Visits to The Home Depot, Lowe’s Home Improvement, and Tractor Supply soared in 2020. Now, with 2021 almost behind us, we dove into one of the pandemic’s biggest retail winners to uncover the long-term impact of the 2020 home improvement craze.

Home Improvement Leaders Holding On to Visit Gains

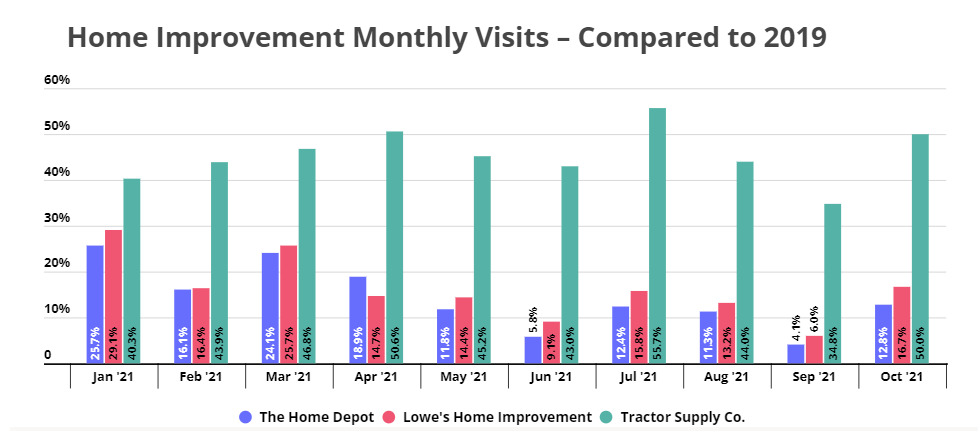

The Home Depot, Lowe’s Home Improvement, and Tractor Supply are holding on to their 2020 visit gains, with August visits to Home Depot, Lowe’s, and Tractor Supply exceeding August 2019 visits by 11.3%, 13.2%, and 44.0%, respectively. Foot traffic even continued to exhibit year-over-two-year growth in September, despite the overall retail downturn that month.

This past month, visits rose again, indicating that the sector is still performing far ahead of its 2019 baseline. October foot traffic to Home Depot, Lowe’s, and Tractor Supply increased by 12.8%, 16.7%, and 50.0%, respectively, compared to 2019.

2020’s Impact on 2021 Performance

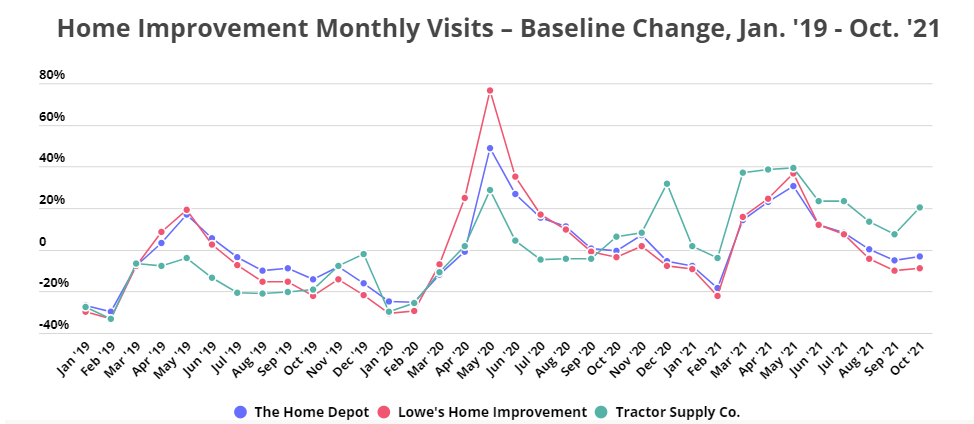

Baseline change compares periodic visits (daily, weekly, or monthly) to the average visit levels over a certain period. In the graph below, the monthly change in visits for each brand is analyzed against that brand’s baseline (e.g., monthly visits to Home Depot in a given month are compared against the average monthly visit levels to home depot during the period between January 2019 and September 2021).

