Before the pandemic, it was typical for many of us to make several weekly runs to our neighborhood grocery stores so we could throw together a last-minute dinner. And if we were too tired to cook, dining in at our local restaurant would also work in a pinch.

Since COVID-19 was declared a global pandemic, those carefree grocery habits and preferences have evolved for consumers around the country. Initially, customers embraced these new behaviors out of necessity. However, as the pandemic persisted, these new habits ended up sticking around as life adjusted around this new normal. In fact, U.S. online grocery sales surged to $9.3 billion in January 2021, surpassing the previous high of $8.8 billion in June 2020.

Today, we’ll look at the grocery category’s top three advertisers in the second half of 2020 through the first half of 2021. We’ll analyze their spending habits and creative strategies to see how these powerhouse grocers adapted to dramatically shifting consumer needs and demands in a COVID world.

Kroger pushes fearlessly into a more profitable 2021

While the pandemic is far from over, new trends are emerging as customers settle into new routines. Consumers enjoy cooking more than they did pre-COVID, and as peoples’ social schedules pick back up, more customers are seeking convenience in their cooking options. Kroger’s performance and digital ad campaigns mirrored these emerging trends. By the close of fiscal 2020, ending January 30th, the Cincinnati-based grocer’s sales totaled $132.5 billion, up 8.4% from 2019, and digital sales for the brand increased 108% on a two-year basis.

