Last week, Kroger made headlines when it announced the launch of its Delivery Now service, promising groceries delivered in 30 minutes or less. Grocery has been one of the many industries benefitting from the surge of online shopping over the last year and a half, but can Kroger’s gambit add a second burst to the trajectory? And could it be a model for other players both in the US and overseas? In today’s Insight Flash, we look at how grocery spend has grown by channel in the US versus UK, what the average ticket is for third-party delivery versus the Grocers’ direct channels in both markets, and which US Grocers have the highest percentage of sales from third-party services.

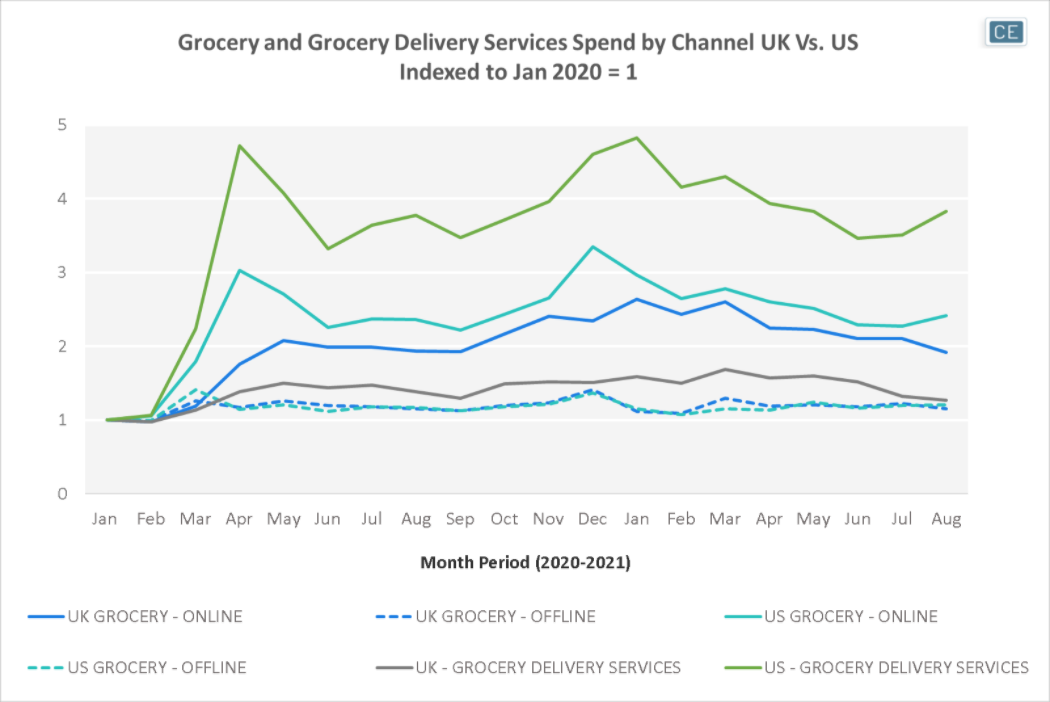

Since January 2020, growth in Grocery Delivery Services in the US has far outpaced the Grocery retailers’ own online spend. Both peaked last winter and have slowed in recent months (although Delta variant fears likely drove the small uptick in August), with this slowdown perhaps part of what has Kroger looking for alternative strategies. In the UK, the Grocery retailers’ own e-commerce spend has been growing faster than spend for third-party services, but has been outpacing in-store growth.

