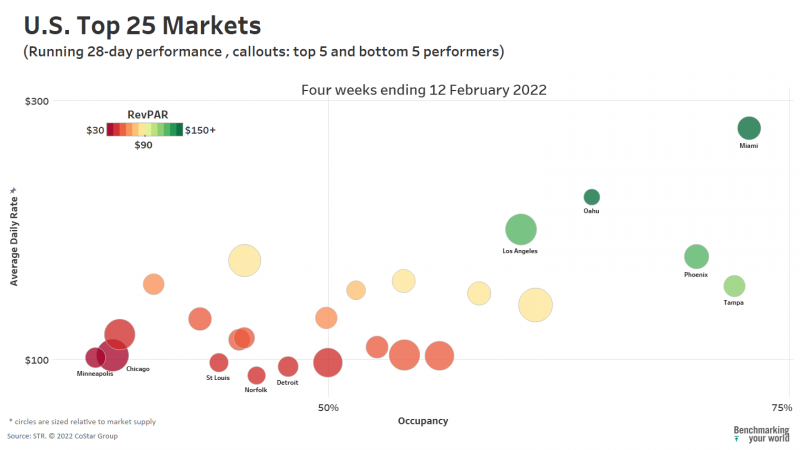

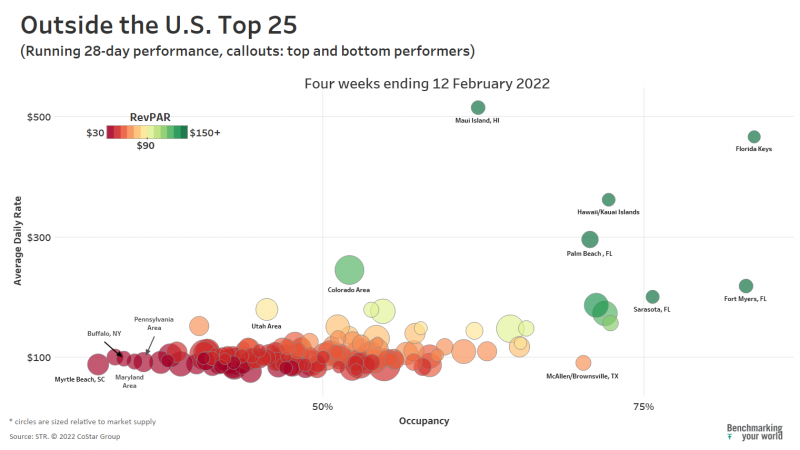

STR’s latest 28-day visuals show markets collectively getting closer to their seasonal performance expectations. The leaders and laggards are highlighted in the “bubble” charts below with averages covering the four weeks ending 12 February.

Among the Top 25 Markets, four of five leaders have recently outpaced their comparable revenue per available room (RevPAR) from 2019. Miami had the top four-week RevPAR (US$203) and a RevPAR index score of 104 (4% above the 2019 comp) after hitting 161 last month. Oahu’s RevPAR of US$145 made it the second best among large markets, still, it was downgraded from “high-flyer” status with a RevPAR index of 94 after coming in at 141 last month. Phoenix (117) continued showing strength when compared with 2019 levels.

Outside of the largest U.S. markets, the same pattern as last month occurred where outdoor or beach/ski resort regions continued to dominate. At the top, the Florida Keys recorded a four-week RevPAR of US$390, which was an increase of US$137 above 2019. Maui’s strong average rates over the past month (US$515) contributed to its solid RevPAR index (129).

Last month, Myrtle Beach trailed all U.S. markets with RevPAR of US$28 (index score 98). Its moderate indexed value, like other lower performing markets, implies that modest performance is largely seasonally expected. Other low absolute RevPAR markets are outperforming their 2019 levels—Maryland Area (106), Pennsylvania Area (103), Buffalo (108) and Oklahoma Area (112). For the most recent four weeks, 15 of 20 bottom markets based on absolute RevPAR are outperforming their 2019 levels.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.