From pizza companies to burger chain upstarts such as Shake Shack, quick-service restaurants have seen their sales grow during the pandemic. Bloomberg Second Measure transaction data shows that this has also been the case with major fast food chains such as McDonald’s (NYSE: MCD) and Wendy’s (NASDAQ: WEN). Additionally, McDonald’s and Wendy’s, as well as Burger King, owned by Restaurant Brands International (NYSE: QSR), are seeing increased average transaction values.

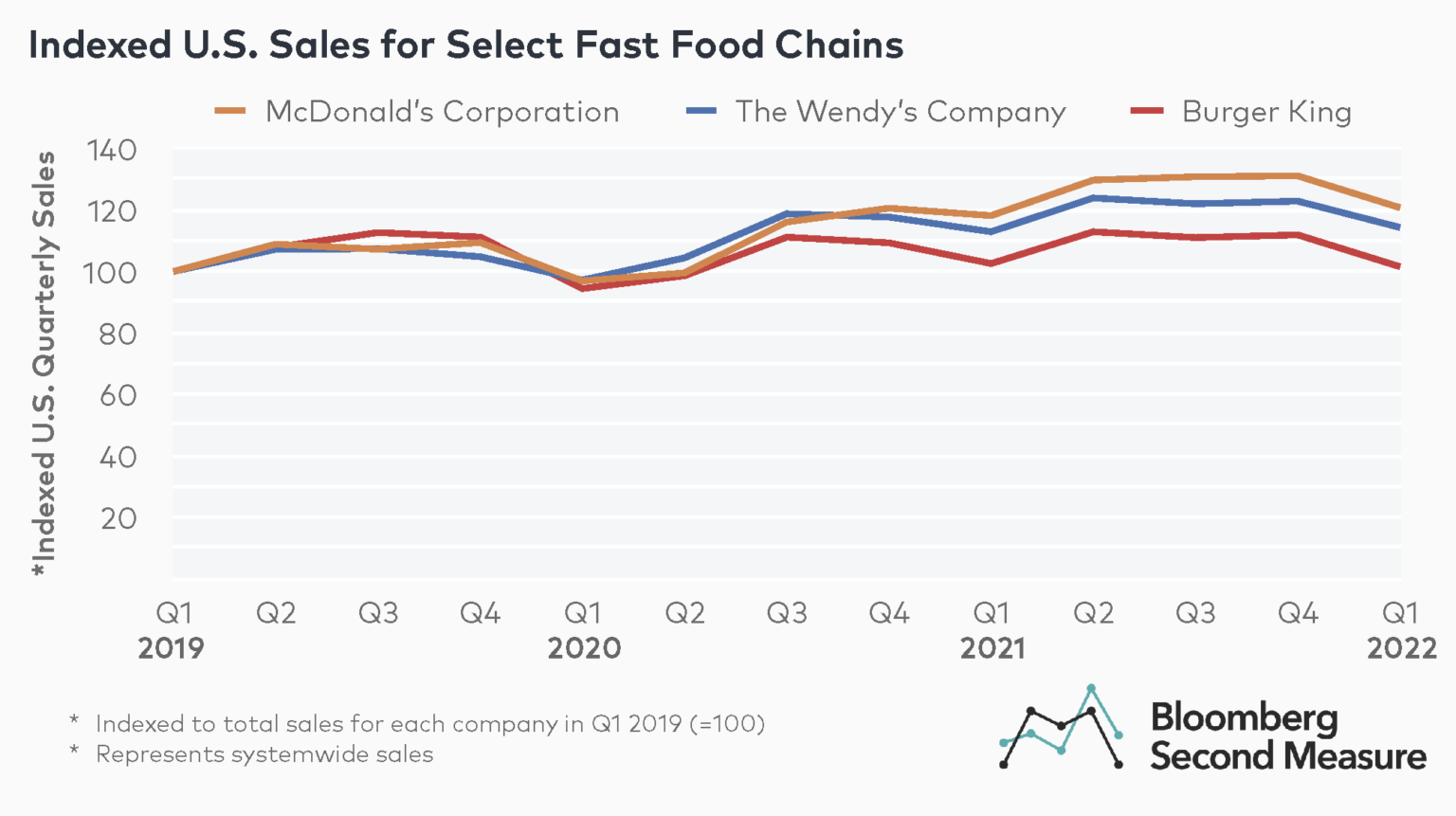

Sales at major fast food chains have been trending upward during the pandemic

After a decrease in sales at the onset of the pandemic, all analyzed fast food chains saw sales rebound in Q3 2020. By Q4 2020, sales at McDonald’s, Wendy’s, and Burger King exceeded their pre-pandemic levels and have mostly remained elevated since.

However, even though sales increased across all three of these fast food chains, they did so at varying rates. Wendy’s had double-digit growth from Q3 2020 through Q2 2021, and McDonald’s from Q4 2020 through Q3 2021, with sales in Q2 2021 up 30 percent year-over-year at McDonald’s and up 19 percent year-over-year at Wendy’s.

Burger King also experienced year-over-year sales growth in Q2 2021, with sales up 15 percent. This was the only quarter since the beginning of the pandemic in which the company has seen double-digit year-over-year sales growth.

Compared to Q1 2020, McDonald’s and Wendy’s sales in Q1 2022 were up 25 percent and 18 percent, respectively, while Burger King’s sales grew 8 percent. Sales in Q1 2022 remained relatively unchanged for all analyzed fast food chains year-over-year.

