Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through November 2021.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

“Nonfarm employment rose 6.45 million during 2021, helping to rebuild income for families under financial stress during the pandemic. Income growth has helped to reduce past-due rates and home equity build-up has reduced the likelihood of a distressed sale for families that experience financial challenges. ”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

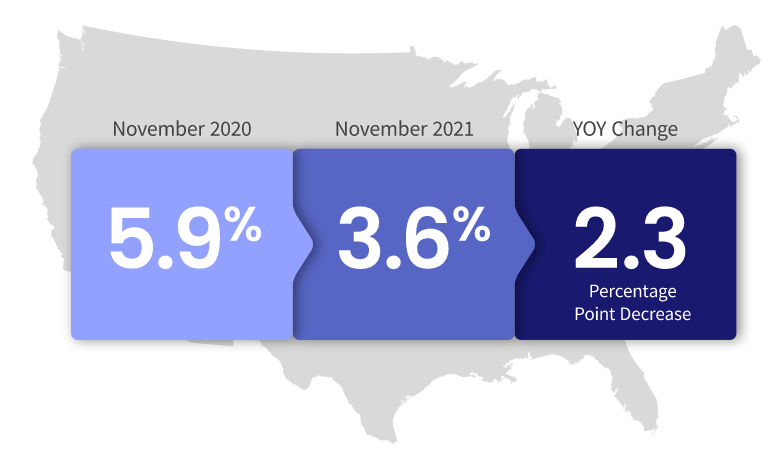

30 Days or More Delinquent – National

In November 2021, 3.6% of mortgages were delinquent by at least 30 days or more including those in foreclosure.

This represents a 2.3-percentage point decrease in the overall delinquency rate compared with November 2020.

Finally Below March 2020 Level

For the first time since the onset of the pandemic, national overall delinquency dropped below the March 2020 level of 3.6%, a sign that mortgage performance is following the nation’s income growth. At the same time, foreclosure rates remain at historic lows as borrowers have been able to lean into the equity generated by a year of record-breaking home price growth. These factors combined have helped borrowers weather the lasting economic impacts brought on by the pandemic and avoid falling behind on payments or losing their homes.

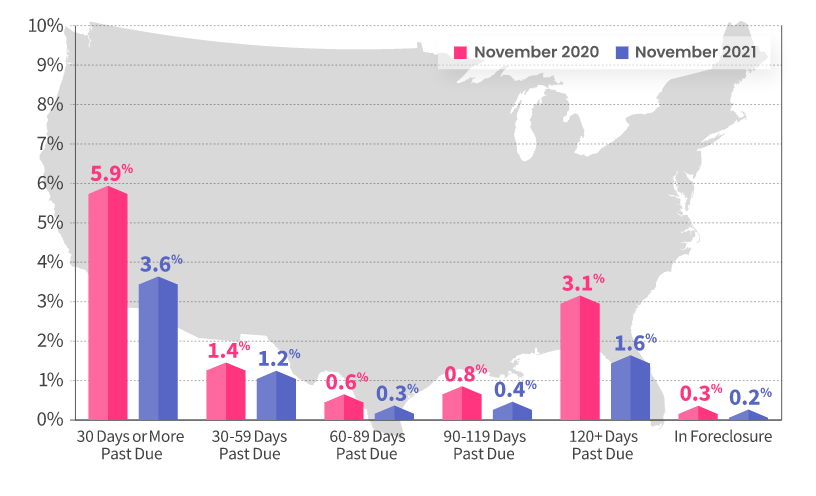

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for November was 3.6%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.2% in November 2021, down from 1.4% in November 2020. The share of mortgages 60 to 89 days past due was 0.3%, down from 0.6% in November 2020. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 2%, down from 3.9% in November 2020.

As of November 2021, the foreclosure inventory rate was 0.2%, down from 0.3% in November 2020.

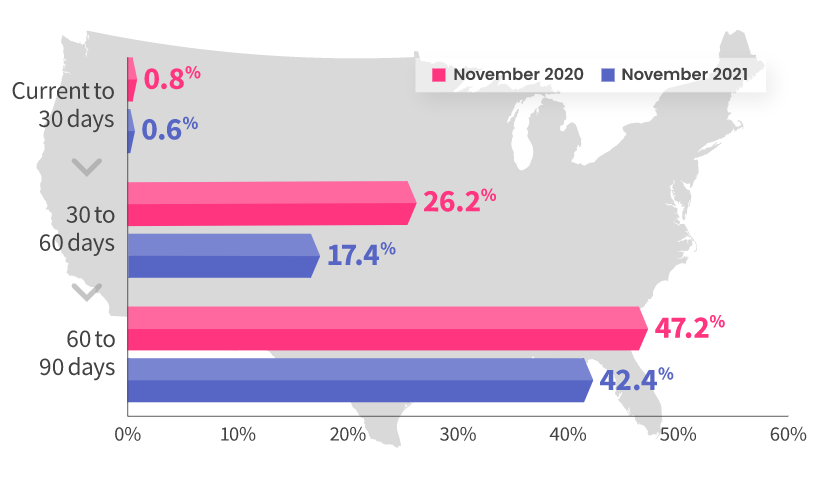

Transition Rates – National

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.6%, down from 0.8% in November 2020.

