Source: https://secondmeasure.com/datapoints/dominos-nyse-dpz-growth-strategy-qsr-pizza-chain-market-share/

The pizza industry has been busy in the first quarter of 2022. In recent weeks, Little Caesars raised the price of its Hot-N-Ready pizza for the first time ever, Domino’s CEO announced his upcoming retirement, and Papa John’s CEO described 2021 as the biggest year in the company’s history. Consumer spending data reveals that Domino’s (NYSE: DPZ) is still the big cheese when it comes to national pizza chain market share, but Papa John’s (NASDAQ: PZZA) has experienced the most sales growth among major pizza companies since 2019.

Domino’s (NYSE: DPZ) dominates the national market, but some states prefer other quick-service pizza chains

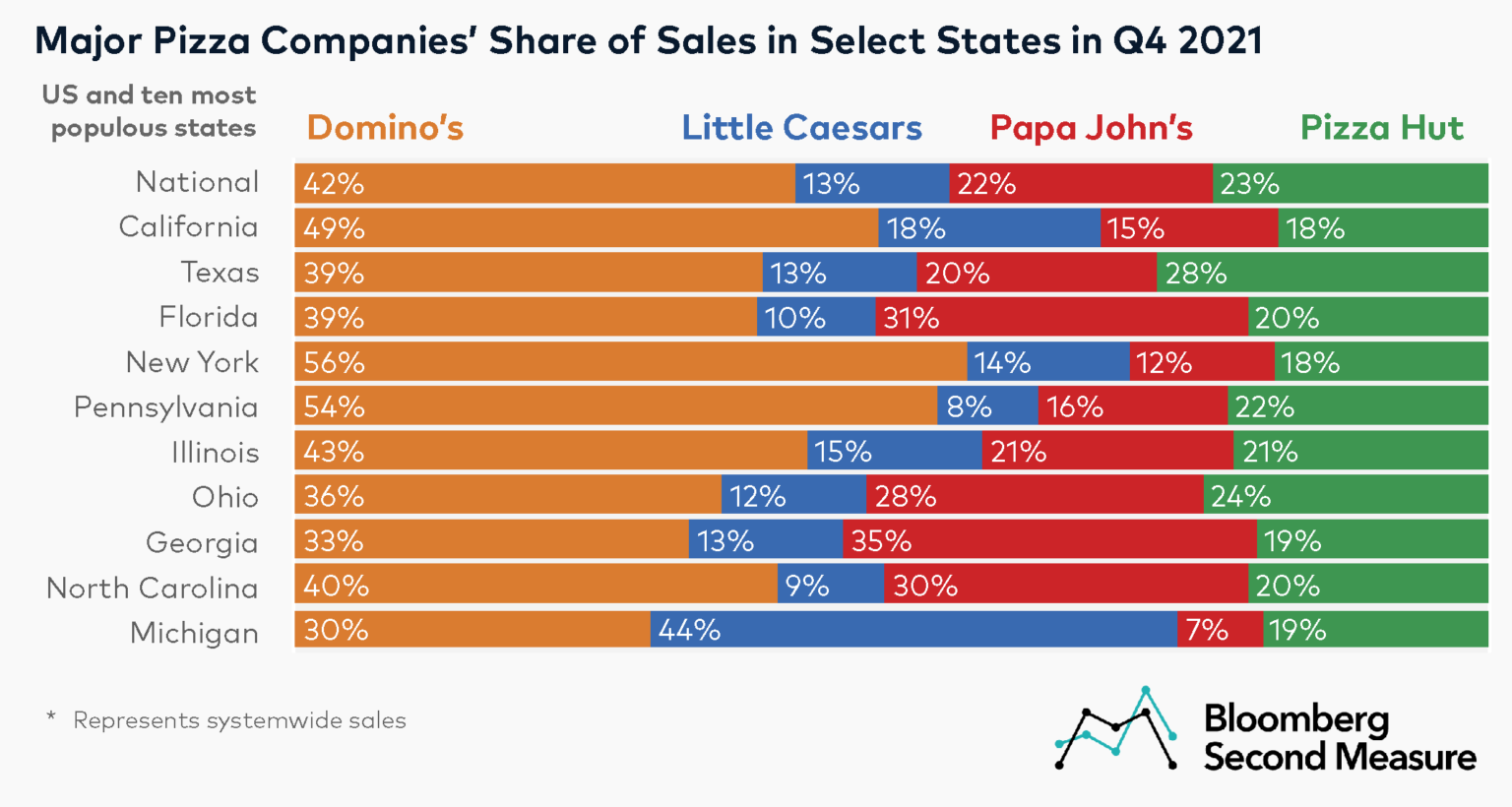

Nationwide, 42 percent of sales among major pizza chains went to Domino’s in Q4 2021. Pizza Hut, which is owned by Yum! Brands (NYSE: YUM), accounted for 23 percent of national pizza chain market share, followed by Papa John’s with 22 percent. Privately-owned Little Caesars earned 13 percent of U.S. sales among these companies.

Comparing pizza chain market share in the ten most populous states, Little Caesars only earned the top spot in Michigan—where it was founded in 1959—with 44 percent of sales in the fourth quarter of 2021. Papa John’s was the most popular of these major pizza chains in Georgia, accounting for 35 percent of pizza chain market share in Q4 2021. Aside from its national dominance, Domino’s is especially popular in the Northeast, accounting for more than half of sales among the group of pizza quick-service restaurants (QSR) in New York and Pennsylvania.

