In this Placer Bytes, we dive into two companies that dominated headlines in recent weeks – Starbucks and Dollar General.

The Starbucks Transition

Earlier this month, Starbucks announced that it would be expanding its physical footprint and that CEO Kevin Johnson would be retiring. The announcement comes at a particularly interesting time for a company that has proven incredibly resilient in the face of COVID and the corresponding disruptions to normal routines and shifts to hybrid work.

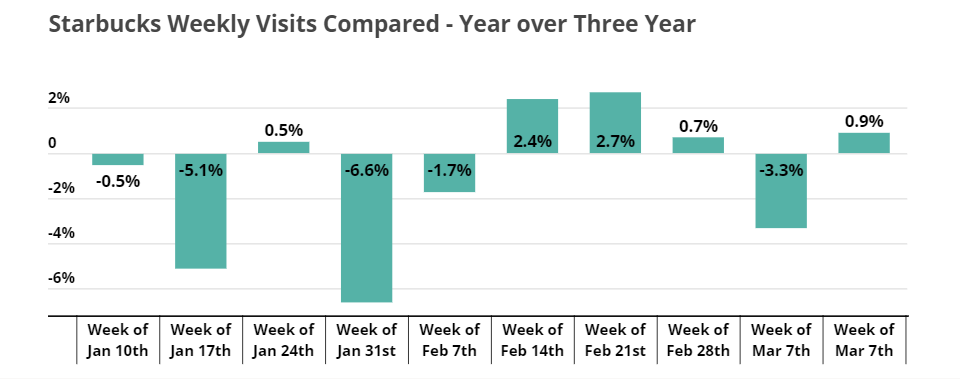

Even in recent weeks, when inflation and rising gas prices were added to the mix of obstacles, Starbucks visits have shown growth compared to pre-COVID 2019. While the effects of these challenges are becoming more evident with visit declines the week of March 7th, 2022 compared to the equivalent week in 2019, at this stage, the impacts are still fairly limited.

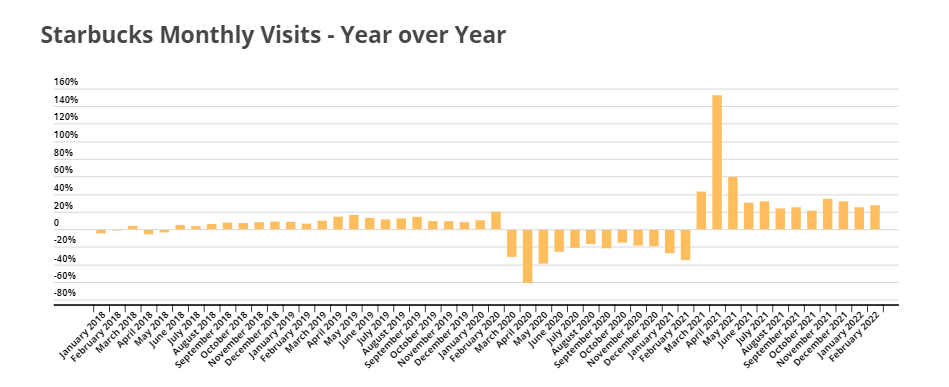

But the transition to a new leadership also creates an opportunity to highlight just how consistent visit growth to Starbucks locations has been in recent years. From early 2018, year-over-year (Yo2Y) monthly visit growth was an ongoing reality until the onset of the pandemic in 2020. And while the YoY success in the recovery is exaggerated due to comparisons to a shutdown retail landscape, the trend is as obvious as it is impressive.

Thanks to an innovative approach of owning the retail calendar and a seemingly endless understanding of how to drive urgency and demand, Starbucks has maintained its powerful position atop the coffee landscape.

