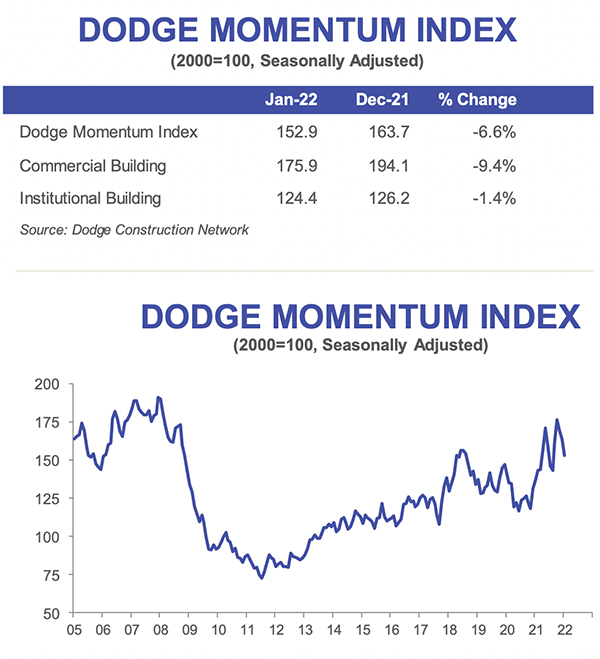

The Dodge Momentum Index declined 7% in January to a four-month low of 152.9 (2000=100), from the revised December reading of 163.7. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In January, commercial planning fell 9%, and institutional planning slipped 1%.

The Dodge Momentum Index had a stellar 2021, rising 23% from 2020 and reaching levels not seen in nearly 14 years. The recent string of declines, however, may be blamed on rising costs, logistical problems and shortages of skilled labor. Still, even as it has decreased, the dollar value of projects in planning remains exceptionally strong, especially for education, warehouse and healthcare projects.

A total of 13 projects with a value of $100 million or more entered planning in January. The leading institutional projects were a $400 million hospital in Tahlequah, OK, and the $320 million Ascension Seton Medical Tower in Austin, TX. The leading commercial projects were the $300 million first phase of the Willets Point redevelopment in Willets Point, NY, and the $300 million XNRGY headquarters in Chandler, AZ.

Many of the challenges facing construction in 2022 will be similar to those in 2021, dampening expectations for robust growth. However, the volume of projects in planning provides hope not only for a continuing recovery, but for it to be more evenly dispersed than last year.

January 2022 DODGE MOMENTUM INDEX

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.