The fast growing China cosmetics market has been increasingly gaining investors’ attention. The emergence and rise of domestic players widened choices for consumers and exerted fierce competition into the market, encouraging brands to adapt quickly and seek more effective strategies. Meanwhile, constant change in consumer appetite within yet another year under the pandemic have led the landscape to evolve.

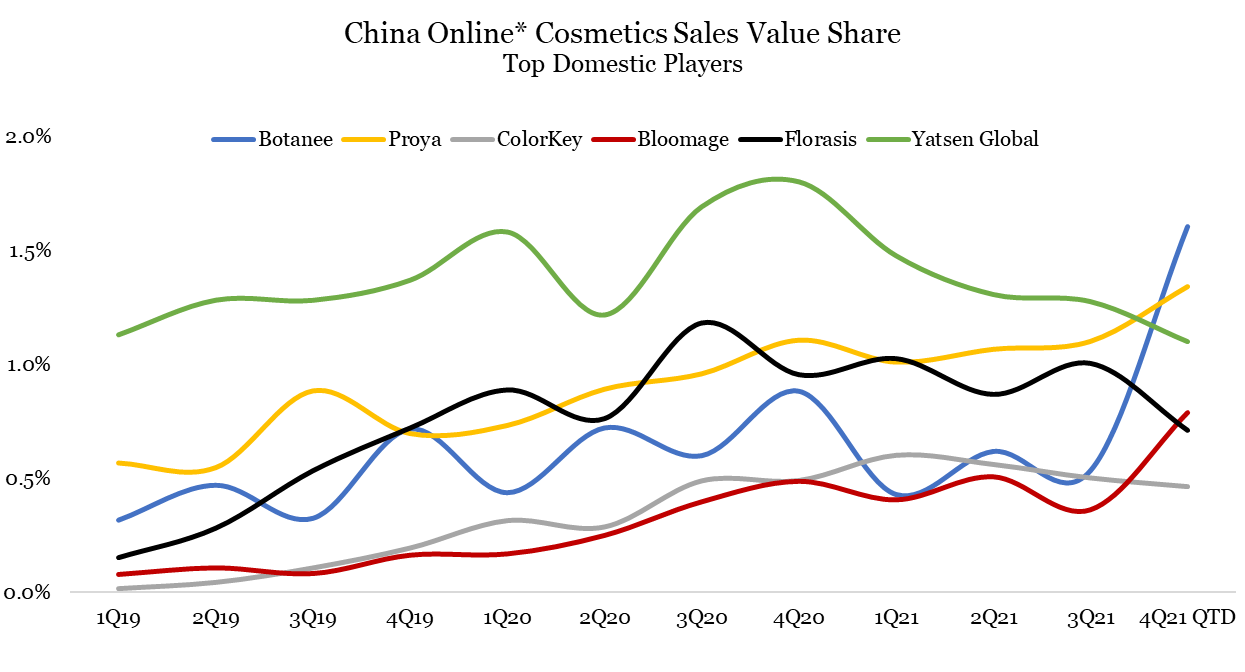

Sandalwood e-commerce data showed that leading domestic skincare brands – Proya, Winona (Botanee), Quadha(Bloomage) displayed strong Double 11 sales and continued their positive momentum into the fourth quarter. Similar trends did not go with make-up brands, however, as top players Yatsen, Florasis, ColorKey all lost share in the cosmetics sector. Yatsen Global, who had been holding the most sales value share until 3Q21, lost its place on top to Botanee.

Yatsen Global’s weakness was mostly seen on make-up brands as well. Sandalwood data observed a downward sales trend for both Perfect Diary and Little Ondine throughout 2021. Overall, Sandalwood China Online data points to a sluggish make-up segment within the cosmetics sector compared to skincare, suggesting potential consumer preference shift.

International brands account for the majority of the top 10 best-selling brands, though dometic brands have also been picking up consumer appetite. L’oreal remained on top with robust sales during the Double 11 period due to enticing live streaming promotion. New dometic skincare risers Winona and Proya earned their place on the rank, while L’oreal may be subject to compensation for Chinese consumers after failing to deliver the cheapest price available through two top influencers’ live streaming platforms – whether the incident will have continuous negative effect on L’oreal’s brand image will be monitored through Sandalwood e-commerce data.

The ever-fierce competition within the industry has led brands to constantly evolve on marketing strategy. The most noteworthy in 2021 is the sales channel shift from traditional e-commerce giants Tmall and JD to live streaming platforms such as Douyin and Kuaishou.

Moreover, a large part of prior success for live streaming channels can be attributed to the popularity of key opinion leaders like Li Jiaqi and Viya who got banned from further online appearances due to a tax-evasion scandal. Recent Chinese crackdown on online influencers as such may have further implications on the live streaming landscape for the industry. Moving into 2022, whether or not live streaming platforms would gradually replace e-commerce channels as the cosmetics main sales battlefield is uncertain, as most brands still preferred Tmall during the Double 11 period shown by Sandalwood China Online data.

To learn more about the data behind this article and what Sandalwood has to offer, visit http://www.sandalwoodadvisors.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.