Dick’s Sporting Goods is taking its omnichannel strategy to the next level by adding an experiential component to its already strong digital and brick and mortar presence. We analyzed some of the brand’s recent ventures to see what we can learn from this omnichannel pioneer.

Dick’s Sporting Goods’ Winning Omnichannel Strategy

Dick’s Sporting Goods has been working to make its technology and physical stores complement and elevate each other for almost a decade. The company started shipping online orders directly from its stores in 2013 and launched “Buy Online Pick-up In Stores” (BOPIS) already in 2014 – long before the pandemic made BOPIS widespread. And while Dick’s has been investing heavily in its digital infrastructure, the company openly declares that “stores are the hub of our omni-channel ecosystem”; Dick’s understands that physical stores are a critical and central component of any winning omnichannel strategy.

Dick’s Main Brand vs. Dick’s Specialty Stores

The best omnichannel retailers know that it’s not enough to have one digital and one brick and mortar channel working hand in hand, especially since different types of digital apps and physical channels appeal to different customers. Dick’s understands this and operates various types of digital channels and applications alongside a diverse portfolio of brick and mortar chains that include the main brand Dick’s Sporting Goods, Golf Galaxy, and Field & Stream.

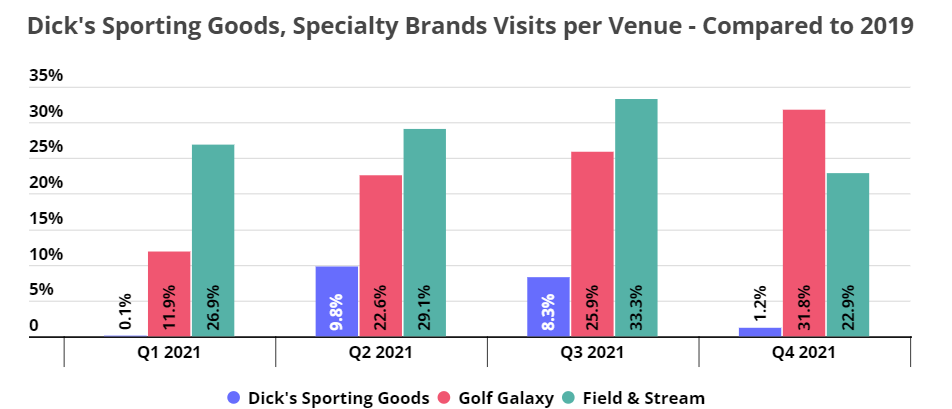

Comparing foot-traffic data between the main Dick’s brands and the company’s Golf Galaxy and Field & Stream brands provides some compelling insights. Despite the continuing impact of the pandemic, average visits per venue for Dick’s Sporting Goods stores were remarkably strong in 2021, with foot traffic per store even with or exceeding 2019 levels every quarter. But Dick’s Sporting Goods’ resilience pales in comparison to the truly remarkable growth in visits per venue for Golf Galaxy and Field & Stream; both saw double digit growth in visits per venue every quarter of 2021.

Different Brands, Different Shopping Experiences

Operating the specialty stores alongside the main brand gives the company several advantages. Although there is some product overlap between the main stores and Golf Galaxy and Field & Stream, maintaining the specialty brands enables Dick’s to carry a wider range of specialized products relating to golf, hunting, and fishing without taking up too much inventory space.

The specialty brands also help Dick’s channel the customers only interested in outdoor recreation or golf to stores staffed with specially-trained associates. They facilitate product discovery and create a more personalized shopping experience.

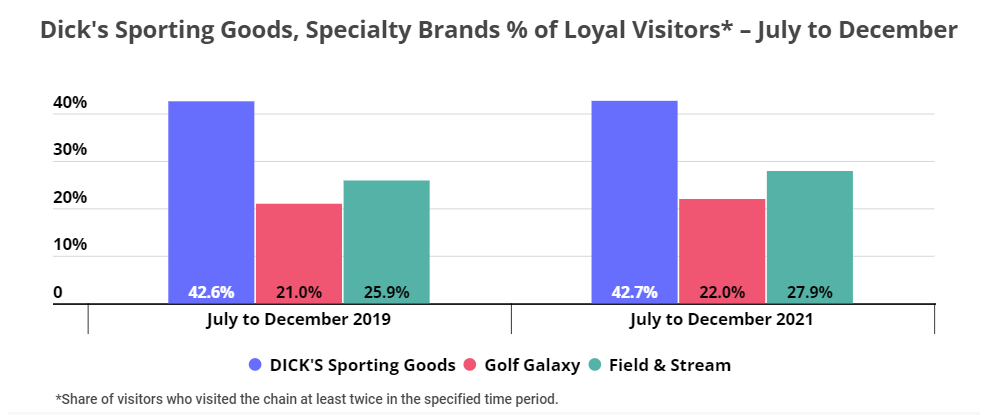

Analyzing customer loyalty numbers confirms that the different brands fill varied shopping needs. Whereas nearly half of Dick’s Sporting Goods’ customers visited the main stores twice between July and December, only around a quarter of customers returned to Golf Galaxy and Field & Stream more than once in the same period.