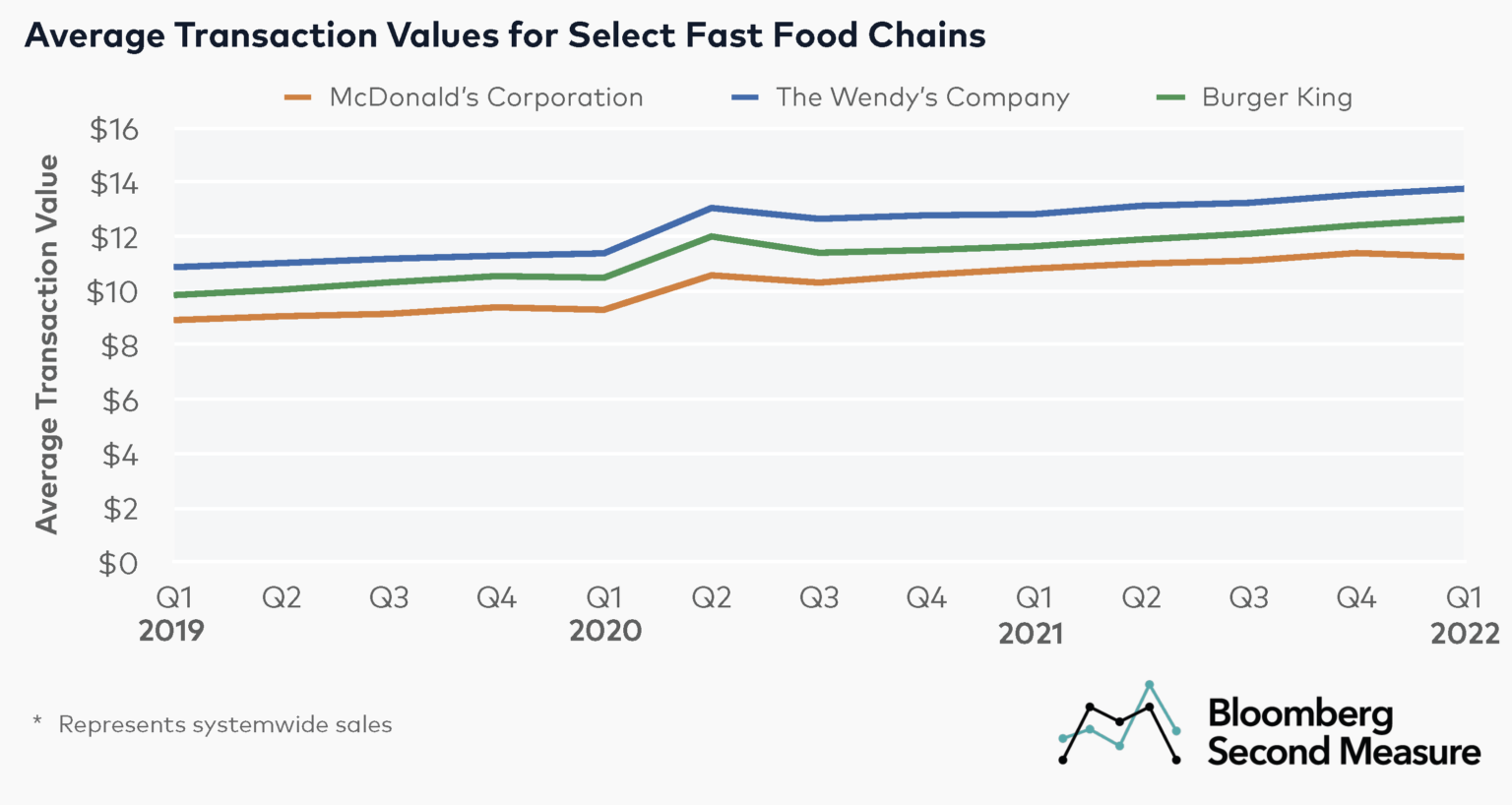

Fast food chains have seen an increase in average transaction values during the pandemic

All analyzed fast food chains recorded a sharp increase in average transaction values at the beginning of the pandemic. In Q2 2020, Burger King’s average transaction value, at $12, was up 20 percent year-over-year, Wendy’s average transaction value, at $13, was up 18 percent year-over-year, and McDonald’s, at roughly $11, was up 17 percent year-over-year. Among the possible factors that may have affected the average transaction values at fast food chains are the higher cost of fast food orders coming via third-party delivery apps, as well as increased prices of fast food menu items caused by the growing cost of ingredients, due to supply-chain shortages.

In Q1 2022, average transaction values at all analyzed fast food chains further increased. Wendy’s had the highest average transaction value at $14, up 7 percent year-over-year, followed by Burger King’s average transaction value of $13, up 9 percent year-over-year. McDonald’s had the lowest average transaction value in Q1 2022 at $11, up 4 percent year-over-year.

