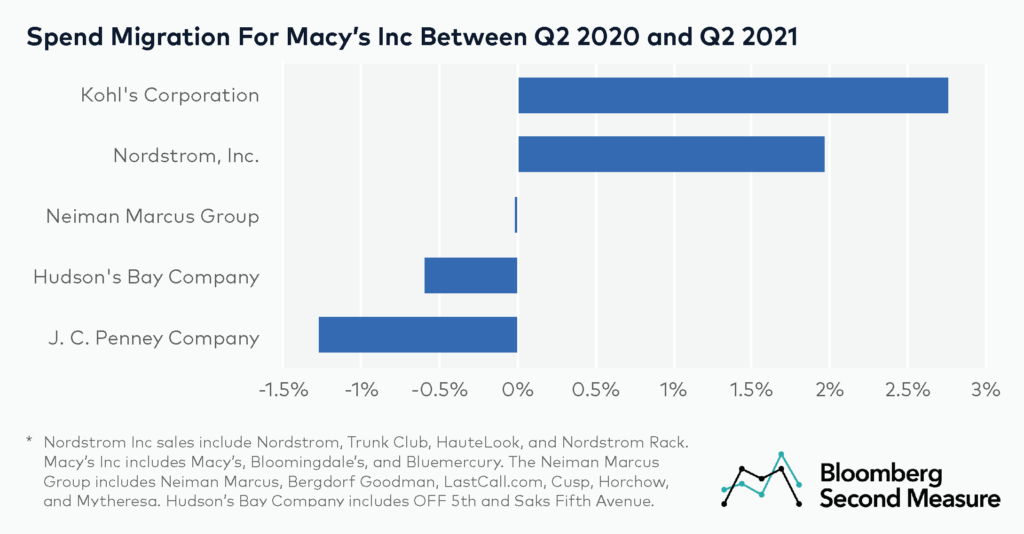

Taking a closer look at the year-over-year change from Q2 2020 to Q2 2021, Macy’s Inc sales growth slightly outperformed overall sales growth among a select group of national department store companies—Nordstrom Inc, Kohl’s Corporation, The Neiman Marcus Group, Hudson’s Bay Company, and J.C. Penney.

In this time frame, Macy’s relative share growth—or growth rate of market share—was 3 percent. Spend migration data reveals that Macy’s relative share growth came at the expense of Nordstrom and its subsidiaries as well as Kohl’s Corporation. However, these gains were partially offset by market share losses to J.C Penney, Hudson’s Bay Company, and to a much lesser extent, The Neiman Marcus Group.

Nordstrom is reportedly recovering more slowly than similar retailers, while Kohl’s is seeing strong revenue gains, especially in the activewear category.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.