Dollar General’s Secret Weapon

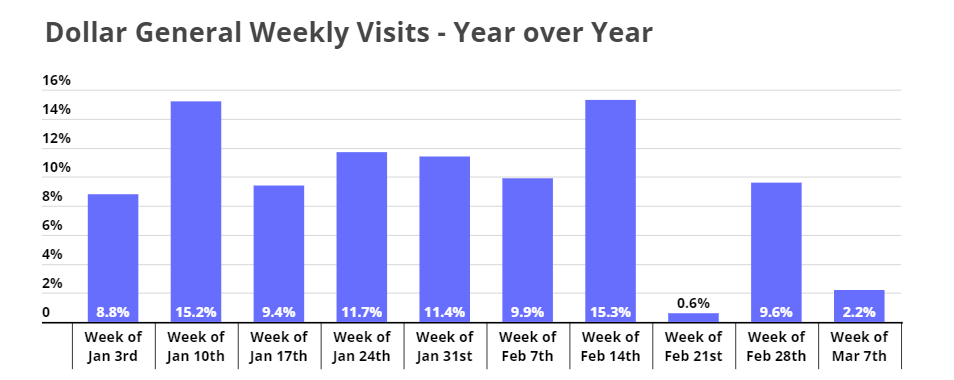

To begin, it demands noting that Dollar General’s impressive visit growth has continued into 2022 with visits up each week compared to the equivalent week a year prior. Comparisons to two and three years before are even more impressive, largely due to the retailer’s aggressive and successful expansion plan.

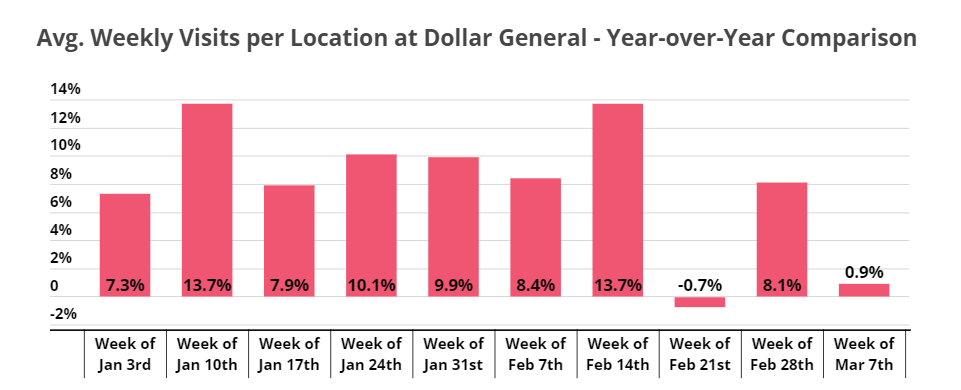

Impressively, the growth hasn’t just been a product of increased locations, but increased demand on a per-location basis. Visits per location metrics have been up all but one week in 2022. This was true even in early March when the wider retail landscape went against a significant headwind driven by rising gas prices. The performance helps explain the company’s recent announcement of a continued expansion with new store openings throughout the country.

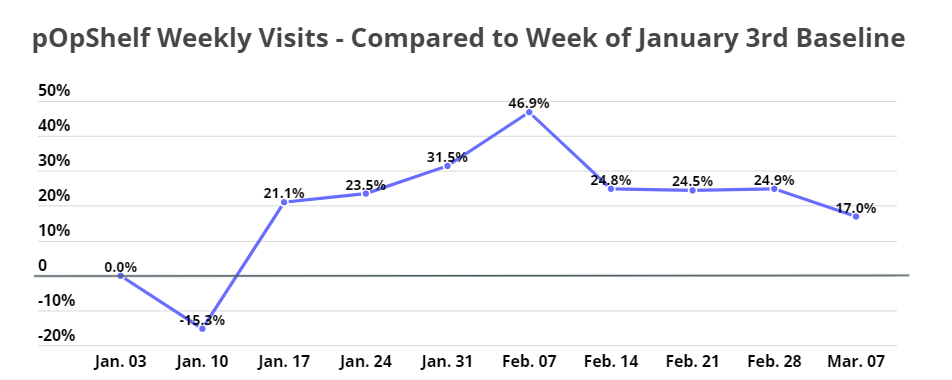

But the not-so-secret secret weapon still centers around the potential of pOpshelf. Dollar General expects to add another 1,000 pOpshelf locations by the end of 2025, and the reason seems fairly obvious. The success of the chain was impressive in early 2022, a continuation of the trend seen in late 2021.

The timing here is also critical with increased competition being seen in retail’s value lane. The push upmarket – even if only slightly – could help Dollar General attract new and different audiences, expanding the pie it has access to. And this is what makes the decision so exciting. Should pOpshelf prove to be a complementary asset that doesn’t compete directly with Dollar General’s existing base, the opportunity for an enhanced trajectory is significant.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.