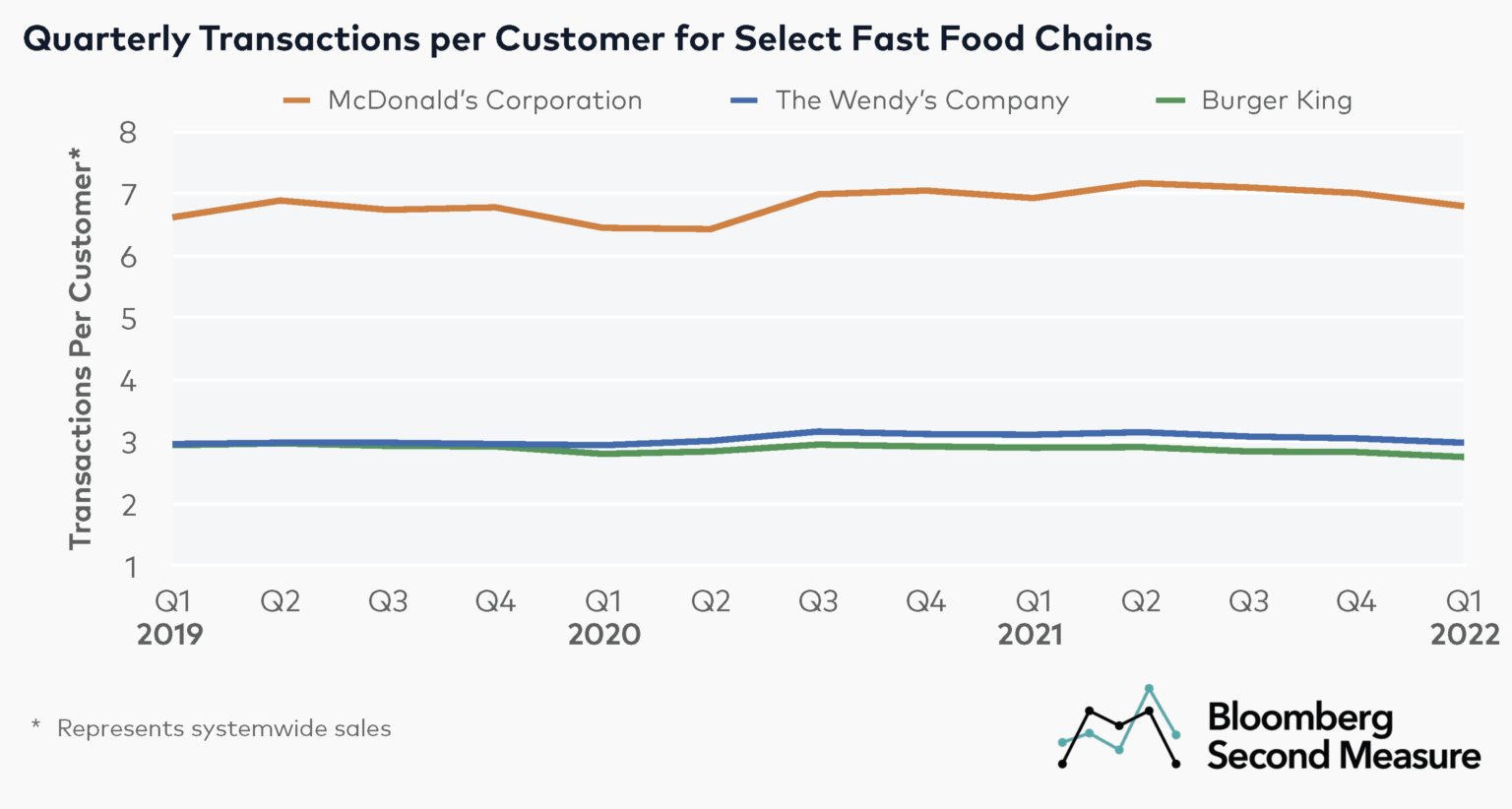

McDonald’s lead in quarterly transactions per customer has grown during the pandemic

Bloomberg Second Measure’s consumer transaction data shows that McDonald’s recorded the highest number of quarterly transactions per customer among the analyzed fast food chains. In Q1 2020, the number of quarterly transactions per customer at McDonald’s was 6.4, more than twice as many as the number of purchases among Wendy’s and Burger King customers, who made on average 2.9 and 2.8 purchases, respectively.

In Q1 2022, the number of transactions per customer at McDonald’s was down 2 percent year-over-year, but up 5 percent compared to Q1 2020. Meanwhile, Wendy’s recorded 4 percent fewer quarterly purchases per customer in Q1 2022 than in the same period of 2021 and 1 percent more transactions than in Q1 2020.

Burger King was the only major fast food chain that recorded fewer transactions per customer in Q1 2022 than in both Q1 2021 and Q1 2020. In Q1 2022, the company saw 5 percent fewer transactions per customer than in Q1 2021 and 2 percent fewer than in the same period of 2020.

Looking into the future despite labor woes

Fast food chains enjoyed growth in sales over the pandemic, but they also experienced some challenges. These included industry-wide problems such as labor shortages, forcing some chains to shorten their opening hours and cut back on menu items.

Notwithstanding these issues, fast food chains are looking into the future by introducing more plant-based menu items, such as “Impossible Nuggets” at Burger King and McPlant at McDonald’s, and environmentally-friendly packaging, as well as ramping up food delivery capabilities by opening ghost kitchens.

Another trend emerged recently, as fast food chains made a move into the virtual realm. Burger King supported its new “Keep it Real campaign” by introducing non-fungible tokens (NFTs), while Wendy’s entered the metaverse with the launch of Wendyverse and McDonald’s released its McRib NFTs, with plans to join Wendy’s in the metaverse.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.