TV streaming platforms such as FuboTV, Sling TV, and YouTube TV have been on the rise for the past few years, bolstered by a combination of price increases and new subscribers. While OTT streaming platforms such as Netflix and Hulu experienced a spike in sales and customers at the start of the pandemic, a different pattern has emerged for TV streaming services. Consumer transaction data shows that TV streaming companies, especially FuboTV, generally experience the highest spike in sales and new subscribers in September, corresponding with the start of football season.

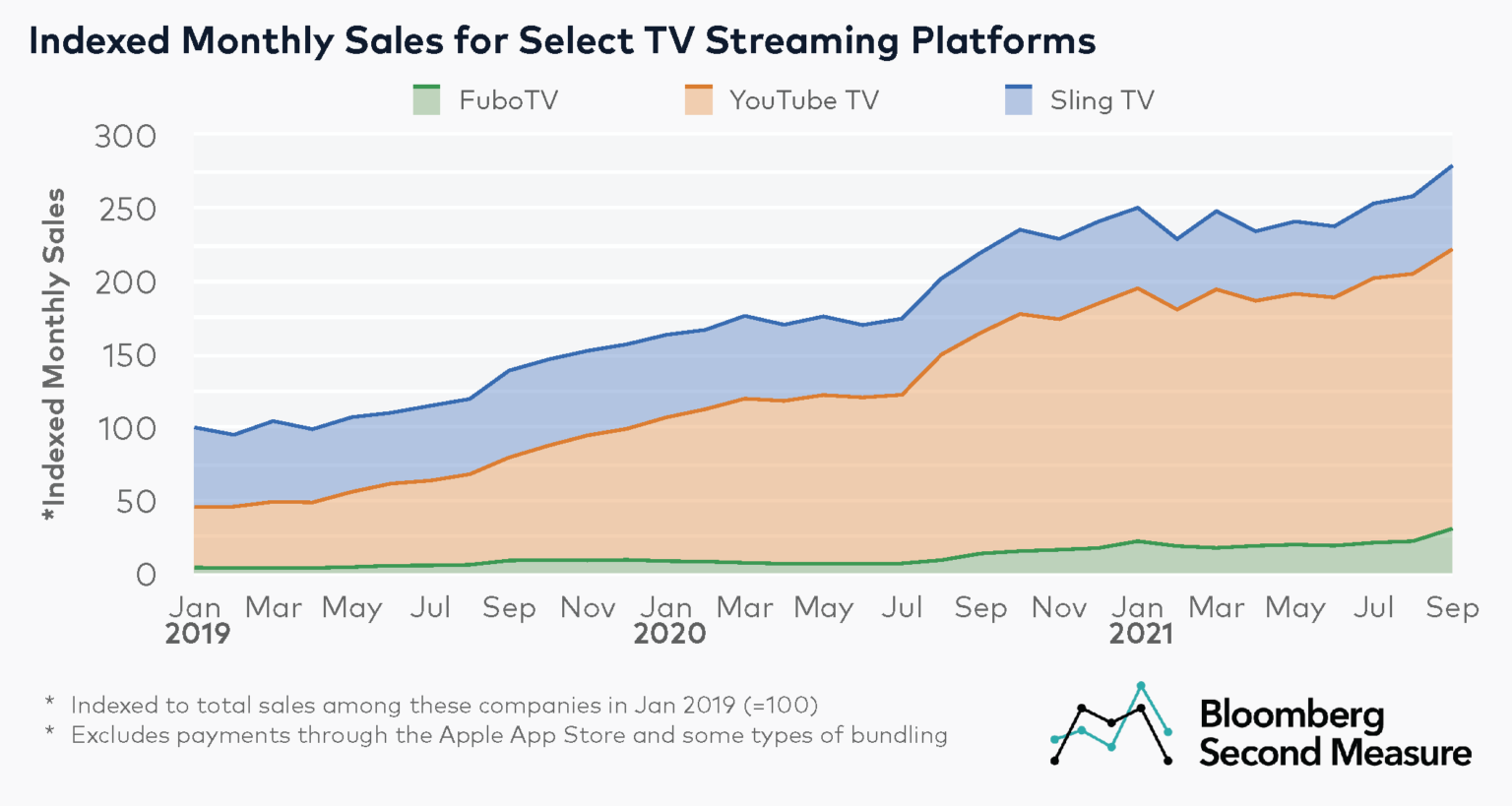

YouTube TV leads the pack in terms of TV streaming sales

TV streaming services such as YouTube TV, FuboTV, and Dish Network-owned Sling TV provide a cable-free, contract-free alternative to traditional cable providers. FuboTV and Sling TV were founded in 2015, while YouTube TV launched in 2017. Although Sling TV accounted for more than half of sales within this competitive set in January 2019, YouTube TV has captured an increasing share of sales among the three companies over the past few years. In September 2021, YouTube TV earned 69 percent of sales among the competitive set, compared to 20 percent for Sling TV and 11 percent for FuboTV. It is worth noting that this data excludes certain payment channels, including purchases through the Apple App Store and some types of bundling.

