This back-to-school season marks the first time that many students across the U.S. are returning to the classroom since schools transitioned to remote instruction in March 2020 amid the coronavirus pandemic. Interestingly, August 2021 consumer sales for office supply company Office Depot (which includes stores under the Office Depot and OfficeMax brands) were lower than sales for August 2020 and August 2019. Consumer transaction data also shows that Office Depot’s August 2021 sales patterns varied by metro area; sales spikes occurred at different points during the month, with differing back-to-school dates potentially being a factor.

Consumer spending at Office Depot is usually highest in August

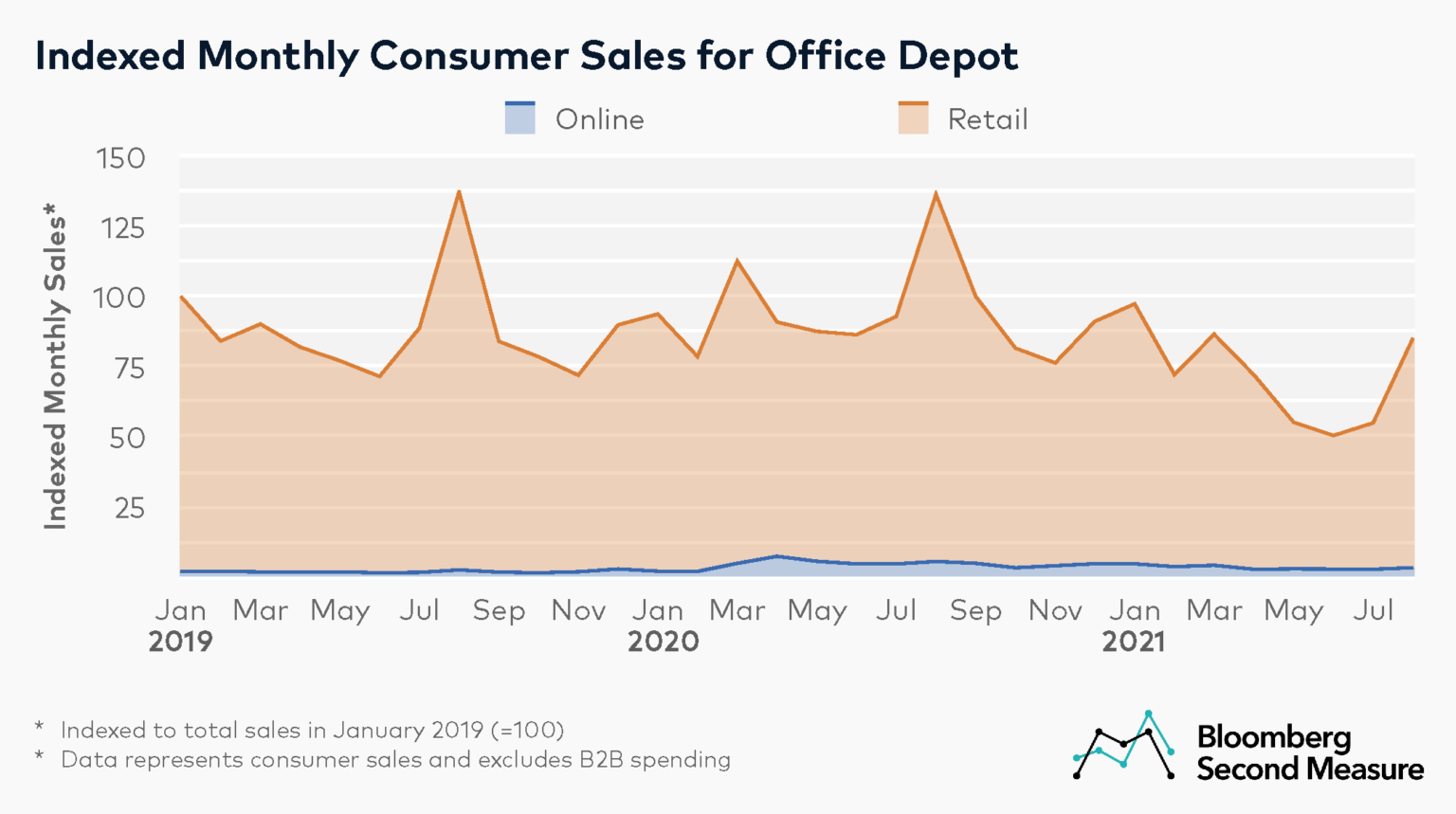

Office Depot has historically seen a spike in consumer spending in August, corresponding with the back-to-school season. For example, August accounted for 13 percent of annual sales at Office Depot in 2019 and 12 percent of annual sales in 2020. Consumer sales also tend to increase in January, which may be due to demand for more school supplies at the start of a new semester. Office Depot also experiences a slight uptick in March sales.

Consumer spending at Office Depot increased 25 percent year-over-year in March 2020, likely driven by the shift to working from home during the onset of COVID-19 as well as schools transitioning to remote instruction. While many school districts continued to teach remotely or in a hybrid format in the 2020-2021 school year, August 2020 sales at Office Depot remained consistent with the prior year. It is worth noting that Bloomberg Second Measure’s transaction data only captures consumer spending and excludes B2B spending.

However, Office Depot experienced a significant dip in sales year-over-year during the 2021 back-to-school season. In August 2021, Office Depot’s sales were 38 percent lower than in August 2020 and August 2019. Bucking the trend of sales being highest in August, the company’s August 2021 sales were 12 percent lower than sales in January 2021 and 1 percent lower than in March 2021. Some of this could be the effect of Office Depot’s evolving strategy. In 2020, the company announced a restructuring of its operations to focus on its IT and B2B offerings, which would include the closure of an undisclosed number of retail stores by 2023.