Papa John’s had the highest sales growth from 2019 to 2021

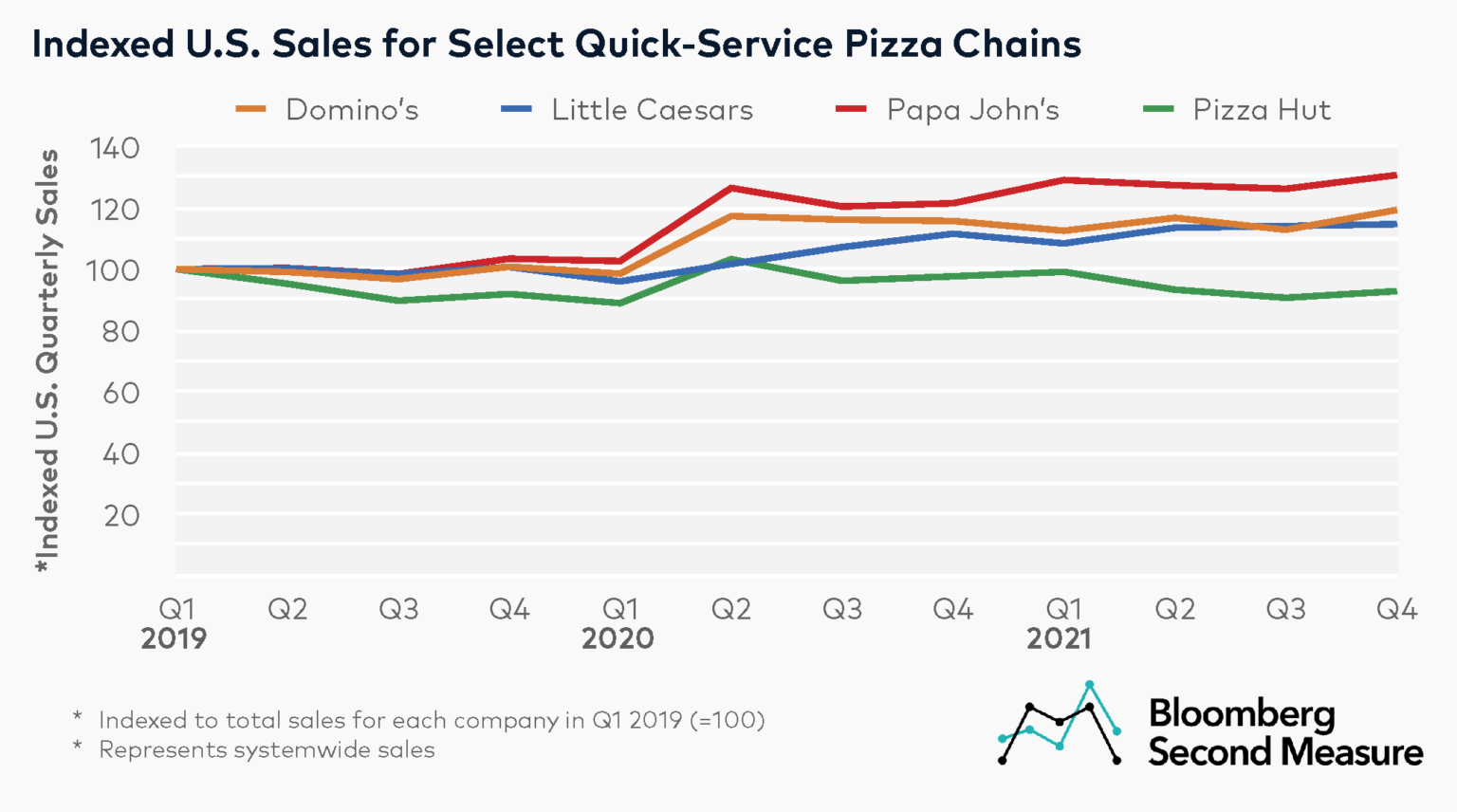

The start of the pandemic coincided with piping hot sales for pizza companies. All four chains in our analysis experienced a boost in quarter-over-quarter sales in Q2 2020, when shelter-in-place orders were in place. Quarterly sales at Papa John’s, Domino’s, and Little Caesars have since remained elevated, while sales at Pizza Hut have declined from its pandemic peak.

In Q4 2021, U.S. consumer sales at Papa John’s were 26 percent higher than sales in Q4 2019. Domino’s growth was 18 percent in the same time frame, while Little Caesars sales grew 14 percent.

Contrasting with competitors’ sales growth, Pizza Hut sales remained relatively flat during this period. Pizza Hut has been downsizing its retail footprint, closing 300 locations when its largest franchisee filed for bankruptcy in 2020. Pizza Hut is also known for its “red roof,” or dine-in, locations as well as its carryout and delivery operations. Since 2019, the chain has been replacing several of its underperforming dine-in locations with take-out focused, quick-service restaurants as part of its growth strategy.

Customer counts have decreased for several pizza chains, but remaining customers are shelling out more dough

