Source: https://www.data.ai/en/insights/market-data/finance-app-downloads-reach-new-heights-in-2021/

data.ai’s latest analysis shows the big migration to ‘on-the-go’ finance accelerated in 2021 as neobanks, payment wallets, and cryptocurrency trading propelled mobile app downloads to new heights.

The mobile app has had a huge impact on finance. The underbanked want access. The rest want convenience. And the way people shop, pay, save, borrow, and invest has been utterly transformed by the smartphone. This revolution came in two stages. The first saw the arrival of mobile banking apps, which let people check balances, make transfers, and organize their budgets – all without the need to visit a branch. The second big innovation was in payments. With the emergence of contactless and QR code functionality, the phone became a wallet as well as a bank.

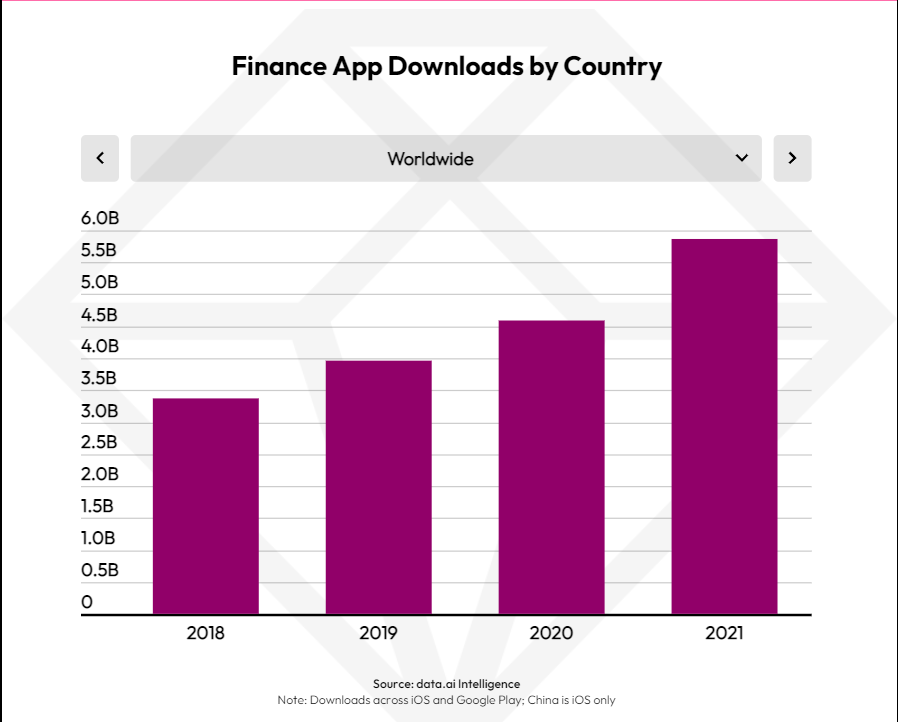

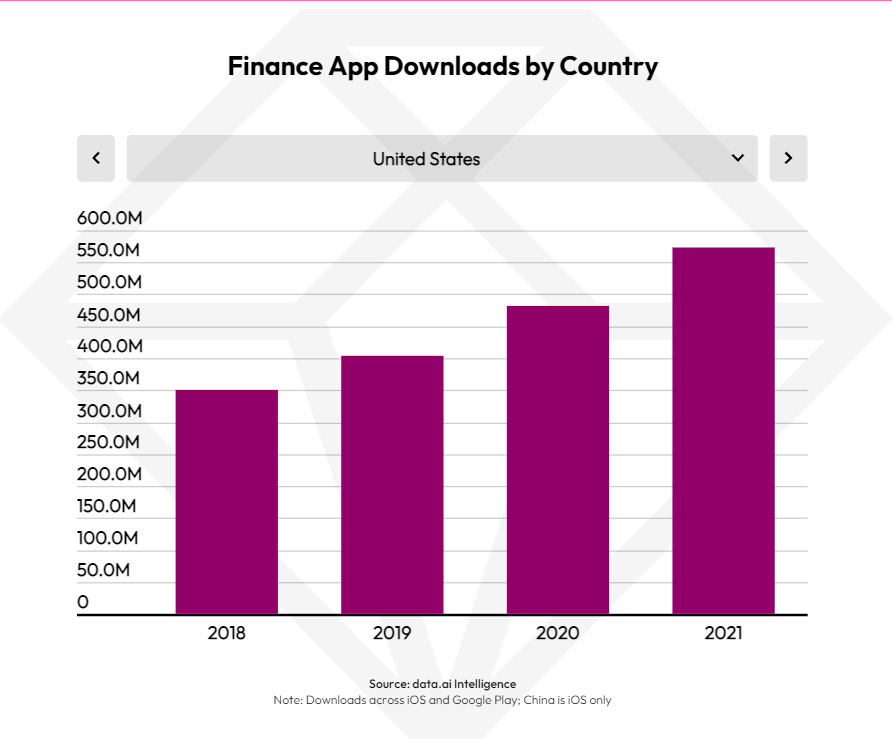

Like it did with many other industries, COVID-19 accelerated the mobile ‘takeover’ of finance. According to data.ai’s State of Mobile 2022 report, global downloads of finance apps lept from 3.4 billion in 2018 to 5.9 billion in 2021. In fact, finance app downloads saw increases in 16 of the 17 countries studied in the report.

Mobile Users in LATAM and India Drove the Biggest Upswings

One region that saw exceptional growth was in Latin America — with Mexico, Argentina, and Brazil posting growth in the last 4 years at 250%, 180%, and 175% respectively. LATAM has the right conditions in place for a fintech boom. In recent years, more than half of the population is unbanked and barely 20% have a credit card. Already in areas such as Brazil, fintech companies such as neobanks (together with traditional banks) have enabled 88% of its adult population to have access to a digital account, up 28% since 2017.

A similar transformation occurred in India – though this has more to do with payments and m-commerce than banking. India has an array of popular mobile payment products such as Paytm, MobiKwik and Google Pay which have changed the way its citizens shop. India doubled its annual finance app downloads from 516 million in 2018 to 1.3 billion in 2021.

The market has also been helped by the Indian government’s resolve to reduce dependency on cash and migrate customers and businesses towards digital payments. The state launched the Unified Payments Interface (UPI) – an instant real-time payment system that all merchants opt into. The apps that did the best job of integrating UPI have emerged strongest from the pandemic. Leading the pack is PhonePe, which was #1 on the data.ai breakout app chart for 2021 (representing the biggest YoY growth) and processes 2.5 billion transactions a month.

