Source: https://insights.consumer-edge.com/2022/03/where-might-prices-take-the-gas-out-of-consumer-spending/

One of the unfortunate fallouts of Russia’s war with the Ukraine is rising gas prices in the US as oil embargoes take root. Which US consumers are most affected and which businesses could see the biggest decline in sales as consumer discretionary wallets shrink? In today’s Insight Flash, we analyze gas price increases to date, which demographics and geographies are most affected, and which companies are most likely to feel fallout effect based on cross-purchase rates.

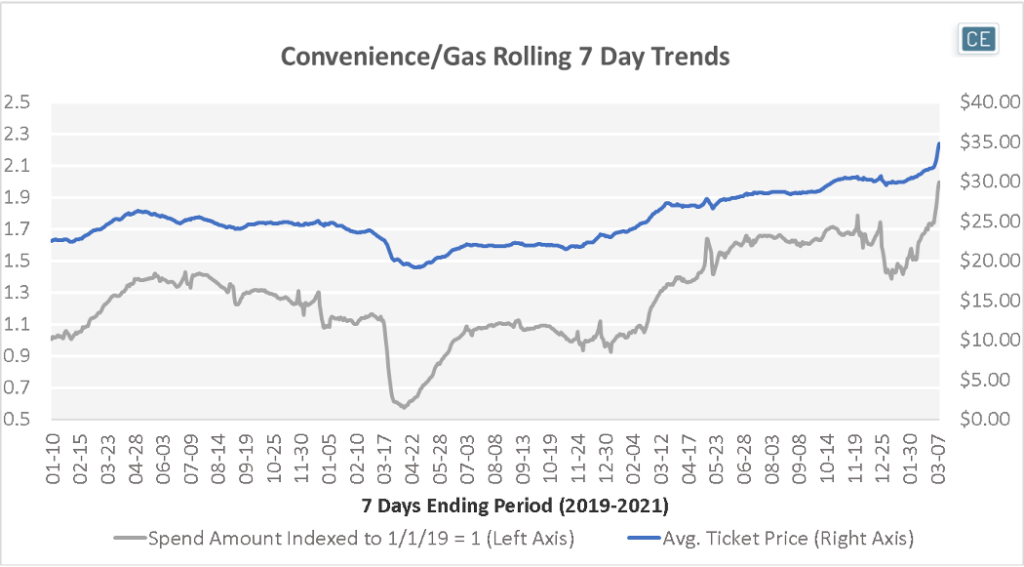

Since the beginning of March, our CE Transact US data has reflected the increase in fuel prices due to Russian oil embargoes. The average ticket price per transaction at Convenience/Gas outlets has risen to $34.77 in the seven days ending March 10, up 50% from the year prior. This takes into account the fact that people maybe be topping off their tanks to less than full to avoid high payments at the pump. Total spend has increased to twice the levels of January 1, 2019, with price and return-to-work driving substantial increases from COVID levels.

Spend Growth and Average Ticket Increases

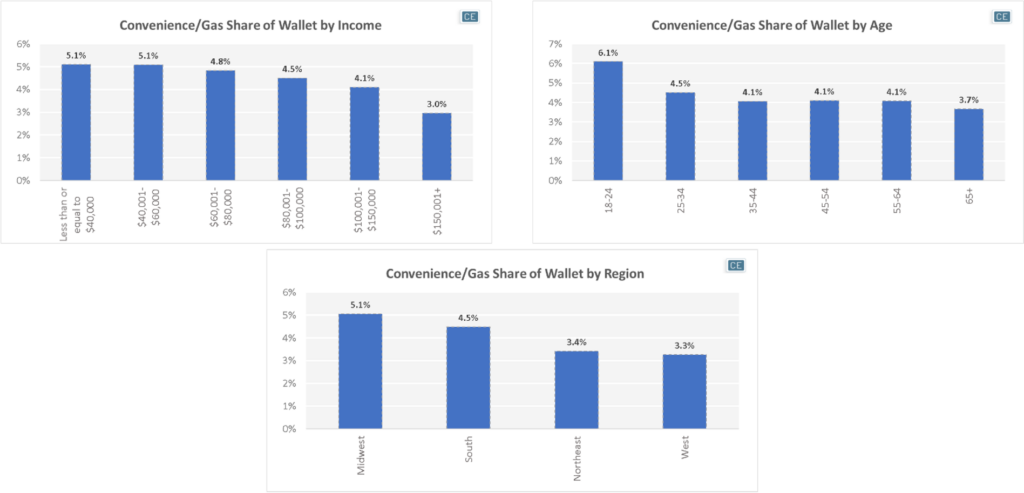

These increases are most likely to affect low-income shoppers, younger shoppers, and those living in the Midwest. In the last year, those making under $60,000 spent 5.1% of their total tagged wallet at Convenience/Gas stations, versus only 3.0% for those making over $150,000. Similarly, those aged 18-24 spent 6.1% of their total tagged wallet at Convenience/Gas versus 3.7% for those ages 65+. Finally, those in the Midwest spend 5.1% of their tagged wallet versus 4.5% in the South, 3.4% in the Northeast, and 3.3% in the West.

Share of Wallet by Demo and Geo

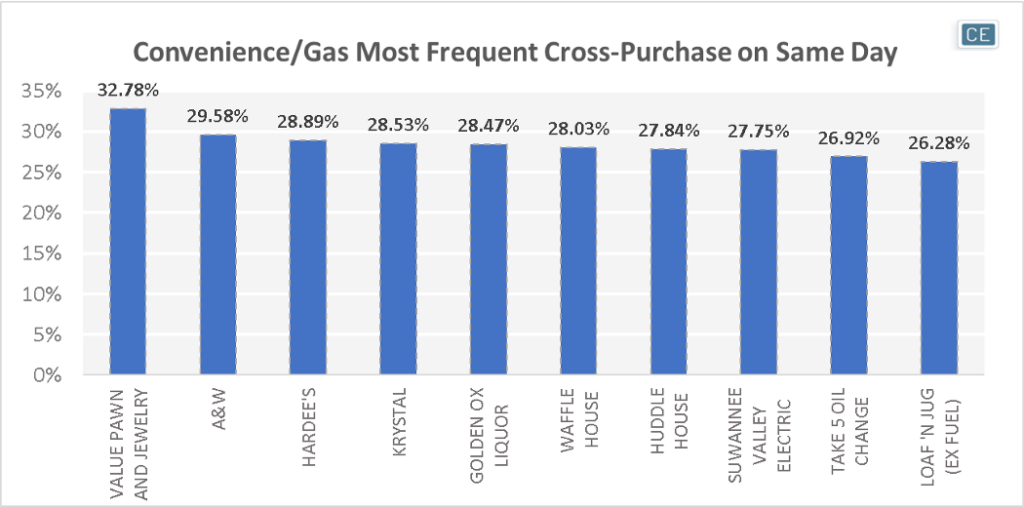

Although cross-shop is generally high with a large percentage of the nation buying gas at some point in the week or month, CE data allows for a brand basket analysis of companies most frequently cross-shopped on the same day as fuel purchases to understand which retailer may be most impacted by rising gas prices. Many travel brands such as hotels and rental cars show up on the list, but further analysis of more consistent refueling shows that Limited-Service Restaurants such as A&W and Hardee’s may suffer as a more expensive trip to the pump leaves fewer extra dollars for an on-the-go burger.

Brand Basket

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.