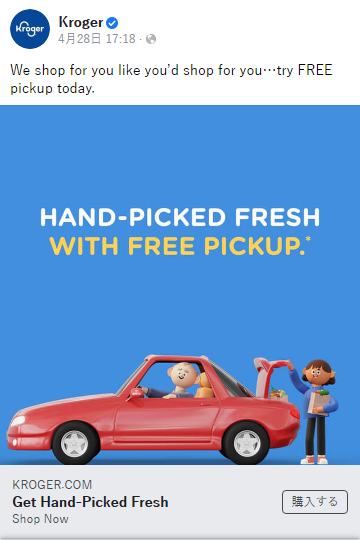

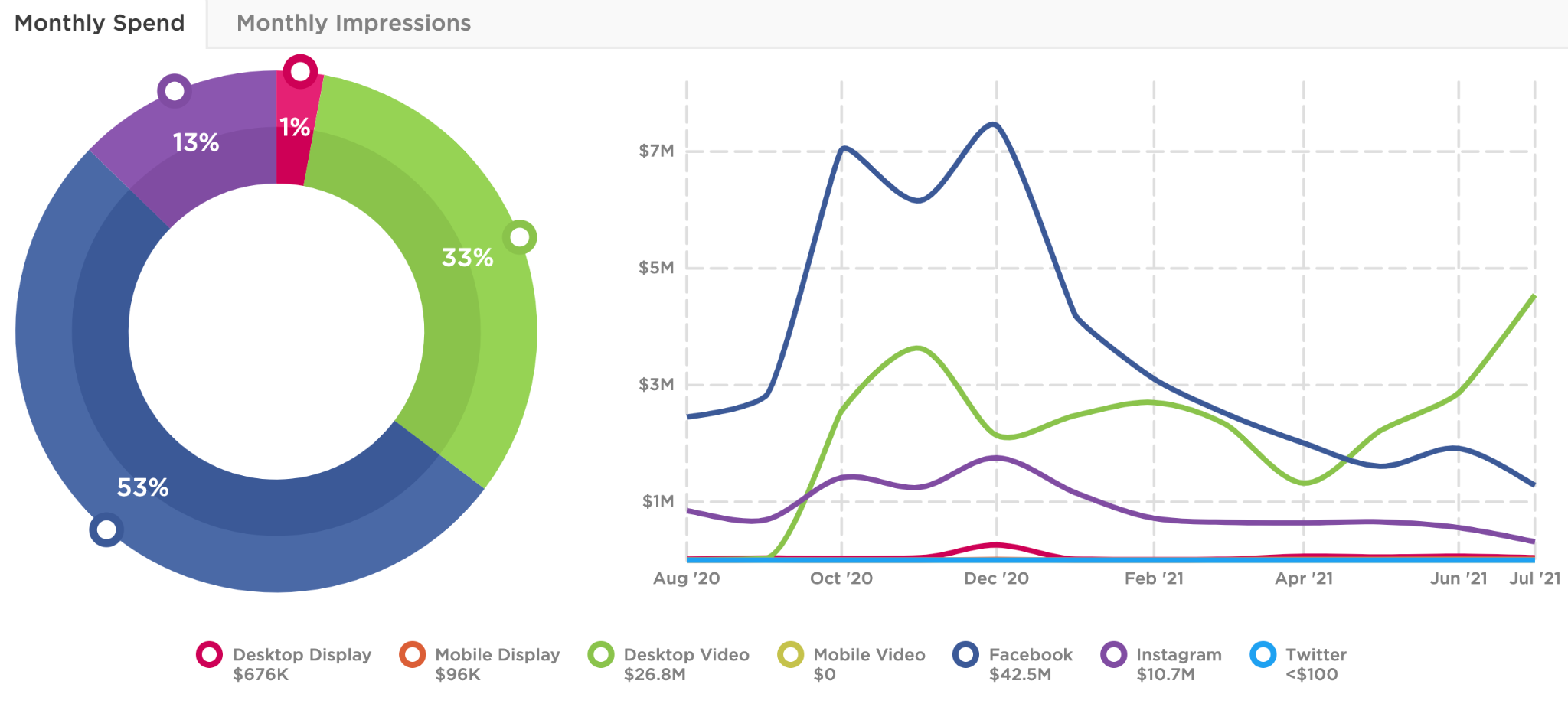

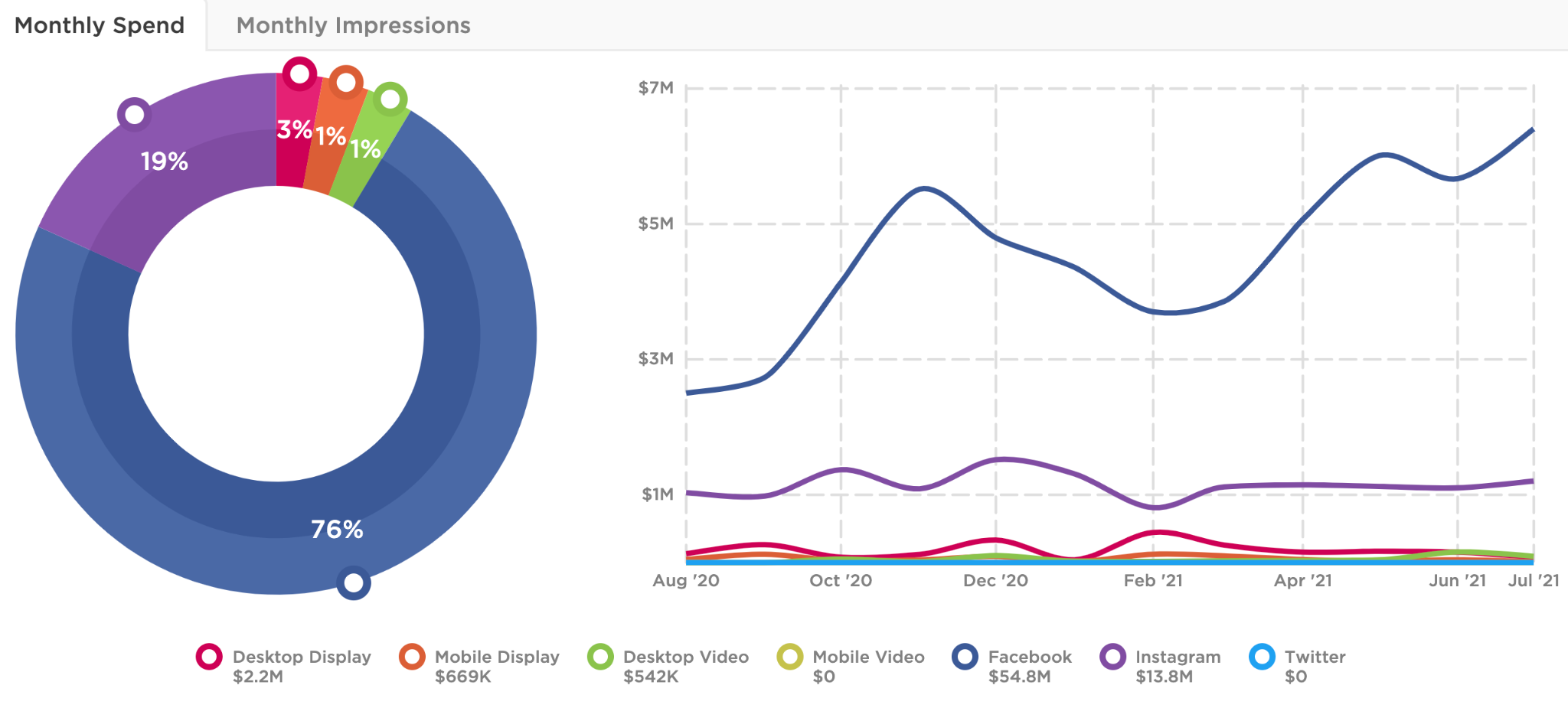

Kroger was the top advertiser in the grocery category, accounting for almost a fifth (18.85%) of total spend. The grocer spent $95M on digital ads in total, earning 11B impressions from its digital campaigns primarily across Facebook.

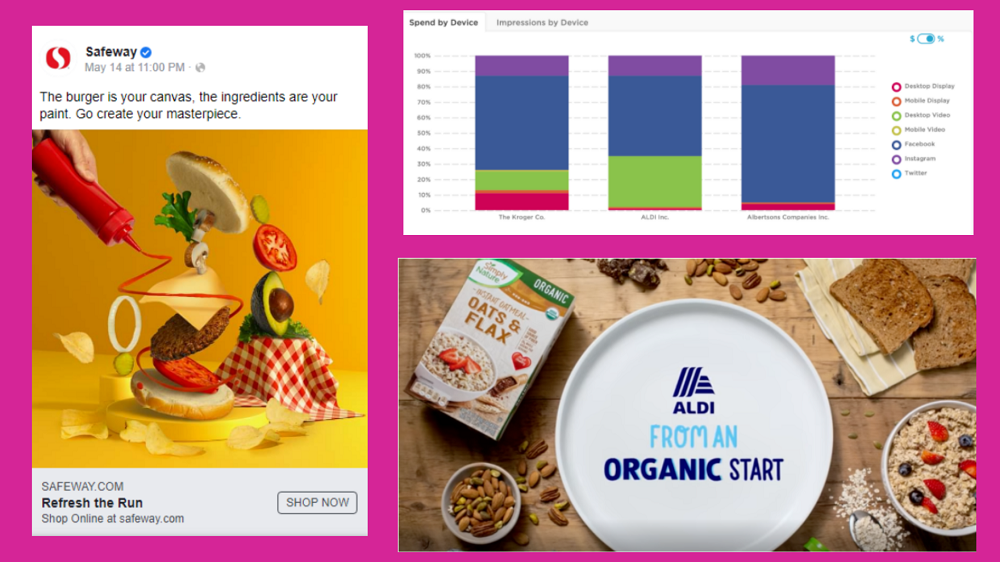

The brand has responded to the pandemic and subsequently reduced foot traffic in their stores with hassle-free online in-store pickup and delivery options to keep the shopping experience safe and seamless for customers. The company’s top creative ran in late summer through early fall 2020. The creative was part of a larger campaign comprised of multiple animated video spots and static posts promoting the company’s in-store and delivery service.