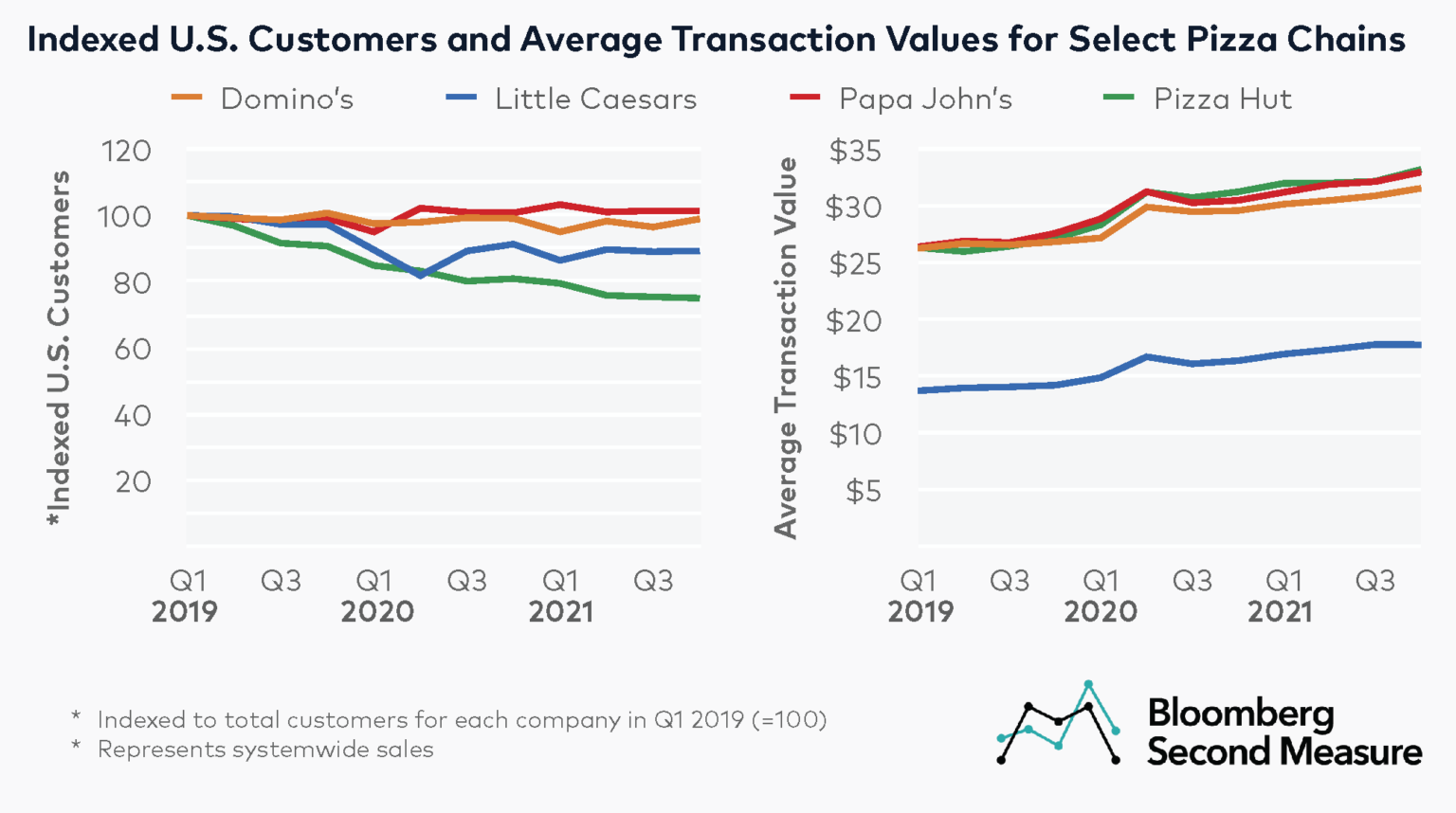

Quarterly customer counts remained relatively consistent for Papa John’s and Domino’s from the beginning of 2019 through the end of 2021, but steadily declined for Pizza Hut and Little Caesars. Customer counts at Pizza Hut in Q4 2021 were 17 percent lower than the same quarter in 2019. Little Caesars customer counts also dropped 8 percent in the same period.

With customer counts decreasing and quarterly transactions per customer remaining steady, sales growth among pizza chains primarily came from increased spending. Average transaction values between Q4 2019 and Q4 2021 increased 25 percent for Little Caesars, 22 percent for Pizza Hut, 19 percent for Papa John’s, and 18 percent for Domino’s. Papa John’s has noted that its new premium products such as New York style pizza and stuffed crusts were strong contributors to rising consumer spend.

Despite growth in average spend, Little Caesars still has a significantly lower average transaction value than its competitors. In Q4 2021, the average transaction value at Little Caesars was $18, compared to $32 for Domino’s and $33 for Papa John’s and Pizza Hut.

Increases in average transaction values may continue for several of these companies in the near future. In January 2022, Little Caesars raised the price of its Hot-N-Ready pizza for the first time in its history, from $5 to $5.55. When announcing the change, the pizza chain also mentioned that the new price point is for a limited time, and that the Hot-N-Ready pie will also include more pepperoni. To combat soaring food costs, Domino’s will also revise some of its promotions to apply to online customers only—who, the company has noted, typically spend more while reducing the volume of orders over the phone.

Pizza chains differ in their approaches to third-party delivery