Unlike many other retailers, Office Depot’s consumer sales did not show a major shift to ecommerce during the pandemic. In April 2020, 8 percent of Office Depot sales took place online, compared to 2 percent just two months earlier. In August 2021, only 4 percent of Office Depot’s sales took place online. However, it is worth noting that in January 2020, Office Depot partnered with Shipt for same-day delivery of products from its retail locations. These transactions are also not captured as Office Depot transactions in Bloomberg Second Measure data.

Weekly sales spikes for Office Depot vary by metro area

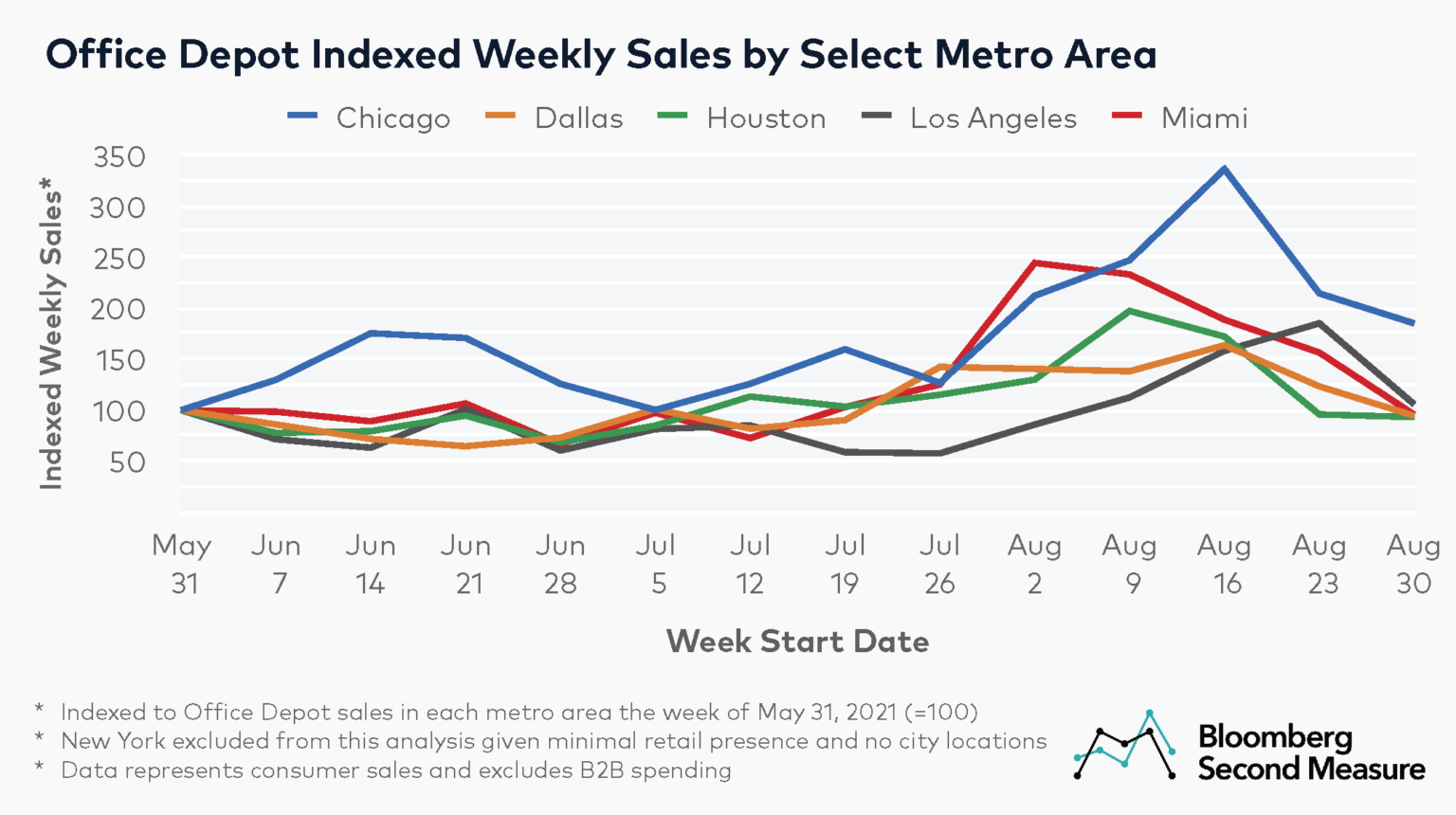

Spikes in weekly spending at Office Depot differ by geography. Looking at the largest metro areas where Office Depot has multiple locations, one of the earliest spikes in weekly spending was in Miami the week of August 2. In the Houston metro area, consumer spending at Office Depot peaked the week of August 9, while in Dallas, it was the week of August 16.

Among the metro areas in our analysis, Chicago had the biggest spike in sales, with consumer spending the week of August 16 more than tripling that of the week of May 31. Los Angeles had the most recent sales spike, which occurred the week of August 23. A potential factor in sales spiking at different times for each metro area is that school districts and colleges have different back-to-school dates, which generally range from early August through mid-September.

What’s next for Office Depot?

At the beginning of this year, Office Depot reportedly declined a buyout offer from office supply competitor Staples. In May 2021, Office Depot then announced that it would be separating its retail and B2B offerings, a change expected to go into effect in early 2022. More recently, Staples returned with a new offer to buy Office Depot’s consumer retail business only, which would include its network of Office Depot and OfficeMax stores.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.