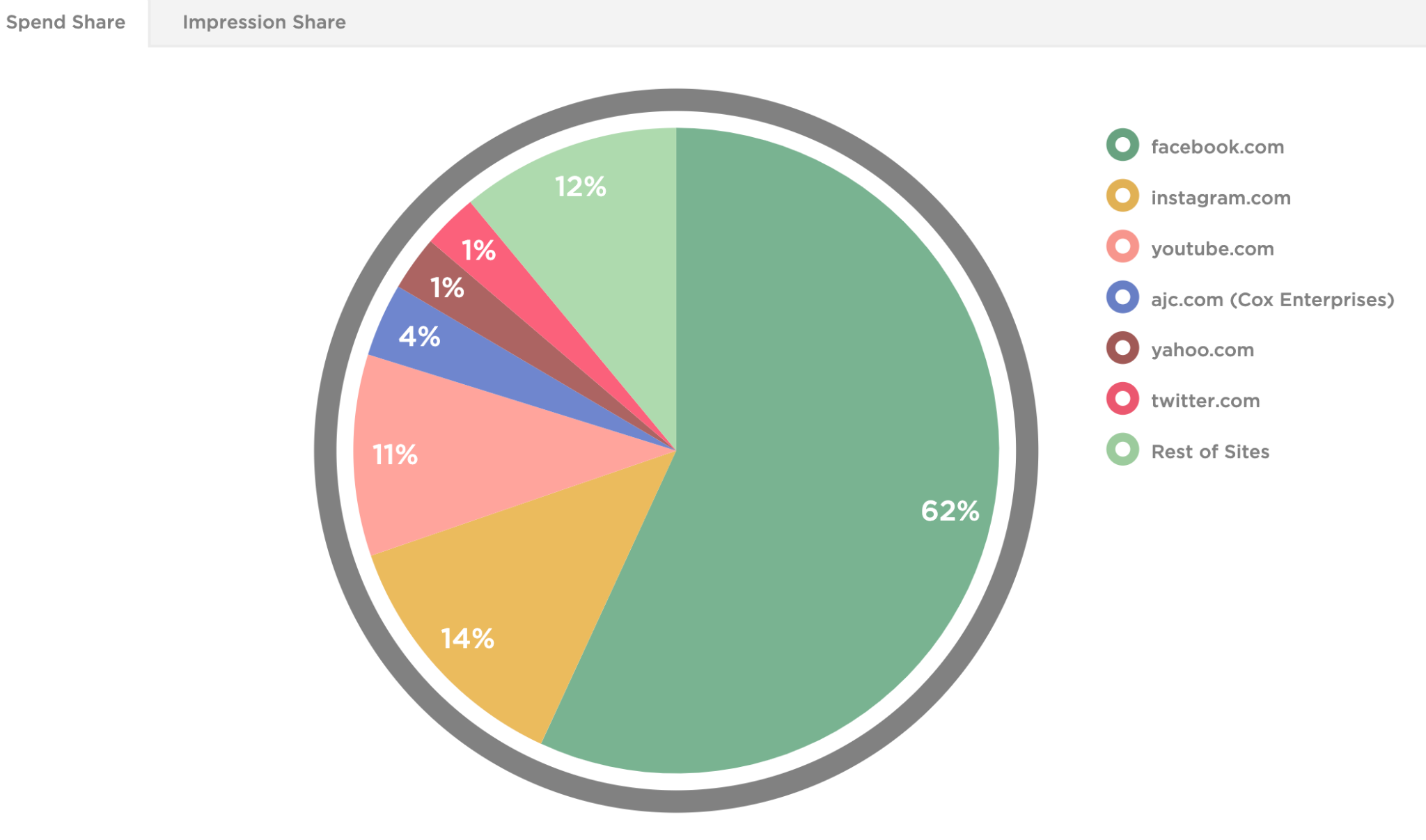

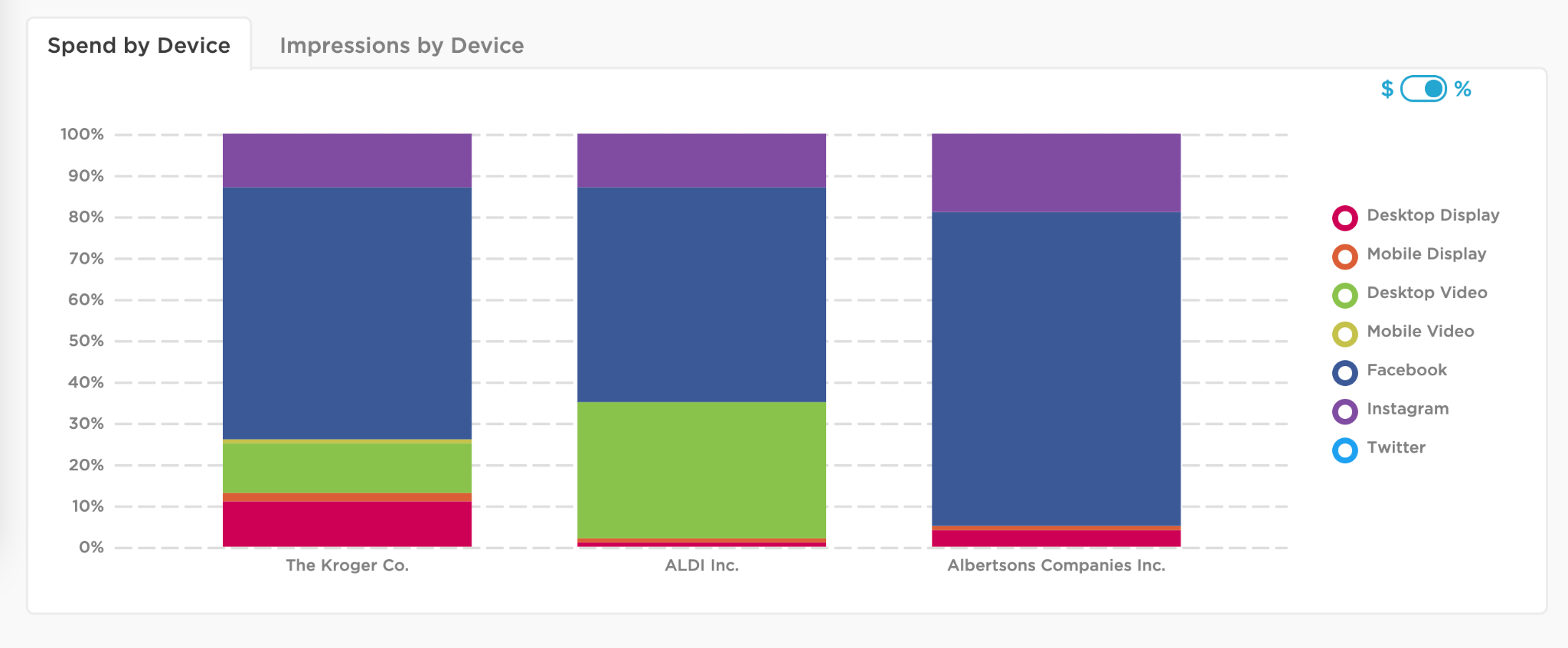

Between August 2020 and July 2021, Kroger invested 62% of its ad budget into Facebook. Spend for the platform may have increased in January to coincide with the peak outbreak period, in addition to the expected new year’s uptick in food shopping trends. The grocery giant also spent over $3M on desktop and mobile display ads in the Atlanta Journal Constitution, an interesting choice until a bit of investigative research revealed the company has over 100 locations in Georgia and the biggest Kroger store based in Atlanta.

