Beauty retailer Ulta recently highlighted a strategic initiative to onboard a larger number of popular brands into its stores. But if you offer them, will customers come? In today’s Insight Flash, we analyze the potential benefits of partnerships with brands like Fenty, Olaplex, and Supergoop by seeing what market share has been for large multibrand beauty retailers over time, what cross-shop looks like between DTC shoppers of these brands and Ulta, and how much DTC brand sales overlap with Ulta when it comes to purchase sizes.

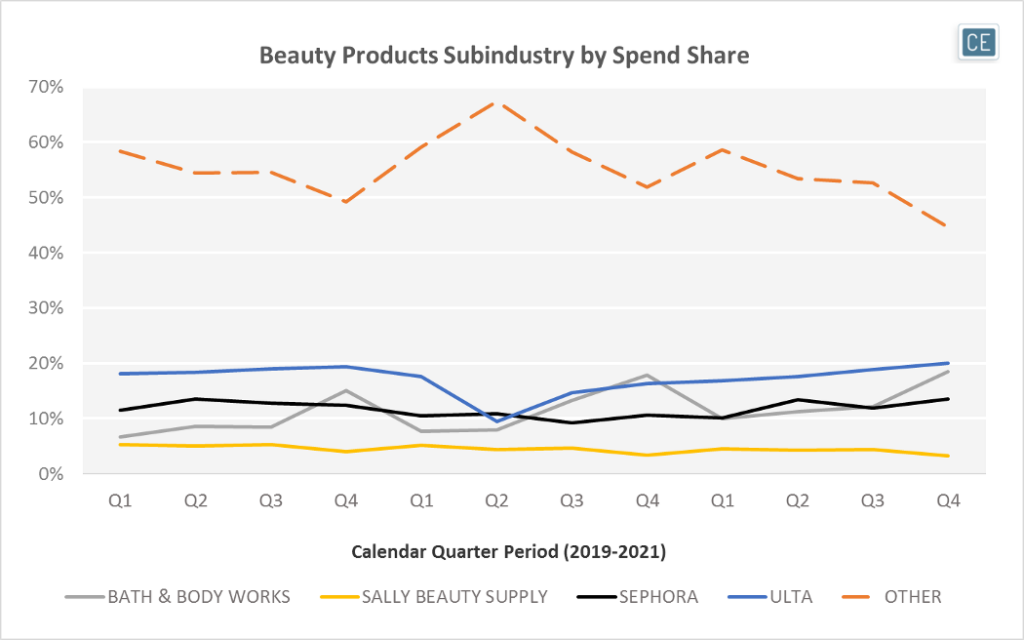

Beauty Products market share for smaller brands, many of which only have an online presence, peaked during 2Q20 due to the COVID-19 pandemic as the brick-and-mortar outlets of larger purveyors shut down. Smaller companies do tend to see a smaller share of the overall Beauty Products subindustry in 4Q as holiday shoppers veer towards crowd pleasers like Bath and Body Works instead of specialty shops.

