In this Placer Bytes, we dive into the recovery of Disney’s two namesake theme parks and explore what Labor Day weekend may be telling us about department stores’ upcoming holiday season.

Disney’s Rebound

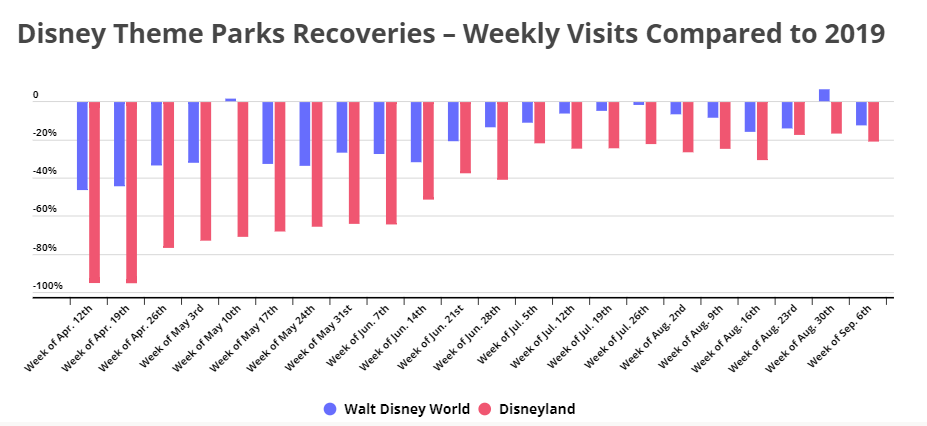

Following an extended period of depressed visits, Disney World and Disneyland both saw visits climb impressively close to 2019 levels during the summer. July visits were down 8.2% to Disney World and 25.3% to Disneyland. The latter saw a much slower recovery due in large part to the nature of state level COVID restrictions in place in California, especially when compared to the far more relaxed limitations in Florida.

Yet, August did mark a step back for both parks with visits down 15.3% in Florida and 27.1% in California. Some of this certainly centered around rising COVID cases, but the comparison to 2019 also demands context. Most of Labor Day weekend 2019 took place in August, whereas the entire weekend took place in September in 2021. In addition, rising COVID cases do look to have made their mark with visit gaps steadily increasing from early August through the end of the month. While weather also had a role to play here, the decline seems to have been affected by the pandemic as well.

Both parks also saw slight increases in the average household income of visitors in 2021 compared to 2019. The takeaway here being that limitations on travel pushed some locals to visit the parks with potentially more dollars to spare.

Department Store – Signs for Holiday Hope?

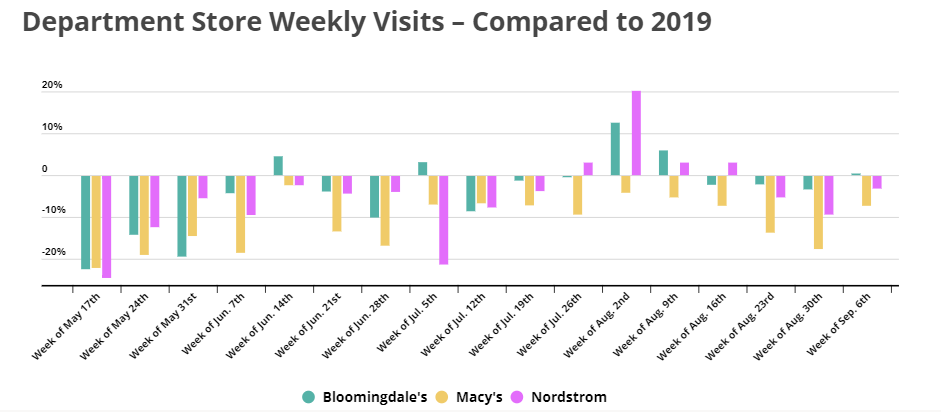

Several trends that seem to be aligning could bode well for department store performance in the coming holiday season. First, top tier malls seem to have effectively recovered, indicating that they could prove to be a valuable platform this winter. Second, the Back-to-School season does seem to have galvanized excitement for apparel shopping. Several department stores saw relatively strong numbers in July and August with visits either up on 2019 levels or visits gap shrinking to far more optimistic levels.

And while the end of the summer and the coinciding rise in COVID cases does look to have diluted the full effect of the retail recovery, Labor Day brought some more important signs of strength. While the week beginning August 30th saw visit gaps extended compared to the week prior, the week beginning September 6th saw the visit gap shrink once again. Much of this was likely due to Labor Day, and while the comparison to a ‘normal’ day in 2019 certainly helped the cause, it still speaks to the pull and power of retail holidays.

Should the current COVID wave begin to dissipate by the holiday season, there is real reason to believe that a reopened retail environment could drive a stronger than expected period.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.