Combined sales for the three TV streaming services remained relatively steady in the first few months of the pandemic before experiencing a significant jump in late summer 2020. Price hikes were a likely factor in late 2020 sales growth, especially for YouTube TV and FuboTV. In June 2020, YouTube TV raised its price from $50 per month to $65 per month, while FuboTV also increased its price from $60 per month to $65 per month. SlingTV raised its price by $5 for new subscribers in January 2021, and rolled out the same price change for existing subscribers in August 2021.

In addition to sales increases corresponding with price changes, all three companies have historically experienced an uptick in sales in September. In September 2021, combined sales among the three companies grew 27 percent year-over-year, while they grew 58 percent in September 2020. FuboTV saw the highest sales growth in September 2021, with 125 percent year-over-year.

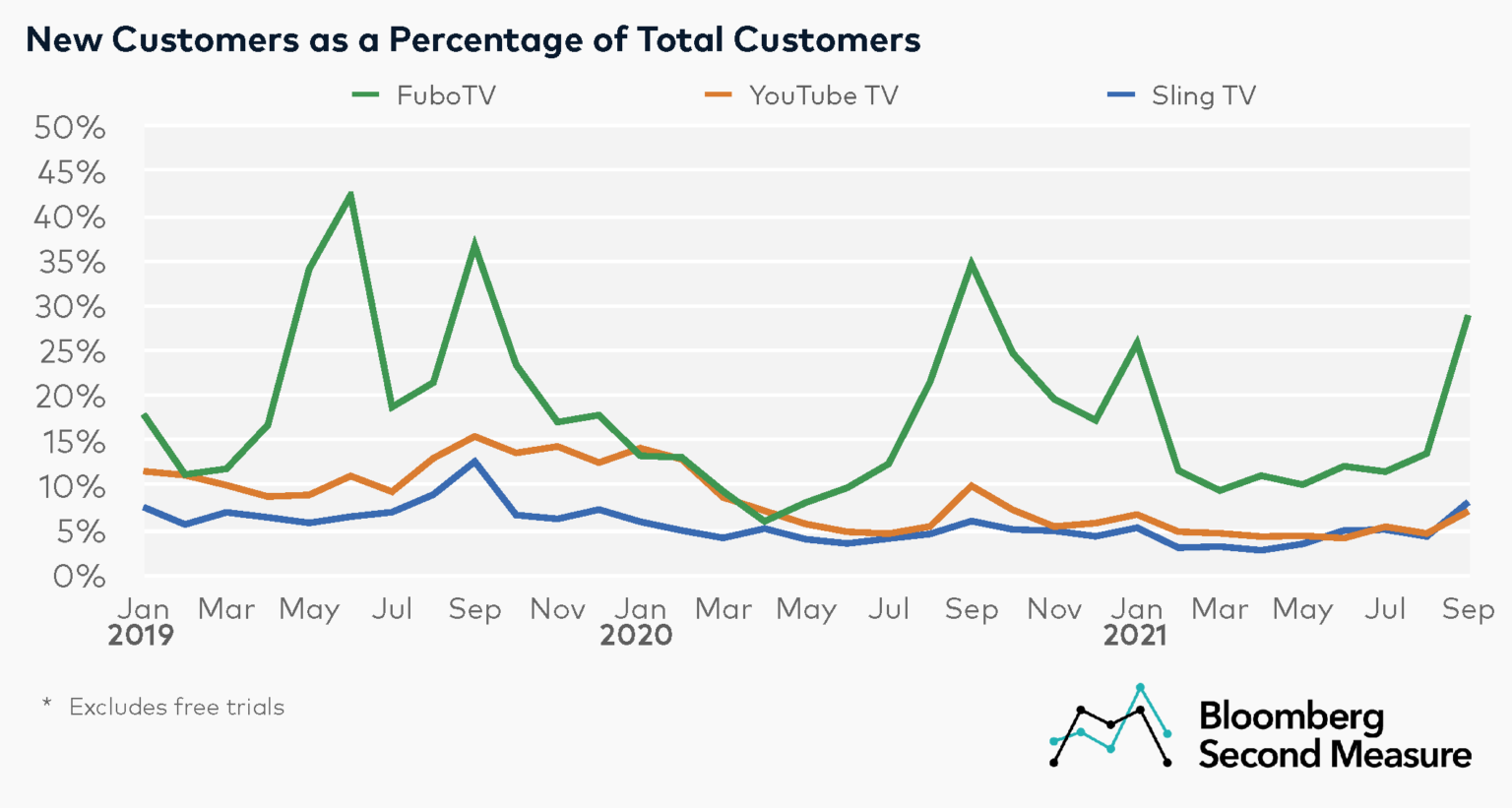

While returning customers are the majority, FuboTV has the highest percentage of new customers

Most customers at the three TV streaming companies are returning, but there is still some new customer growth. Among the three companies, Fubo TV has the highest percentage of new customers most months. All three companies typically experience a spike in the percentage of new customers in September. In September 2021, 39 percent of Fubo TV’s customers were new, compared to 4 percent at YouTube TV and 8 percent at Sling TV.

