Last December, Kohl’s and Sephora announced a long-term strategic partnership to revitalize Kohl’s beauty offerings by opening Sephora shops-in-shop at select Kohl’s locations throughout the country. The plan involved launching 200 “Sephora at Kohl’s” locations by the fall of 2021, for a total of at least 850 Kohl’s with a Sephora store-in-storeby the end of 2023.

The first four Sephora at Kohl’s locations opened August 6th, 2021, and another 73 opened August 20th. With only a couple weeks of data, we compared the visit patterns at the remodeled stores with visits to the Sephora-less Kohl’s stores to understand the impact and potential of this partnership.

Some Context

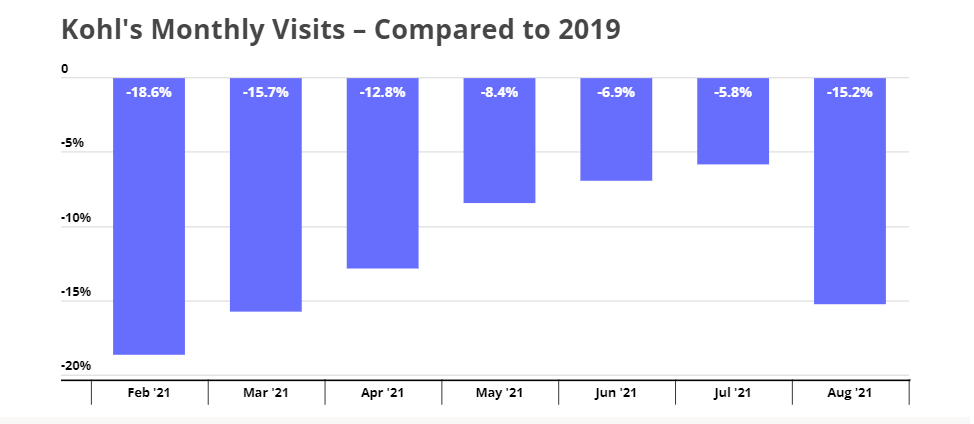

Kohl’s launched its first Sephora at Kohl’s locations in August 2021 – a tough month for some retailers as consumer confidence dipped due to the COVID resurgence. After months of edging closer to its 2019 visit levels, the department store leader took a significant hit in August, with monthly visits down -15.2% compared to 2019 – a visit gap not seen since March. A big piece of this comes from the lack of Labor Day visits in August as compared to 2019, and a wider cross-retail trend of increasing visit gaps compared to 2019.

The Starting Four

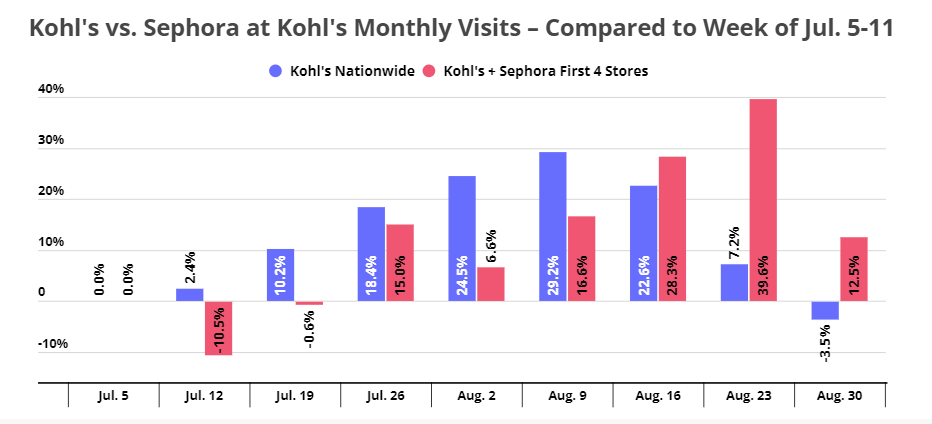

Still, despite the overall August downturn, the impact of the Sephora-Kohl’s partnership is starting to show. Using weekly visits for the week of July 5th as a baseline, we compared the average performance of the 1000+ Kohl’s locations in the United States to the performance of the first four Sephora at Kohl’s locations that opened on Friday, August 6th.

Before the launch, the four locations slated for the first Sephora shops-in-shop were underperforming compared to the legacy Kohl’s stores. The Sephora at Kohl’s opened near the end of the week beginning August 2nd and the impact was not felt immediately, though weather did play a role. But, beginning with the week of August 16th, ten days after the launch, Sephora at Kohl’s locations began outperforming Kohl’s nationwide average.

For the weeks beginning August 16th, 23rd, and 30th, the four Sephora at Kohl’s locations averaged a 28.3%, 39.6%, and 12.5% increase in visits, respectively, when compared to the July 5th baseline. Meanwhile, visits to legacy Kohl’s increased only 22.6% and 7.2% between August16 to 22 and August 23 to 29, respectively, and decreased by -3.5% the week of August 30th when compared to the same baseline of the week of July 5th.