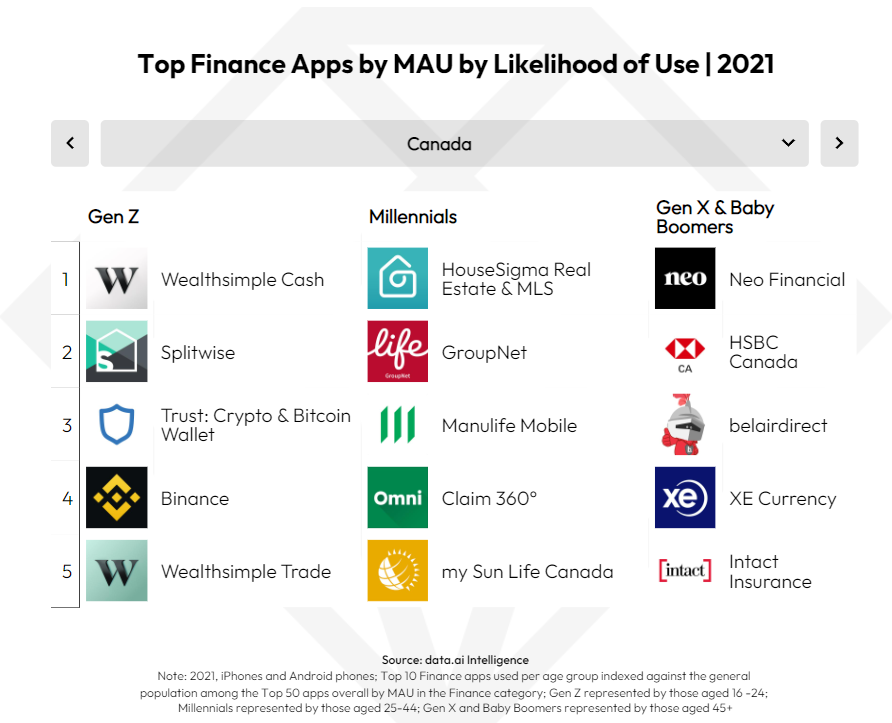

Gen Z Reveal Surprising Engagement with Trading and Money Movement Apps

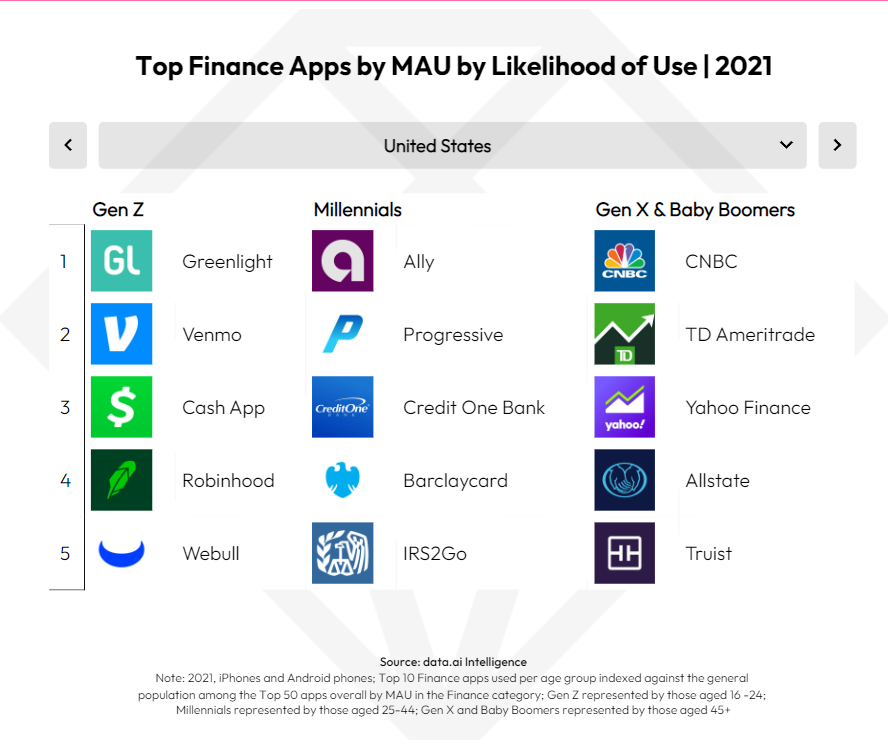

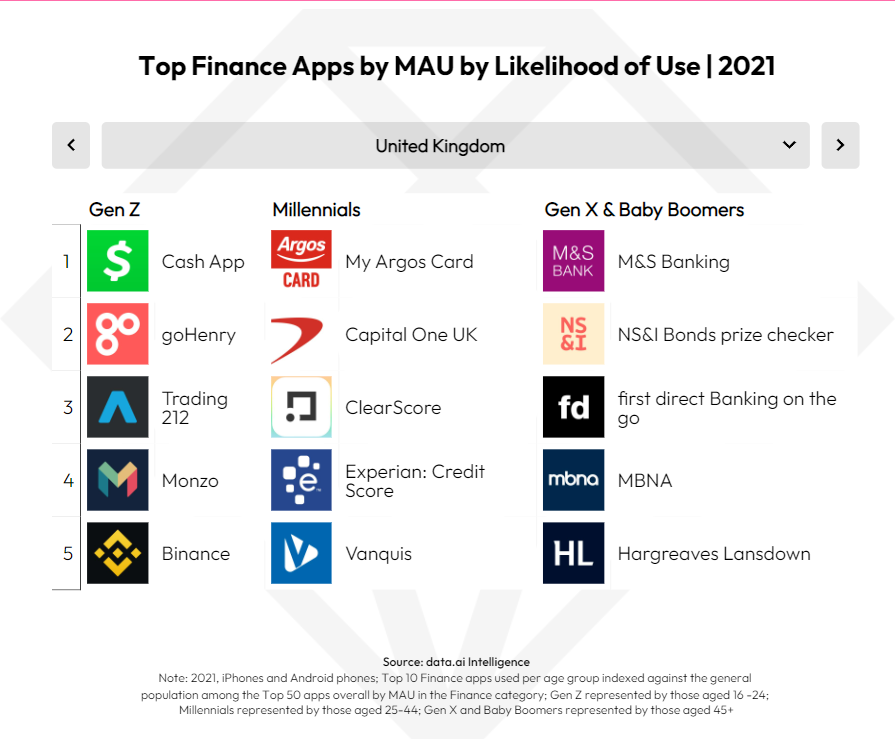

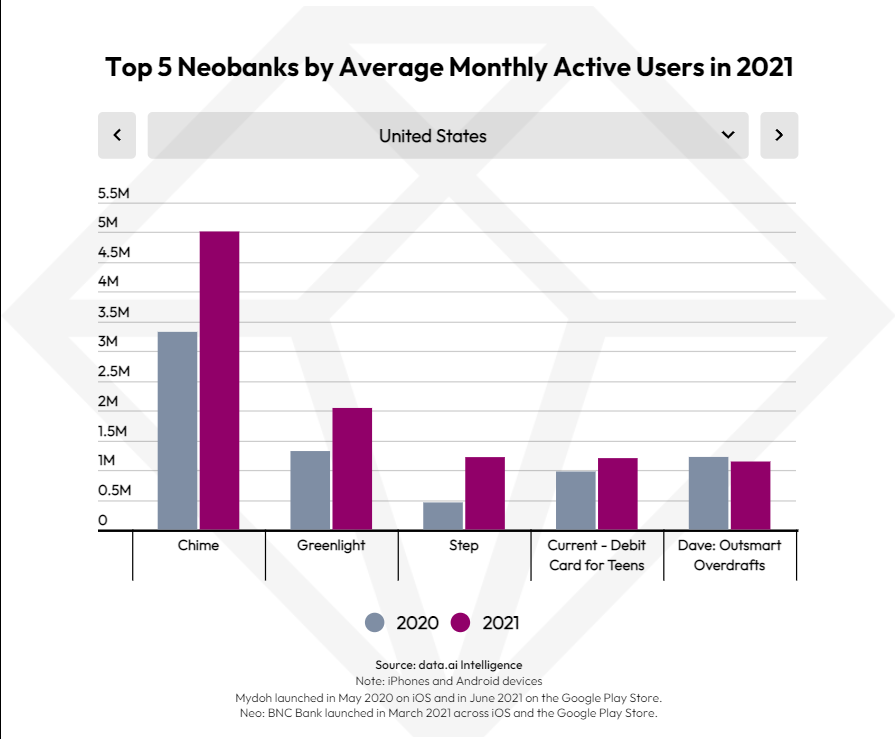

Perhaps it’s no surprise that younger smartphone users are the most enthusiastic adopters of innovative new finance products. By contrast, older age groups prefer the mobile versions of time-tested brands. Looking at the top apps by likelihood of use by monthly active users (MAU), the top 5 apps in both the US and UK, for example, are all fintech brands. They include money transfer apps such as Venmo and Cash App, neobanks such as goHenry and Greenlight, and trading products such as Webull, Robinhood and Trading 212.

The interest in trading apps among our youngest audience might seem a little surprising. After all, Gen Z users tend not to have much spare income to invest. But such is the innovation enabled by mobile apps, which make it possible (and easy) to trade very small sums (i.e. fractional investing) in a few taps. This might be one factor as to the success of crypto trading apps across markets. In Germany, Binance and Coinbase were 2021’s top products among Gen Z consumers. In France, they were #3 and #4, respectively.