One potential factor for the increase in new paid subscribers in September is the kickoff of football season, since all three streaming companies offer sports as part of their packages or as an add-on. FuboTV is known primarily for its sports programming, and Sling TV and YouTube TV also offer sports channels or sports add-on coverage. FuboTV also experienced an elevated percentage of new subscribers in June 2019–possibly due to sporting events like the NBA playoffs and women’s World Cup–as well as in January 2021, when FuboTV announced its plans to acquire sports betting platform Vigtory and launch a sportsbook before the end of the year. Notably, customers who signed up for free trials are excluded from this data.

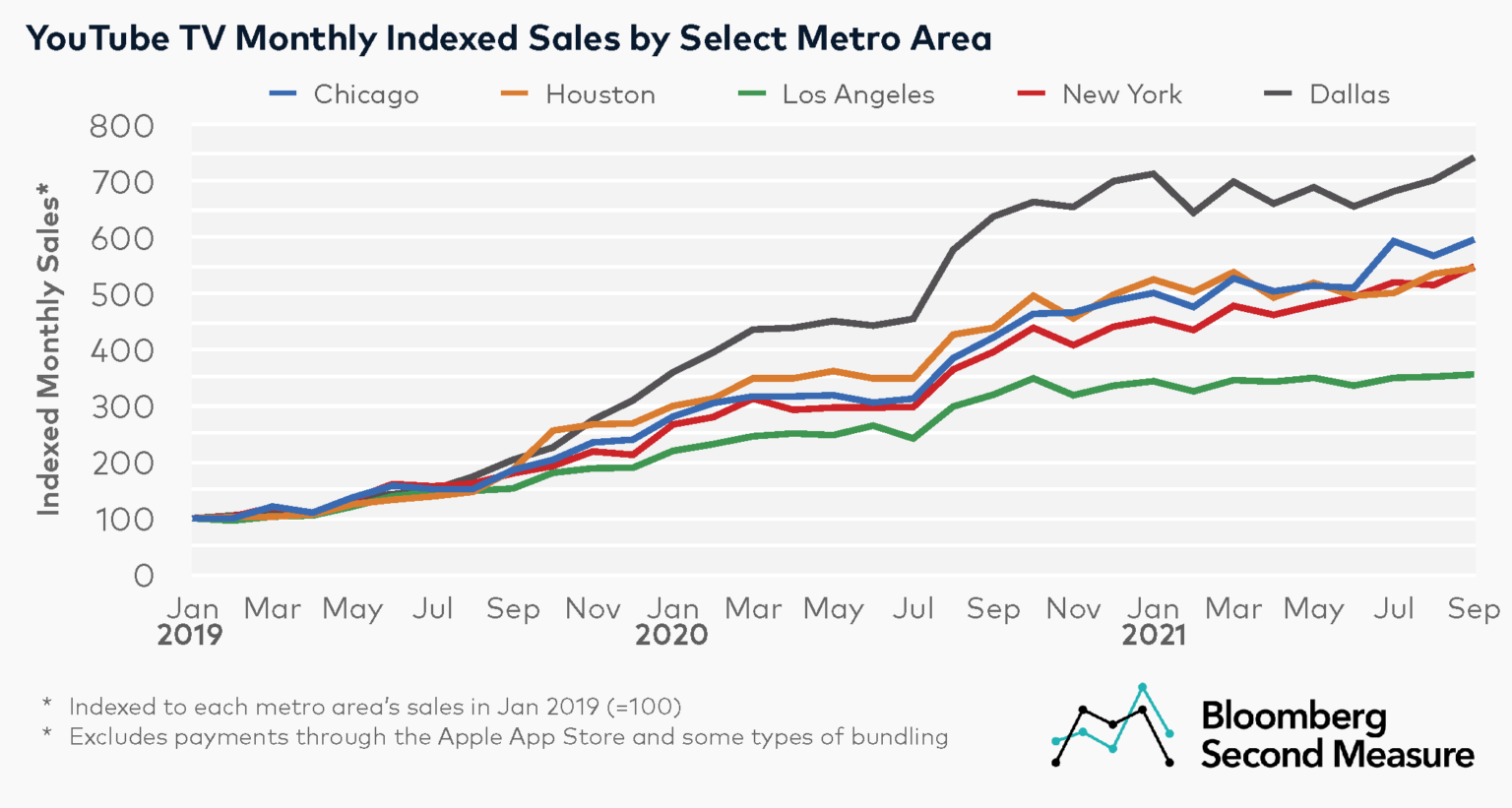

YouTube TV’s sales growth in Dallas has outpaced other large metros

At a more granular level, some metro areas have seen greater growth in TV streaming sales than others. Among the top five metro areas by population, Dallas has experienced the most sales growth for YouTube TV over the past two years. As of September 2021, Dallas sales were more than 7 times higher than in January 2019. By contrast, YouTube TV’s sales in the Chicago, Houston, and New York metro areas have more than quintupled in this time period, while sales in Los Angeles have more than tripled.

In September 2021, Chicago saw the biggest change in year-over-year sales, a 41 percent increase. The Dallas metro area’s sales grew 16 percent year-over-year in September 2021.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.