Source: http://www.sandalwoodadvisors.com/chinas-ev-market-outlook-competition-amidst-shared-challenges/

With all the attractive perks such as convenience in getting license plates, government subsidy, better driving experience, and shrunken price difference, electric vehicles sales in China skyrocketed 154% last year as more consumers opt for greener cars. Tesla and BYD remain as market leaders followed by Xpeng, Li Auto and Nio. Tesla beat market expectation and finished 4Q21 strong with 116,236 delivery units in China, attaining +92% y/y growth. Xpeng and Li Auto also showed positive momentum with 41,751 and 35,221 delivery units respectively in 4Q21, while Nio had a mediocre 4Q21 performance with 25,034 units delivered.

There could be a dent in the growth momentum as the crunch in global semiconductor supplies leaves the industry with limited production capacity and upward demand pressure. Perhaps the least affected are BYD and Tesla, with the former manufactures most key parts of its vehicles on their own and Tesla’s ability to develop their own software. Both Li Auto and Xpeng were affected by the shortage which resulted in lower configuration, however quickly recovered later in 4Q21 as both CEOs were on top of making sure the effect on battery supply is contained. Nio, on the other hand, took a hard hit due to limited power over the supply chain compared with the other players. The company also underwent an assembly line upgrade which further limited production capacity. The effect of global supply chain shortages is said to last throughout 2022, causing fear that the hindered growth of the EV market is yet to ease.