Visits Lengths Are Longer

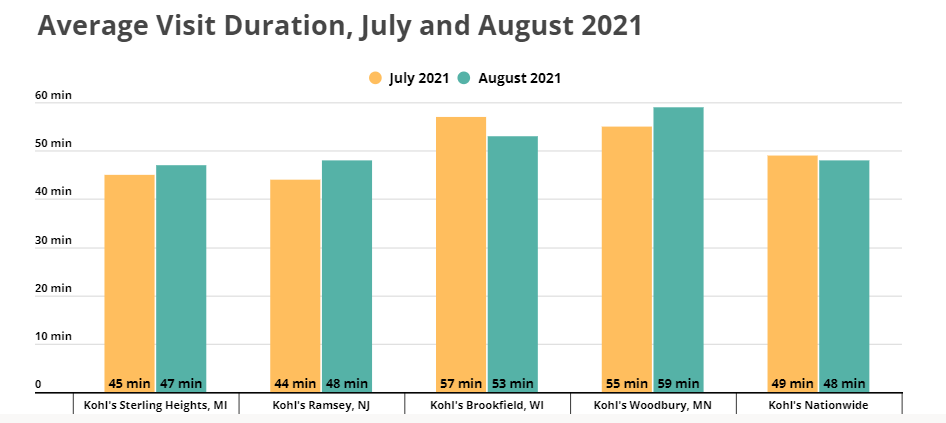

There are also indications that the launch of the Sephora shops-in-shop have increased the average visit duration. While the average visit length to Kohl’s nationwide dropped by a minute between July and August, the average visit length to three out of the four Kohl’s with a Sephora store-in-store increased significantly.

And while visit length to the Brookfield, Wisconsin Kohl’s location fell in August, the average visit duration there was still higher than both the nationwide average and than the average visit duration to the Brookfield Kohl’s in June 2021. It is likely, then, that the decrease in average visit duration at that location is due to the branch’s unusually long July visits rather than a lack of interest in the new beauty offerings.

True Trade Areas are Bigger

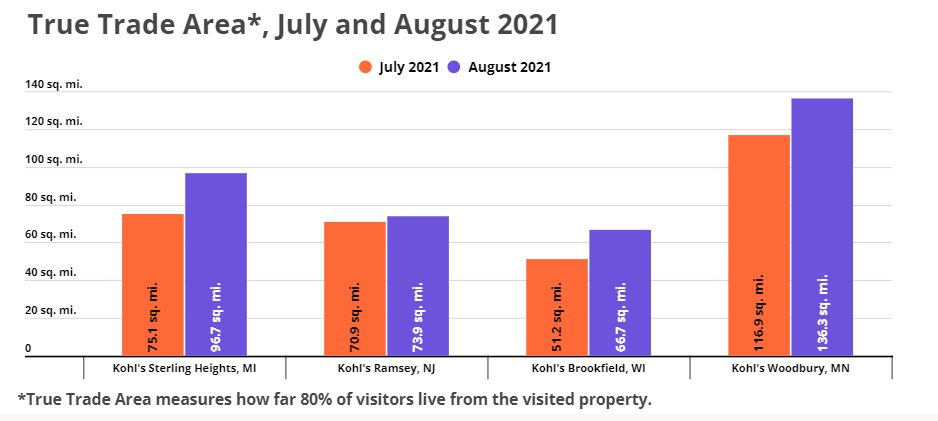

Customers are not only staying longer, they are also coming from further away. The opening of the Sephora store-in-stores seems to have significantly expanded the True Trade Area (TTA, as measured by distance between the specified Kohl’s location and the 80% of the customers’ homes) of all four Kohl’s locations already in the first month of the launch. The TTA of the Sterling Height, Michigan Kohl’s grew from 75.1 sq. miles to 96.7 sq. miles; the TTA of the Ramsey, NJ Kohl’s increased from 70.9 sq. miles to 73.9 sq. miles; Brookfield, Wisconsin Kohl’s TTA went from 51.2 sq. miles to 66.7 sq. miles; and the TTA of the Kohl’s in Woodbury, Minnesota, rose from 116.9 sq. miles to 136.3 sq. miles.

Additional Sephora shops-in-shops opened in over 70 Kohl’s locations August 20th, and more than 100 more are slated for the fall. The next couple of weeks will reveal whether the second batch of Sephora at Kohl’s is as successful as the first cohort. So far, the data looks extremely promising.

Will the Sephora – Kohl’s partnership help Kohl’s close its visit gap? Will Kohl’s with Sephora shops-in-shop continue to outperform legacy locations?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.