Diving deeper into food industry consumer trends, our transaction data has shown that the volume of third-party delivery sales skyrocketed for QSR restaurant brands, such as pizza chains, at the beginning of the pandemic. But pizza companies have varied in their relationships with meal delivery services and how these third-party aggregators play a role in growth strategy.

Papa John’s, which offers delivery through DoorDash, Grubhub, Postmates, and Uber Eats, has also publicly attributed its strong growth in sales and new customers to these third-party apps. Little Caesars also formed an exclusive partnership with DoorDash in 2020 to deliver pizzas ordered through its own app and website. In late 2021, the pizza company doubled down on its growth strategy through third-party delivery services by listing directly on DoorDash’s ordering platform.

Unlike competitors, Domino’s has famously refused to use third-party delivery platforms. In response to third-party delivery companies’ surprise fees, last summer Domino’s promoted “Surprise Frees”, in which they provided free menu items to randomly selected customers who ordered delivery from the pizza chain’s own app or website.

Labor shortages may leave some customers hungry

In recent months, the restaurant industry has struggled with labor shortages. In fact, Papa John’s has temporarily closed some locations or reduced store hours in order to meet delivery demand. But quick-service pizza restaurants are getting creative in managing high order volumes. Both Domino’s and Pizza Hut have encouraged curbside pickup rather than home delivery. At the end of January 2022, Domino’s also began a promotion offering $3 toward a future pickup order to customers who picked up their own orders.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.