Over the past couple of years, several home furnishing retailers – including At Home, HomeGoods, and Floor & Decor – have expanded their physical footprint, while other brands such as Tuesday Morning shrunk their store count. We dove into the foot traffic numbers to find out how modifying the store fleet size has affected these retailers’ recent performance.

At Home, HomeGoods, and Floor & Decor’s Expansions Drive Foot Traffic

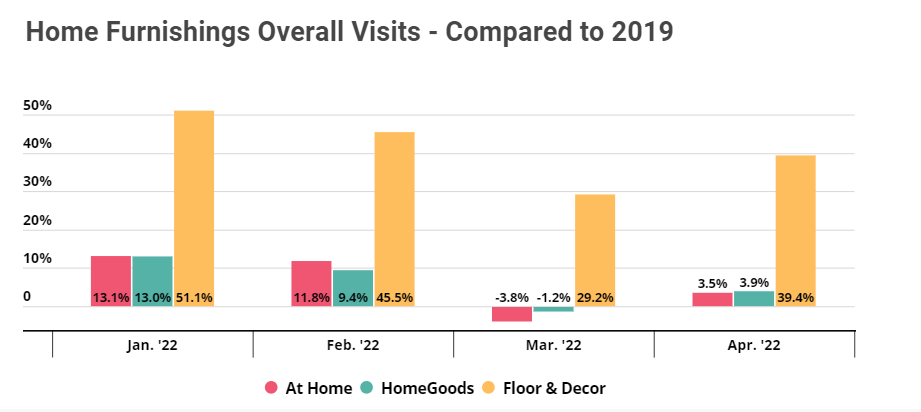

Despite the wider challenges impacting retail, recent location analytics data shows that several home furnishing leaders are seeing visits that match or exceed 2019 foot traffic levels. At Home and HomeGoods started off 2022 strong, and quickly returned to Yo3Y growth following a small dip in March, with April 2022 visits 3.5% and 3.9% higher, respectively, than in 2019. And Floor & Decor has seen astronomical growth in overall visits this year, with foot traffic up by 51.1%, 45.5%, 29.2%, and 39.4%, respectively, for the first four months of the year.

For all three retailers, the growth in visits is largely due to store fleet expansion. As hybrid and remote work arrangements become permanent, the home goods category may well see a long-term boost in consumer interest – and these brands will be ready to meet the heightened demand with their expanded store fleets.

Impact of Wider Economic Situation

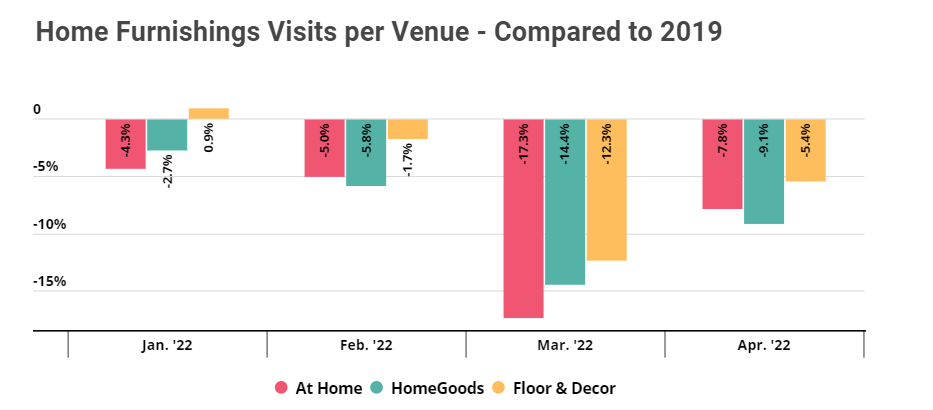

Although store fleet expansions have kept overall Yo3Y visit numbers for At Home, HomeGoods, and Floor & Decor strong, a closer look at foot traffic trends shows that the wider economic situation has impacted these retailers – although all three brands now appear to be bouncing back. While average visits per venue in January and February 2022 stayed relatively close to 2019 levels despite the brands’ much larger store fleet, visits per venue took a major hit in March, with average foot traffic per At Home, HomeGoods, and Floor & Decor location down by 17.3%, 14.4%, and 12.3% compared to March 2019. But by April 2022, all three brands saw an impressive recovery, with At Home, HomeGoods, and Floor & Decor seeing their Yo3Y visits-per-venue gap shrink to only 7.8%, 9.1%, and 5.4%.

This swift comeback – which was seen across several other retail categories – may be a sign that the initial shock of inflation and rising prices is beginning to wear off and customers are slowly but surely returning to retailers after a March pause in shopping.

Checking in On Tuesday Morning

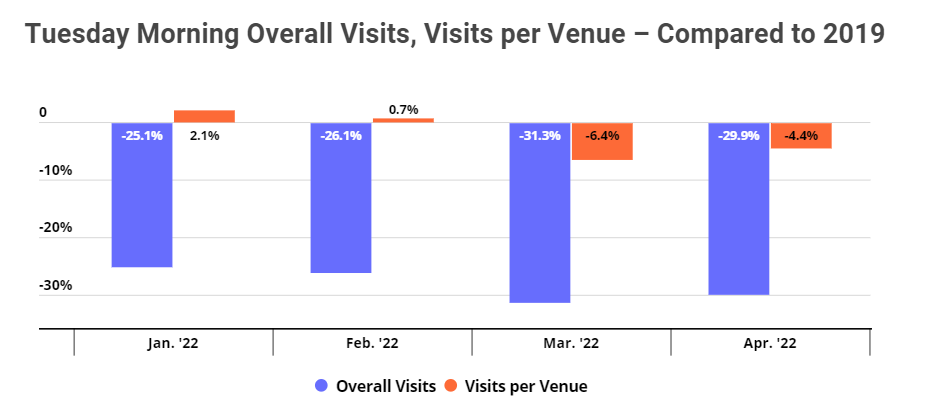

In January 2021, Tuesday Morning exited bankruptcy with 490 stores after shedding its underperforming stores and reducing its store fleet down from the 687 stores the brand was operating when it filed for bankruptcy. The right-sizing worked, with the brand seeing an increase in visits-per-venue for much of 2021 even as overall visits were down (owing to the significantly reduced store fleet). Between October and December 2021, the brand even opened two new stores while successfully maintaining Yo3Y visit-per-venue growth in January and February 2022.

And even though Yo3Y visit-per-venue numbers took a downturn in March – likely due to the wider economic situation – the visit gap had narrowed by April, just like it did for the other three home furnishing retailers analyzed. Since average April 2022 foot traffic per Tuesday Morning stores was only 4.4% lower than in April 2019, the recent visit-per-venue contraction in March may well be just a minor hiccup in Tuesday Morning’s turnaround story.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.