The heat between gig companies and worker rights groups is intensifying. And the ad numbers show it.

Last year, businesses like Uber and Lyft contributed a record-breaking $200 million to the Prop 22 campaign in California, which allowed the companies to classify workers as independent contractors rather than employees.

As similar legislation gets closer to the ballot in Massachusetts, how much money will these companies shell out?

Gig companies take their fight out east

After California voters passed Prop 22 in California in November 2020, Uber, Lyft, DoorDash, Instacart and other similar app-based services began to push for similar measures in other states.

Prop 22 allowed app-based transportation and delivery companies to classify gig workers as independent contractors, rather than employees. The compromise being that companies were exempt from standard employee taxes and benefits, but they needed to give contractractors additional benefits.

Essentially, workers became classified as ‘independent contractors plus’. (The proposition has recently been deemed unconstitutional by a California superior court—so that leaves the future of the expensive legislation uncertain. Gig companies are already putting in an appeal.)

While the battle rages on in California, the same companies are now trying to pass similar legislation in Massachusetts and at least five other states.

The law in Massachusetts would ensure drivers receive $18 an hour for driving, plus additional benefits. Drivers get to maintain the flexibility and control of their hours, something that makes gig work distinct. The coalition of companies provided The New York Times this statement from a DoorDash courier, Pam Bennett:

“This is the best of both worlds. This measure will help every driver by preserving our ability to work whenever and however we want, and also give us access to brand-new benefits that will really help.”

On the other hand, critics say that the companies are deceiving the public and haven’t delivered the additional benefits like health insurance to drivers in California.

Uber, Lyft and similar companies have been criticized for their treatment of workers and political funding, but they say they’re trying to find a legal way to ensure drivers can work the way they want to work.

No matter how you see it—it’s expensive.

The Coalition to Protect Workers’ Rights expects the gig services spend around $100 million campaigning in Massachusetts.

We are still at the beginning of defining what the gig economy should and shouldn’t be. What type of advertising spending are we seeing from these companies?

MediaRadar Insights

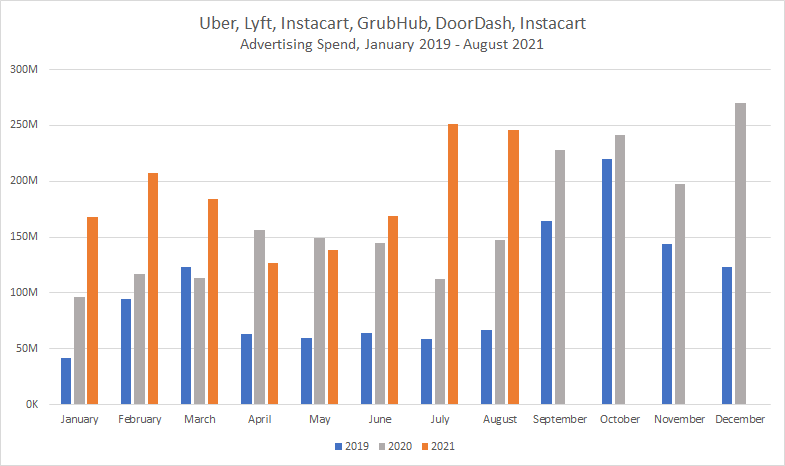

In 2021, advertising from Lyft, Uber, Instacart, Doordash, and Grubhub is up 44% over the same period in 2020 (January – August). These advertisers spent $1.4B this year vs $1.03B in 2020.

Spend increased significantly in July and August (123% and 66% year-over-year respectively) when the Massachusetts ballot measure gained national attention.

UberEats, GrubHub and DoorDash make up the largest amount of spending from this category this year, accounting for 80% of all the category’s spend in 2021.

Though their outside efforts to lobby for these measures are significant, none of the creative from these companies focuses specifically on workers’ benefits. Winning over customers and the affinity of voters might be a key way for these companies to achieve their goals.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.