Analyzing the baseline change in visits to the home improvement leaders over the past twenty-one months can help uncover some key insights. First, the sector exhibits a high degree of seasonality. The primary visit peak happens over the spring – traditionally home renovation season – with another, smaller spike in visits in late fall-early winter, as Americans weather proof their home for the cold, wet months ahead. Thus, the beginning of the pandemic and the height of the lockdowns and shelter-in-place orders coincided with the sector’s customary strong season, leading to a perfect storm of heightened home improvement demand. All three brands showed much higher visit peaks in spring 2020 than they had in spring 2019, and foot traffic never quite dropped down again to 2019 levels after that.

Second, the monthly baseline change reveals when Tractor Supply’s visit growth pulled ahead of its competitors. Although Tractor Supply’s spring 2020 visit peak was much less pronounced that the spring visit peaks at Home Depot and Lowe’s, the early winter spike was much bigger at Tractor Supply – and the brand managed to hold on to its visit gains throughout the winter. So, when spring 2021 came along, the brand was well positioned to capitalize on normal seasonality to continue overtaking its competitors in terms of foot traffic growth.

Interestingly, in 2019, early winter visits to Tractor Supply also increased more than they did to Home Depot or Lowe’s. This could have to do with Tractor Supply’s highly diverse offerings, which in addition to regular home improvement tools and materials also includes farm, ranch, and pet supplies. So consumers may visit Tractor Supply in early winter to get the materials they need to prepare their land and animals for winter – materials which may not be available at other home improvement retailers.

Diving Into Tractor Supply

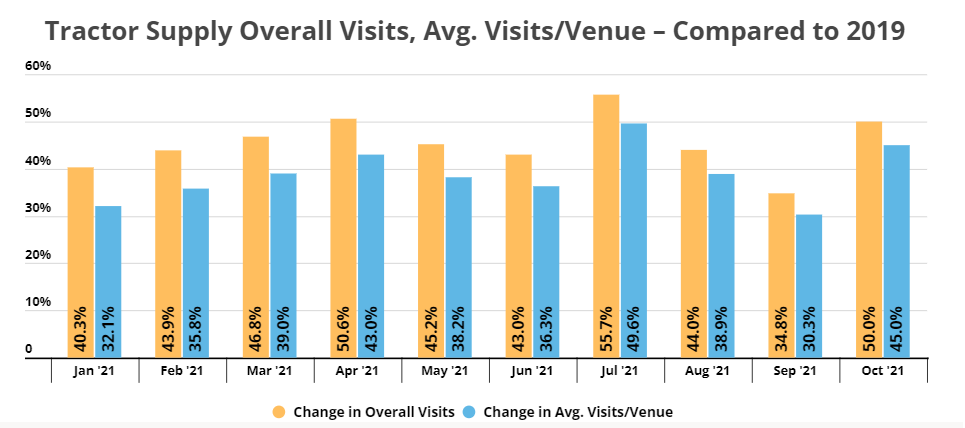

It could be argued Tractor Supply’s rise has been one of the most dramatic retail success stories of the pandemic, even in comparison to the other players in the impressively successful home improvement sector. The retailer has seen huge year-over-two-year visits increases every month this year. And while some of the growth in foot traffic could be attributed to new store openings, the number of average visits per venue has exceeded 2019 numbers by more than 40% almost every month this year.

Critically, the Tractor Supply bar graph below shows a consistent year-over-two-year increase in monthly visits evenly spread out throughout the year. The increase isn’t noticeably larger in the spring, and it does not appreciably drop in the summer and fall. This could indicate that Tractor Supply foot traffic increase does not come from a high number of seasonal customers. Rather, Tractor Supply has succeeded in consistently increasing the number of customers who visit its stores throughout the year, and has positioned itself several levels above where it was pre-pandemic.

Will Tractor Supply see another visit spike this winter? Will Home Depot and Lowe’s continue holding on to their 2020 visit gains?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.