**

**

Aldi increases its reach across the U.S., hits 2,000 store milestone

Aldi recently hit its 2,000 store milestone in the U.S. and is now poised to enter two new states. The company’s $5 billion, five-year growth strategy launched in 2017 included plans to extend its retail network from 1,700 to 2,500 stores by the end of 2022. Before the coronavirus outbreak, Aldi’s growth was fueled by a combination of low price points and a growing consumer acceptance of private labels. The company’s online sales of non-food and wine soared 70% in 2020, as more people switched to shopping from home during the pandemic. Additionally, Aldi tested out Instacart delivery in Los Angeles, Atlanta, Dallas, and Chicago back in 2017, and it proved to be a massive success. But with the pandemic putting pressure on the brand, the service has since expanded to more than 5,000 ZIP codes in 36 states.

Looking at YOY trends, Aldi spent just over $80M on digital ads in total, earning 7.5B impressions across 18,000+ creative, 3,000 more ads than Kroger.

While operating with much less inventory and space than traditional grocers, Aldi has always leveraged its private-label value offers as one of its primary selling points. Aldi recognizes private label as a fast-growing and lucrative category consumers are eager to embrace. During this period, Aldi’s creative strategy included video spots highlighting their expansive collection of private-label organic, gluten-free, keto-friendly, and vegan products. While these product categories typically take up smaller shelf space at larger grocers and usually come at a premium, Aldi leveraged them as key selling points in their digital advertising campaigns. The company also took out multiple ads promoting their in-store pickup and delivery service, going toe-to-toe with competing grocers like Kroger.

Between August 2020 and July 2021, Aldi invested 53% of its ad budget into Facebook and 33% into desktop video. Comparatively, Kroger allocated 12% of its ad budget during this period to desktop video campaigns, while Albertsons avoided investing in desktop video advertising altogether.

Despite a decline in YOY sales, Albertsons forges ahead with expanding its private label portfolio

It’s been a whirlwind of a year for Albertsons. The Idaho-based grocer saw a 6.5% YOY dip in its Q2 2021 profits. The company started strong at the beginning of the pandemic, with net sales jumping by 21.4% by the close of fiscal Q1 and digital sales exploding 276% on a two-year basis. To promote e-commerce expansion, Albertsons added over 320 Drive Up & Go curbside pickup locations in Q1 2021. Additionally, Albertsons continued to develop its Own Brands private-label portfolio, adding 318 new items in Q1 2021.

While Albertsons ranks as the third top advertiser in the grocery category for this period, the brand still invested an impressive amount into their digital ad strategy ($71.9M), earning 8.2B total impressions across 19,000+ creative.

Albertsons digital campaigns consisted of static Facebook posts promoting their online shopping experience to drive digital sales during the pandemic. Creative that burst with colorful produce and fresh ingredients came together to form delectable dishes and cocktails, tantalizing their audience’s taste buds and cravings. They also promoted a brand partnership with Tasty, marketing ingredients and products featured in the flagship food recipe channel, potentially as a move to draw in younger buyers and families.

While the number one advertiser for this period, Kroger, spent the majority of their ad budget on Facebook (61%), Albertson’s put most of their eggs in the social platform’s basket, with 76% of their ad budget funneled into Facebook. Spend for the platform spiked in November for the Thanksgiving holiday, dropped, then saw a steady increase from February 2021 to May 2021 in preparation for an upcoming summer season of family barbeques and Memorial Day cookouts.

Our top advertisers and other companies in this category can better prepare for the future with continued innovations and a strategic marketing approach that anticipates consumers’ shifting habits and needs. But they must also meet the customer where they are right now. That means offering meaningful promotions, convenient in-store and online transactions, seamless pickup and delivery options and, ultimately, an understanding that convenience, affordability, supply, and safety will remain top of mind for many shoppers.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.