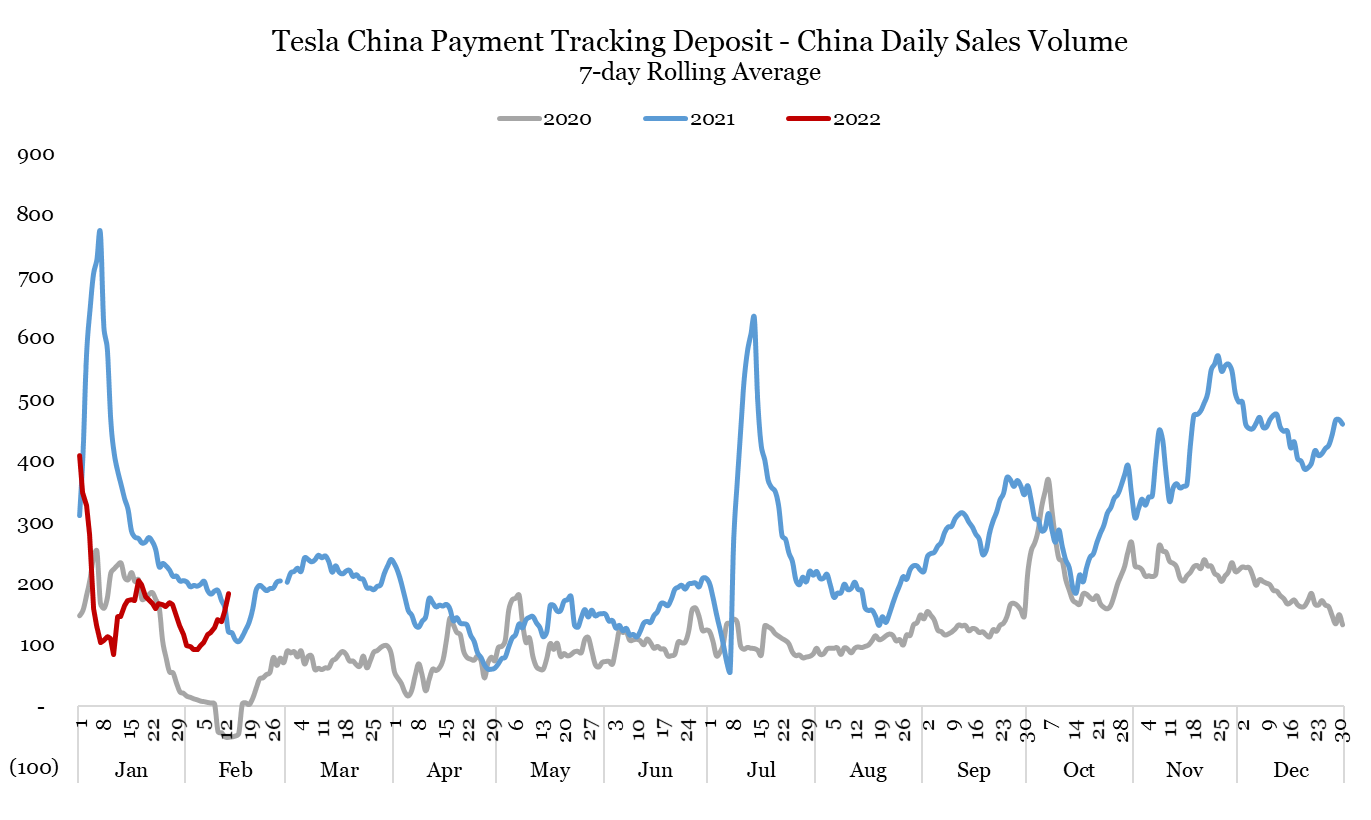

The supply chain shortage that’s causing a steep climb in raw material costs also resulted in EV price hikes. Tesla, for example, has been gradually increasing its price since September 2021. The more significant price raise towards the end of 2021 has caused major slow down in orders for Tesla in January 2022, though the most recent Sandalwood China Payment data saw a quick recovery – whether this indicates the acceptance of the price raise by Chinese consumers remains to be seen.

Meanwhile, Tesla launched a cheaper Model Y Standard Range RWD in China in July 2021 that led to strong order flows as observed in Sandalwood China Payment and Email Receipt data. The momentum was largely sustained to the year end, creating a huge backlog of domestic orders which supported 4Q21’s strong delivery. The effect will likely continue into 1Q22 as well.

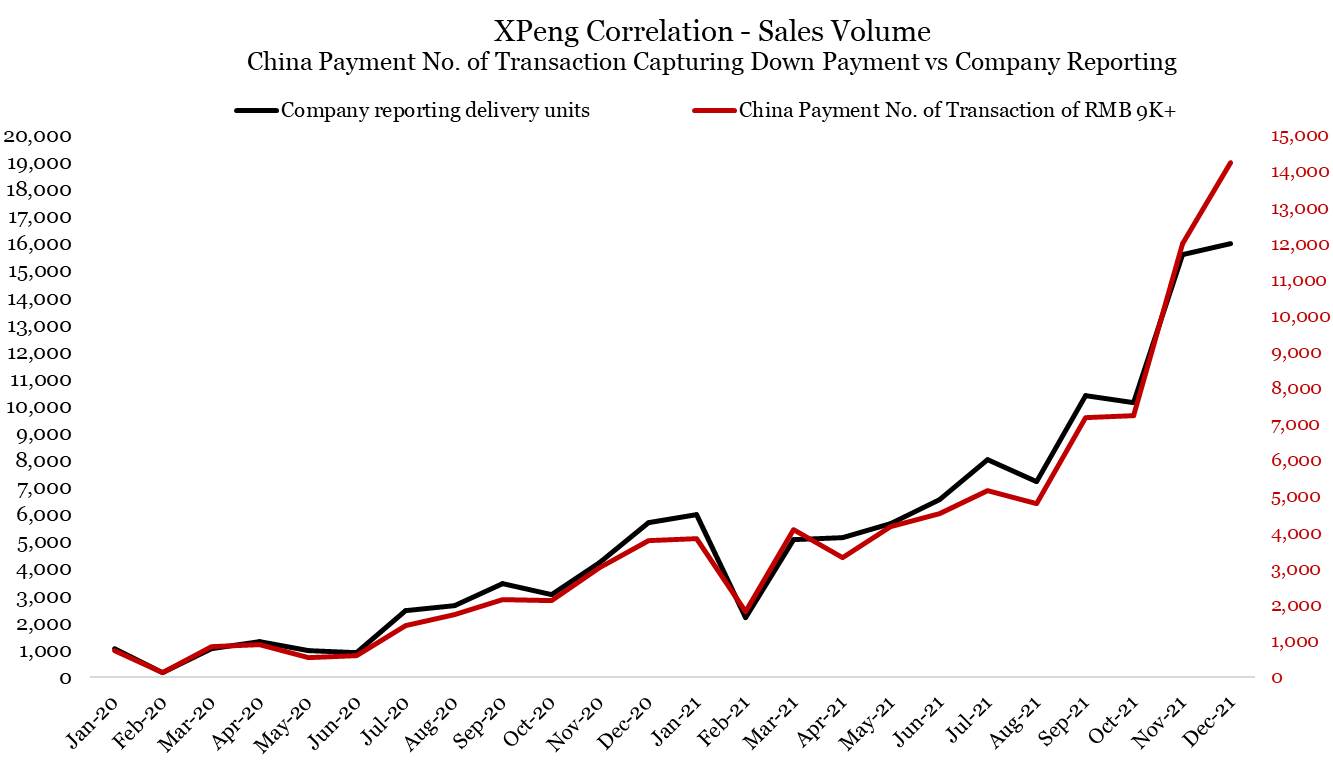

Tesla’s advanced technology and maneuverability have potentially led to lesser price sensitivity. However, the company does not plan to roll out new models in 2022 given supply chain shortage, leaving a chance for competitors. Equally well-known for innovation, high-tech experience (e.g Autopilot), and good design, Xpeng realized aggressive growth in 4Q21 mostly contributed by P7 and the newly-launched P5 models. It is also worth mentioning that the launch of Xpeng’s new G9 model targeted for delivery in 3Q22 will officially open the door for Xpeng to enter the EV SUV market, placing the company in direct competition with Tesla Model Y.