Direct-to-Consumer Market Share

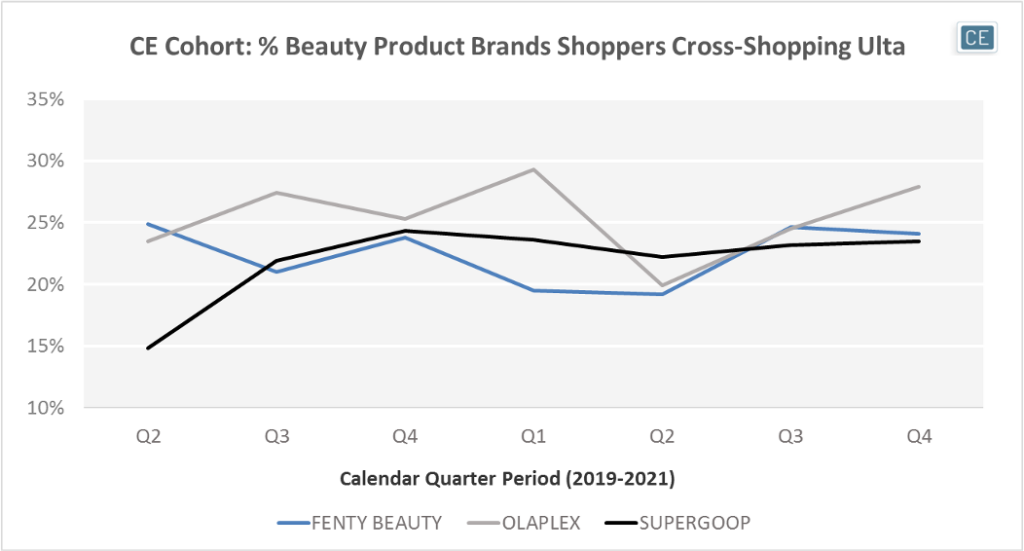

Among the brands cited by Ulta as potential sales drivers, the last two calendar quarters have seen about a fourth of DTC shoppers also visiting Ulta. This implies that many of those shoppers are already familiar with the chain and in close enough proximity to make a physical trip to pick up new items or used to ordering off their webiste. Once there, they may begin to fill up more of their basket with additional purchases. Additionally, this shows high enough affinity that it is likely shoppers who are not currently Ulta customers could be enticed to visit if their preferred brands were offered there.

Cross-Shop

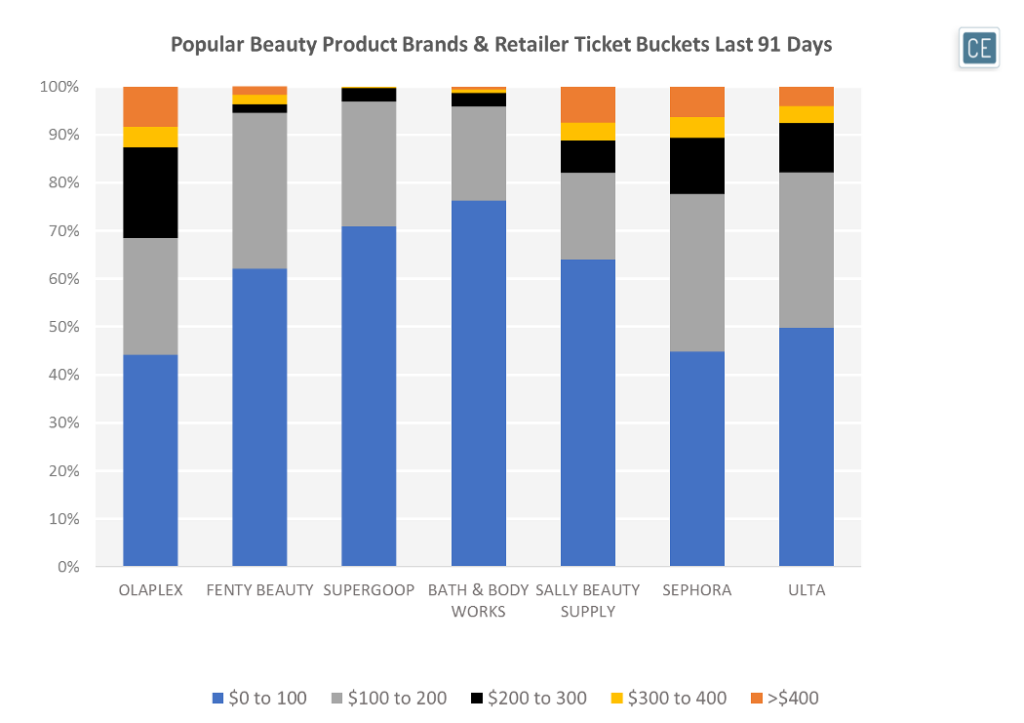

The average basket at Ulta is roughly the same size as the DTC basket from Olaplex, and larger than the DTC basket at Fenty Beauty or SuperGoop. This implies that in addition to potentially attracting new shoppers, a matchup between Ulta and these new brands would likely result in additional add-on purchases during the trip as well.

Ticket Buckets

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.