Industry Growth by Channel

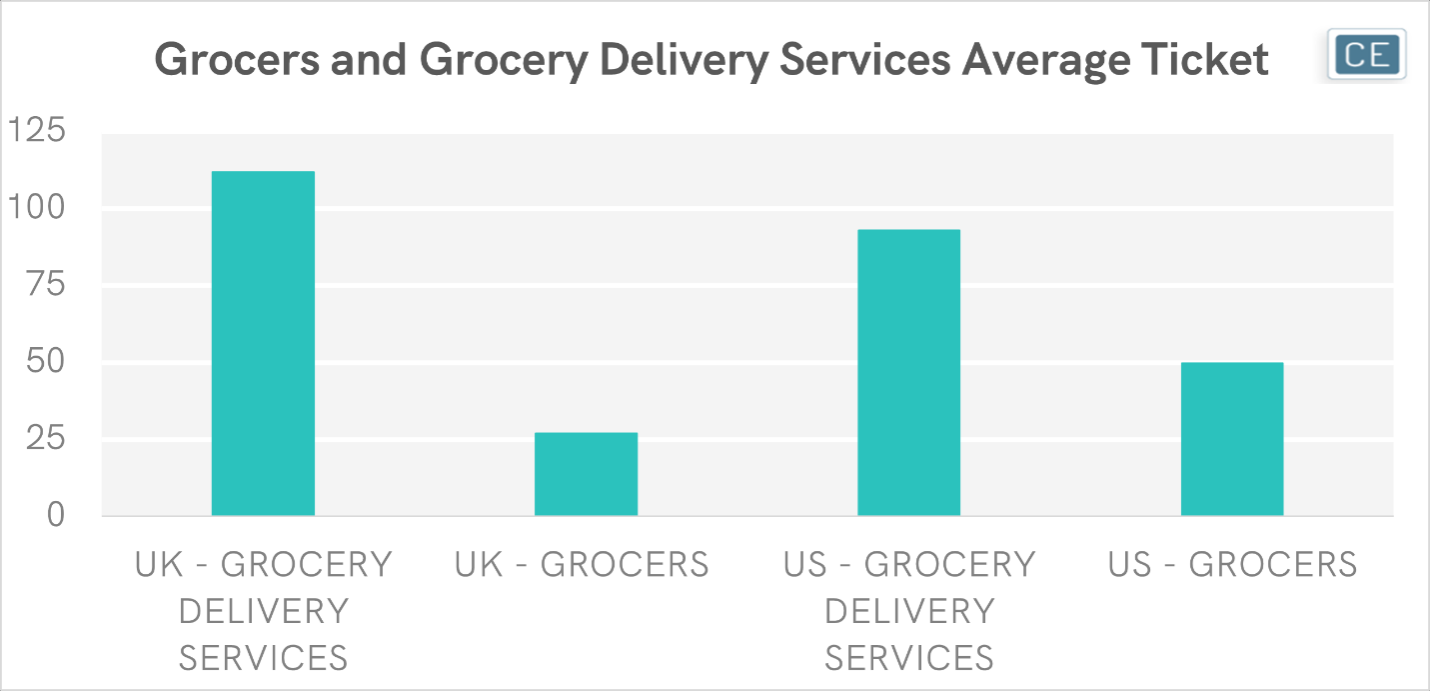

Grocery Delivery Services do have a higher average ticket than transactions at the Grocers in both geographies. This gap is bigger in the UK where the average Grocery Delivery ticket is 4.2x the average Grocer ticket. In the US, the average Grocery Delivery ticket is 1.9x the average Grocer ticket.

Average Ticket

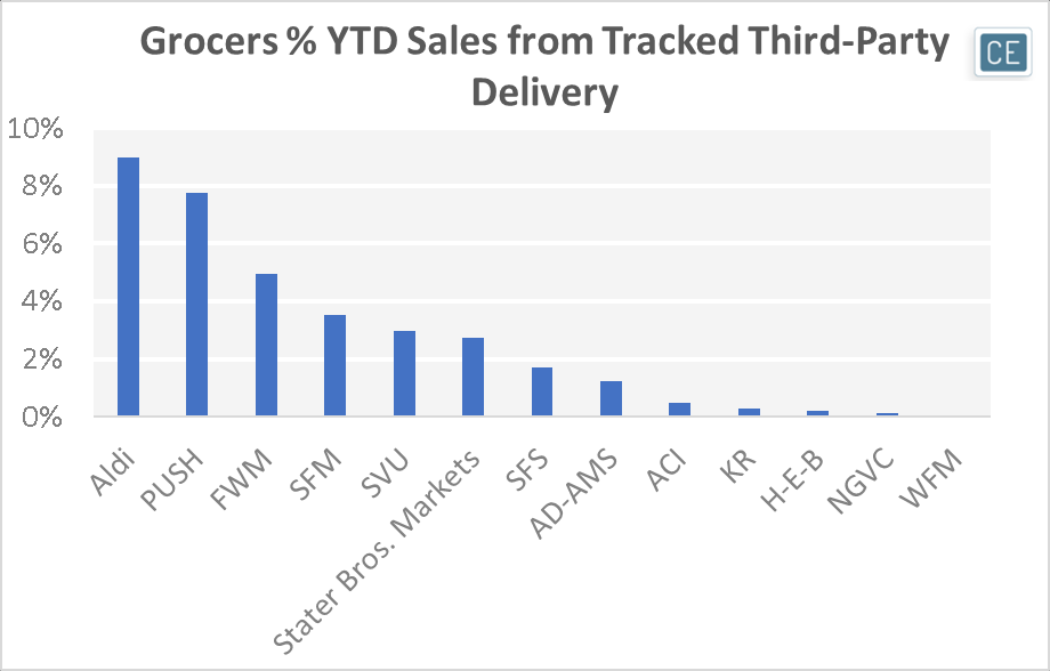

Consumer Edge’s dataset offers the unique ability to see not only which delivery service is providing groceries, but also which Grocer’s products are being delivered. Aldi and Publix have the highest percentage in our tracked universe, at 9.0% and 7.8% respectively.

Grocers by Third-Party Delivery

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.