Since the shares of loyal visitors for all three brands has remained relatively steady between 2019 and 2021, this data reflects a likely fundamental distinction between the brands: Dick’s Sporting Goods customers visit more often as part of their regular shopping routines, to check out the latest sneakers or buy new workout gear. Visitors to Golf Galaxy and Field & Stream, on the other hand, visit the stores once in a while to buy particular pieces of specialized equipment. Dick’s ability to cater to both types of shopping needs through its different physical channels is one important key to its success.

Incorporating Experiential into Omnichannel

Dick’s is also one of the first retailers to understand that a comprehensive omnichannel strategy must include an experiential component. Dick’s first House of Sport opened near Rochester, NY in April 2021, and includes an indoor climbing wall and batting cage, as well as an outdoor track and field. And, in October 2021, the retailer added an ice rink to the mix.

Visitors can test the equipment sold at the store, take various sports and fitness classes, practice individually or with teams, and get advice on recovery and well-being. Following the success of its first location, Dick’s opened a second House of Sport in Knoxville, TN and is now planning a third store in Minnetonka, MN.

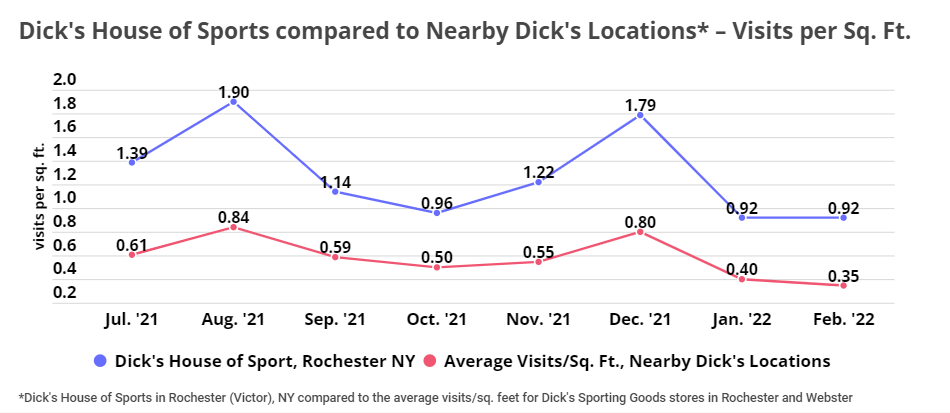

Comparing visits per square ft. for the first House of Sport in Upstate New York to other nearby locations confirms the success of the initiative. Although the House of Sport is substantially larger than the other Dick’s locations, it consistently boasts significantly higher visits per sq. ft.

Taking Risks and Staying Agile

Dick’s has also shown an unusual willingness to take risks. Despite the success of the Field & Stream brand, Dick’s sold eight of the brand’s stores to Sportsman’s Warehouse in 2019, as part of the company’s effort to pull back from the firearms space. But instead of pulling away from the outdoor concept altogether, the company launched a new store format called Public Lands that focuses on hiking and other non-hunting outdoor activities.

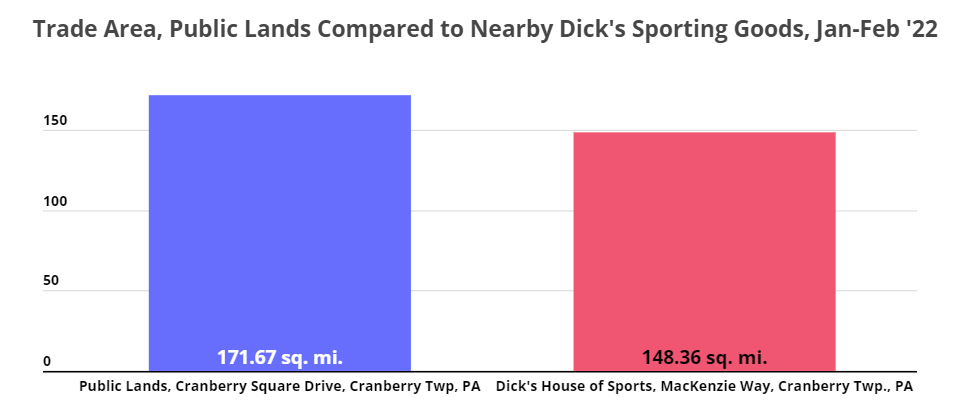

The first Public Lands store opened in September 2021 in Cranberry Township, PA, replacing the Field & Stream store that previously existed at that location. Early foot traffic data already shows that the Public Lands store is attracting visitors from a much larger radius when compared to the trade area of the nearby regular Dick’s Sporting Goods location.

A second Public Lands location opened in Columbus, OH in November 2021. Given the recent rise in nature-based recreation along with Dick’s proven ability to move fast in implementing winning concepts, the two Public Lands stores are likely just the beginning.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.