Yes, Black Friday marks the height of the holiday season – but the day itself can hardly be taken in isolation. For critical context, we took a look at the wider weekend to see how different the holiday season in 2021 has been.

Mall Performance – Impressive in Relative Terms

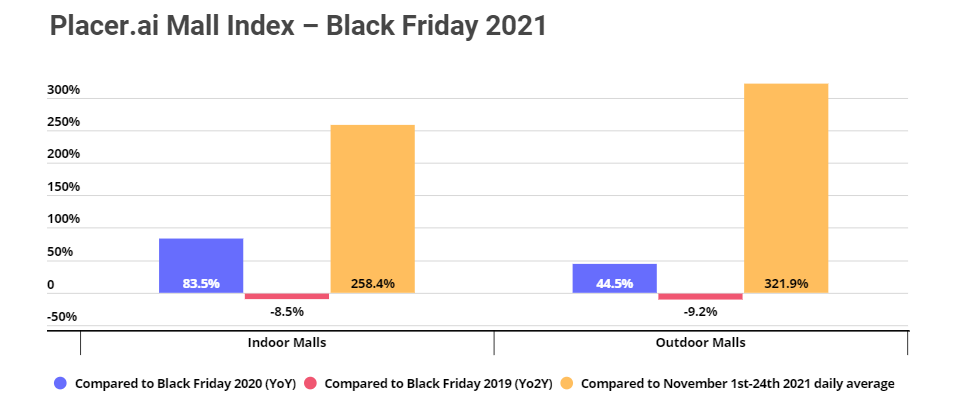

Looking at the Placer.ai Mall Index on Black Friday alone showed visits to indoor malls down just 8.5% compared to 2019, while visits were down 9.2% for outdoor malls. And while the visits marked a significant peak for malls and retailers, looking at the wider weekend metrics paints an even rosier picture.

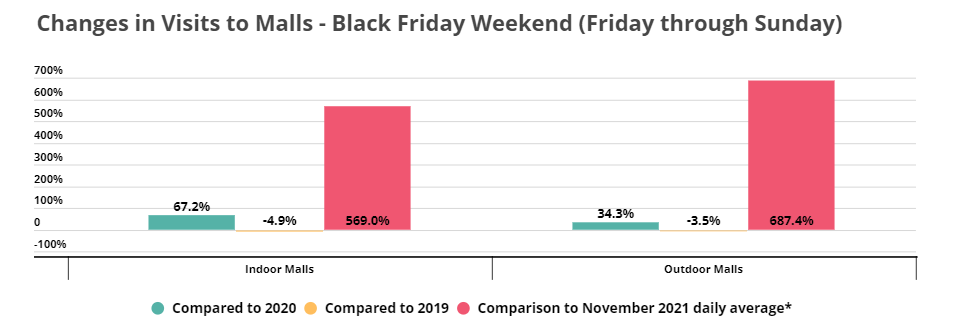

Black Friday declines were driven in part by retailers’ efforts to drive a more extended holiday season. The clearest example of this is the increase in visits many shopping centers, malls, and retailers have seen earlier in the season. Yet, even within this context, Black Friday weekend’s impact on retail visits was clear. While visits to the Placer.ai Mall Index were down 8.5% compared to 2019 on Black Friday, the weekend from Friday to Sunday saw visits down just 4.9%, largely due to visit strength on Sunday and a more limited decline on Saturday. The important takeaway here is that while the extended holiday retail season may have limited Black Friday peaks, it could still drive greater overall success.

Retailer Performances

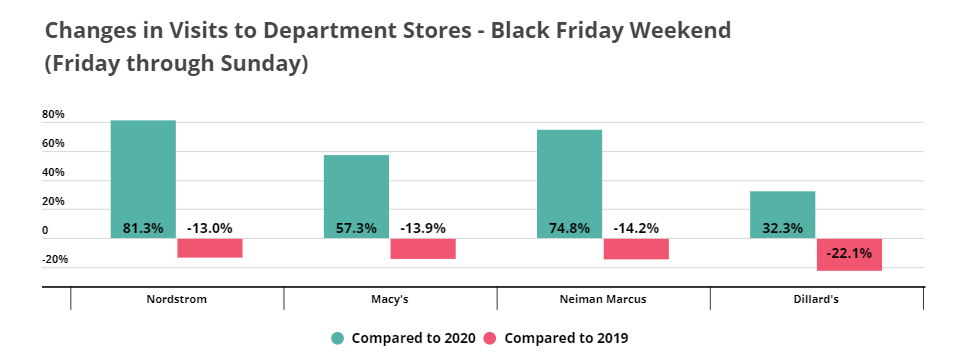

A similar trend was seen across the retail landscape. While Nordstrom and Macy’s saw visits down 18.6% and 18.0%, respectively, on Black Friday compared to 2019, the declines over the wider weekend was just 13.0% for Nordstrom and 13.9% for Macy’s.