Another leader in the SUV space is Li Auto. Li Auto is able to concentrate all its resources including R&D, production, sales and promotion on Li One, the only model on sale, making it a top selling SUV model in China. The company, however, is expected to add a new model, Li X01 to its product portfolio in 2022 for the first time – and its performance will be monitored through Sandalwood China Payment data. Whether Li Auto sustains future growth in the market is largely dependent upon its ability to copy Li One’s success for the new models.

Diversification is also at the core of Nio’s business strategy for 2022 – although the company’s outdated hardware and functionalities, and its inability to adjust to supply chain shortages compared with other players are majorly limiting its growth potential. Moreover, the high price set by Nio limits its market potential and targeted customer group to consumers in the higher-income group. In response to the declining sales in 4Q21, Nio is set to launch 2-3 new models in 2022, the performance of which would be closely monitored.

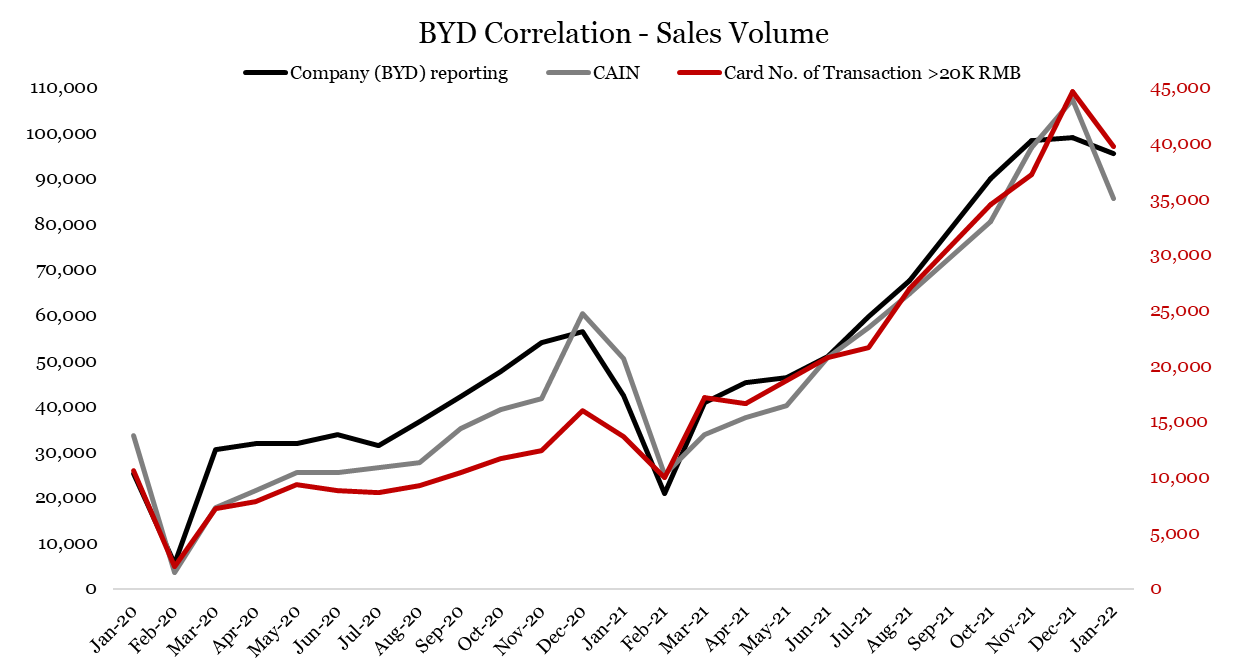

In contrast to Nio’s high price, BYD adopts a lower price strategy aiming to target the mass market (ASP for Nio, Li Auto, Tesla, Xpeng, BYD is around 400k, 310k, 286k, 213k, 150k RMB respectively), placing BYD on top of the market in delivery units. The company’s break-through in its self-owned battery technology and innovation in its hybrid vehicle models also provide natural advantages, allowing BYD to outsell the other key players.

With more conventional vehicle manufacturers like BYD venturing into the EV space in China, the competition has become tighter. Meanwhile, global supply chain shortages are expected to last well into 2022. Whether the top five players are able to sustain and keep their market share as they try to outperform each other in an increasingly complex market condition remains to be seen – and closely monitored.

To learn more about the data behind this article and what Sandalwood has to offer, visit http://www.sandalwoodadvisors.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.