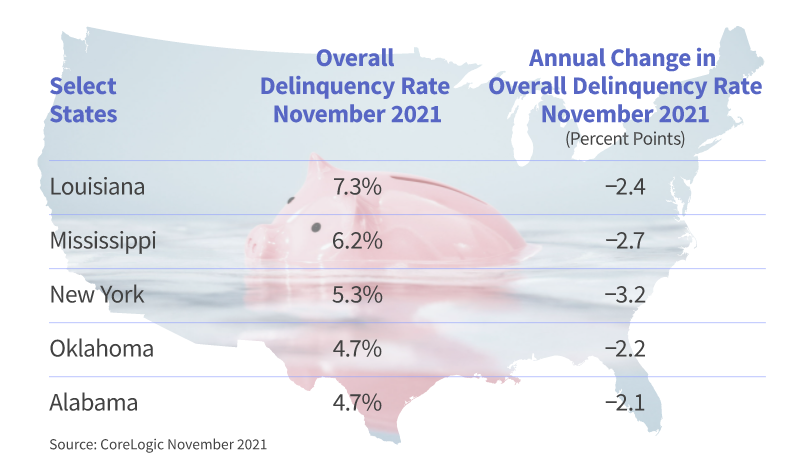

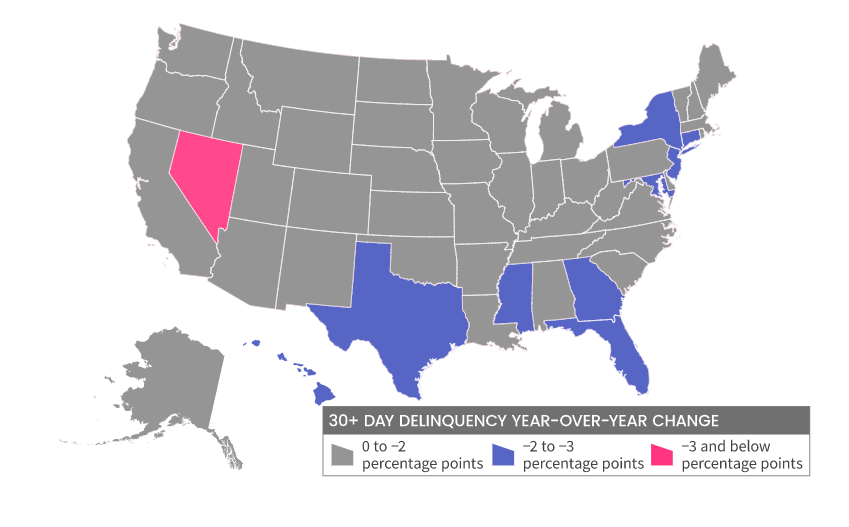

Overall Delinquency – State

Overall delinquency is defined as 30-days or more past due, including those in foreclosure.

In November 2021, all states logged year over year declines in their overall delinquency rate. The states with the largest declines were: Nevada (down 3.8 percentage points); New Jersey (down 3.6 percentage points); Hawaii (down 3.5 percentage points); Florida (down 3.4 percentage points); and New York (down 3.2 percentage points).

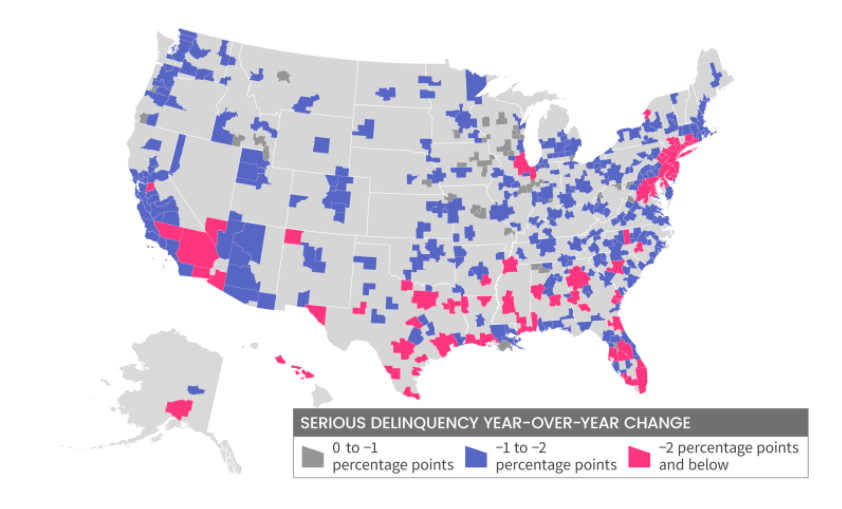

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were 1 metropolitan areas where the Serious Delinquency Rate increased.

There were 383 metropolitan areas where the Serious Delinquency Rate remained the same or decreased.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.