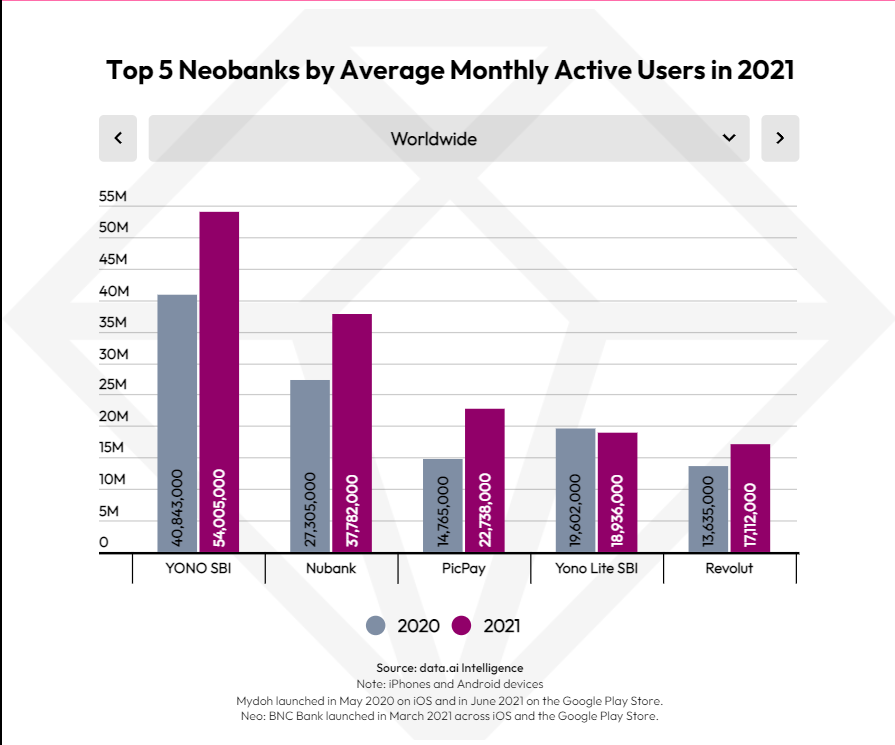

YONO SBI was the Under-the-Rader Neobank App that Reached #1 in Terms of Monthly Active Users Globally in 2021

The world’s top neobank by MAU for 2021 was YONO SBI. YONO SBI was not launched by a startup, but was instead the offshoot of the State Bank of India, launching in 2017 with the acronym YONO (‘You Only Need One’) and now has more than 54 million MAUs.

The second and third most popular neobank apps both emerged from LATAM’s dynamic mobile finance scene. At #2, Nubank has 38 million MAUs and looks set for even more growth in active users this year, raising $2.6 billion in a US IPO last December to finance more expansion. In third place, PicPay ended 2021 with 23 million MAUs. Although PicPay is more of a wallet than a bank, the company is now piloting loans and credit services. These neobanks are crucial in the LATAM region as they fill the gap left by the traditional retail banks in serving the underbanked and unbanked community. During the COVID-19 pandemic, many people in the region relied on neobanks and subsequently they saw increases in account openings thanks to their low costs and barriers to entry.

PayPal’s Entry into Cryptocurrency Yields an Instant Win – But the Market Remains Wide Open

In March 2021, PayPal gave a big boost to the crypto world. It launched Checkout with Crypto, a new feature that lets US customers use their cryptocurrency holdings to pay for purchases at some of its merchants. The launch was designed to give businesses a safe way to accept crypto – all transactions are converted and settled in USD without any additional integrations or fees required by the business.

Such is PayPal’s high profile that the company immediately ascended to the top of the crypto app charts. According to data.ai’s State of Mobile report metrics for engagement in 2021, PayPal ended the year at 225 sessions per user per month, ahead of WazirX with 160 sessions and Robinhood at 91.

Despite PayPal’s entry into the market, the crypto app space remains a highly dynamic one with many competing players. One of 2021’s other big stories was the emergence of CoinDCX out of India. Despite only launching in Q4 2020, the app reached #9 worldwide in terms of the most downloaded cryptocurrency apps. In April 2022, it announced a new fund series D fund worth more than $135 million.

Cryptocurrency apps are quickly becoming one of the most downloaded finance app subgenres. As Gen Z are already embracing these apps, they will only grow in the near future as they take on the role traditional banks have played for centuries.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.