Faced with a rise in inflation resulting from a myriad of factors such as COVID-induced supply chain bottlenecks to increases in wages and pent-up demand, U.S. consumers in 2021 had to act definitively and fine-tune their spending behavior. Envestnet® | Yodlee® financial behavior trends, derived from aggregated and de-identified transaction datasets, can be utilized to provide answers to questions around major shifts in consumer spending trends such as those emanating from inflationary pressure.

Change in Composition of Discretionary Expenses

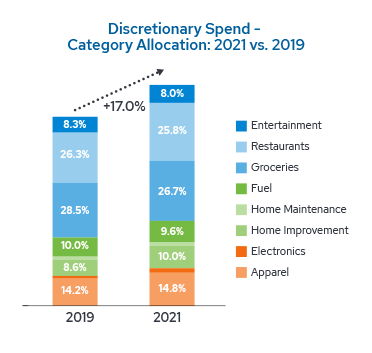

According to the Envestnet | Yodlee trend data, the overall spend among top categories of discretionary expenditure increased by 17% in 2021 (vs. 2019 pre-pandemic). However, the allocation of spend for each type of expense differed based on changing consumer needs driven by both the inflation as well as the pandemic.

As consumers spent more money on home improvement and maintenance in 2021, consumers cut back on staples such as food and fuel. The data indicated that home improvement spend went up by 1.4 percentage points in 2021 whereas groceries fell by 1.8 percentage points.

Impact on Essentials – Groceries and Fuel

Consumers wary because of increasing grocery prices

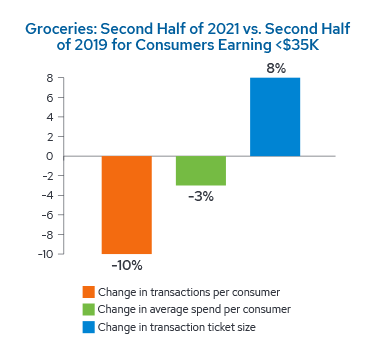

Rising costs of food and other essential items in the second half of 2021 contributed to higher receipts at grocery stores. Similar patterns were seen in a steep 14% hike in consumer-level spend versus the same period in 2019.

An analysis of the lowest income earners (<=$35K annual income) showed a 3% decline in average consumer spend and, particularly, a sharp 10% drop in the average number of transactions at grocery retailers in the second half of 2021 (vs. the second half of 2019). This indicates that consumers preferred to shop less frequently and more cautiously.

Rising fuel costs have forced consumers to make fewer gas station visits

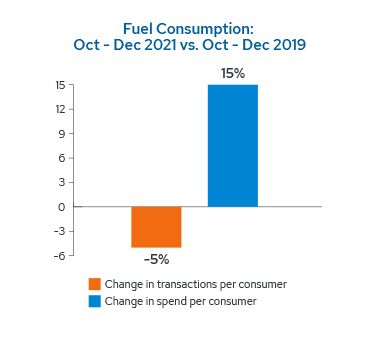

The effect of inflation has been evident in rising fuel bills, as consumers spent 15% higher1 on fuel in Q4 (October – December) 2021 vs Q4 2019. However, the average number of transactions dropped by a noticeable 5% when compared to Q4 2019, the last quarter before the onset of the pandemic.

The lowest income group experienced a more severe impact. When looking at their gasoline expenditures, for example, their transactions in Q4 (October – December) 2021 declined by 12% and they spent 8% lower on average (vs. October - December 2019). Various media reports also highlight how rising fuel bills have resulted in consumers opting to drive less and better plan their trips.

Non-Essentials like Apparel Were Cut Back

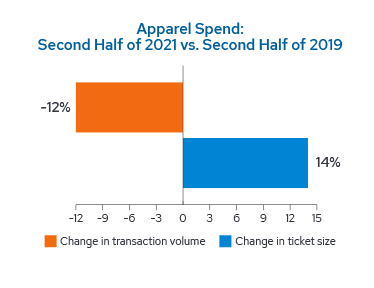

Consumers deprioritized the purchase of non-essentials like apparel towards the second half of 2021. While overall spend for this period remained almost flat compared to the second half of 2019, unprecedented cost and price increases resulted in a 12% reduction in number of purchases, albeit at much higher average ticket sizes (+14%).

For the lowest-income consumers who felt the pinch even more, apparel transaction volumes for this segment declined by 30% in the second half of 2021 compared to the second half of 2019.

An Intelligent Financial Life: Wading Through Uncertain Times

As the post-pandemic world sees changing paradigms towards income, spending, and savings, there is an emerging opportunity to navigate financial trends with more intelligence than ever before. With the consumer shift to digital engagement, the ability to help people plan their finances and optimize their savings and investments is increasingly data driven. Inflation is at record highs – and people need to be financially more aware than ever before. While there is a clear gap in the way certain segments of the populace are dealing with financial decisions in our new normal, bringing smarter and intelligent decision-making into this sphere can create a more equitable playing field.

About Envestnet | Yodlee Income and Spending Trends

Envestnet | Yodlee Income and Spending Trends utilize de-identified transaction data from a diverse and dynamic set of data from millions of accounts to identify patterns and context to inform spending and income trends. The trends reflect analysis and insights from the Envestnet | Yodlee data analysis team.

1 Views based on a cohort of consumers who frequently transacted at a gas station (at least once a month over the last 3 years). About 20 of the largest gas station chains including Exxon Mobil, Chevron, Shell and others were considered for the analysis

To learn more about the data behind this article and what Yodlee has to offer, please reach out to Dylan Curtis at Dylan.Curtis@yodlee.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.