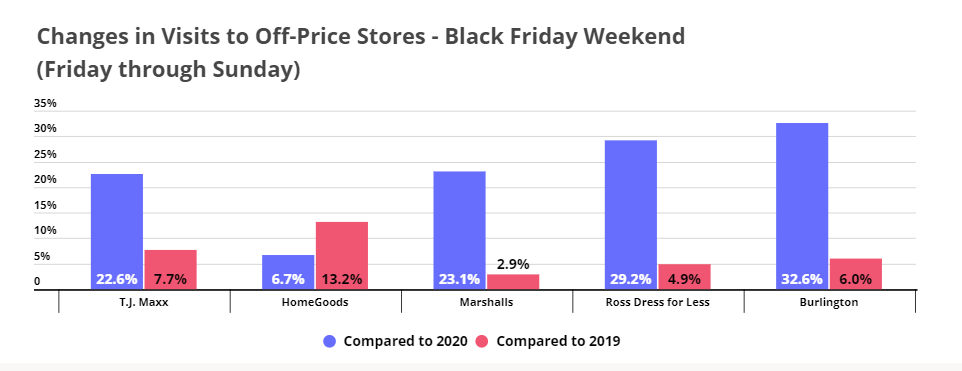

The trend also held for the Off Price retail sector, which saw some of the strongest results on Black Friday compared to 2019. Black Friday visits to T.J. Maxx, Burlington and HomeGoods increased by 2.9%, 0.4% and 7.6% respectively. And for the overall weekend, visits were up 7.7% for T.J. Maxx, 6.0% for Burlington, and 13.2% for HomeGoods.

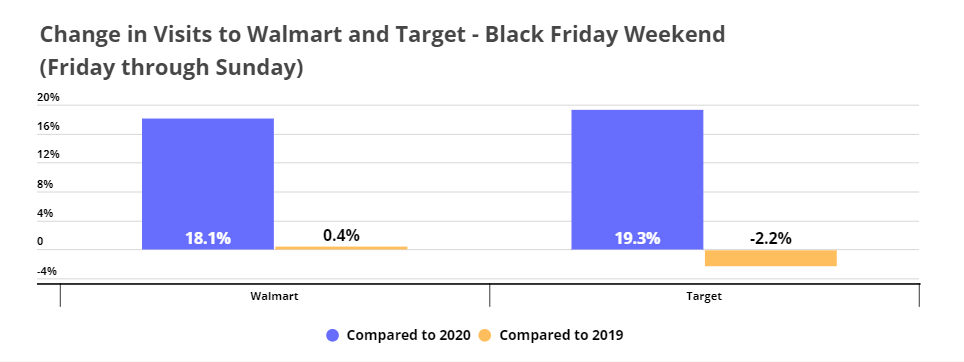

Interestingly though, Walmart did buck this trend. Like most of the retail landscape, superstore counterpart Target saw a stronger performance for the overall weekend than it did on Black Friday in isolation. Yo2Y visits went from -3.1% on Black Friday compared to 2019 to -2.2% for the wider weekend – again indicating a strong jump on Sunday. Yet, Walmart saw visits go from a 2.8% increase on Black Friday to just a 0.4% increase compared to 2019 for the wider weekend. The interesting takeaway here is that Walmart was one of the very few brands able to sustain the traditional centrality and urgency around Black Friday itself.

Black Friday Weekend’s Biggest Winner

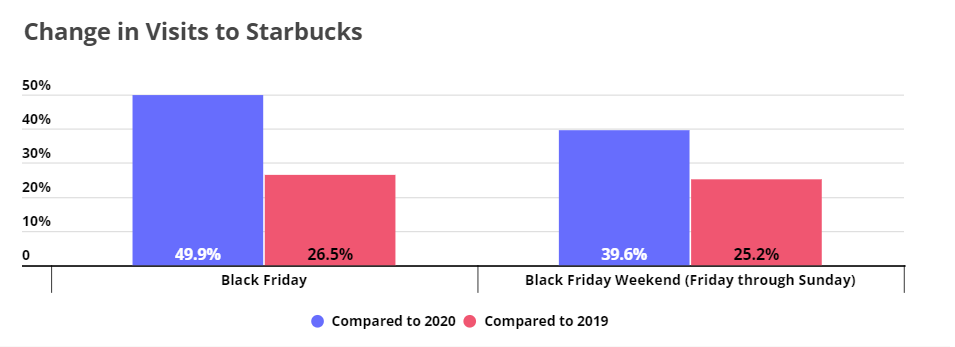

But it is impossible to talk about Black Friday weekend without discussing the brand that dominates it most – Starbucks. Starbucks saw a huge surge in visits on Black Friday and Black Friday weekend compared to 2019. Visits for the day itself were up 26.5% while visits for the weekend were up 25.2%.

The coffee giant consistently drives huge visits on Black Friday because of the complementary nature of its offering. A day full of shopping requires at least one pit stop to refuel, and Starbucks is ideally positioned to answer that need. Yet, the success also speaks to the unique nature of the 2021 holiday season. In the past, the brand likely played a complementary role – helping bring a buzz to those in the midst of a full day out shopping. However, in 2021, the day out experience itself was a key part of the Black Friday draw. From that perspective, the full range of offerings – from food to entertainment to apparel – were part of the force that pulled customers into malls and shopping centers, and so Starbucks played a much more central role in shaping the Black Friday experience this year than in years past.

How will the rest of the holiday season unfold and which retailers will benefit most?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.